Mortgage Basics #Featured articles

Mortgage Basics #Featured articles

How to Calculate Different Types of Mortgage Payments

Table of contents

Notice: Effective November 21, 2024, mortgage transfers between lenders will be exempt from requalification. Transactionally insured (those who originally purchased with less than 20% downpayment) and uninsured mortgages (without increasing mortgage balance or amortization) will no longer be required to stress test when changing lenders at maturity. Going forward, only new purchase and refinance mortgage applications must be qualified through the stress test.

A mortgage is one of the most significant financial investments Canadians make, so it’s essential to understand how each mortgage component will impact your payments and overall financial well-being. Understanding how to calculate mortgage payments is crucial for anyone buying a home in Canada.

Using a mortgage calculator to calculate mortgage payments is the easiest way to determine if your budget can accommodate the added expenses of a mortgage. This guide will walk you through the components of mortgage calculations and what factors can impact your payments.

Key Takeaways

- Mortgage payments consist of principal and interest, sometimes including taxes and insurance.

- Understanding the amortization schedule helps you track the progress of paying your mortgage.

- Mortgage calculators are valuable tools for estimating payments and exploring different scenarios.

Understanding the Structure of Mortgage Payments in Canada

In Canada, mortgage payments play a starring role in homeownership. They are the regular payments you make to your lender to gradually pay off the borrowed amount (principal) and the associated interest. Understanding how these payments are structured will help you plan your finances and create a sound mortgage strategy.

Mortgage payments consist primarily of principal and interest. However, you may also choose to include property taxes and insurance as part of your mortgage payment.

Understanding the Components of a Mortgage Payment

While your mortgage payment will mostly go toward the principal and interest components, a few additional components could impact the total amount you pay. Each mortgage payment could include portions allocated to property taxes, CMHC insurance, and mortgage insurance if you have chosen to add these as part of your payments.

Principal

The principal is the money you borrow from the lender to purchase a home. This can be determined by taking the purchase price and subtracting the amount you put down as a downpayment to get the initial principal balance. With each mortgage payment, a portion of the payment reduces the principal balance.

In the early years of your mortgage, a smaller portion of your payments go toward the principal, while a larger portion goes toward interest. As you progress with your mortgage, this will gradually shift around the halfway mark of your amortization, with a larger portion going toward the principal and a smaller portion toward the interest.

For example, the chart below shows a breakdown of principal and interest on a $500,000 mortgage with a 25-year amortization and a 5% fixed interest rate. If you assume that the interest rate remains unchanged for the life of the mortgage and make monthly payments, you will pay more toward the interest component for the first 11 years of the mortgage and start paying less in the 12th year until the mortgage is paid off.

| Year | Beginning Balance | Principal | Interest | Ending Balance |

|---|---|---|---|---|

| 1 | $500,000 | $10,386 | $24,510 | $489,614 |

| 2 | $489,614 | $10,912 | $23,984 | $478,702 |

| 3 | $478,702 | $11,465 | $23,432 | $467,237 |

| 4 | $467,237 | $12,045 | $22,851 | $455,192 |

| 5 | $455,192 | $12,655 | $22,242 | $442,538 |

| 6 | $442,538 | $13,295 | $21,601 | $429,242 |

| 7 | $429,242 | $13,968 | $20,928 | $415,274 |

| 8 | $415,274 | $14,676 | $20,221 | $400,598 |

| 9 | $400,598 | $15,418 | $19,478 | $385,180 |

| 10 | $385,180 | $16,199 | $18,697 | $368,981 |

| 11 | $369,981 | $17,019 | $17,877 | $351,962 |

| 12 | $351,962 | $17,881 | $17,016 | $334,081 |

| 13 | $334,081 | $18,786 | $16,110 | $315,295 |

| 14 | $315,295 | $19,737 | $15,159 | $295,558 |

| 15 | $295,558 | $20,736 | $14,160 | $274,822 |

| 16 | $274,822 | $21,786 | $13,110 | $253,036 |

| 17 | $253,036 | $22,889 | $12,007 | $230,147 |

| 18 | $230,147 | $24,048 | $10,849 | $206,099 |

| 19 | $206,099 | $25,265 | $9,631 | $180,834 |

| 20 | $180,834 | $26,544 | $8,352 | $154,290 |

| 21 | $154,290 | $27,888 | $7,008 | $126,403 |

| 22 | $126,403 | $29,300 | $5,597 | $97,103 |

| 23 | $97,103 | $30,783 | $4,113 | $66,320 |

| 24 | $66,320 | $32,341 | $2,555 | $33,979 |

| 25 | $33,979 | $33,979 | $918 | $0 |

Interest

The interest is the fee the lender charges to loan you the principal, known as the cost of borrowing. The interest rate you are charged on your mortgage directly impacts how much you will pay each month. A higher interest rate will mean higher mortgage payments and a higher overall cost of borrowing. This is why it’s an important part of your mortgage strategy to compare rates from different lenders to ensure you always secure the best mortgage rate with the most favourable terms.

For example, the chart below shows how interest rates affect the principal and interest you would pay over a 5-year fixed term on a $500,000 mortgage with a 25-year amortization.

| Interest Rate | Principal Paid | Interest | Remaining Mortgage Balance |

|---|---|---|---|

| 3% | $72,627 | $69,347 | $427,373 |

| 4% | $64,730 | $93,076 | $435,270 |

| 5% | $57,462 | $117,019 | $442,538 |

| 6% | $50,816 | $141,126 | $449,184 |

Higher interest rates not only increase your mortgage payments, but they also decrease your purchasing power. Higher interest rates reduce the amount of mortgage you can qualify for as you are required to be stress tested. The stress test is based on a rate of 5.25% or the rate you are offered +2%, whichever is higher. This means if you are offered a 3% interest rate, you would need to qualify at 5.25%, but if offered a 5% interest rate, you would need to qualify for a mortgage at 7%.

Taxes

Municipalities levy property taxes depending on your property’s location and assessed value. Some lenders will allow you to include property taxes as part of your mortgage payment. The lender will collect a portion of the taxes with each payment and hold them in an escrow (property tax) account until they are due. They will then remit payment to the municipality on your behalf.

Insurance

There are 2 types of insurance that you can typically include in your mortgage payments.

Mortgage default insurance is required if you put down less than 20% of the purchase price when you buy a home. The insurance premium can be paid upfront as a lump sum or included in your mortgage. If you choose to include the premium with your mortgage, this will increase your principal balance, though once included, it cannot removed but only paid off as a prepayment to reduce your interest-carrying costs.

| Loan-to-value (LTV) | Premium on Total Loan |

|---|---|

| 80.01% – 85% | 2.80% |

| 85.01% – 90% | 3.10% |

| 90.01 – 95% | 4.00% |

For example, if you put down 5% on a home with a $500,000 purchase price, you would require a mortgage of $475,000. However, you would be required to pay mortgage default insurance of $19,000 (a 4% premium). If you include the premium amount with your mortgage instead of paying it upfront, your total principal becomes $494,000, and you will pay mortgage interest on this amount.

Mortgage protection insurance is optional and offered when you take out a mortgage. At any time during the life of your mortgage, you may also choose to apply for this insurance even if you initially decided not to take it. Coverage can include life, critical illness, disability, or job loss, protecting you by covering mortgage payments or paying off the balance owing on the mortgage.

Premiums are charged based on age and mortgage amount. For example, if you are 30 years old and the premium is $0.15 per $1,000 of mortgage balance, you would pay roughly $75 monthly on a $500,000 mortgage.

If you purchase this protection through your lender, you will pay the premium with each mortgage payment. You also have the option to purchase this protection through an insurance company and pay the premium separately from your mortgage payments.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

Using a Mortgage Calculator in Canada

Mortgage calculators are widely available online and can be a helpful tool to estimate your mortgage payments. You must input specific information about your mortgage to use an online mortgage calculator.

How to Input Information

To get started using nesto’s mortgage payment calculator for a new mortgage, you will need to input the following:

- Asking Price: The purchase price or appraised value of the property.

- Downpayment: The amount of money you plan to put towards the purchase upfront, either as a dollar amount or a percentage of the purchase price.

- Amortization Period: The total time to pay off your mortgage in full.

- Payment Frequency: How often you want to make mortgage payments (e.g., monthly, bi-weekly, accelerated bi-weekly, etc.).

- Interest Rate and Term: You can enter information here if you have already been offered an interest rate for a term or want to compare fixed and variable options or different mortgage terms.

- Taxes/Fees (optional): If you know the annual property taxes or purchase a condo with maintenance fees, you can enter this information for a more accurate output.

In addition to the above information, if you use the payment calculator for a refinance or renewal, you must input the current property value and mortgage balance.

Example Calculation on a $400,000 Home

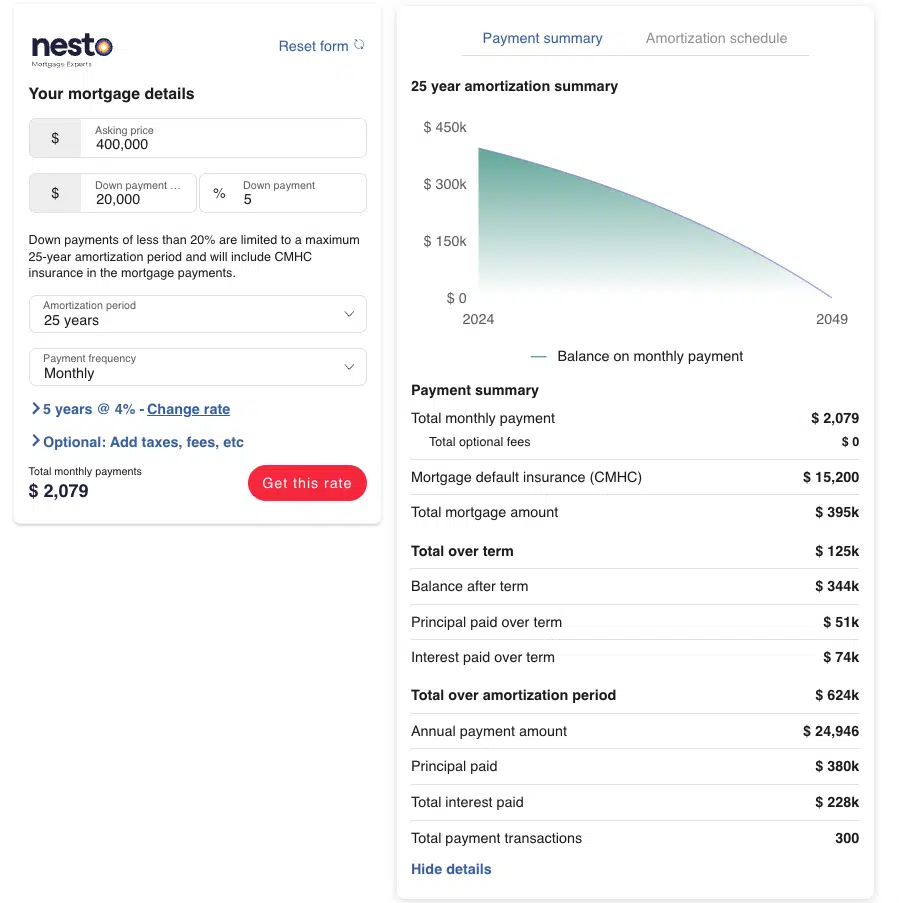

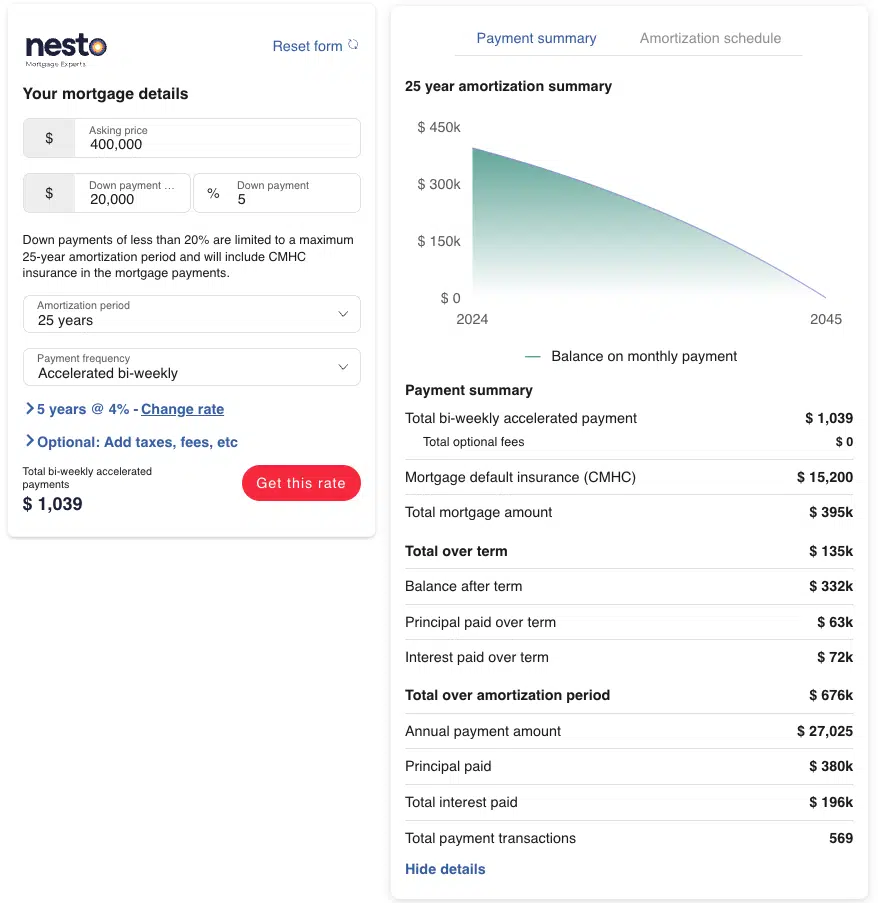

For example, you plan to purchase a $400,000 home with a 5% downpayment ($20,000), a 25-year amortization, and a 4% 5-year fixed interest rate. Using nesto’s mortgage calculator, you can estimate your mortgage payments based on the payment frequency.

The calculator will provide an estimated mortgage payment amount based on the payment frequency. If applicable, this amount includes principal, interest, and mortgage default insurance. You can also view the amortization schedule, which shows how payments are applied over the life of your mortgage.

Understanding the Output

If you selected monthly payments and included mortgage default insurance with your mortgage, you would pay approximately $2,079 monthly. Over the 5-year term, you would pay approximately $51,000 toward the principal and $74,000 toward the interest. When you are up for renewal, you will have an estimated mortgage balance of $344,000 at the end of the term.

If you selected accelerated bi-weekly payments and included mortgage default insurance with your mortgage, you would pay approximately $1,039 bi-weekly or 26 mortgage payments a year. Over the 5-year term, you would pay approximately $63,000 toward the principal and $72,000 toward the interest. When you are up for renewal, you will have an estimated mortgage balance of $332,000 at the end of the term.

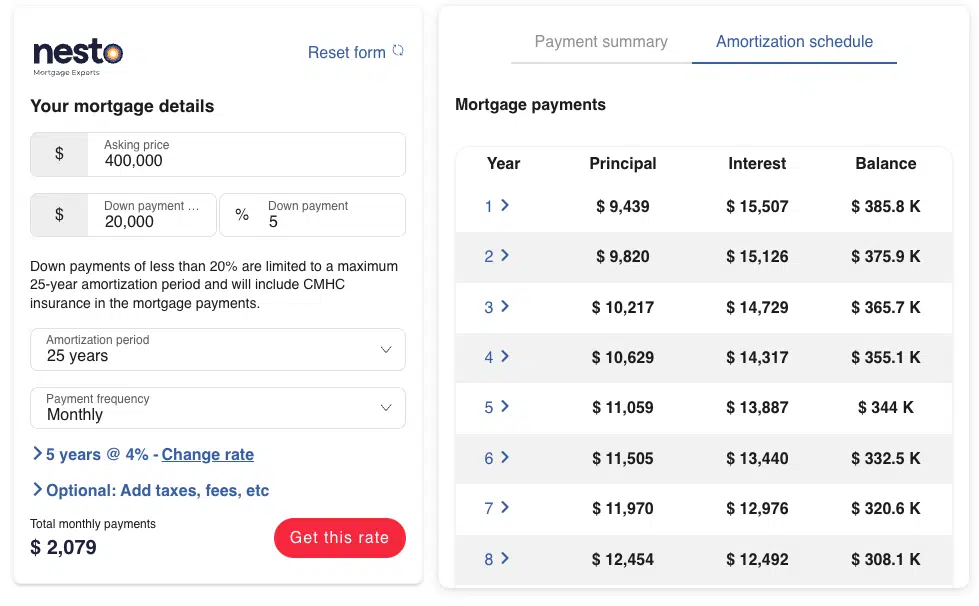

The Amortization Schedule Explained

An amortization schedule details each mortgage payment, showing a breakdown of how much goes toward principal and interest and the balance remaining after each payment. This schedule helps you track the progress of your mortgage and understand how your payments contribute to paying it off. However, when looking at an amortization schedule for the entire life of the mortgage, it assumes that your interest rate remains the same.

Example Schedule for a 25-year Amortization

An amortization schedule for a 25-year mortgage will show 300 monthly payments (25 years x 12 months). In the early years, a larger portion of each payment goes towards interest. As you progress, more of each payment goes towards the principal, gradually reducing the outstanding balance.

How Can Inputs Affect Your Mortgage Payment

Many variables can affect your mortgage payments. Adjusting your downpayment amount, interest rate, and payment frequency can all change the amount you will pay.

Downpayment

The downpayment is the amount you are putting down toward your home purchase. A larger downpayment reduces the amount you need to borrow, resulting in lower mortgage payments and less interest paid over the life of the mortgage. A large enough downpayment can also prevent you from having to pay for mortgage default insurance.

Mortgage Rate

The interest rate you are offered affects your mortgage payments and your qualifying amount. Even a slight difference in interest rates can significantly impact the overall cost of your mortgage. Higher rates mean higher mortgage payments and higher interest-carrying costs. Lower rates mean lower mortgage payments and lower interest-carrying costs.

This is why shopping around for the best rates and terms is essential when getting a new mortgage or renewing/refinancing. By finding a lower rate, you can save on interest-carrying costs over the life of your mortgage, lower mortgage payments, and qualify for a larger mortgage amount. Working with a licensed mortgage expert can help you explore rates from different lenders, ensuring you get the best mortgage rate and terms for your financial circumstances.

Payment Frequency

The frequency of your mortgage payments can help you reduce interest-carrying costs and potentially pay off your mortgage faster. Bumping your payments from monthly to semi-monthly or any other payment frequency will reduce the principal balance on which interest is compounded, helping you save on interest-carrying costs over the life of the mortgage.

Choosing an accelerated payment frequency will add the equivalent of an extra monthly mortgage payment divided equally over each payment you make during the year. This additional payment helps you save on interest-carrying costs and reduces the time it takes to pay off your mortgage so you can be mortgage-free faster. Accelerated payment frequencies will provide the most significant cost savings over other payment frequencies.

Mortgage Term

The mortgage term is the length of time that your mortgage contract is in effect. Terms typically range from 6 months to 10 years. When you reach the end of your mortgage term, you will need to renew it. If you have a fixed-rate mortgage, you must renew at current interest rates, and your mortgage payments will adjust to reflect the new interest rate.

With so many types of mortgage solutions available in Canada, shorter mortgage terms typically have higher interest rates than longer ones. Shorter terms can also expose you to interest rate risk since the need to frequently renew your mortgage means choosing a new rate more often. If rates are higher, your mortgage payments will increase, and you will pay more interest. However, shorter terms can help you save on interest costs if it’s anticipated that rates will decrease in the near future.

Frequently Asked Questions

What are the main components of a mortgage payment in Canada?

Principal and interest are the main components of a mortgage payment in Canada. However, you can include mortgage default insurance if applicable, property taxes if your lender allows, and mortgage insurance premiums.

How does a larger downpayment affect my mortgage?

A larger downpayment reduces the amount you need to borrow (principal), helping you save on interest-carrying costs while reducing your mortgage payments.

What is an amortization schedule, and why is it important?

Amortization is the time it takes to pay off the mortgage in full. The amortization schedule outlines each mortgage payment, breaking down the principal and interest paid. This can help you track your progress and how much each payment goes toward principal and interest.

What is CMHC insurance, and when is it required?

CMHC insurance is a type of mortgage default insurance required when you have a downpayment of less than 20%. Mortgage default insurance protects the lender if you default on your mortgage. This insurance can also be purchased from Sagen and Canada Guaranty.

How do I calculate my first mortgage payment?

The easiest way to calculate your first mortgage payment is to use an online mortgage calculator to estimate the payment. Your mortgage expert can also tell you what your first mortgage payment will be when you go through the mortgage process.

Final Thoughts

Calculating mortgage payments involves understanding how various factors influence your payments so you can determine if you can comfortably afford the additional costs of a mortgage payment. A mortgage payment calculator is a valuable tool to help you estimate mortgage payments and see how each payment reduces your mortgage balance over the life of the mortgage.

By utilizing an online mortgage calculator and consulting with a mortgage expert, you can gain a comprehensive understanding of your financial commitments and secure the best rate and terms for your home purchase.Ready to take the next step in your homeownership journey? Contact a nesto mortgage expert today to discuss your options and secure the best mortgage for your needs.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!