Featured articles #Industry News

Featured articles #Industry News

April 2024 Mortgage Report: Fixed Rates At Risk Of Rising Despite Incoming BoC Rate Cuts

Table of contents

Latest expert predictions indicate that the Bank of Canada will likely cut rates before the US Federal government. While a rate cut has been highly anticipated among Canadian potential homebuyers and mortgage holders alike, the Canadian dollar’s ability to retain its buying power after the cut will ultimately determine the fate of the fixed mortgage rate.

Fixed rates and variable rates in Canada can differ significantly, which means that even if there is a rate cut in June or July, fixed rates might continue to rise. However, if the rate cut expected in June is delayed even further, this fixed rate could go even higher.

With uncertainty surrounding fixed mortgage rates in the coming months and variable rates still high for the near future, the best thing borrowers can do is lock in their fixed rates to avoid the impact of changes to the policy rate.

Key Highlights

- Mortgage Rates: Despite fixed rates trending down since September 2023, going from 5.34% to 4.84%, the latest expert analyses expect an increase in the fixed rate, regardless of a BoC rate cut in June.

- Purchase vs. Renewal vs. Refinance: While renewal applications decreased again in March, going from 42% to 39%, this is more likely indicative of homeowners waiting and hoping for rate cuts before renewing.

- Purchase Timing Intent: The portion of clients “ready to buy” continues to increase– up to 44% from 30% last March– as buyers re-enter the market to take advantage of stabilizing home prices.

- Purchase Price & Down Payments: Overall, home prices remain stable in QC, AB, and the rest of Canada, with ON showing early incoming signs of a slight price increase. Median home prices in ON funded by nesto have increased to $650K.

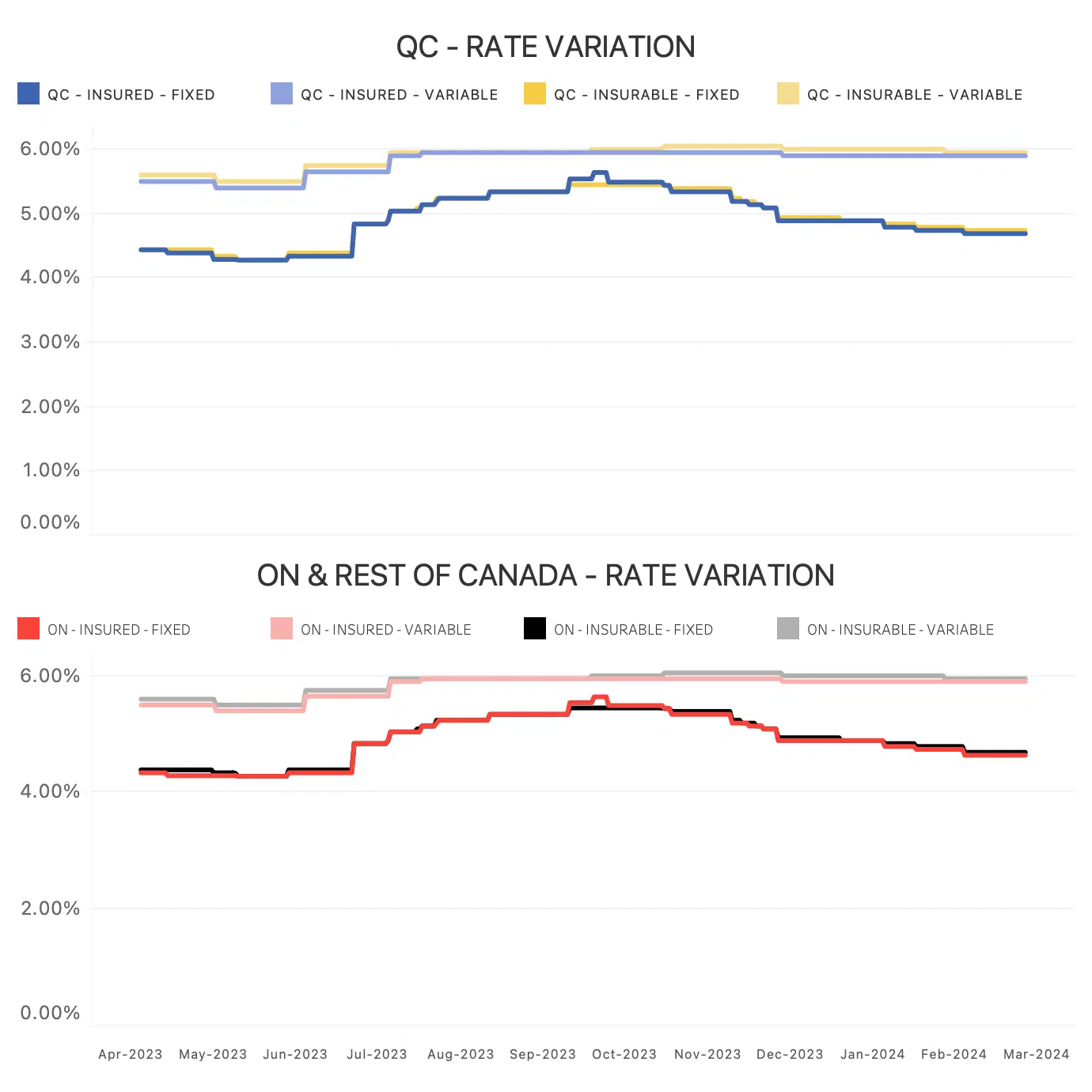

Mortgage Rate Trends To Know

When tracking rate variance between October 2023 and March 2024, it’s clear that the Bank of Canada’s continuous rate holds have alleviated inflationary pressure by noting the direction of lowered fixed rates. However, more recent data expects this downtrend to fizzle out. While a hotter market might be in store for later in the summer, fixed rates are likely to experience an increase over the short term, whether a BoC rate cut is made or not.

Rate Variation

Fig. 1: These graphs show the rate variances between transaction types in Quebec compared to Ontario and the rest of Canada.

The lowest 5-year fixed rate for insured mortgages for home buyers with less than a 20% down payment is 4.84%. If this rate goes up by another 30 basis points (bps), it could reach 5.14% within the next two months. However, if the rate cut expected in June is delayed, this rate could go even higher.

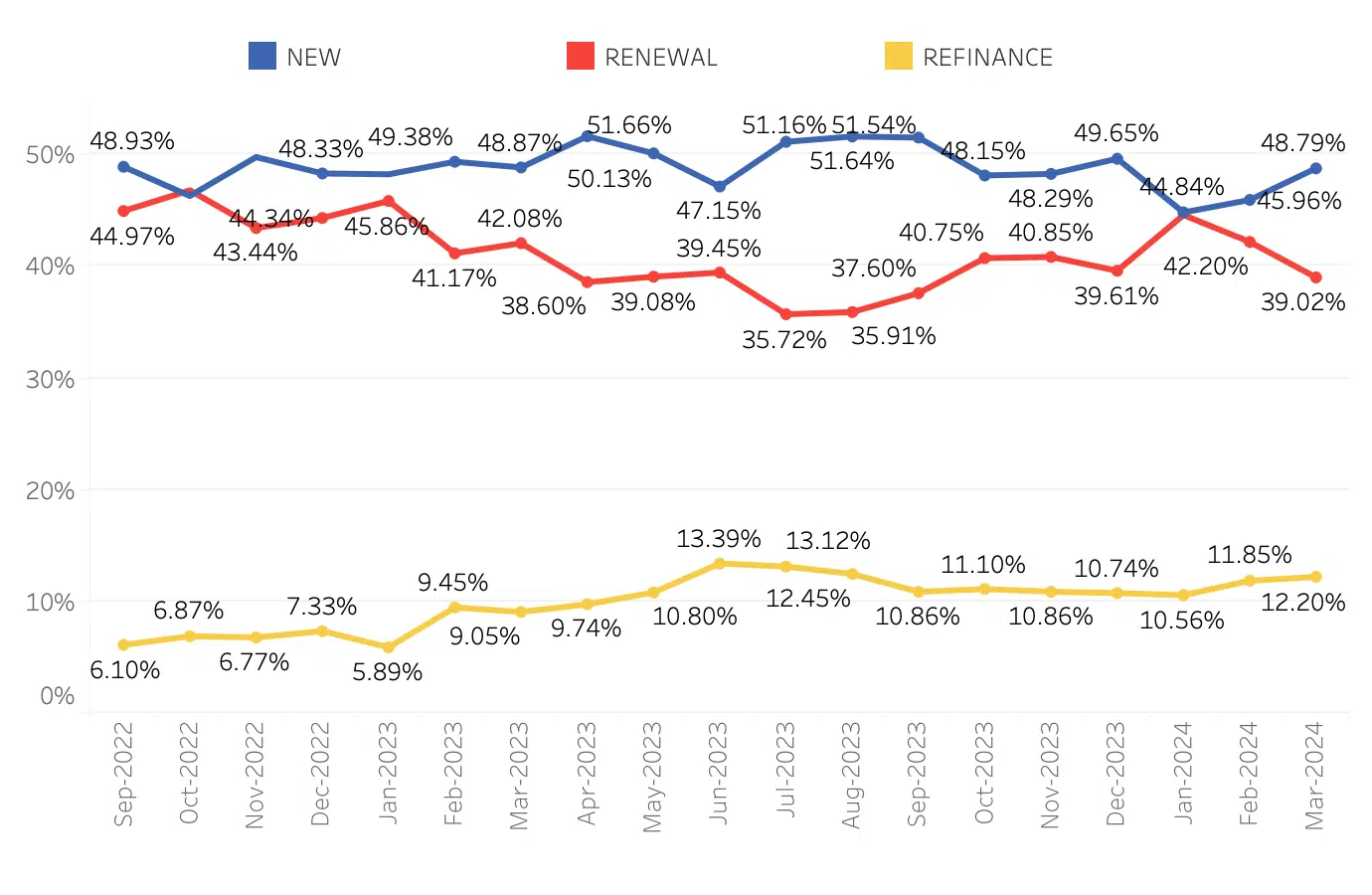

Purchases vs Renewals vs Refinances

Nearly half of Canadian homeowners are expected to renew their mortgages between 2024 and 2025. More importantly, homeowners of the Great Renewal Wave will likely face payment shock, with monthly mortgage payments increasing as much as 30%.

Trends for the Proportion of New Mortgages, Renewals, and Refinances

Fig. 2: Trends for the proportion of purchases (new mortgages) vs. renewals vs. refinances over the last 18 months, from September 2022 to March 2024.

The gap between new purchase and renewal applications finally closed at the start of the year and is expected to narrow for the remainder of 2024. While renewal applications decreased again in March, going from 42% to 39%, this likely indicates homeowners awaiting rate cuts before renewing.

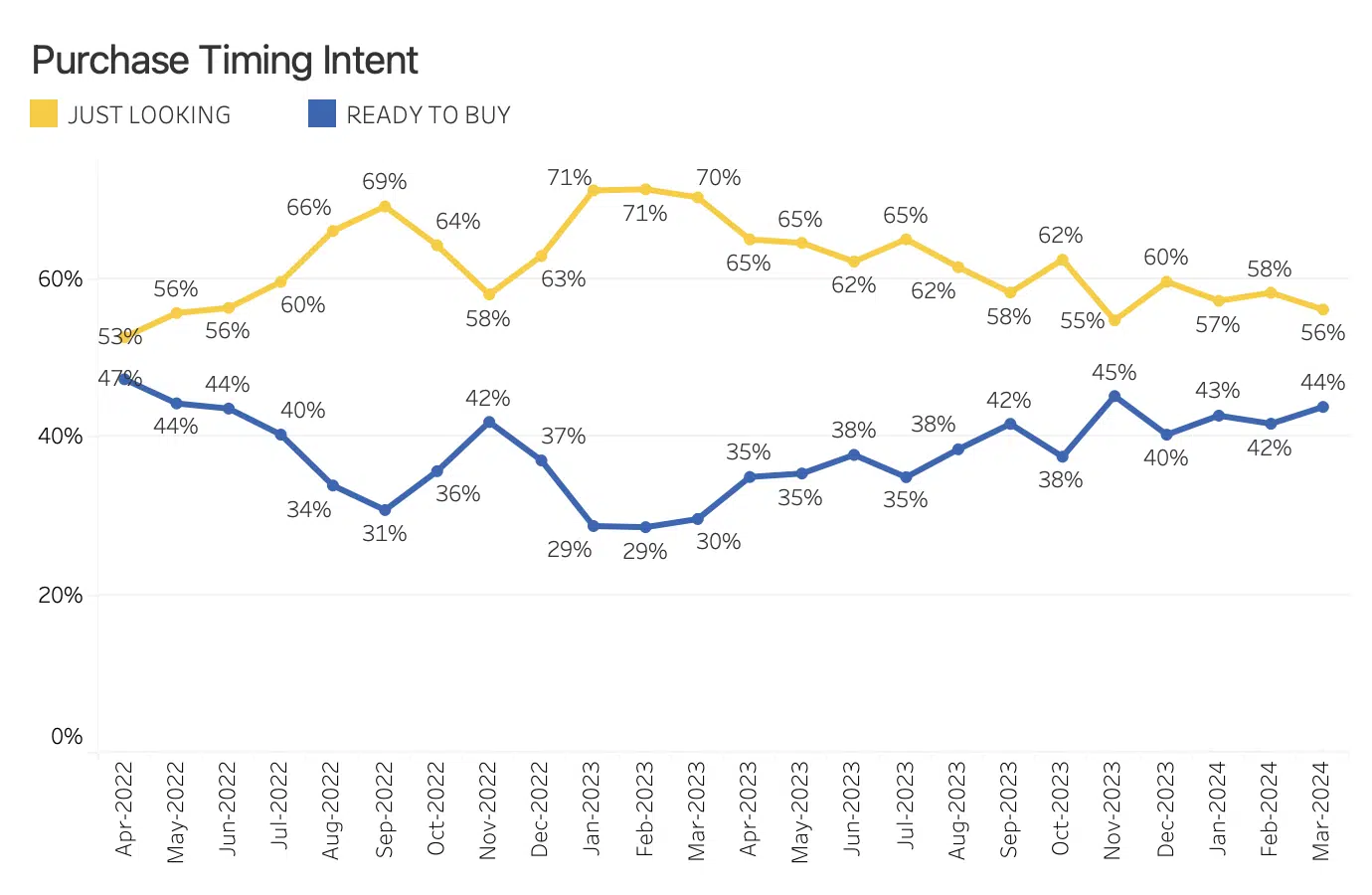

When Is The Best Time To Buy?

In March 2024, buyer intent data indicated that 56% of users reported they were ‘just looking,’ while 44% said they were ‘ready to buy.’ This narrowing divide aligns with the ongoing trend of more clients exiting the sidelines and looking to purchase homes.

Purchase Intent: proportion of users “ready to buy” vs. “just looking”

Fig. 3: Purchase intent: proportion of clients “ready to buy” vs. “just looking” in their mortgage journey with nesto, illustrated over the last 2 years from April 2022 to March 2024.

Home prices are expected to shift again through the summer months as the rate environment and competition in the market change. However, they remain stable as home buyers take advantage of re-entering the market.

Home Prices And Down Payments

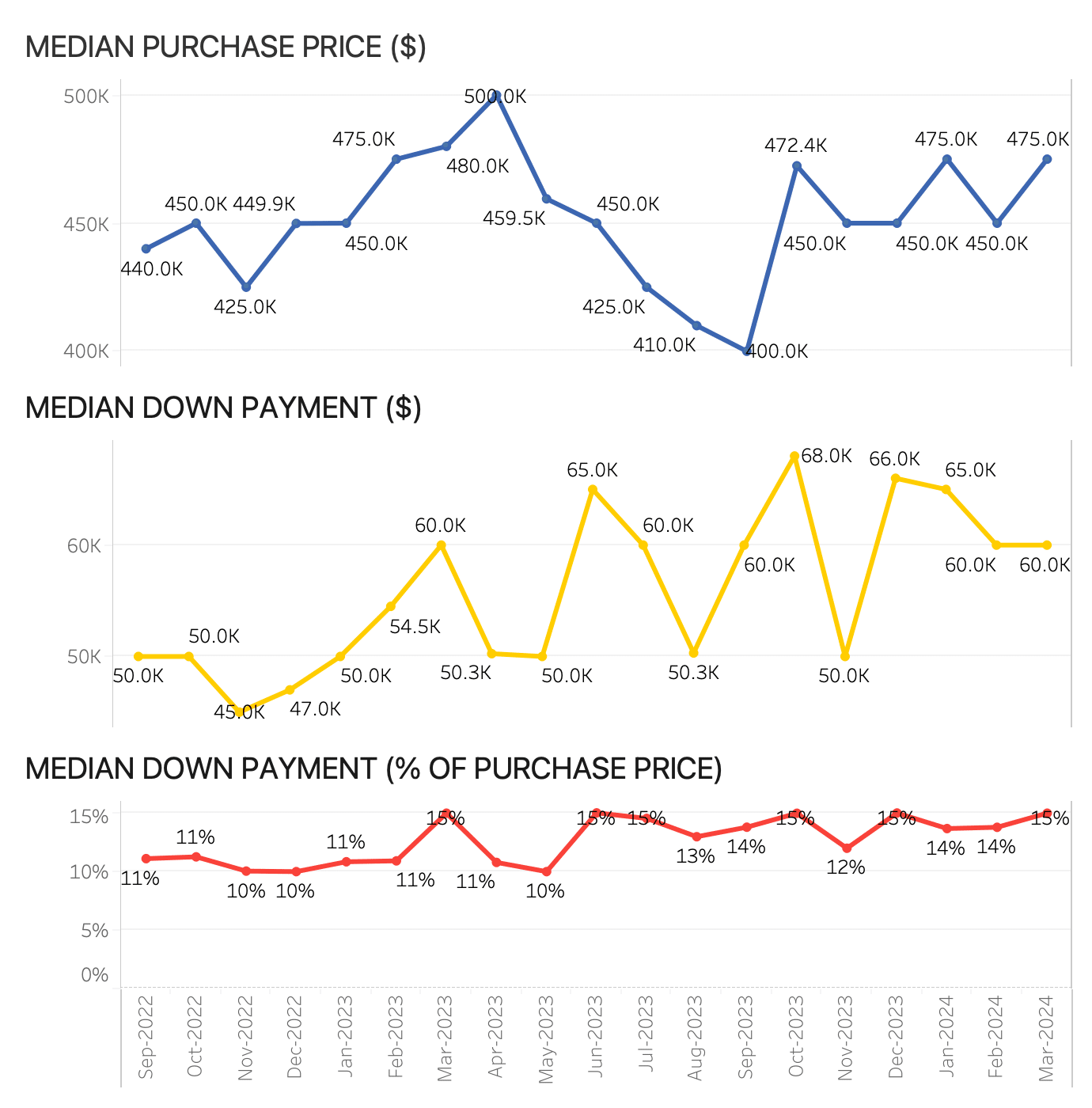

In March 2024, the median purchase price for properties financed through nesto in Canada increased by $25K, while the median down payment contributions in both dollar value and percentage value remained relatively stable, at $60K and 15%, respectively.

Median Purchase Price and Median Down Payment in Canada

Fig. 4: Median purchase price and median down payment values over the last 2 years in Canada between September 2022 and March 2024.

Canadian home purchase prices and down payment data at nesto have remained stable over the past few months. As noted above, this is partly due to rates remaining stable and, therefore, purchase intent and home prices following suit. If current potential buyers want to take advantage of stable, lower home prices, it’s best to avoid delaying their home purchase, as home prices are expected to increase in the summer.

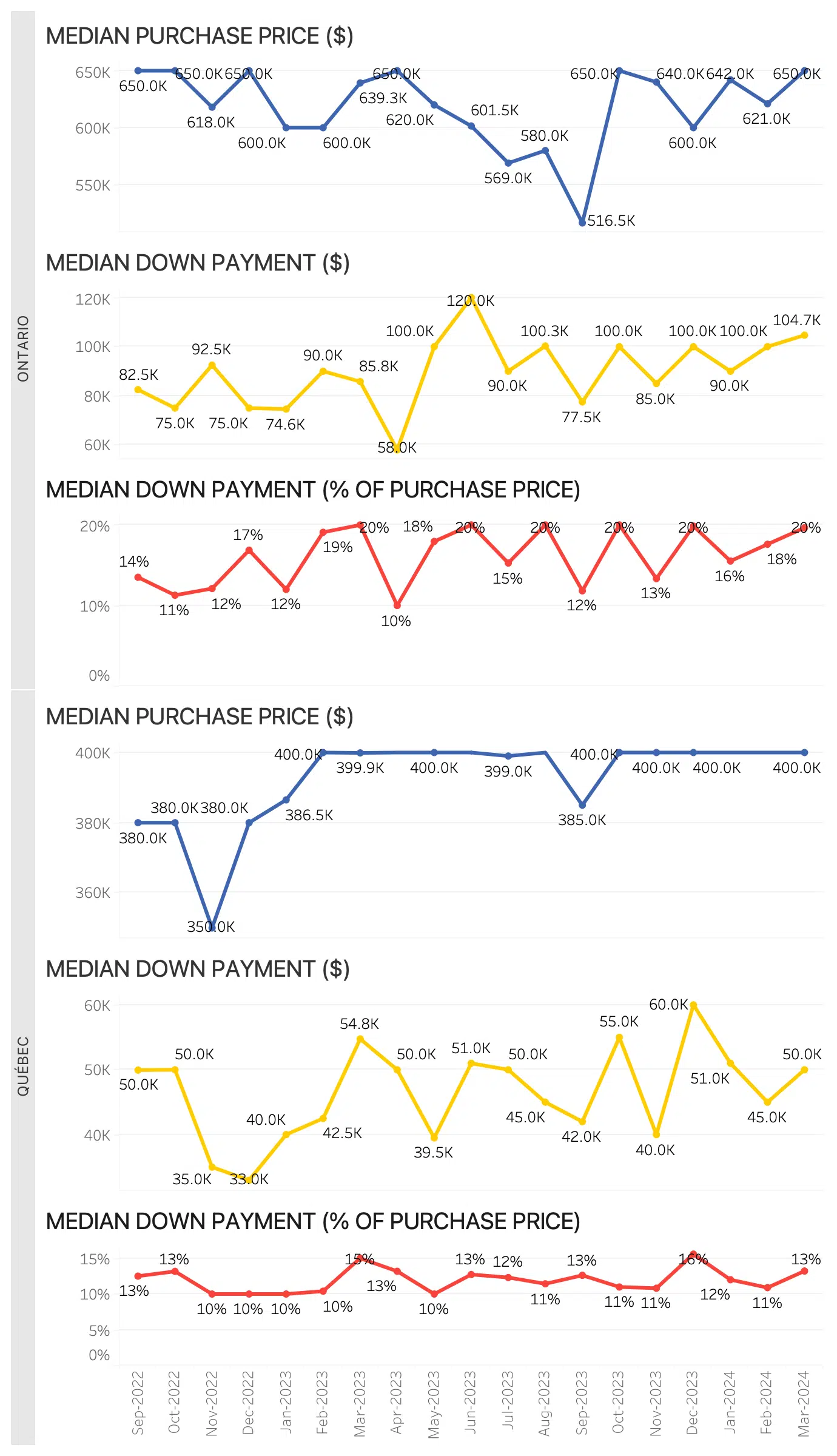

Quebec and Ontario

Fig. 5: Median purchase price and median down payment values in Ontario and Quebec over the last 2 years, between September 2022 and March 2024.

In March 2024, Ontario’s median purchase price and down payment amounts increased. Purchase price increased from $621K to $650K, while down payment contribution amounts increased from $100K to $104.7K in dollars, or by 2%.

In contrast, the median purchase price in Quebec continued to plateau at $400K in March 2024 for the 6th month in a row, while down payment contribution amounts increased, going from $45K to $50K and from 11% to 13%

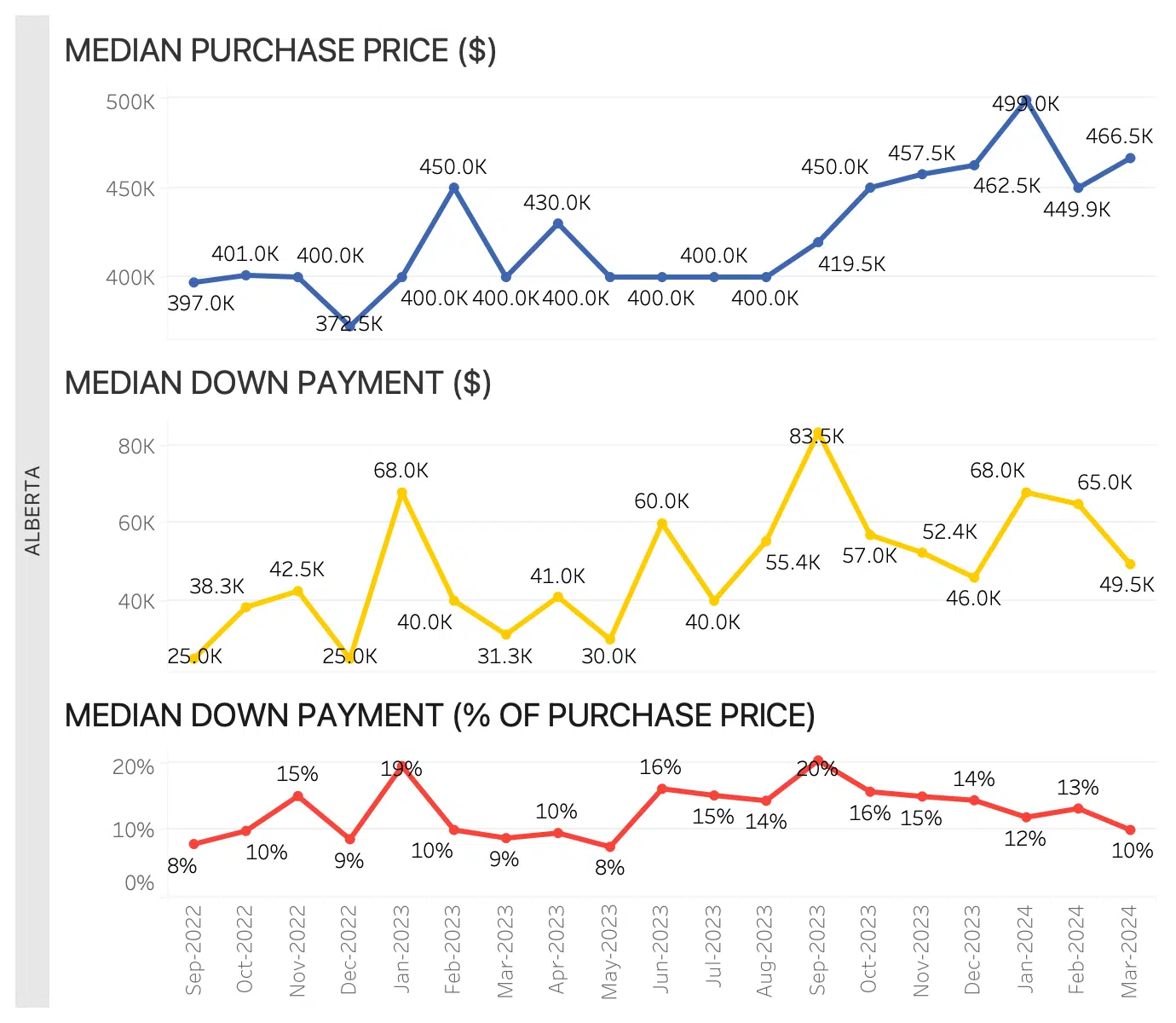

Alberta

Fig. 6: Median purchase price and median down payment values in Alberta over the last 2 years, between September 2022 and March 2024.

Home prices in Alberta resumed their upward trend in March 2024, after a slight dip in February, increasing to $466K from $450K. Down payment contributions, however, saw an overall decrease, going from $65K to $50K, or a reduction of 3% during that same period.

Final Thoughts

Current economic indicators point towards a hike in fixed mortgage rates as Canadian bond yields continue to be pulled up by US T-bills, whether or not we see a BoC policy rate cut in June. The longer the BoC delays a rate cut, the more fixed rates will increase. Buyers on the sidelines are encouraged to lock in a rate and take advantage of the lower rates and stability in home prices.

Don’t get caught off guard by the market changes this summer. Prepare yourself now so you can confidently face whatever comes your way. Remember, being ready for any outcome is crucial to reaching your homeownership goals in this housing market. Be prepared for market changes this summer, regardless of the outcome.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!