REFINANCE

Refinance & Unlock Your Home Equity

Enjoy a fee-free refinancing experience with a nesto mortgage expert.

- Unlock home equity and enjoy a cash injection for whatever you need right now.

- Update your mortgage terms and find peace of mind.

A Rate Redo That Suits You!

Had a low variable rate once upon a Bank of Canada hike? Refinance for savings and stability.

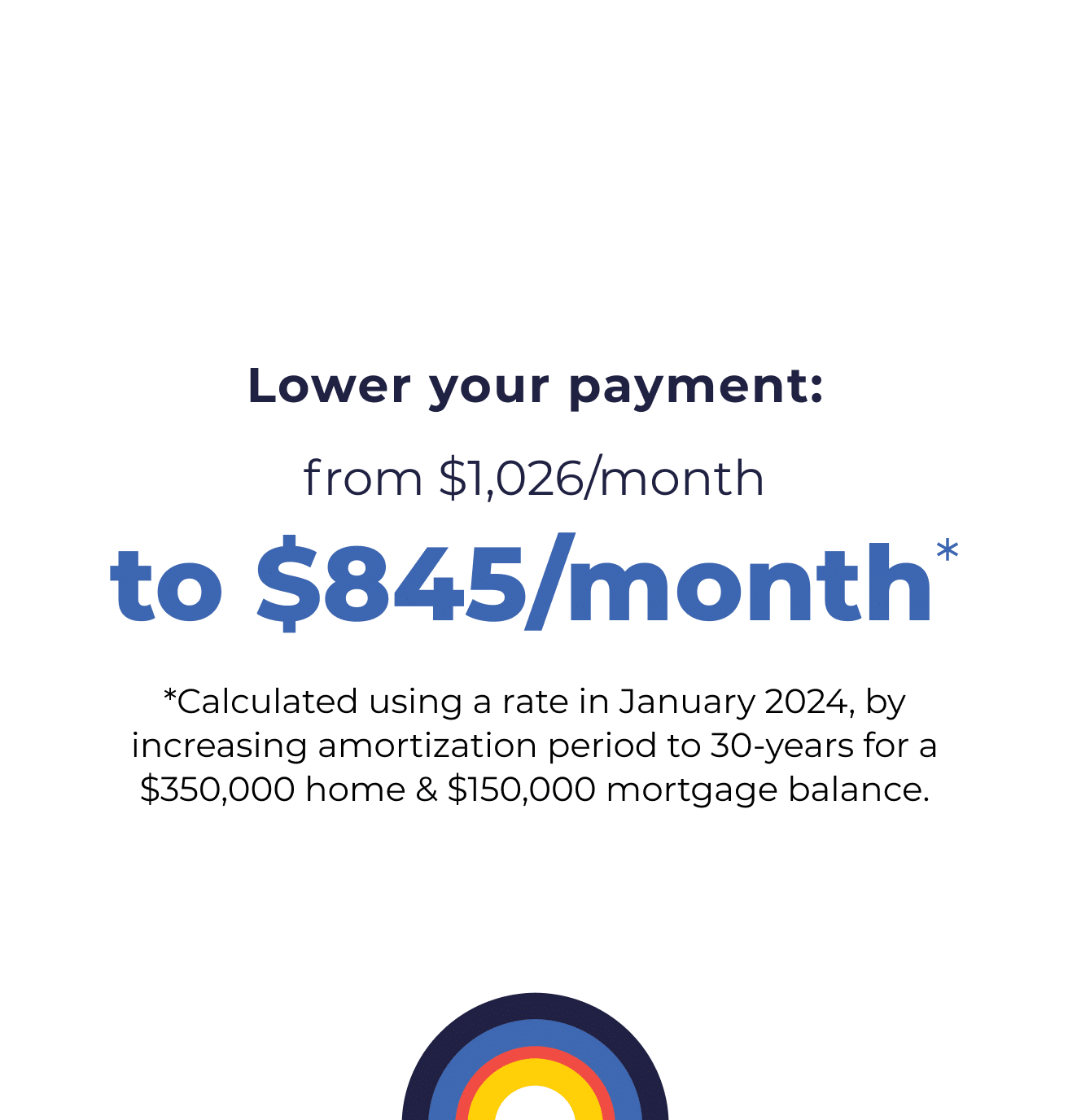

Our 300+ experts will help you negotiate new terms on your next mortgage, from adjusting your rate type to lowering your monthly mortgage payments, if you’ve been impacted by rate increases.

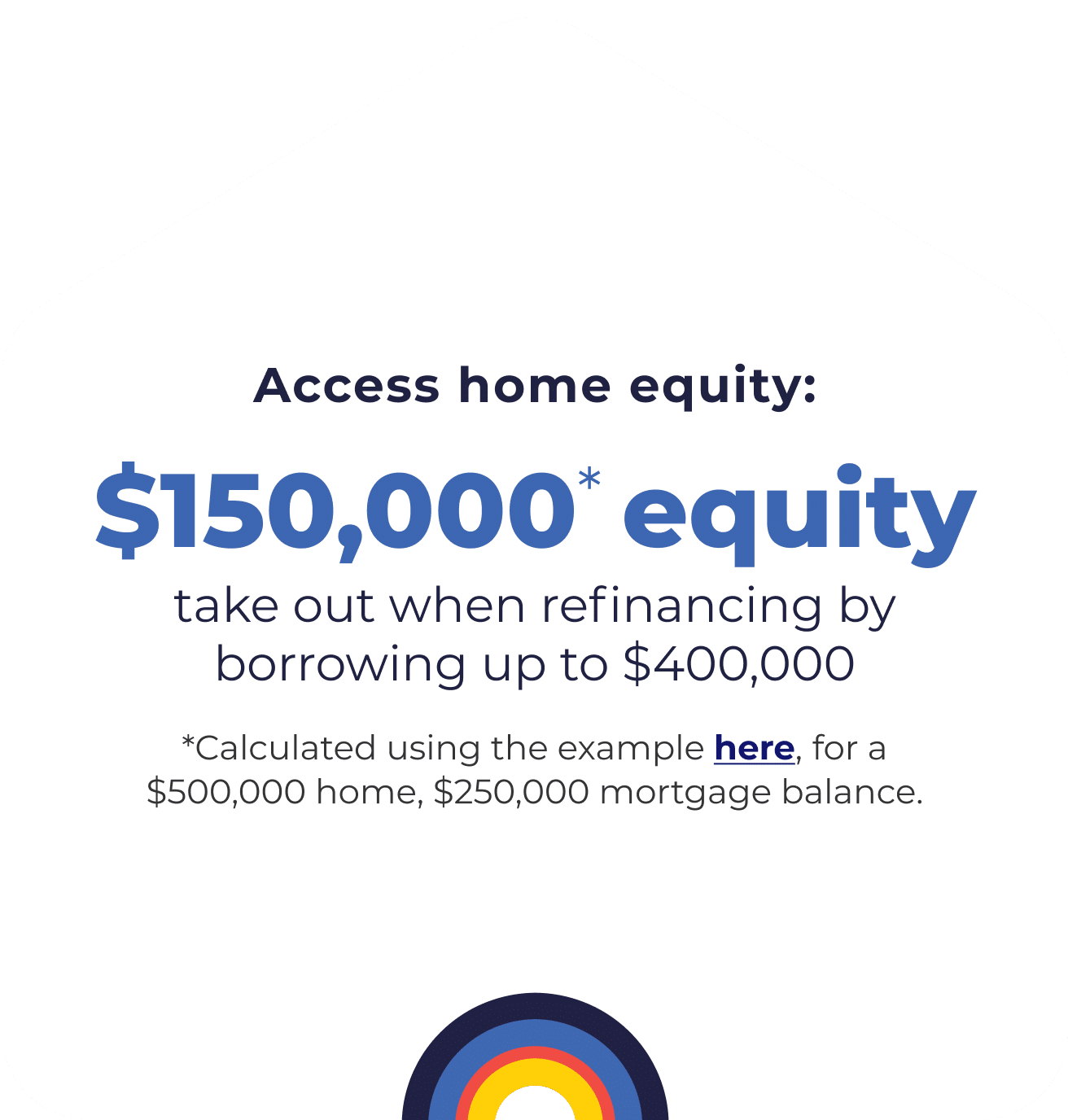

Have a home with equity that you want to tap for renovations? Refinance to make your dream a reality.

We’ll help you access your hard-earned home equity, whether it’s to upgrade your home, fund education expenses or other investments.

Refinance Rates in Canada

Unlock a low, 5-year mortgage refinancing rate today.

*Unlike variable rate mortgages (VRM), adjustable rate mortgages (ARM) cannot negatively amortize. (Aiming for a score above 680)

CURIOSITY PIQUED?

See how much equity you have!

REFINANCE

The bright side of refinances

We’ve provided mortgage advice to over 450,000+ Canadians, so we understand every situation is unique. No matter what’s driving the refinance — whether it’s a overwhelming mortgage payments or debt consolidation- we’re here for you. Here’s how we helped a couple refinance.

Goal: Accessing Equity to Afford Mortgage

Issue: Affordability Challenge

Michael and Carmen dreamed of a comfortable life in their own home, but as the years went by, their mortgage payments became increasingly burdensome.

Are you refinancing?

Province

Tips for refinancing your mortgage

Discover the secrets to successful mortgage refinancing! Take control of your financial future with our essential refinancing tips.

Tip 1

Tip 2

Tip 3

Tip 4

Tip 5

Tip 6

Credit Mastery

Improve your credit score – To access the lowest rates and improve your chances of an approval.

Mortgage Shopping

Shop around for the lowest rates without impacting your mortgage features. With nesto, you’ll get our Low Rate Guarantee (or $500*) without compromising on your mortgage features.

Appraisal

Use MLS and Realtor.ca to find comparable properties in your neighbourhood to get an idea of what yours is worth.

Mortgage Calculator

Use nesto’s refinance and mortgage payment calculators to gauge your carrying costs and how they will affect your cash flow post-refinance.

Level-Up

Check out nesto’s transparent articles to better understand the true costs and intricacies of a refinance.

Unbiased Advice

Have an unbiased conversation with a nesto mortgage expert to understand the pros and cons of refinancing and how they impact your mortgage needs.

Refinancing FAQs

What is a mortgage refinance?

Refinancing is renegotiating your existing loan or applying for a new loan where you already own the property. The new mortgage terms could include a different interest rate than your existing loan agreement. It could also increase the mortgage’s amount (or balance) and the life (or amortization) of the mortgage.

What are the costs of refinancing?

While there are fees associated with refinancing (ie. prepayment penalty, appraisal fees, etc.), for many, the benefits can outweigh these costs. See a full breakdown on the costs of refinancing here.

When is the best time to refinance?

The best time is always when you’re up for renewal so you can avoid the penalty on your current mortgage. But it also depends on when is best for your financial situation. If refinancing is going to free up much needed cash flow or equity, making it easier to get to your goals then it’s the right reason and time to proceed. At the end of the day, completing a cost savings analysis with one of nesto’s accredited mortgage experts will be your moment of truth – if it’s a sound fiscal choice.

What’s an equity take out (ETO) refinance?

Equity Take Out refinancing is the process of completing a refinance to take advantage of the built up equity in your property’s value by remortgaging it with a higher balance. The difference between the balance on your existing mortgage and new mortgage minus fees is your equity take out.

Happy nesto

Refinance Clients

![]()