Income Needed to Get a Mortgage in Canada

The Bank of Canada’s recent rate adjustments have significantly affected housing affordability nationwide in today’s evolving economic landscape. This guide breaks down current income requirements for securing mortgage loans in various Canadian regions and cities, helping you understand how these economic shifts affect home affordability. We’ll examine critical factors such as loan-to-value (LTV) ratios, debt service requirements, amortization periods, and the latest mortgage stress test implications for Canadian borrowers.

Key Takeaways

- Canadians typically need an income of 4 to 5 times the mortgage amount.

- Income requirements vary widely across Canadian provinces and cities.

- Your mortgage term and type selection can significantly affect the income required to qualify.

What would my Mortgage Payment be at Today’s Interest Rate?

At today’s insured 5-year fixed rate of

See full mortgage payment examples at today’s rates.

Qualifying for a Mortgage in Canada

Details

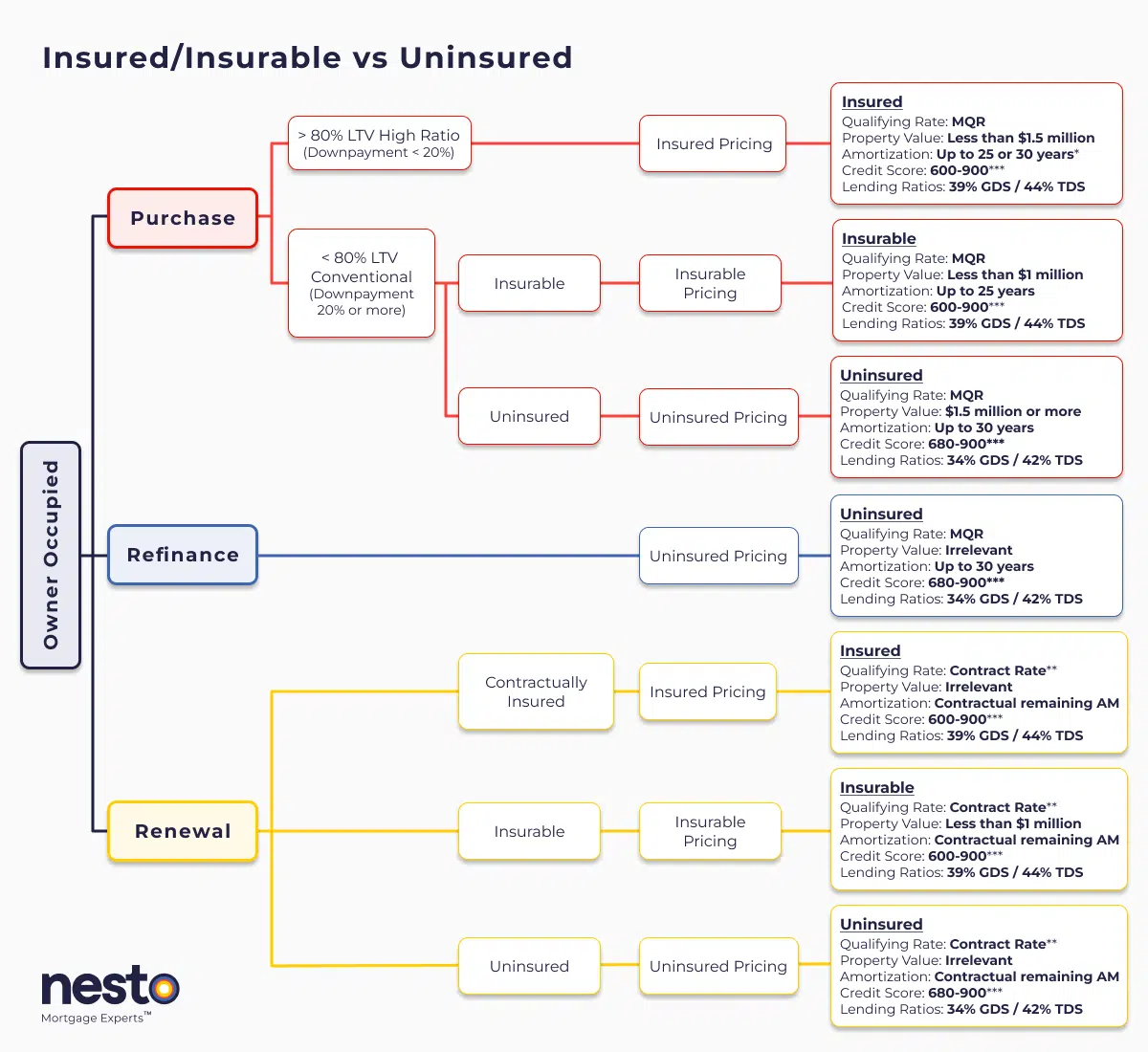

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

Loan-To-Value (LTV) Ratios and Qualifying Rates

Higher loan-to-value (LTV) ratios for insured mortgages remain beneficial in the current market, allowing you to access lower qualifying rates. However, higher interest rates mean borrowers must meet stricter income and credit score standards.

Understanding Debt Service Ratios

Debt service ratios, also known as debt-to-income ratios, gross debt service (GDS) and total debt service (TDS) ratios, are critical as borrowers face higher qualifying standards:

Adjusted Ratios for Insured and Uninsured Mortgages: Insured mortgages allow up to 39% GDS and 44% TDS, while uninsured mortgages typically require lower ratios.

Focus on Financial Health: With higher interest rates, managing monthly mortgage payments within your budget is essential.

| Transaction Type & Limitation | Minimum GDS | Minimum TDS |

|---|---|---|

| Credit score (FICO) for the lowest-score borrower (between 650 and 680) | 32 | 40 |

| Uninsured refinance or uninsured purchase of a property valued at $1.5 million or more | 35 | 42 |

| Insured purchase with a down payment of less than 20% (also applies to insurable mortgages for new purchases and renewals) | 39 | 44 |

How Do You Qualify for a Mortgage in Canada?

To qualify for a mortgage, you must pass a stress test to prove you can handle higher interest rates, which applies to all borrowers, even without mortgage default insurance. Lenders confirm you can manage your mortgage at an elevated rate, known as the minimum qualifying rate.

The minimum qualifying rate (MQR) is the greater of the contracted rate plus 2% or 5.25%. However, when an insured mortgage (where the borrowers paid for the insurance) is transferred or switched between lenders at renewal, it will not be stress-tested and will be qualified at the contract rate.

Understand Canada’s mortgage stress test rules.

Mortgage Default Insurance Requirements

Mortgage default insurance is mandatory for downpayments under 20%, impacting your mortgage qualifying amount and monthly costs. Default insurance often applies to higher-LTV loans, making high-ratio mortgages more affordable. Due to limitations on amortization periods, these mortgages require a smaller downpayment despite having a higher monthly payment.

| Loan-to-Value | Premium (25-year Amortization) | Premium (30-year amortization) |

|---|---|---|

| 80.01% to 85% | 2.80% | 3.00% |

| 85.01% to 90% | 3.10% | 3.30% |

| 90.01% to 95% | 4.00% | 4.20% |

Region-Specific Income Requirements & Monthly Updates

Income requirements and purchase prices vary by location:

- Major cities like Toronto and Vancouver have higher income requirements based on property values and interest rate changes.

- Cities like Montreal are more affordable but still require a slight increase in income.

Month-Over-Month Change in Income Required for Mortgages in Canadian Provinces

For Canadian provinces, the average home prices and the income required to qualify for a mortgage on an average-priced home have changed compared with last month.

| Province | Income Needed This Month | Income Needed Previous Month | $ Difference | Home Prices This Month | Home Prices Previous Month | $ Difference |

|---|---|---|---|---|---|---|

| Canada | $120,666 | $122,939 | $2,273 | $658,300 | $660,300 | $34,100 |

| BC | $145,241 | $165,361 | $20,120 | $886,200 | $894,000 | $45,400 |

| AB | $88,552 | $93,622 | $5,071 | $499,300 | $498,800 | $16,000 |

| SK | $70,335 | $71,283 | $948 | $359,500 | $359,000 | -$19,100 |

| MB | $73,490 | $90,730 | $17,240 | $373,802 | $392,045 | -$22,674 |

| ON | $141,267 | $144,071 | $2,804 | $745,800 | $749,200 | $56,000 |

| QC | $94,663 | $99,213 | $4,550 | $535,000 | $529,600 | -$35,600 |

| NB | $66,815 | $68,693 | $1,879 | $329,400 | $334,100 | -$15,200 |

| NS | $84,115 | $84,460 | $345 | $417,700 | $413,300 | -$2,400 |

| PE | $75,095 | $76,488 | $1,393 | $371,700 | $373,300 | -$6,200 |

| NL | $63,337 | $64,508 | $1,171 | $334,000 | $335,100 | -$29,600 |

All calculations are based on a mortgage with a 25-year amortization, a 20% downpayment, a GDS ratio 39%, assuming no other debts and a property tax rate (averaged for provinces), including $100 for monthly heating costs. Home prices are sourced from the most recent report at crea.ca. Unless specified, we use the lowest insured/insurable 5-year fixed rate available on nesto.ca at the time of each monthly update. All figures and calculations are for illustration purposes only.

Year-Over-Year Change in Income Required for Mortgages in Canadian Provinces

For Canadian provinces, average home prices and the income required to qualify for a mortgage on an average-priced home have changed compared with last year.

| Province | Income Needed This Year | Income Needed Last Year | $ Difference | Home Prices This Year | Home Prices Last Year | $ Difference |

|---|---|---|---|---|---|---|

| Canada | $120,666 | $123,536 | $2,871 | $658,300 | $692,400 | $34,100 |

| BC | $145,241 | $149,105 | $3,864 | $886,200 | $931,600 | $45,400 |

| AB | $88,552 | $90,729 | $2,177 | $499,300 | $515,300 | $16,000 |

| SK | $70,335 | $71,902 | $1,568 | $359,500 | $340,400 | -$19,100 |

| MB | $73,490 | $75,120 | $1,630 | $373,802 | $351,128 | -$22,674 |

| ON | $141,267 | $144,520 | $3,252 | $745,800 | $801,800 | $56,000 |

| QC | $94,663 | $96,996 | $2,333 | $535,000 | $499,400 | -$35,600 |

| NB | $66,815 | $68,251 | $1,437 | $329,400 | $314,200 | -$15,200 |

| NS | $84,115 | $85,936 | $1,822 | $417,700 | $415,300 | -$2,400 |

| PE | $75,095 | $76,716 | $1,621 | $371,700 | $365,500 | -$6,200 |

| NL | $63,337 | $64,794 | $1,457 | $334,000 | $304,400 | -$29,600 |

All calculations are based on a mortgage with a 25-year amortization, a 20% downpayment, a GDS ratio of 39%, assuming no other debts, and a property tax rate (averaged across provinces), including $100 for monthly heating costs. Home prices are sourced from the most recent report at crea.ca. Unless specified, we use the lowest insured/insurable 5-year fixed rate available on nesto.ca at the time of each monthly update. All figures and calculations are for illustration purposes only.

Month-Over-Month Change in Income Required for Mortgages in Canadian Cities

In Canadian cities, average home prices and the income required to qualify for a mortgage on an average-priced home have changed from last month.

| City | Income Needed This Month | Income Needed Previous Month | $ Difference | Home Prices This Month | Home Prices Previous Month | $ Difference |

|---|---|---|---|---|---|---|

| Vancouver | $180,126 | $228,921 | $48,795 | $1,101,900 | $1,114,800 | $66,500 |

| Victoria | $144,609 | $160,097 | $15,488 | $861,600 | $865,000 | $8,500 |

| Calgary | $97,460 | $103,788 | $6,327 | $555,500 | $554,800 | $18,600 |

| Edmonton | $76,239 | $81,077 | $4,837 | $409,000 | $408,300 | $1,900 |

| Saskatoon | $81,349 | $81,341 | $8 | $417,800 | $417,700 | -$17,300 |

| Regina | $66,793 | $67,811 | $1,018 | $330,600 | $330,900 | -$17,100 |

| Winnipeg | $75,053 | $88,906 | $13,853 | $382,100 | $380,400 | -$20,100 |

| Toronto | $164,372 | $174,129 | $9,757 | $935,200 | $942,300 | $82,400 |

| Hamilton | $140,593 | $142,716 | $2,123 | $725,100 | $725,200 | $80,300 |

| Ottawa | $115,027 | $118,099 | $3,072 | $606,700 | $613,700 | $11,800 |

| Guelph | $141,263 | $141,103 | $160 | $731,600 | $719,700 | $43,000 |

| London | $112,479 | $113,063 | $584 | $558,000 | $552,800 | $52,200 |

| Mississauga | $173,655 | $180,755 | $7,100 | $949,500 | $973,300 | $94,400 |

| Kitchener | $124,469 | $125,181 | $711 | $646,200 | $640,100 | $66,200 |

| Montreal | $105,175 | $107,146 | $1,971 | $579,900 | $573,300 | -$31,400 |

| Quebec City | $79,525 | $82,168 | $2,643 | $437,400 | $435,700 | -$56,400 |

| Gatineau | $88,001 | $88,383 | $382 | $494,603 | $469,937 | -$20,943 |

| Saint John | $70,692 | $74,791 | $4,100 | $326,100 | $341,100 | $12,900 |

| Moncton | $74,425 | $75,908 | $1,483 | $379,800 | $381,800 | -$40,000 |

| Fredericton | $73,765 | $74,664 | $898 | $351,800 | $351,200 | -$10,600 |

| Halifax | $95,011 | $101,646 | $6,635 | $545,200 | $543,000 | $3,700 |

| St. John’s | $72,810 | $74,798 | $1,987 | $395,500 | $395,100 | -$33,600 |

| Kingston | $102,833 | $106,291 | $3,458 | $517,600 | $527,600 | $34,200 |

| Windsor | $121,942 | $123,253 | $1,311 | $574,700 | $573,000 | $11,900 |

| Saguenay | $69,624 | $69,285 | $339 | $366,240 | $358,648 | -$34,742 |

| Sherbrooke | $92,979 | $96,101 | $3,122 | $521,260 | $512,456 | -$21,511 |

| Trois-Rivieres | $81,212 | $78,834 | $2,378 | $442,507 | $417,336 | -$54,537 |

| Central Quebec | $60,203 | $50,528 | $9,675 | $334,200 | $340,200 | -$24,300 |

| Estrie | $89,127 | $71,614 | $17,512 | $469,600 | $457,100 | -$64,500 |

| Mauricie | $58,193 | $47,478 | $10,715 | $309,000 | $315,200 | -$23,600 |

All calculations are based on a mortgage with a 25-year amortization, a 20% downpayment, a GDS ratio of 39%, assuming no other debts, and a property tax rate (averaged across provinces), including $100 for monthly heating costs. Home prices are sourced from the most recent report at crea.ca. Unless specified, we use the lowest insured/insurable 5-year fixed rate available on nesto.ca at the time of each monthly update. All figures and calculations are for illustration purposes only.

Year-Over-Year Change in Income Required for Mortgages in Canadian Cities

For Canadian cities, average home prices and the income required to qualify for a mortgage on an average-priced home have changed compared with last year.

| City | Income Needed This Year | Income Needed Last Year | $ Difference | Home Prices This Year | Home Prices Last Year | $ Difference |

|---|---|---|---|---|---|---|

| Vancouver | $180,126 | $184,931 | $4,805 | $1,101,900 | $1,168,400 | $66,500 |

| Victoria | $144,609 | $148,366 | $3,757 | $861,600 | $870,100 | $8,500 |

| Calgary | $97,460 | $99,883 | $2,422 | $555,500 | $574,100 | $18,600 |

| Edmonton | $76,239 | $78,023 | $1,784 | $409,000 | $410,900 | $1,900 |

| Saskatoon | $81,349 | $79,408 | -$1,941 | $417,800 | $400,500 | -$17,300 |

| Regina | $66,793 | $68,234 | $1,442 | $330,600 | $313,500 | -$17,100 |

| Winnipeg | $75,053 | $76,719 | $1,666 | $382,100 | $362,000 | -$20,100 |

| Toronto | $164,372 | $168,450 | $4,078 | $935,200 | $1,017,600 | $82,400 |

| Hamilton | $140,593 | $143,755 | $3,162 | $725,100 | $805,400 | $80,300 |

| Ottawa | $115,027 | $117,673 | $2,646 | $606,700 | $618,500 | $11,800 |

| Guelph | $141,263 | $144,453 | $3,190 | $731,600 | $774,600 | $43,000 |

| London | $112,479 | $114,912 | $2,433 | $558,000 | $610,200 | $52,200 |

| Mississauga | $173,655 | $177,796 | $4,141 | $949,500 | $1,043,900 | $94,400 |

| Kitchener | $124,469 | $127,287 | $2,818 | $646,200 | $712,400 | $66,200 |

| Montreal | $105,175 | $107,704 | $2,529 | $579,900 | $548,500 | -$31,400 |

| Quebec City | $79,525 | $81,433 | $1,907 | $437,400 | $381,000 | -$56,400 |

| Gatineau | $88,001 | $90,158 | $2,157 | $494,603 | $473,660 | -$20,943 |

| Saint John | $70,692 | $72,114 | $1,422 | $326,100 | $339,000 | $12,900 |

| Moncton | $74,425 | $76,081 | $1,656 | $379,800 | $339,800 | -$40,000 |

| Fredericton | $73,765 | $75,299 | $1,534 | $351,800 | $341,200 | -$10,600 |

| Halifax | $95,011 | $97,389 | $2,378 | $545,200 | $548,900 | $3,700 |

| St. John’s | $72,810 | $74,535 | $1,725 | $395,500 | $361,900 | -$33,600 |

| Kingston | $102,833 | $105,090 | $2,257 | $517,600 | $551,800 | $34,200 |

| Windsor | $121,942 | $124,448 | $2,506 | $574,700 | $586,600 | $11,900 |

| Saguenay | $69,624 | $71,221 | $1,597 | $366,240 | $331,498 | -$34,742 |

| Sherbrooke | $92,979 | $95,252 | $2,273 | $521,260 | $499,749 | -$21,511 |

| Trois-Rivieres | $81,212 | $83,142 | $1,930 | $442,507 | $387,970 | -$54,537 |

| Central Quebec | $60,203 | $61,660 | $1,457 | $334,200 | $309,900 | -$24,300 |

| Estrie | $89,127 | $91,175 | $2,048 | $469,600 | $405,100 | -$64,500 |

| Mauricie | $58,193 | $59,540 | $1,348 | $309,000 | $285,400 | -$23,600 |

All calculations are based on a mortgage with a 25-year amortization, a 20% downpayment, a GDS ratio of 39%, assuming no other debts, and a property tax rate (averaged across provinces), including $100 for monthly heating costs. Home prices are sourced from the most recent report at crea.ca. Unless specified, we use the lowest insured/insurable 5-year fixed rate available on nesto.ca at the time of each monthly update. All figures and calculations are for illustration purposes only.

We’re curious…

Are you a first-time buyer?

Frequently Asked Questions (FAQs) on Mortgage Affordability

What salary do I need to buy a home in Canada right now?

The income needed to buy a home in Canada depends on where you live, current mortgage rates, the home price, property taxes, heating costs, and the mortgage stress test. At a national level, the qualifying income for an average-priced home is $120,666, which updates automatically as interest rates and home prices change. Regional and city income requirements can vary significantly, so comparing location-specific data is essential before setting a budget.

To illustrate the varying income requirements across Canada, nationally, they range between $118,982 and$139,809, while purchasing the average home in Vancouver will require a range of household income between $177,308 and$209,672, and an average-priced home in Newfoundland ranges between $62,483 and$73,292.

Why are mortgage payments still rising even when rates feel more stable?

Mortgage payments remain elevated because borrowers continue to qualify at higher stress-test rates, and home prices remain high in many markets. Even if interest rates stabilize, higher borrowing costs continue to push up qualifying monthly payments, especially for new buyers and those looking to refinance. Many Canadians are stretching amortizations to manage cash flow, but longer amortizations increase total interest paid over time and can affect long-term affordability.

Why haven’t variable mortgage payments gone down yet?

Most variable-rate mortgages in Canada are structured as VRMs, where the payment remains fixed while the interest-to-principal mix changes. When rates rise, more of the payment goes toward interest; when rates fall, more goes toward principal, but the payment itself does not automatically drop.

Many VRM borrowers who took out mortgages during the low-rate period have reached their trigger points, which explains why payments have not gone down as quickly as expected.

By contrast, monthly payments on adjustable-rate mortgages (ARM) change with rates, allowing payments to fall sooner as rates go down.

How much income do I need to qualify for a $400,000 mortgage?

The income required to qualify for a $400,000 mortgage depends on the qualifying rate, down payment size, and household expenses. Using today’s insured qualifying assumptions, the required income is $92,389. This figure already accounts for the mortgage stress test, which uses the higher of 5.25% or the contract rate plus 2%, making it a realistic benchmark for what lenders will approve.

How do mortgage rates and home prices work together to affect affordability?

Mortgage affordability is shaped by the interaction between interest rates and home prices, not by either alone. Even modest changes in interest rates can materially affect qualifying income, while month-over-month or year-over-year price shifts also move the affordability needle.

That’s why tracking both income requirements and price trends, such as Canada’s home price now at $658,300 compared to last month’s $660,300 or the average home price last year this month at $692,400, provides a clearer picture of whether affordability is improving or worsening for buyers.

Final Thoughts

Navigating Canada’s housing market takes more than watching home prices or waiting for interest rates to move. Whether you’re buying your first home, upsizing, or planning for a future purchase, staying on top of income requirements, debt-to-income ratios, and qualification rules gives you clarity when it matters most. Mortgage decisions made with current information tend to hold up better, especially in an environment where borrowing costs and affordability can shift quickly.

Working with a mortgage expert helps turn that information into a strategy. A clear view of your options, budget, and long-term goals can make the difference between stretching too far and buying with confidence. Connect with nesto mortgage experts to find the most suitable mortgage strategy for your affordability.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and the quality of their advice. nesto aims to transform the mortgage industry by providing honest advice and competitive rates through a 100% digital, transparent, and seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!