Featured articles #Industry News

Featured articles #Industry News

February 2024 Mortgage Report: 80% of Canadians homebuyers chose down payments over marriage

Table of contents

According to a 1000-person survey by 360Lending, 80% of Canadian homebuyers said they’d rather save money for a down payment than get married. In the spirit of Valentine’s day, we’re kicking off February’s nesto-meter with a look into our own data and see if romance is truly taking a back seat in the mortgage world. Here’s what we found:

- Between February 2023 and February 2024, 76% of nesto mortgage applicants reported being single, while 24% reported being married.

- In QC, 50%+ of nesto’s base reported being “common-law” married.

- Among co-applicants, 64% reported being married and 36% reported being single.

- Among solo applicants, 81% reported being single, while 19% reported being married.

- On average, solo applicants contribute larger down payments than co-applicants.

As for the rest, this month’s report provides a snapshot of the housing market and mortgage trends as we enter 2024 and a forecast for what’s to come later this year. With predictions of rate cuts and hotter markets floating around, let’s see what January is setting us up for!

Key Highlights

- Mortgage Rates: In January 2024, despite an uptick in inflation, the Bank of Canada maintained the policy rate once again in their announcement, allowing nesto’s fixed rate to remain low after its initial decrease in November.

- Purchase vs. Renewal vs. Refinance: We are seeing the first signs of the upcoming Great Renewal wave. Renewals have finally caught up to new purchases to share an equal portion of applications in January, at 45% each.

- Purchase Timing Intent: Buyers on the sidelines are finally starting to re-enter the market, as buyer intent data shows the portion of clients who are ‘ready to buy’ grew by 14% between January 2023 and January 2024.

- Purchase Price & Down Payments: Yet another sign of a hotter market on the horizon in 2024! nesto’s median purchase price increased by $25K between December and January, and by $75K since the fall.

Mortgage Rate Trends To Know

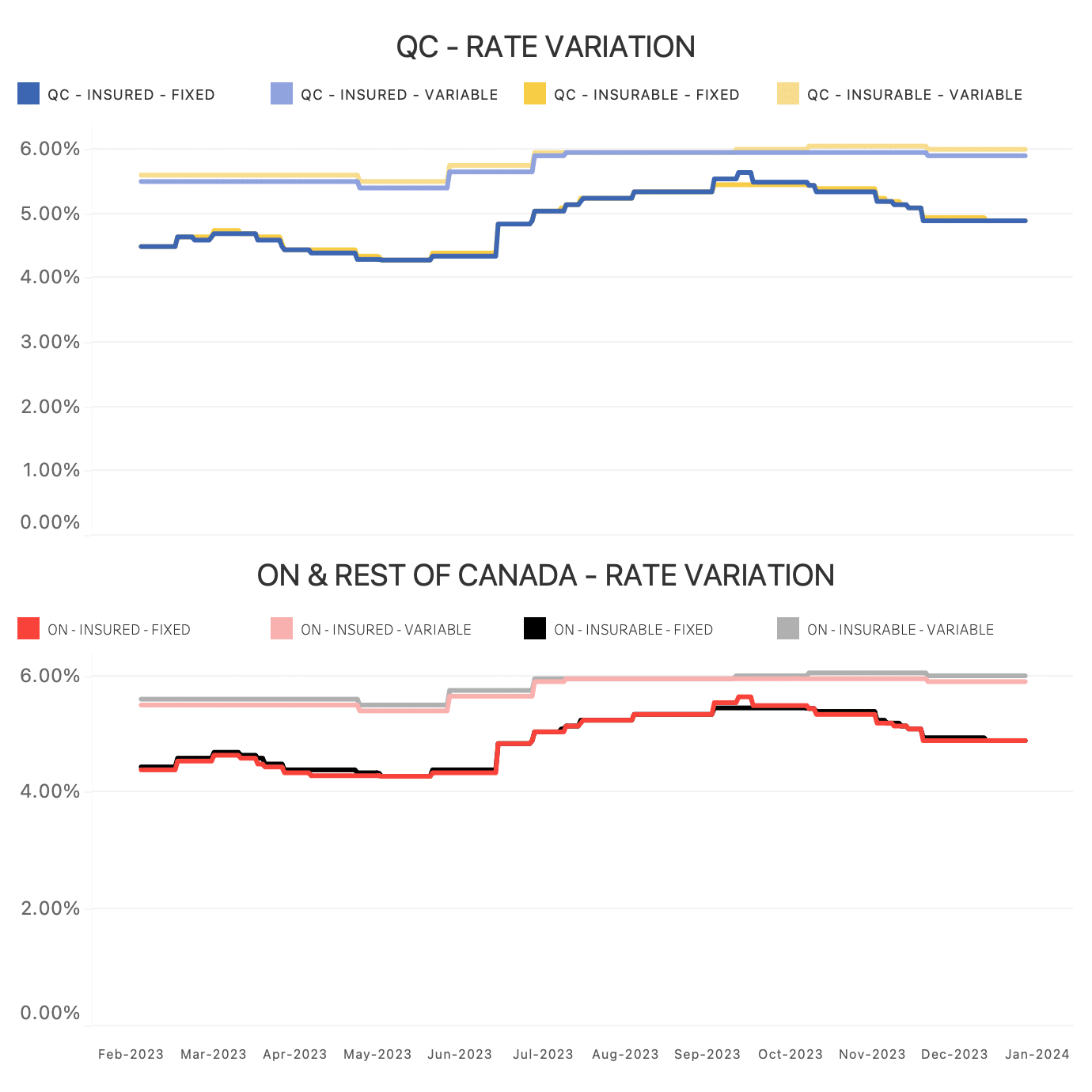

Trends in rate variance near the end of 2023 and now at the beginning of 2024 are indicative of a hotter housing market to come later this year.

Rate Variation

Fig. 1: These graphs show the rate variances between transaction types in Quebec compared to Ontario and the rest of Canada.

After consecutive Bank of Canada rate holds in the fall, consumer spending decreased, and so did inflationary pressures. With this, bond yields started falling in late October, pulling down nesto’s fixed rates. In January 2024, despite an uptick in inflation, the Bank of Canada maintained the policy rate once again in their announcement, allowing nesto’s fixed rate to remain low. The effect of these consecutive rate holds is also reflected in the reported increase in home sales for major Canadian cities in January 2024.

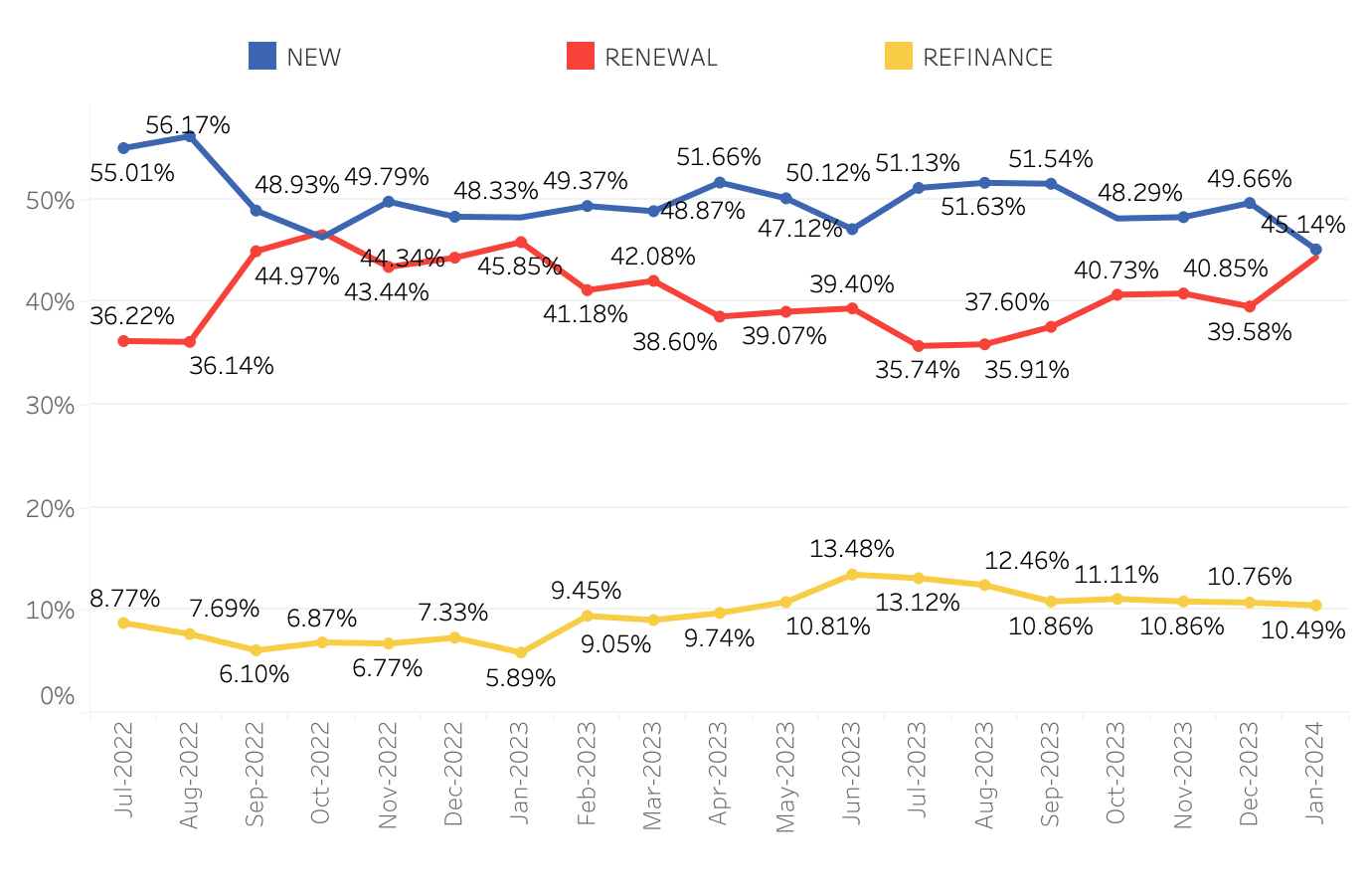

Purchases vs Renewals vs Refinances

New purchase and renewal data in January 2024 is truly illustrative of the Great Renewal Wave gearing up to start this year. Renewals have finally caught up to new purchases to share an equal portion of applications in January, 45% each. Mortgage holders on the sidelines holding off on renewing due to the high rate environment are getting their applications in, whether to take advantage of lower rates or because they have reached their maturity dates.

Trends for the Proportion of New Mortgages, Renewals, and Refinances

Fig. 2: Trends for the proportion of purchases (new mortgages) vs. renewals vs. refinances over the last 18 months, from July 2022 to January 2024.

As for refinances, applications continue to hover around 11%, but a potential increase may be in store as more renewers approach their maturity day and are faced with payment shock. Unable to afford their monthly payments anymore, it’s likely that some of these renewers decide a refinance is a better financial option.

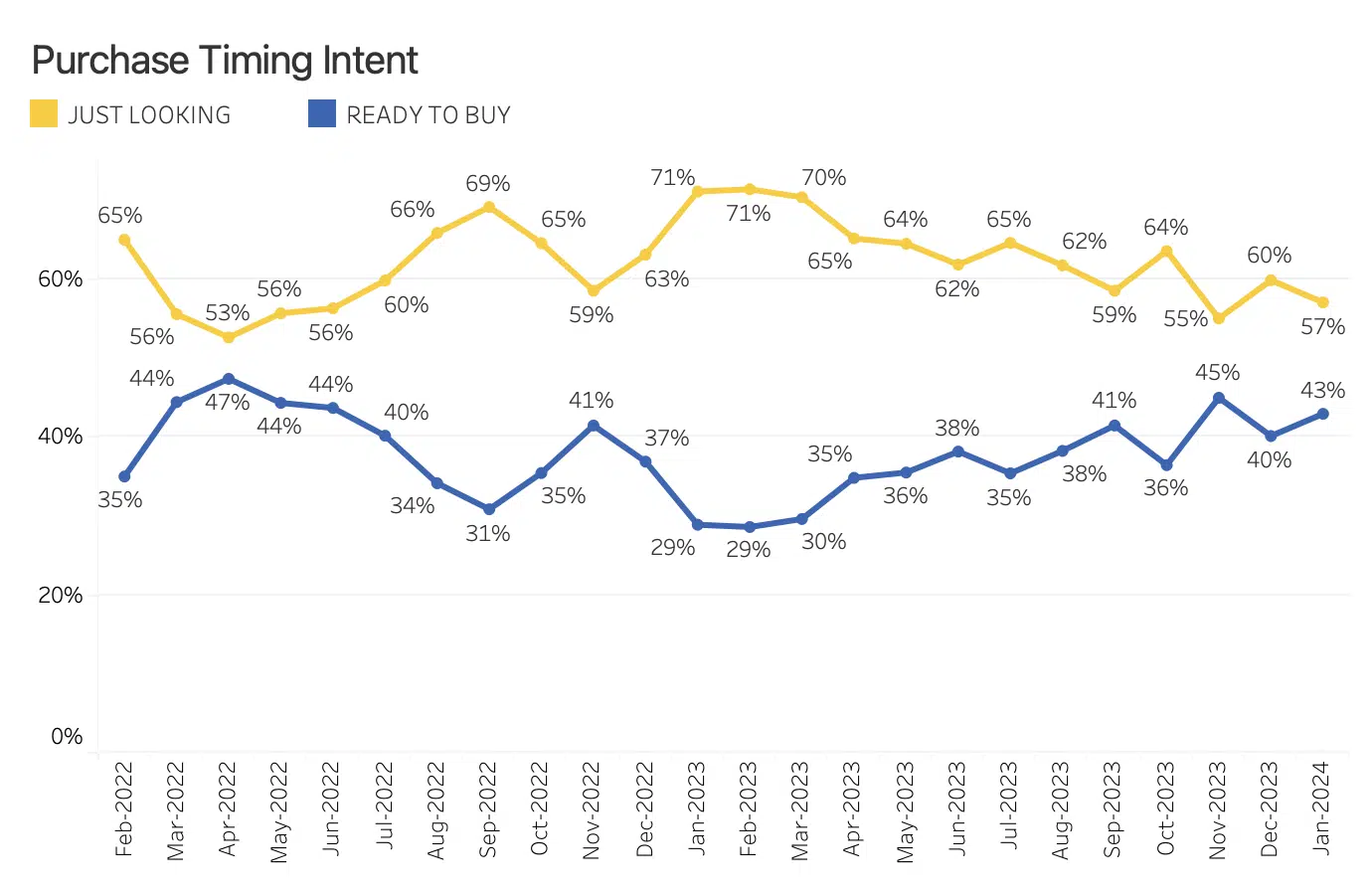

When Is The Best Time To Buy?

In 2023, we saw the gap in buyer intent tighten month after month as more clients shifted camps from ‘just looking’ to ‘ready to buy.’ In January 2024, this trend continues with 57% of clients who are ‘just looking’ and 43% ready to buy, as even more potential buyers re-enter the market.

Purchase Intent: proportion of users “ready to buy” vs. “just looking”

Fig. 3: Purchase intent: proportion of users “ready to buy” vs. “just looking” in their mortgage journey with nesto, illustrated over the last 2 years from February 2022 to January 2024.

Purchase intent numbers haven’t been this close since Spring 2022. This is in part due to forecasts predicting rate cuts this coming Spring. With home prices stabilizing, it’s likely that buyers are seeing this as the most opportune time to take advantage of lower prices before the market heats up and gets competitive again when bigger rate cuts happen in the second half of the year.

Home Prices And Down Payments

As we were already seeing in the later months of 2023, purchase prices and down payment amounts are continuing to increase after months of buyers shopping at much lower price points.

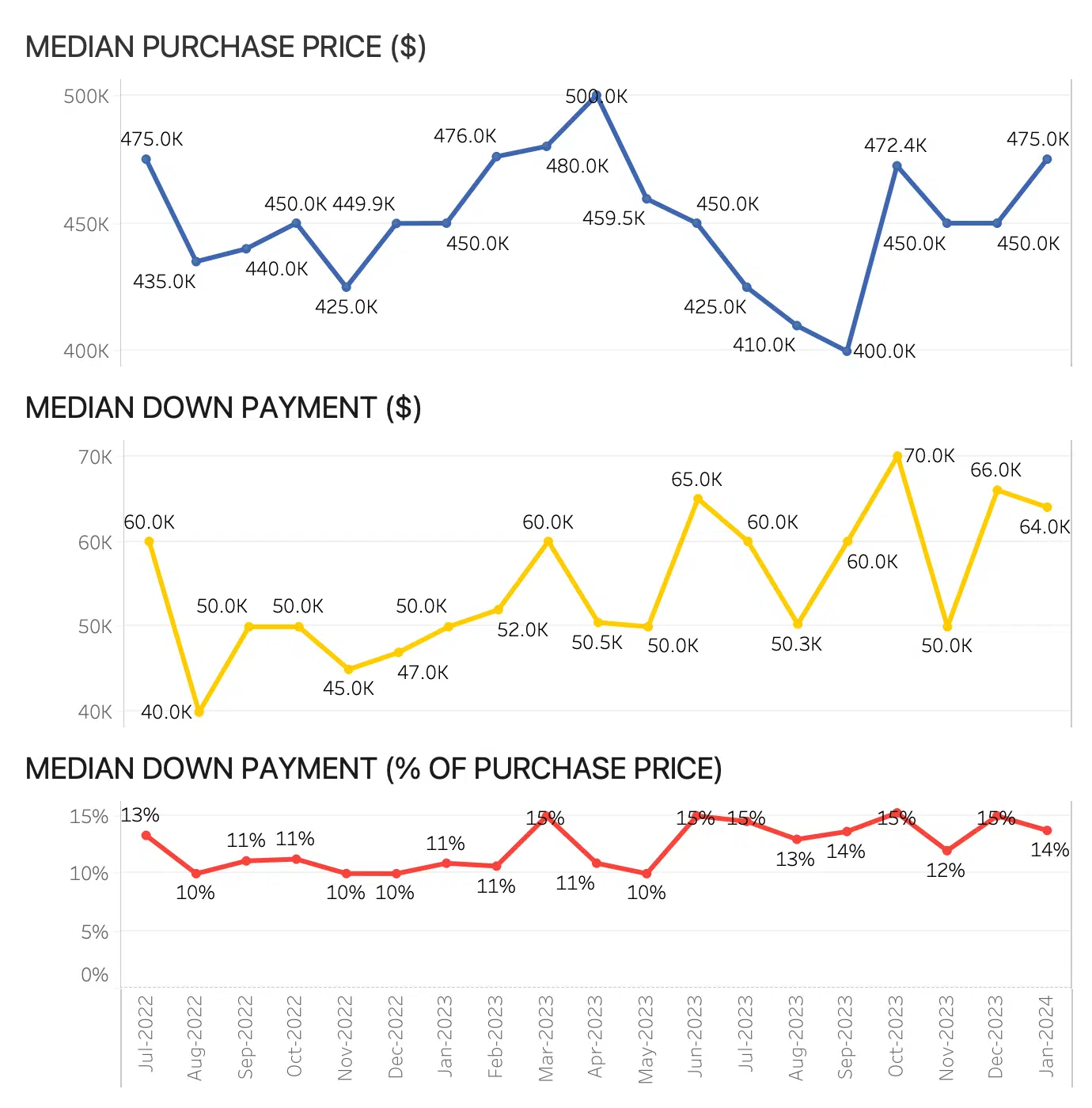

Median Purchase Price and Median Down Payment in Canada

Fig. 4: Median purchase price and median down payment values over the last 2 years in Canada between July 2022 and January 2024.

In January 2024, the median purchase price in Canada increased by $25K, while the median down payment amount in both dollar and percentage values remained relatively stable (only decreasing by $2K and 1%, respectively). These trends are in line with the above buyer intent data, signalling a shift in purchase intent as buyer hesitance finally begins to wane.

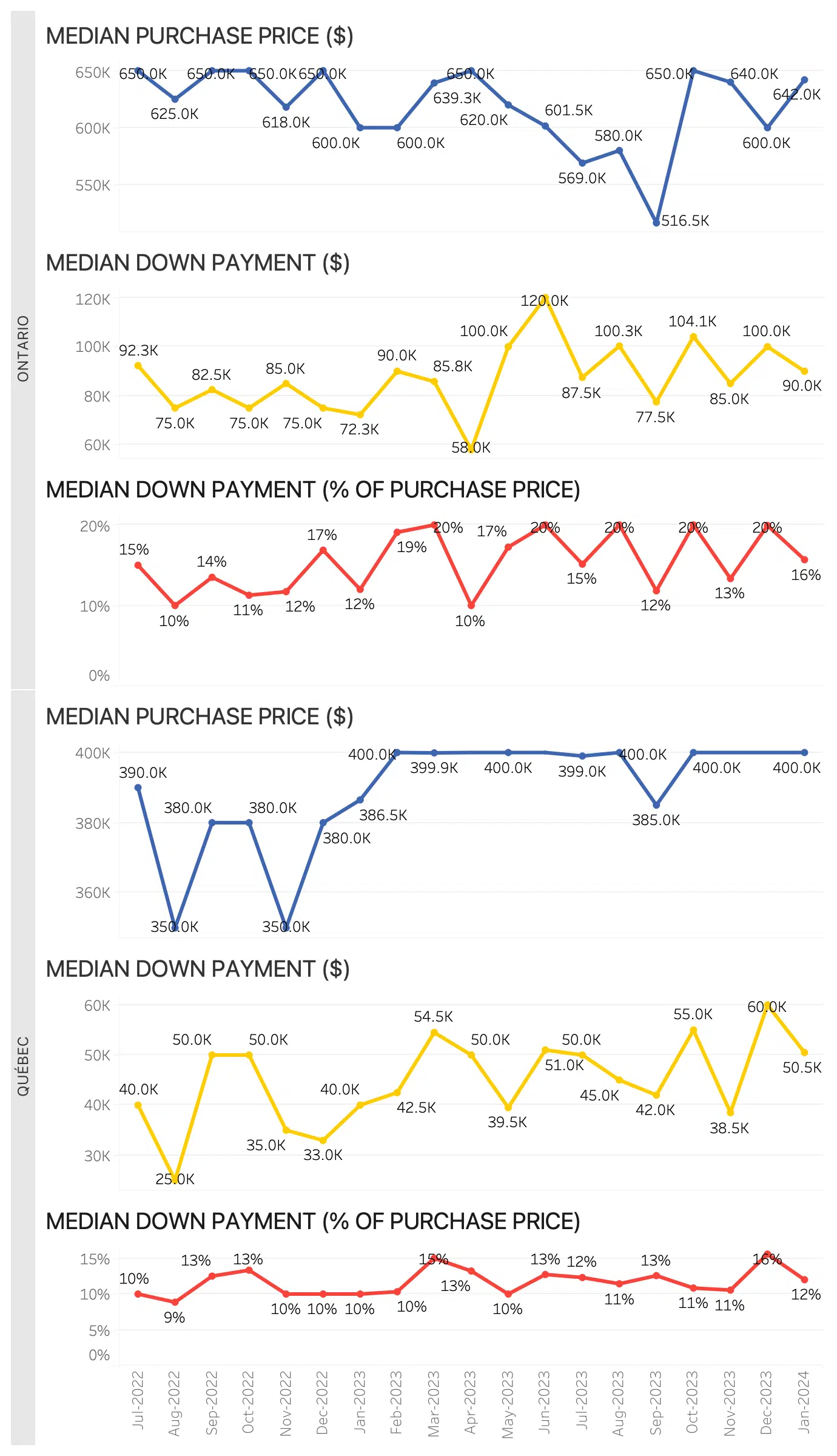

Quebec and Ontario

Fig. 5: Median purchase price and median down payment values in Ontario and Quebec over the last 2 years, between July 2022 and January 2024.

Ontario’s median purchase price was trending down earlier in 2023, only to recover later in the last quarter. In January 2024, this trend continued with a median purchase price increase of $42K since the previous month. In turn, the median down payments experienced a slight decrease in both dollar and percentage value. This could indicate that buyers, who were previously shopping at lower price points due to high rates, are taking advantage of slightly lower rates before larger rate cuts lead to increased home prices in the spring.

In turn, the median purchase price in Quebec remained relatively stable at $400K once again in January 2024. While we noted an increasing trend in down payment value in 2023, QC down payments experienced a dip in January, as they did in ON.

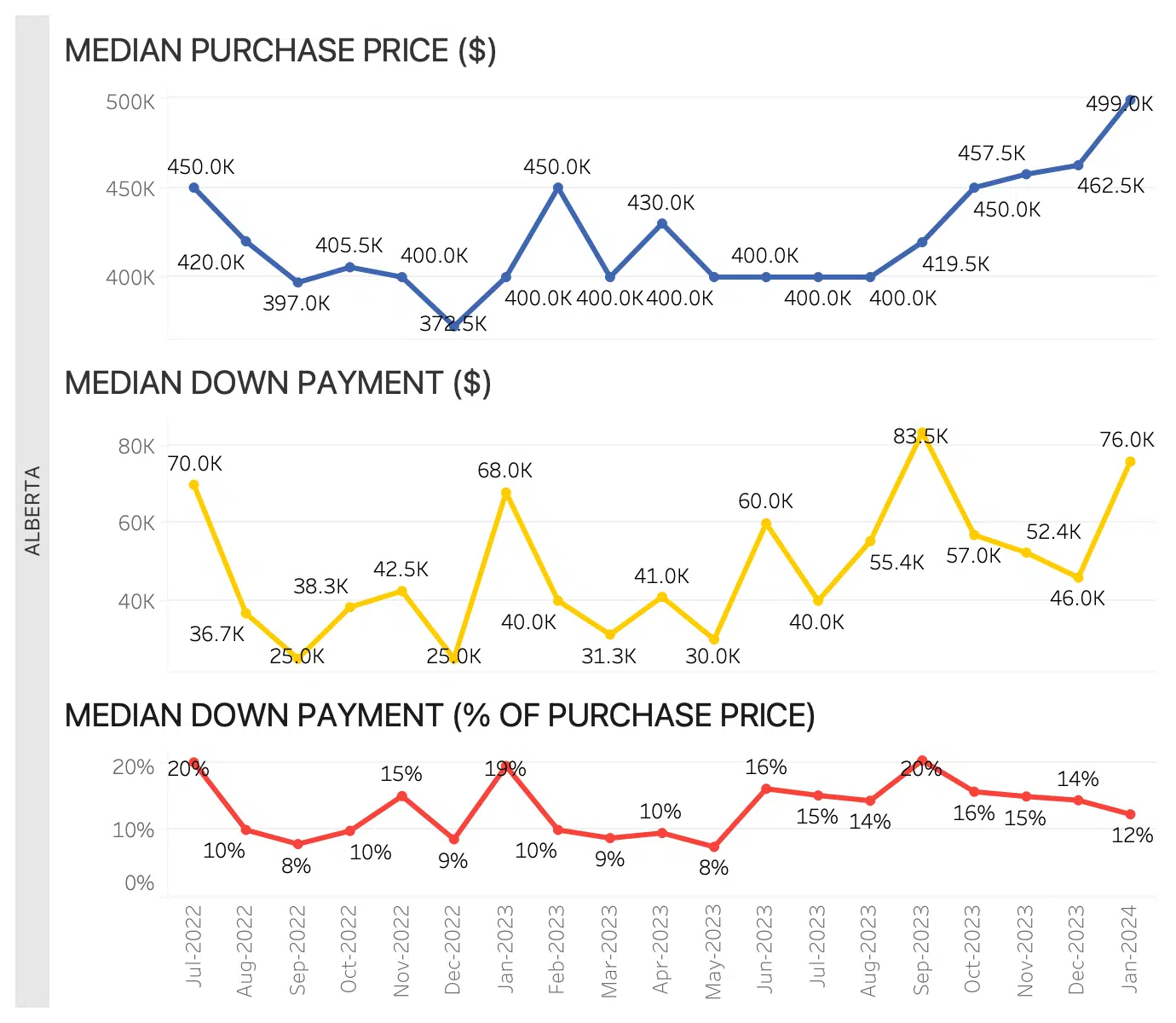

Alberta

Fig. 6: Median purchase price and median down payment values in Alberta over the last 2 years, between July 2022 and January 2024.

Alberta’s market is heating up faster than the rest of Canada, and January 2024 data only further supports that claim. Home prices have been on an upward trend since the summer, increasing by almost $100K between August 2023 and January 2024. The median down payment amount is showing a similar trend, with dollar value going up $30K between December and January alone.

Final Thoughts

The homebuying and mortgage data from January 2024 is truly paving the way for what we can expect later in the year. The market still has a way to go in the coming months, but between rate holds and the uptick in home purchases for major Canadian cities, it’s clear the market is already heating up.

As the Canadian economy continues to recover from the high-interest rate environment of the past 20 months or so, buyers on the sidelines are gearing up to enter the market in 2024. With a lack of new builds coming up for completion, things are about to get competitive and higher home prices are going to follow. Let’s make sure you’re staying ahead.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!