Featured articles #Industry News

Featured articles #Industry News

March 2024 Mortgage Report: Canada’s Spring Lending Season Has Started

Table of contents

This month’s mortgage report marks the start of Canada’s Spring mortgage lending season. In February, we saw sidelined homebuyers finally start to re-enter the market and the beginnings of the Great Renewal Wave.

Fixed rates continued to slowly go down but have yet to drop dramatically. While we are not in the full swing of things yet, many people are expected to purchase homes as soon as rates have rescinded.

Key Highlights

- Mortgage Rates: Tracking rate variance over the last six months, we can note a clear downward trend in nesto’s fixed rate tracking Canada’s 5-year mortgage bond. Between September 2023 and February 2024, the fixed rate decreased from 5.34% to 4.74%.

- Purchase vs. Renewal vs. Refinance: We are seeing an overall increasing trend in renewals over the course of the year as homeowners start to reach their maturity dates and/or take advantage of slowly decreasing rates.

- Purchase Timing Intent: Those signalling ‘ready to buy’ aligns with increasing prospective homebuyers exiting the sidelines.

- Purchase Price & Down Payments: Home purchase trends also signal a return to the market as prices start trending upward again, going up by $100K over the last 6 months.

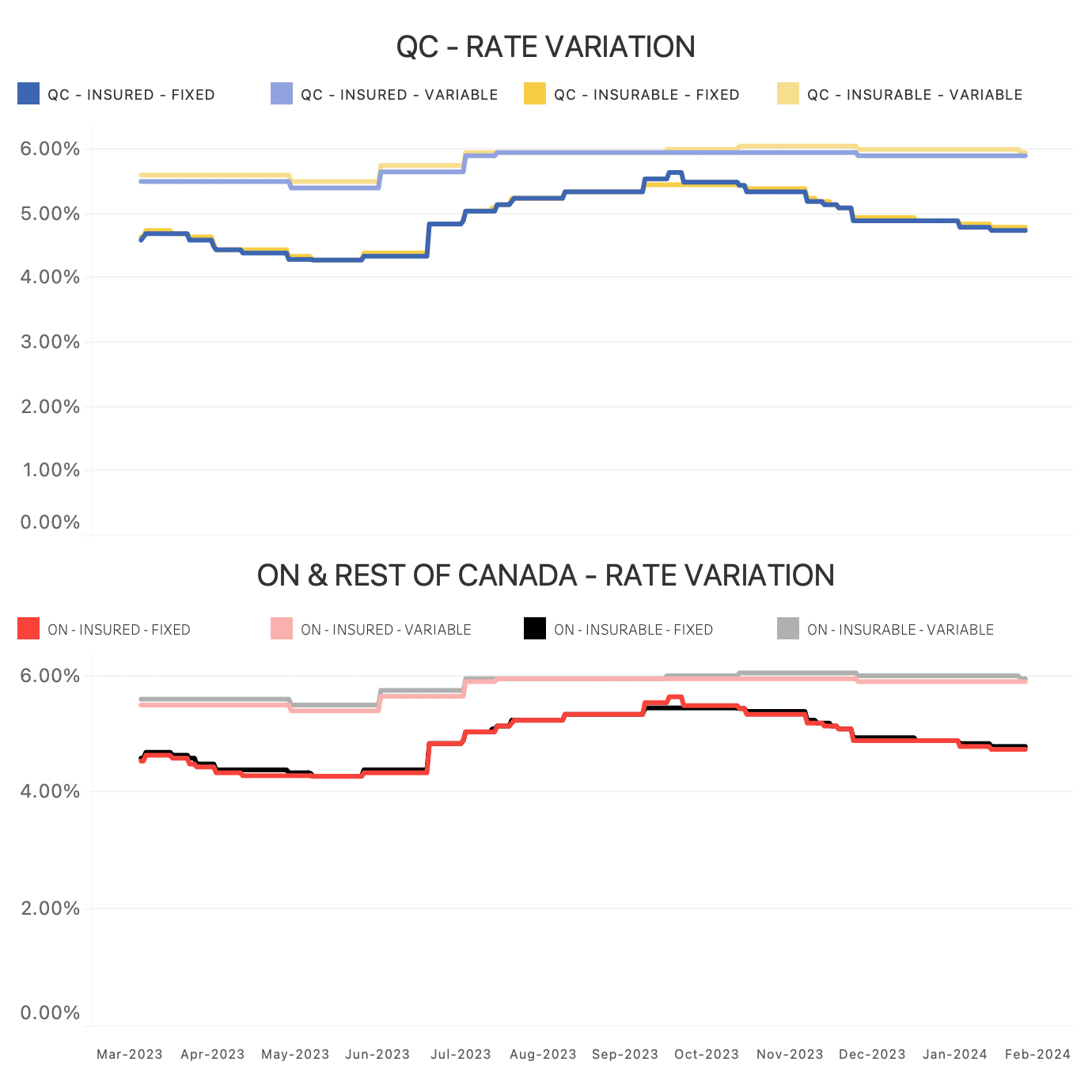

Mortgage Rate Trends To Know

Tracking rate variance over the last 6 months, we can note a clear downward trend in nesto’s fixed rate that started in October 2023 in both QC and the rest of Canada. Between September 2023 and February 2024, nesto’s 5-year fixed-rate decreased from 5.34% to 4.74% in all of Canada.

Rate Variation

Fig. 1: These graphs show the rate variances between transaction types in Quebec compared to Ontario and the rest of Canada.

BoC’s policy rate holds throughout the fall and into 2024 did their job in alleviating inflationary pressure on variable and adjustable mortgages, and as bond yields began to decrease in October, as did nesto’s fixed rate.

The steady decrease in fixed rates since October aligns with the continued policy rate holds by the Bank of Canada, including the latest one this March. This signals that the market is heating up again, as the expectation for rate cuts remains on the horizon for later in the summer.

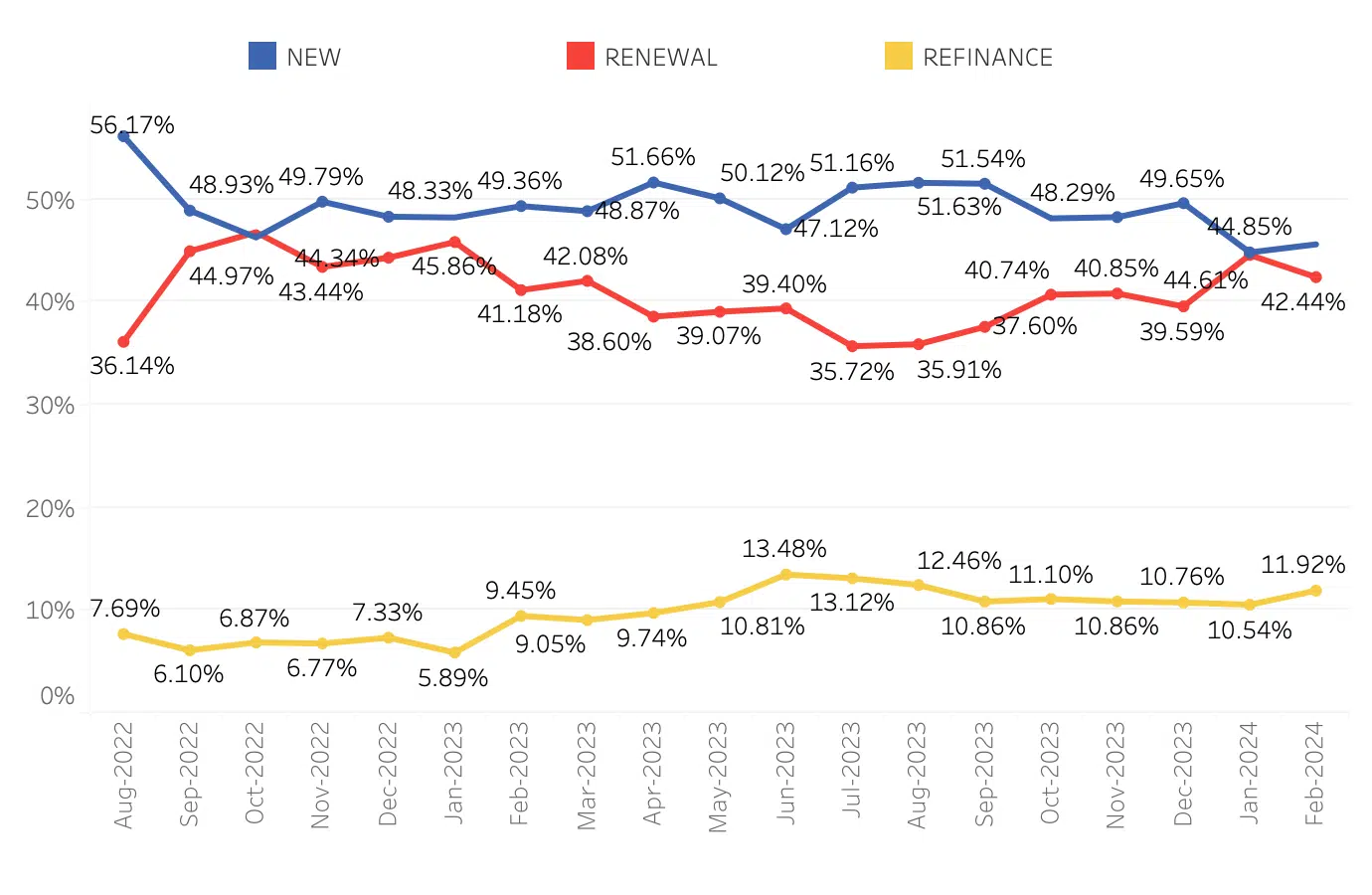

Purchases vs Renewals vs Refinances

In January 2024, renewal applications finally caught up to new purchases, signalling the first stirrings of the Great Renewal Wave. It’s expected that between 2024 and 2025, 45% of Canadian homeowners will be coming up on their renewals and will likely face payment shock renewing at much higher rates.

Trends for the Proportion of New Mortgages, Renewals, and Refinances

Fig. 2: Trends for the proportion of purchases (new mortgages) vs. renewals vs. refinances over the last 18 months, from August 2022 to February 2024.

While February 2024 data records a small dip in renewal applications, we are still likely to see an overall increasing trend in renewals over the course of the year as homeowners start to reach their maturity dates and/or take advantage of lower rates.

Applications for refinances have remained steady since last summer and continue to hover between 10% and 12%. The incoming renewal trend could potentially result in an increase in refinances as some renewers faced with payment shock may not be able to afford their monthly payments and decide a refinance is a better financial option.

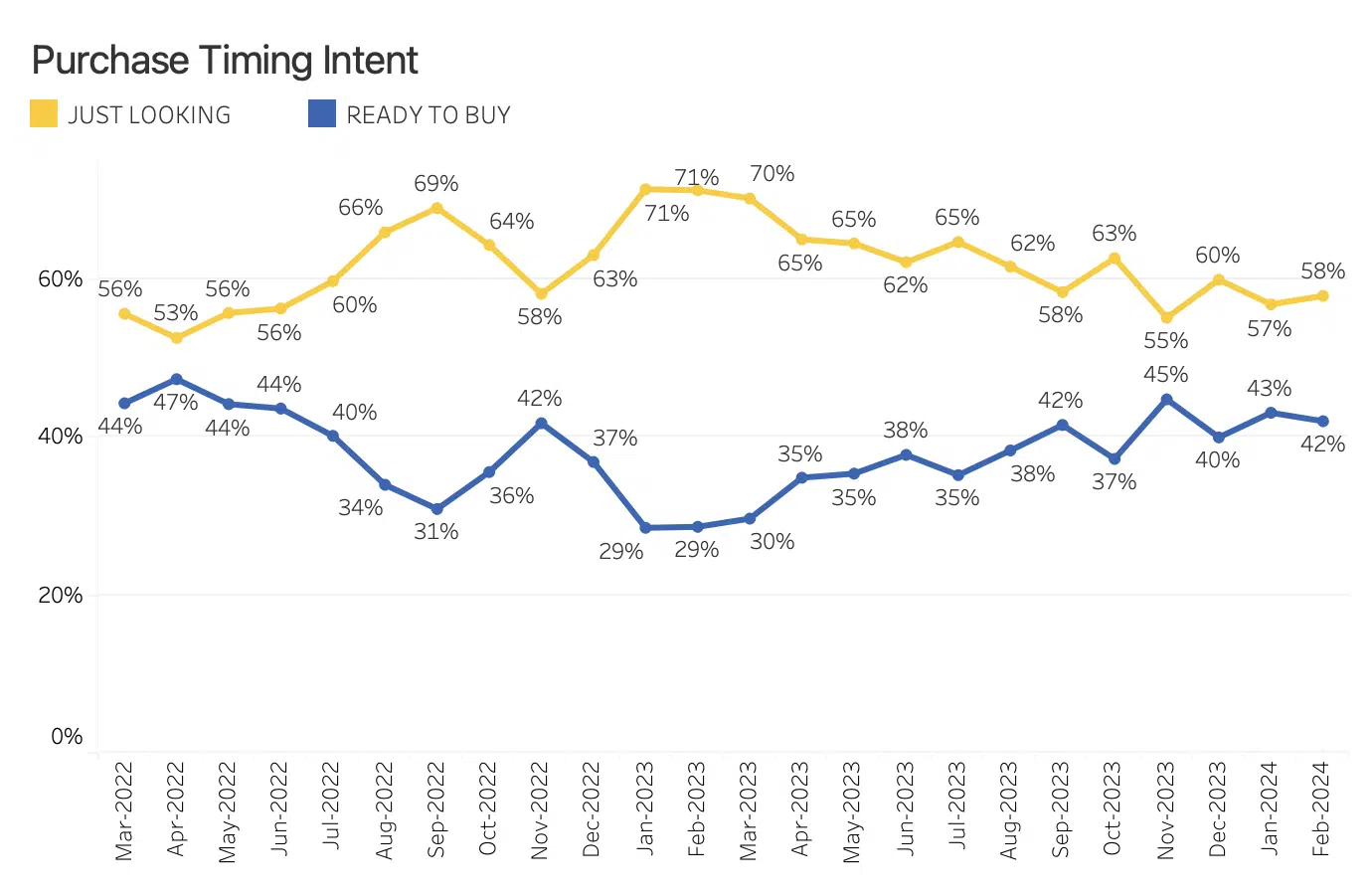

When Is The Best Time To Buy?

In February 2024, buyer intent data indicated that 58% of users reported they were ‘’just looking,’ while 42% said they were ‘ready to buy.’ This narrowing divide aligns with the ongoing trend of more and more clients exiting the sidelines and looking to purchase homes.

Purchase Intent: proportion of users “ready to buy” vs. “just looking”

Fig. 3: Purchase intent: proportion of clients “ready to buy” vs. “just looking” in their mortgage journey with nesto, illustrated over the last 2 years from March 2022 to February 2024.

This re-entry into the market can be explained through stabilising home prices, as buyers take advantage of the low prices before rate cuts heat up the market again. We can expect the difference in buyer intent to narrow even further as we progress into the year, especially once we start seeing rate cuts.

Home Prices And Down Payments

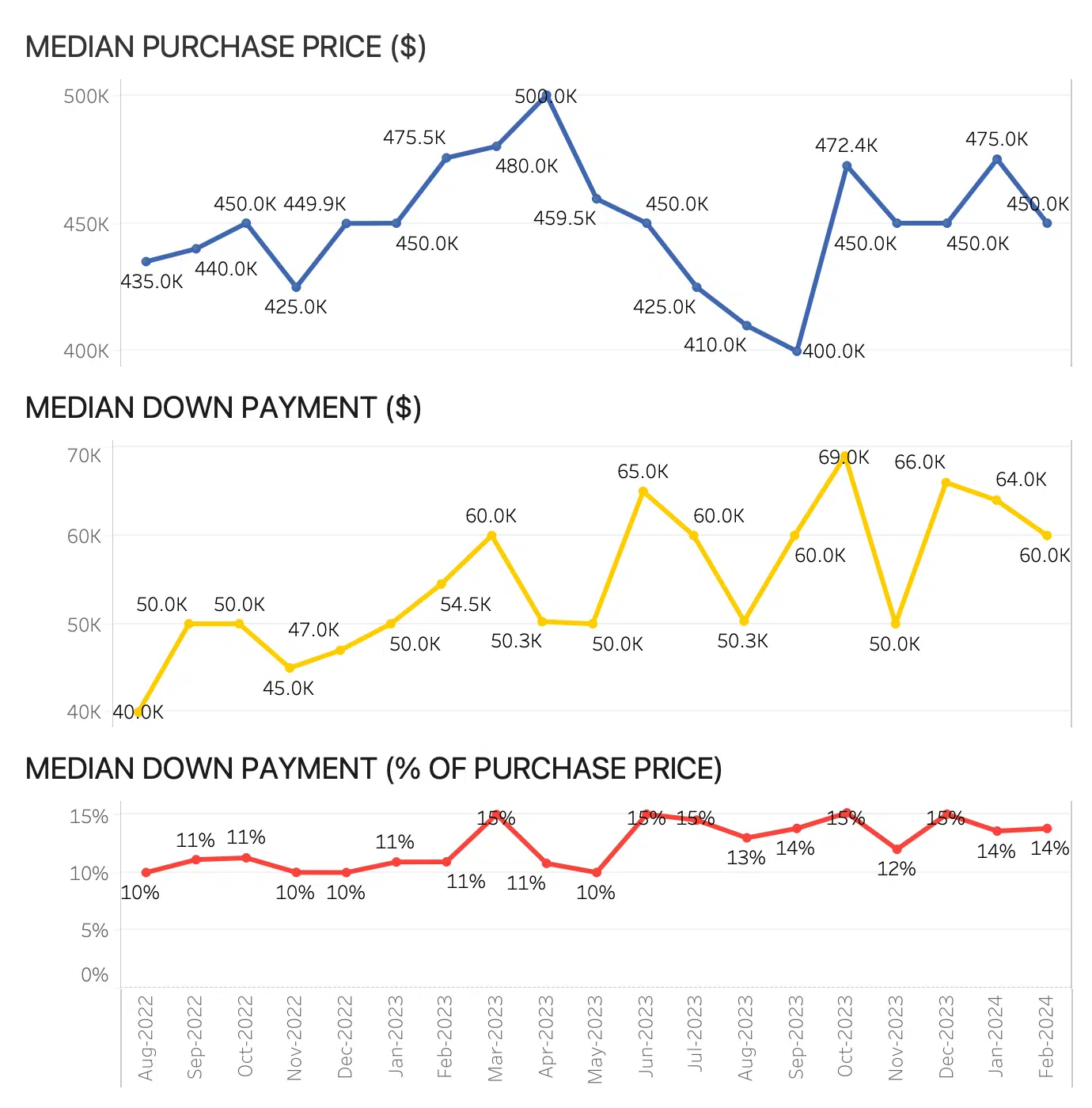

In February 2024, the median purchase price in Canada decreased by $25K, while the median down payment amount in dollar value decreased by $4K and remained stable in percentage value at 14%.

Median Purchase Price and Median Down Payment in Canada

Fig. 4: Median purchase price and median down payment values over the last 2 years in Canada between August 2022 and February 2024.

These numbers are similar to those reported in the previous month and reflect what experts have been predicting since the start of the year: the market is heating up again, as indicated by slowly increasing home prices in anticipation of upcoming rate cuts.

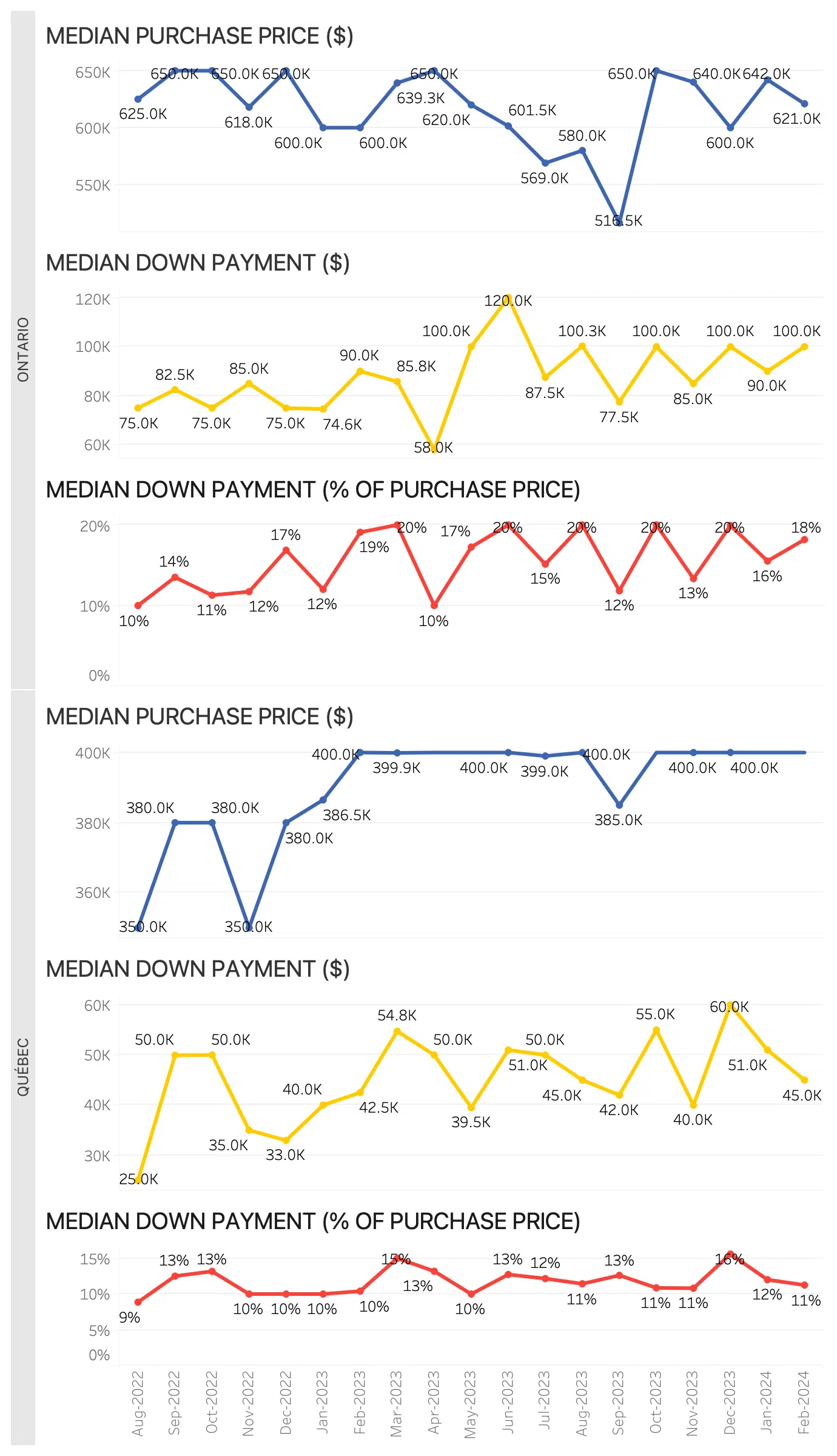

Quebec and Ontario

Fig. 5: Median purchase price and median down payment values in Ontario and Quebec over the last 2 years, between August 2022 and February 2024.

In February 2024, Ontario’s purchase data trended similarly to national data, where purchases continued on an upward trend and down payments remained relatively stable. Purchase price decreased by $21K between January and February, while down payments increased by $10K in dollar value and by 2 percentage points.

In contrast, the median purchase price in Quebec continued to plateau at $400K in February 2024 for the 5th month in a row. Despite an increasing trend in 2023, QC down payments experienced a dip in January and continued downward in February, dropping by $15K and 1 percentage point.

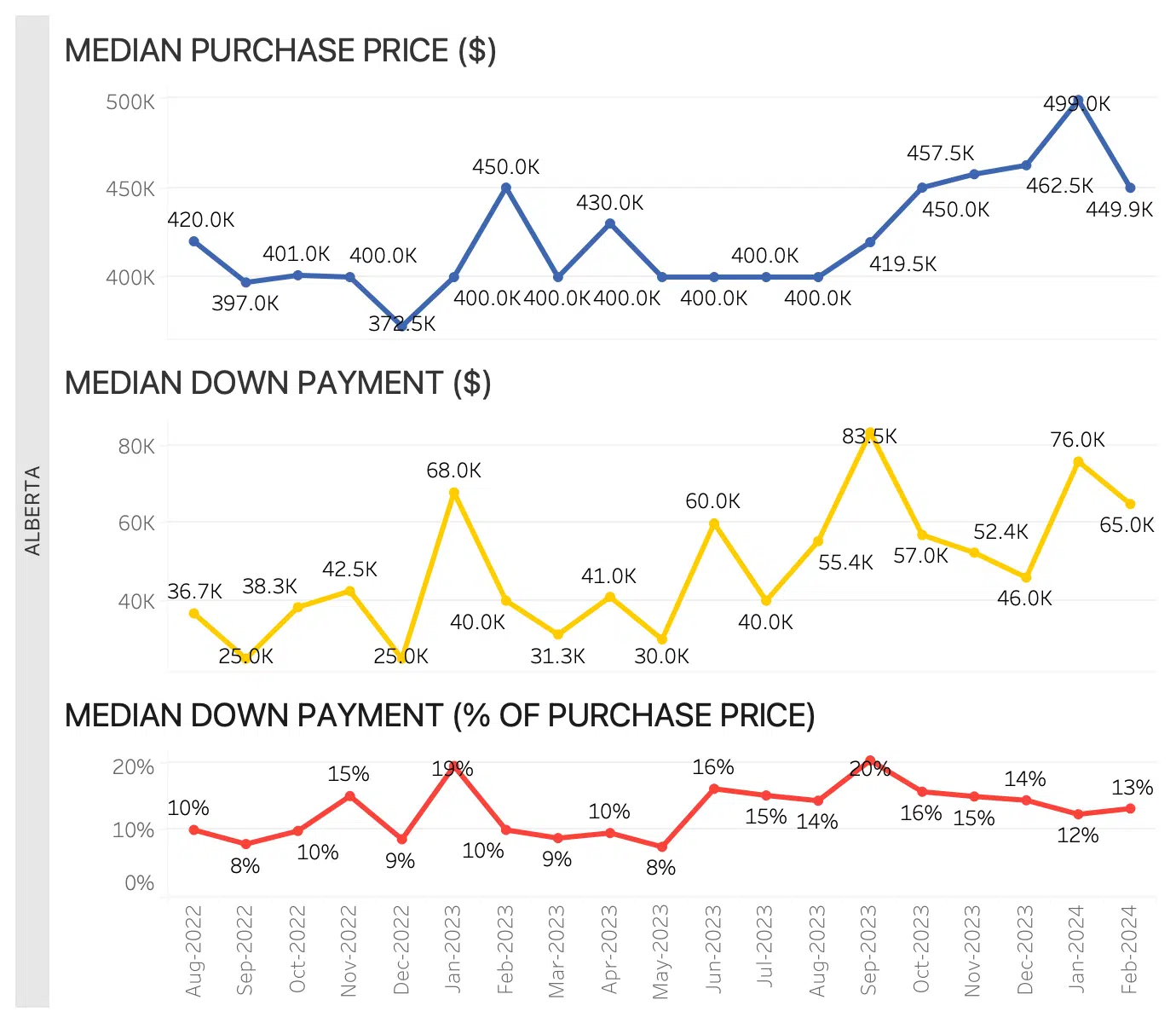

Alberta

Fig. 6: Median purchase price and median down payment values in Alberta over the last 2 years, between August 2022 and February 2024.

Home prices in Alberta had been on an upward trend since August 2023 and only experienced their first decrease in February 2024, dropping from $500K to $450K. That being said, there were few shifts in down payments, both in dollar and percentage values, where the down payment dipped by $9K but increased by 1 percentage point.

Final Thoughts

It’s clear the market still has a way to go in the coming months, as potential homebuyers and homeowners await the highly anticipated rate cuts expected in the summer.

As the Canadian economy continues recovering from the inflationary pressures and monetary tightening of the past 20 months or so, homebuyers on the sidelines are gearing up to enter the market in 2024. The shortfall in new build completions will only make the housing market more competitive as higher home prices will follow. Let’s ensure you’re staying ahead with suitable advice and trending data.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!