Renewal and Refinancing #Loan Types

Renewal and Refinancing #Loan Types

Are Reverse Mortgages a Bad Idea?

Table of contents

Despite the fact that reverse mortgages have been available for over 25 years, many misconceptions and myths still remain about this handy financial product. Many people view reverse mortgages as a trap that will lead a homeowner to lose their home when all is said in done.

This may be attributable to the fact that reverse mortgages are not a common or well-known solution. This is unfortunate because less than informed reactionary commentators often cause some homeowners to ignore the option without taking the time to learn the real facts about reverse mortgages.

How Can a Reverse Mortgage Work for You?

The truth is that, in the right economic context, reverse mortgages can be a powerful financial tool.

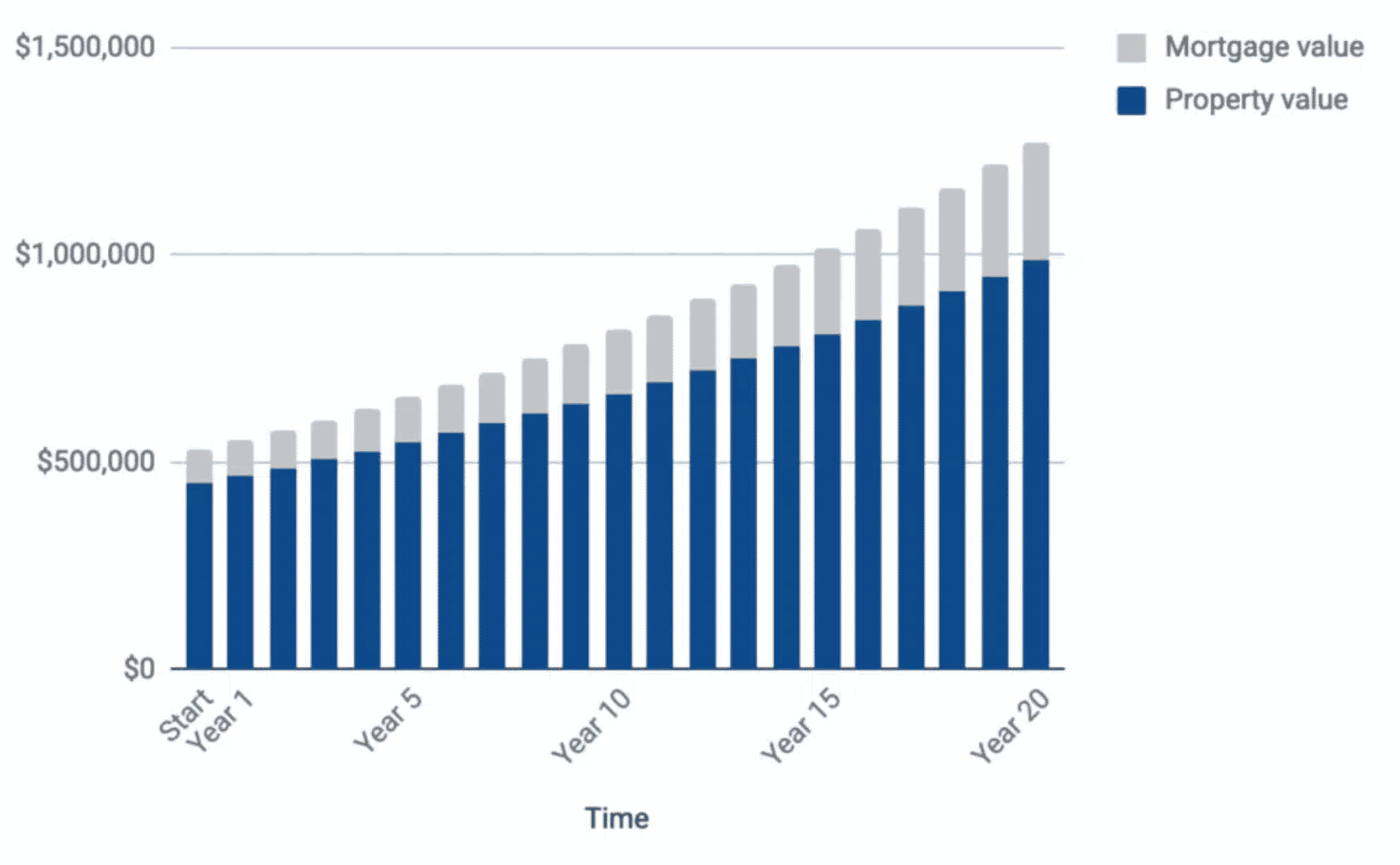

As an example, let’s look at the life of a reverse mortgage during a 20-year span from an economic perspective.

Barry, a 65-year-old borrower, owns a mortgage-free property currently appraised at $450,000. After filling his application, Barry learns he is eligible for a reverse mortgage up to $96,000. This amount is based on his age and the appraised value of his home.

Rather than take the full amount he is entitled to, Barry settles for $80,000, which he opts to receive in one lump sum payment. Barry plans on paying off his credit card debt and giving some money to his children while also taking a trip to the French Riviera.

Now, let’s look at the value of Barry’s property with regards to the interest paid on his reverse mortgage.

Let’s assume that the value of his property will grow at an average yearly pace of 4%, which is a conservative estimate considering what we’ve experienced over the last 2 decades in Canada. And, for the sake of this example, let’s say that the interest rate on Barry’s reverse mortgage sits at 6.5%.

Take a look at the following chart, which shows the estimated market value of Barry’s property over the course of 20 years and the interest to equity ratio.

At the time Barry purchases his reverse mortgage, the loan is equal to 17% of his home’s value. Five years later, that ratio has now grown to 20%. In year 10, it sits at 23%.

Twenty years later, when Barry turns 85, that ratio will sit at 29%.

Get approval on your low rate today

No big bank bias, just commission-free experts ready to help you.

No, the Bank Can’t Own Your Home

One of the most popular misconceptions around reverse mortgages is that by obtaining this product, homeowners would be surrendering the ownership of their property to the lender.

Nothing could be further from the truth. There are many safeguards built into reverse mortgages to protect borrowers from ending up “underwater”, a.k.a. owing more on an asset than the asset is worth.

Most lenders set extremely conservative loan-to-value limits dependent on the borrower’s age and the appraised market value of the home.

Because of these protections, homeowners will always maintain complete ownership and control of their property. The lender can never force a homeowner to sell their home. The sole obligation homeowners have is to pay any and all property taxes, to keep the property in good order, and to maintain a valid fire-loss policy.

If you do that, you can remain in your home as long as you so desire.

The Right Tool For the Right Job

Reverse mortgages are financial tools available to homeowners who have specific needs. When properly advised on how to access it and how to use it properly, there’s no doubt that it can have a profound impact on the quality of life for senior homeowners.

Talk to your nesto advisor today to find out more about reverse mortgages.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!