![]()

FIRST-TIME HOME BUYER

Let’s unlock the door to homeownership together

Lowest rates, expert advice, and savings to guide you through this milestone moment.

- 15% lower rates than banks, no haggling needed*

- Canada’s leading digital mortgage lender

Are you a first-time buyer?

Province

We are the bright side of mortgages!

Buying your first home is a big deal—and with high rates and affordability challenges, every dollar counts. nesto offers 15% lower rates than the big banks upfront* to help you save big from day one. We’re here to make the dream happen for all Canadians, stress-free.

33%

of non-homeowners think they will never own a home*. We disagree.

$3,687

is the average monthly mortgage payment in Canada (stress-tested)*

$309

saved on interest per month if you choose nesto over the “other guys”*

Skip the rate shopping. Get the lowest rate right from the start from Canada’s leading digital mortgage lender.

New rules, new opportunities

The federal government has introduced new measures to help first-time buyers step off the sidelines and into the market. Here’s a quick guide to the changes—because we’re here to support you every step of the way.

Extended amortizations

Effective December 15, 2024

First-time homebuyers and those purchasing newly built homes are now eligible for a 30-year amortization period on insured mortgages (less than 20% down payment). What does this mean for you? It can help qualify and reduce monthly mortgage payments by an average of $200/month*. But first, it’s important to weigh the pros and cons.

Price cap increase

Effective December 15, 2024

The price limit for insured mortgages has increased from $1 to $1.5 million. Previously, homes above $1 million required a 20% down payment. What does this mean for you? In higher-priced markets like Toronto & Vancouver, this helps buyers qualify for mortgages with a lower down payment.

Government programs

First-time buyers can withdraw up to $60,000 from their Registered Retirement Savings Plan (RRSP) & have a lifetime limit of $40,000 to withdraw tax-free from their First Home Savings Account (FHSA). What does this mean for you? These programs are designed to increase access to funds for your down payment.

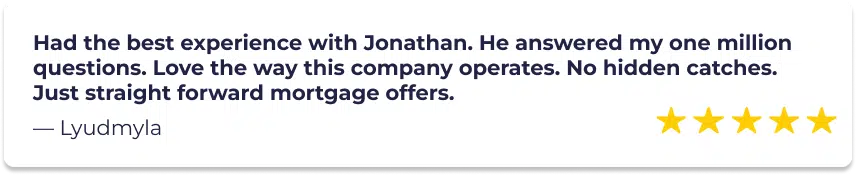

Your first mortgage?

We’ve got the experience to guide you home.

- Low mortgage rates

The lowest rates from the get-go, without the negotiation games

- Personalized advice

As much or as little guidance as you want along the way from our 310+ experts

- Simplicity

100% stress-free mortgage experience. Unlock your low rate in 1 minute.

Knowledge is Power

The ultimate guide for first-time buyers

Home buying can feel like a maze. Skip the rookie mistakes. Learn the ins and outs of homeownership with our simple guide—and chat with a mortgage expert to ensure sure you’re fully ready.

What to expect next:

6 months out

5 months

4 months

3 months

2 months

1 month

Closing day

Financial Preparation

- Assess Homeownership Readiness: Understand the true costs of owning a home—down payments, closing costs, and recurring or unexpected expenses like maintenance and repairs.

- Prepare Your Finances: Explore first-time buyer incentives and use tools like nesto’s Mortgage Affordability Calculator to determine your budget. Make sure your credit score is in good shape, as it impacts your mortgage options.

Do your homework

- Know Your Options: Fixed or variable? Short or long-term? Learn the pros and cons or chat with a mortgage expert to find the right fit for you.

Start your shop

- Compare Lenders: Not all mortgages are the same. Find the best rates and features—or save time and lock in 15% lower rates upfront* with nesto.

- Get Pre-Qualified: Pre-qualification or pre-approval can clarify your price range and lock in your rate for up to 120 days.

Zone In

- Zone In: Narrow down neighbourhoods and homes that match your budget and lifestyle.

- Plan for Extras: Budget for closing costs, inspections, and moving expenses—these can sneak up on you!

Make your Move

- Place Your Offer: Found your dream home? Submit an offer that includes the purchase price, conditions, and closing date.

- Do Your Due Diligence: Hire a professional to assess the property’s structure and condition before finalizing.

Prepare for Closing

- Legal Assistance: Work with a lawyer or notary to review documents and handle the title search.

- Ready Your Funds: Ensure you’ve got your down payment and closing costs, including land transfer taxes and legal fees.

Welcome Home

Congratulations! Here’s what happens next:

- Get the Keys from Your Lawyer: The home is officially yours!

- Change Your Locks: don’t forget this step.

Helpful Tools & Resources

“How much can I really afford?”

How nesto stacks up

When it comes to speed, transparent advice, and low mortgage rates, we deliver. See how we stack up against big banks & brokers in Canada.

![]()

First-Time Home Buyer FAQ

Who is a first-time home buyer?

To qualify as a first-time homebuyer (FTHB), you must not have owned or lived in a home owned by your spouse/common-law partner in the past 4 years. You may still qualify if you’ve rented for 4 years or if your relationship ends.

The federal government recognizes you as an FTHB for default-insured purchases due to a relationship breakdown. You’ll requalify for mortgage insurance and RRSP withdrawals under the Homebuyers’ Plan (HBP) for a spousal buyout after a breakup. However, provincial definitions for FTHB, especially for land transfer tax rebates, may differ if you or your spouse previously owned property.

What’s the difference between a mortgage broker, lender and bank?

Mortgage brokers, lenders, and banks each play a unique role in the mortgage process. Brokers connect borrowers with various lenders, including banks and credit unions, to find personalized mortgage options and competitive rates. Lenders, such as banks, provide mortgage funds, though banks typically only offer their products.

What incentives are available for FTHBs?

Home Buyers’ Plan (HBP) allows you to withdraw up to $60,000 from RRSP tax-free through the HBP for a down payment, which can be repaid over 15 years.

Through the FHSA, you can save up to $40,000 tax-free for a home purchase, with an annual contribution limit of $8,000.

Recover a portion of GST/HST paid on a new or substantially renovated home.

Claim a non-refundable tax credit of $10,000 under the home buyer’s amount, providing up to $1,500 tax relief for eligible first-time homebuyers.

Provincial rebates are available (e.g., up to $4,000 in Ontario) for eligible first-time buyers.

*Canada Mortgage Trends. *Comparing nesto’s January 2024 to September 2024 5-year fixed insured rates vs the big 6 bank posted rates approximately rounded up. Terms & conditions apply. Comparison lenders may offer unpublished special discounts. For insured mortgages. Savings calculation assumes a $500K mortgage amount, 25 year amortization, 5% down payment.