Mortgage Affordability Calculator

Many risks and financial factors must be considered when figuring out how much you can comfortably afford to spend on a home. Let nesto’s Mortgage Affordability Calculator do the hard work for you!

Mortgage Affordability Calculator

What Is Mortgage Affordability?

One of the first steps in searching for a home is figuring out how much mortgage you can afford. This is known as mortgage affordability.

Mortgage affordability represents the maximum price you could pay for a house and the corresponding mortgage. It is primarily based on your income, monthly expenses, and the expenses associated with owning a home. Assessing your capacity to afford a house is an essential step in the mortgage process as it clarifies whether you can comfortably afford your mortgage payments. Assessing your capacity to afford a house will also help you find the home in the right price range to fit your budget.

The easiest way to determine your capacity to afford a house, and the maximum price for which you qualify, is through nesto’s Mortgage Affordability Calculator.

We’re curious…

Are you a first-time buyer?

How to Use the Mortgage Affordability Calculator

nesto’s Mortgage Affordability Calculator is a practical, effective tool that analyzes your financial situation. The calculator will prompt you to input the required information and automatically calculate your affordability after a few simple steps.

To facilitate the process, you’ll want to have all your information ready based on the following:

Employment Income

This is the most important piece of the qualifying puzzle. Most clients have trouble with this, so we’ve created a short guide on calculating your income precisely and correctly using your payroll frequency. Regarding income – it’s better to be as precise as possible. Below is a chart showing you how to calculate your weekly, biweekly, monthly or annual income amount using your weekly guaranteed hours and hourly rate.

| Hourly Rate | Number of Hours | Formula | Sample |

|---|---|---|---|

| Weekly | 35, 40, or 44 hours as guaranteed every week | $/hr x weekly hours guaranteed | $15/hr x 35 hrs/wk = $525 weekly |

| Biweekly | Twice that of weekly | $/hr x 2 x weekly hours guaranteed | $15/hr x 2 x 35 hrs/wk = $1050 biweekly |

| Monthly | Weekly hours multiplied by 52 divided by 12 | $/hr x weekly hours guaranteed x 52 weeks in a year / 12 months | $15/hr x 35 hrs/wk x 52 wks / 12 months = $2275.05 monthly |

| Annually | Weekly hours multiplied by 52 | $/hr x weekly hours guaranteed x 52 weeks in a year | $15/hr x 35 hrs/wk x 52 wks = $27,300.60 annually |

Permanent vs. non-permanent part-time income: Lenders will only consider your guaranteed hours to calculate qualifying income if you’re confirmed as a permanent part-time employee through your LoE (letter of employment); otherwise, the lender will calculate income through a 2-year average of your most recent T4s.

Bonus Income: If you receive any bonuses, you need to average out two years’ income from your T4 (using the number in line 14, which reports your total income). With some exceptions, bonus income can only be used when already paid (essentially, you can’t count the eggs before they are hatched), and it must be received over two fiscal years from the same employer. Additionally, if your average decreases, you must use the lower of the two years.

Example: In 2020, you earned $65K, and in 2021, you earned $60K then the average is calculated as [$65K + $60K] / 2 equals $62,500; however, as income was declining over the two years – most lenders (including nesto) will only consider $60K for qualification purposes.

Sole Proprietor or Incorporated Income: If you’re self-employed, as in a sole proprietor or incorporated, things can get a bit more complicated. It is recommended that you book a meeting and speak with one of our mortgage experts, who can work out your annualized income correctly from some specific lines in your T1 Generals (T1s) and Notice of Assessments (NOA). It would be best if you kept your T1s and NOAs handy during your meeting with one of our knowledgeable and commission-free experts.

Note: BFS individuals must be able to show that any taxes owed to the Canada Revenue Agency (CRA) are fully paid off before any mortgage commitment is issued. The lender will request a CRA Balance of Account Statement to confirm this.

Casual / Contract / Partnership Income: Generally, a 2-year average is calculated much like a combination of the above Bonus Income and/or Self-employed.

Spousal/Child Support: Generally, rules vary between lenders. Still, for these types of payments, you will need to show 2 months’ deposit history in a bank account in your name alongside a completed separation agreement/affidavit.

Canada Child Benefit (UCCB): Rules will vary between lenders, but generally, only the federal portion can be used towards qualifying income for children under 12 years old. You will need the annual statement, proof of birth certificate and 2 months’ deposit history into a bank account in your name.

Canada Pension Plan (CPP): You can use this income to qualify for your mortgage. You will need the T4A for the past year and 2 months’ deposit history into a bank account in your name.

Old Age Security (OAS): You can use this income to qualify for your mortgage. You will need the T4A for the past year and 2 months’ deposit history into a bank account in your name.

Employer Specified Pension Plan (SPP): You can use this income to qualify for your mortgage. You will need the pension statement for the past year and 2 months’ deposit history into a bank account in your name.

Investment Income (RIF/LIF/LRSP/LIRA): Rules will vary between lenders; however, depending on the type of investment, you could use this income. Generally, this is considered taxable income. Alongside, you’ll need 2 months’ deposit history into a bank account in your name. Additionally, you will have to show that you have enough savings to sustain receiving the same payments over 5 to 10 years – or sometimes just over the mortgage term.

Property Taxes

Here, you have various options to figure out the correct amount. Conversely, you can let nesto’s Affordability Calculator estimate your property taxes. The chart below will list the best option for your transaction.

| Type of Transaction | Method |

|---|---|

| Purchase | MLS listing preferred (make sure that your realtor provides you one which has the property taxes listed) OR use the final bill amount stated on the current year’s bill (get a copy from the seller) |

| New Build | 0.50% to 1.3% of the purchase price depending on the type of building, municipality and province – guidelines will vary from lender to lender. |

| Renewal / Refinance | Use the municipality’s final property tax amount stated on the current year’s bill. |

| Private Sale | Use the final bill amount stated on the current year’s bill (get a copy from the seller) |

Heating Costs

Generally, most lenders, including nesto, will base the heating costs on square feet to keep it equitable for all clients in Canada. To simplify things, for up to 2000 square feet, you can use $100/month for your calculation.

Condominium Fees

The condo/strata/maintenance fees must be confirmed either by an MLS (purchase only), a current statement from the condo board indicating the exact amount and unit, or 2 months of current debit history on a bank account in your name. If you’re purchasing a pre-construction condominium, your full purchase agreement should include a page outlining the expected condo fees.

Home Value

The value of the subject property can be confirmed by various means. You can use the purchase price listed on the MLS or something in the range you want. For renewals or refinances, you can use a conservative estimate of the value of your home or look at your previous year’s property assessment statement issued through your province or municipality.

Down payment

The minimum down payment for purchase is 5% for properties under $1M and 20% for properties over $1M. Your down payment amount should be calculated as a net of any debts you already owe. For renewals and refinances, a down payment is interchangeable with the residual equity already built into your property from the time you purchased it.

Interest Rate

The interest rate will depend on the transaction type (purchase, renewal, or refinance), loan-to-value (LTV) ratio, and the expected completion date (closing date for purchase, maturity date for renewal, or enough time to complete the refinance). Please check out our Mortgage Rates page for more details regarding your selection of the correct rate for qualifying purposes.

Mortgage Term

Your mortgage term will depend on your choice and availability based on your need, ranging from 1 to 10 years for fixed rates but only 5 for variable rate mortgages.

Amortization

Your amortization (or the life of your mortgage) will depend on how quickly you want to be mortgage-free. For a purchase, typically, the best rates apply for amortizations of 25 years or less. For renewals, you can only continue paying down your current amortization. For refinances, you can increase your amortization up to a maximum of 30 years, but in some cases, the rate may vary between your choice of 25 or 30 years.

Stress Testing Affordability

Details

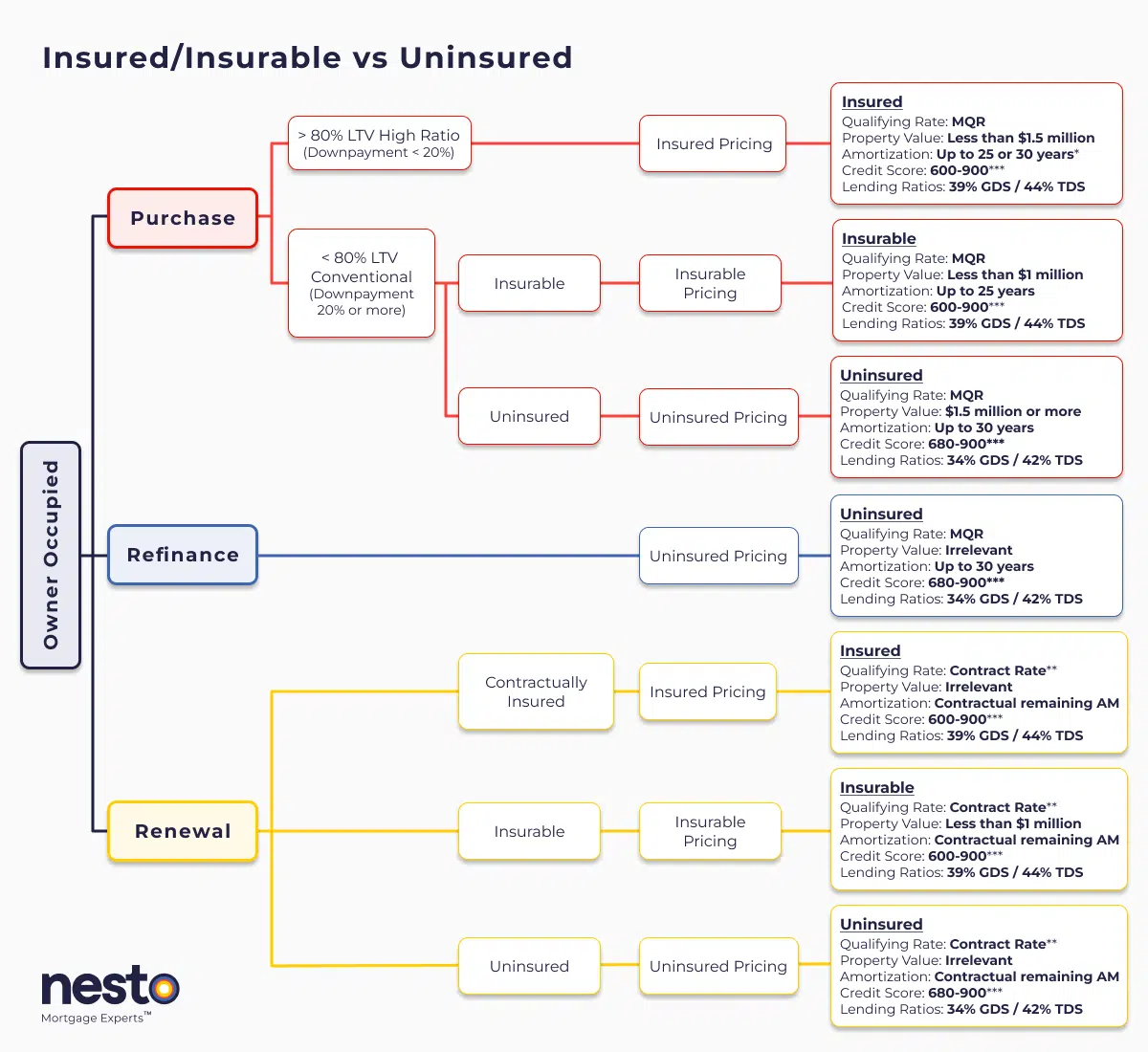

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

How to Estimate Affordability

As part of the affordability assessment and qualification, lenders will take an in-depth look at your overall housing costs and any outstanding debt. Housing costs can be extensive and quickly add up – though not all are used to assess your mortgage affordability. To determine the amount they’ll lend to you, lenders are required to use calculations known as debt service ratios:

Gross Debt Service (GDS) Ratio

This determines the percentage of your gross annual household income required to own your home. Lenders estimate your annual mortgage payments (principal and interest), property taxes, heating costs and a percentage of condo fees, if applicable.

GDSR = (Mortgage Payment + Property Taxes + Condo Fees/2 + Hydro) /Income

Total Debt Service (TDS) Ratio

This is the percentage of your gross annual household income required to own your home, plus all other debts and loans. The calculation uses your GDS percentage and adds any other monthly payments you have, including loans or outstanding credit card debt. Additionally, if you have any spousal or child support payments to make will add to those other debts.

TDSR = (All debts in GDSR calculation + all other debts) / Income

Maximum Limits

Understanding your maximum GDS and TDS limit requirements for mortgage approval is important. Mortgage default insurance is mandatory on every mortgage with less than a 20% down payment to protect lenders in case of default – you can’t repay the mortgage.

Default insurance can be purchased through one of the 3 default insurers in Canada. Canada Mortgage and Housing Corporation (CMHC) – a crown corporation insures against the possibility of default on most of Canada’s prime (A lending) mortgages. There are 2 other mortgage default insurance providers, though they are privately owned: Sagen (GE, also known as Genworth) and Canada Guaranty (CG).

Default insurance is not available for purchases or renewals where the property is valued over $1M property value or refinances.

| Transaction | Required Credit Score (FICO) | Max Allowable GDSR | Max Allowable TDSR |

|---|---|---|---|

| Purchase / Renewal under $1M | 650 – 680 | 32 | 40 |

| Refinance / Purchase over $1M | 680+ | 35 | 42 |

| Purchase / Renewal under $1M | 680+ | 39 | 44 |

Determining Your Down Payment

The minimum down payment when buying a home in Canada is 5% of the purchase price for a home valued at $500,000 or less and 10% for the portion of the purchase price above $500,000.

However, you must have at least a 20% down payment to avoid paying mortgage default insurance premiums.

Example: If you’re buying a home for $750,000, your minimum down payment is $25,000 for the first $500,000 (5%) and $25,000 for the remaining $250,000 (10%) = $50,000 minimum down payment

What Does Mortgage Affordability Look Like Today?

Mortgage affordability is closely related to housing affordability. As home costs rise, so does the need for bigger mortgage payments to pay back the bigger mortgages needed to finance those houses. In this section, we will cover some basic data through graphs to visualize the differences in factors of homeownership throughout Canada.

House Prices

This chart shows the composite average/benchmark home prices in each province and some of Canada’s main urban markets.

This chart shows composite average/benchmark home prices across Canada. Source: CREA

Property Taxes

This table shows the monthly property taxes expected on the average property value.

This table shows expected monthly property taxes on the average-priced homes across Canada.

Mortgage Qualifying on 25 Years Amortization

This table shows monthly stress-tested mortgage payments over a 25-year amortization and the annual income required to service that mortgage on average-priced homes across Canada.

Calculations is based on a mortgage with a 25-year amortization, a 20% downpayment, provincially averaged property tax rate and includes $100 for monthly heating costs. Home prices are sourced from the most recent CREA report.

Mortgage Qualifying on 30 Years Amortization

This table shows monthly stress-tested mortgage payments over a 30-year amortization and the annual income required to service that mortgage on average-priced homes across Canada.

Calculations is based on a mortgage with a 30-year amortization, a 20% downpayment, provincially averaged property tax rate and includes $100 for monthly heating costs. Home prices are sourced from the most recent CREA report.

Closing Costs

It’s important to note that, in addition to your down payment, you also need cash resources to cover the extra costs required to complete the purchase and close the deal.

These costs are not insignificant and need to be factored into your affordability assessment. In most cases, you’ll be required to provide an upfront cash deposit, which is used to demonstrate to the seller that you’re committed to buying the home. There’s generally no minimum required – the seller determines the amount – but a general rule of thumb is at least 5% of the purchase price. The deposit will go towards your down payment.

Closing costs, which cover legal and administrative costs when the transaction closes (e.g., lawyer fees, home inspection fees, land transfer tax, and title insurance), can also add up from 1% to 4% of the purchase price. It is important to note that the specific amount of your closing costs will depend on all the auxiliary services you may need and the land/property transfer tax rate for the province and municipality where your home will be located.

How to Increase Your Mortgage Affordability

There are several ways to increase your mortgage affordability and boost your buying power to ensure you’re viewed as a responsible borrower in the eyes of lenders. Here are some of the recommendations to increase your affordability:

- Pay off debts. Generally speaking, the more debt you have, the less you’ll be able to borrow (your debts will be netted against your down payment, meaning that if you owe more money than you have for a downpayment, then you don’t really have a downpayment).

- Curb your spending. Use a budget planner. Stick to your budget – make sure to give yourself some spending money so it is budgeted.

- Reduce open accounts. Too many credit cards or lines of credit can hurt you, especially if your running balance is more than 35% of the limit.

- Ensure your credit score is healthy. The better your credit rating, the more attractive you are to lenders. The minimum requirement is a score of 680. The best rates are available for scores 720 or above.

- Consider a lower-priced home. A less expensive home means a lower down payment and smaller monthly mortgage payments.

- Consider a higher down payment. A higher down payment means you’ll need a smaller mortgage, but you must be prudent in your planning. Taking time to save more can cost you more for the same property. Conversely, so can allocating all your savings for the down payment.

- Choose a longer amortization. This will lower your monthly repayments, making them more affordable.

Mortgage Affordability FAQ

How do I calculate my mortgage affordability?

When calculating your mortgage affordability, consider your overall housing costs and any outstanding debt. Housing costs include the mortgage payment, property taxes, heating, and condo fees, if applicable. Other costs may include spousal/child support and other debts. Lenders use affordability calculations known as debt service ratios—GDS & TDS.

How much house can I afford based on my salary?

When calculating your mortgage affordability, look at your overall housing costs and any outstanding debt. Housing costs range from property to property; how much house you can afford based on your salary depends on the specific numbers. Mortgage affordability focuses on your income, monthly expenses and specific expenses associated with owning a home. The easiest way to determine affordability is through nesto’s Mortgage Affordability Calculator.

How do mortgage lenders check affordability?

Mortgage lenders check affordability by looking at your overall housing costs and any outstanding debt. Mortgage lenders focus on your income as a ratio of your expenses associated with owning a home – and separately consider any outside debts. Try nesto’s Mortgage Affordability Calculator.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.