Featured articles #Industry News

Featured articles #Industry News

May 2024 Mortgage Report: Lower Fixed Rates And Stable Home Prices See Sidelined Buyers Entering The Market Early In The Summer

Table of contents

Following recent decreases in fixed rates, this month’s mortgage industry report covers the first stirrings of a hotter housing market looming over the horizon this summer. The home purchase data doesn’t lie: buyers are already re-entering the market, and their numbers are increasing every month.

On the mortgage rate side, predictions regarding the BoC’s summer plans have been a major topic of discussion lately, with more experts pivoting towards a potential rate cut in this summer. While this might not affect fixed rates immediately, June or July might mark the first significant dip in variable rates we’ve seen since 2022.

Key Highlights

- Mortgage Rates: Decreases in nesto’s fixed rate over the last 5 months speak to the BoC’s success in moderating inflation through rate holds, clearing the way for rate cuts this summer.

- Purchase vs. Renewal vs. Refinance: Nearly 50% of nesto’s mortgage applications in April were for new purchases, as buyers on the sideline take advantage of lower fixed rates to enter the market.

- Purchase Timing Intent: Between December 2023 and April 2024, homebuyer intent shifted in tandem with rate variance, with the portion of clients who are ‘ready to buy’ increasing from 40% to 48% as fixed mortgage rates decreased.

- Purchase Price & Down Payments: In April 2024, the median purchase price for properties financed through nesto in Canada increased by $15K, with median down payment contributions in dollar value also increasing from $60K to $65K.

Mortgage Rate Trends To Know

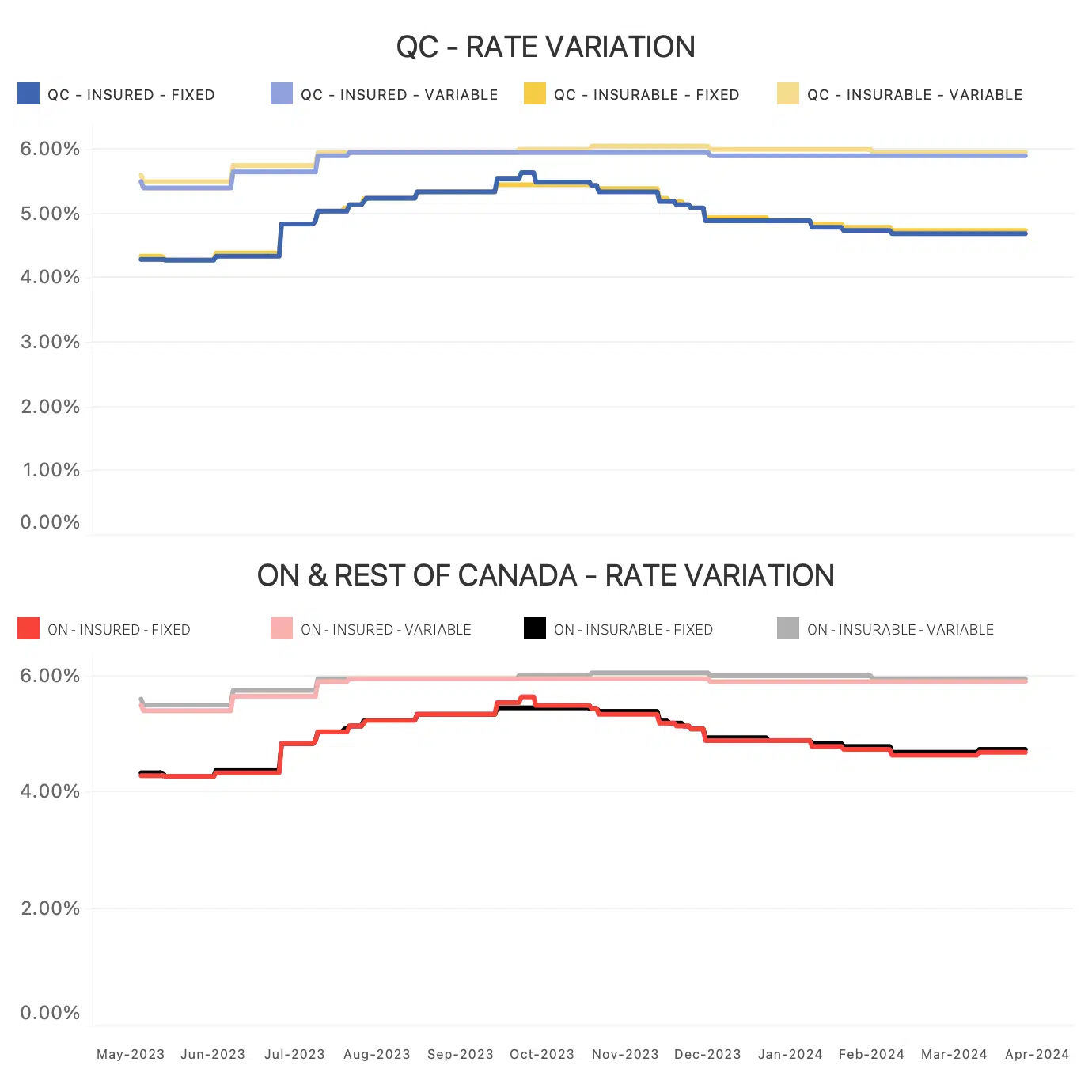

It’s no surprise that this summer’s hot topic is mortgage rate variance, with the graph above illustrating that nesto’s fixed rates have slowly declined over the last 5 months.

Rate Variation

Fig. 1: These graphs show the rate variances between transaction types in Quebec compared to Ontario and the rest of Canada.

There are two key factors to note here. First, the Bank of Canada’s continuous rate holds have moderated inflationary pressure, which explains the direction of lowered fixed rates. Second, in recent predictions, experts have grown more optimistic about a potential BoC rate cut in June or July.

While the BoC overnight rate does not affect fixed rates (increases can still happen), a policy rate cut would lower variable rates for the first time since March 2022.

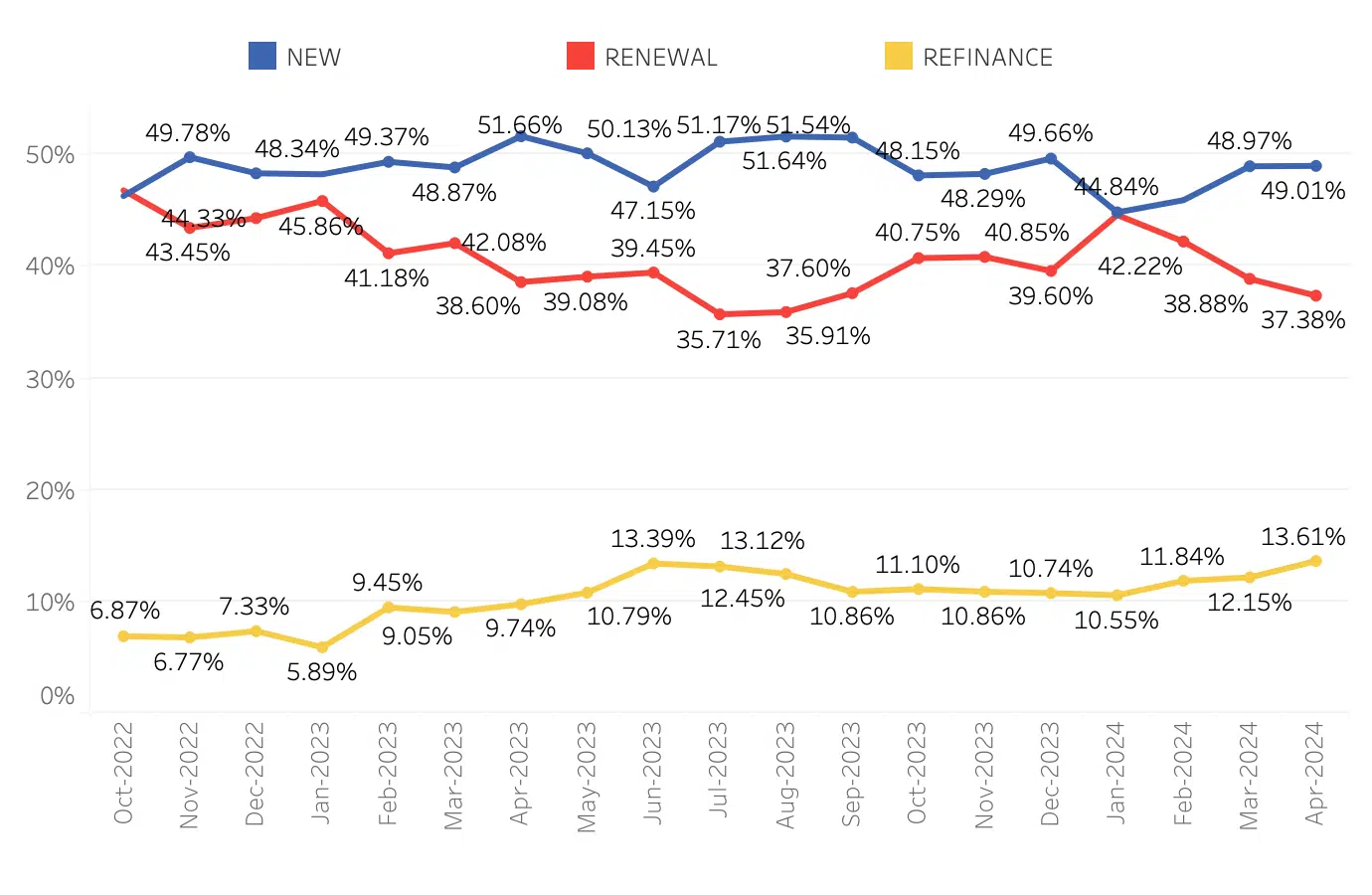

Purchases vs Renewals vs Refinances

Despite the high number of Canadian mortgages coming up for renewal, which, here at nesto, we’ve aptly labelled as the “Great Renewal Wave,” the summer has seen a resurgence of homebuyers. A significant 50% of nesto’s mortgage applications in April were for new purchases, while renewals and refinances made up 37% and 14% of applications, respectively.

Trends for the Proportion of New Mortgages, Renewals, and Refinances

Fig. 2: Trends for the proportion of purchases (new mortgages) vs. renewals vs. refinances over the last 18 months, from October 2022 to April 2024.

Recent national data reflect an increasing number of home purchases in major markets nationwide. This home buying trend resulted from the warm summer months in Canada, the traditional homebuying season. Still, it reflects homebuyers previously on the sidelines taking advantage of favourable conditions, including lower fixed rates and stabilizing home prices.

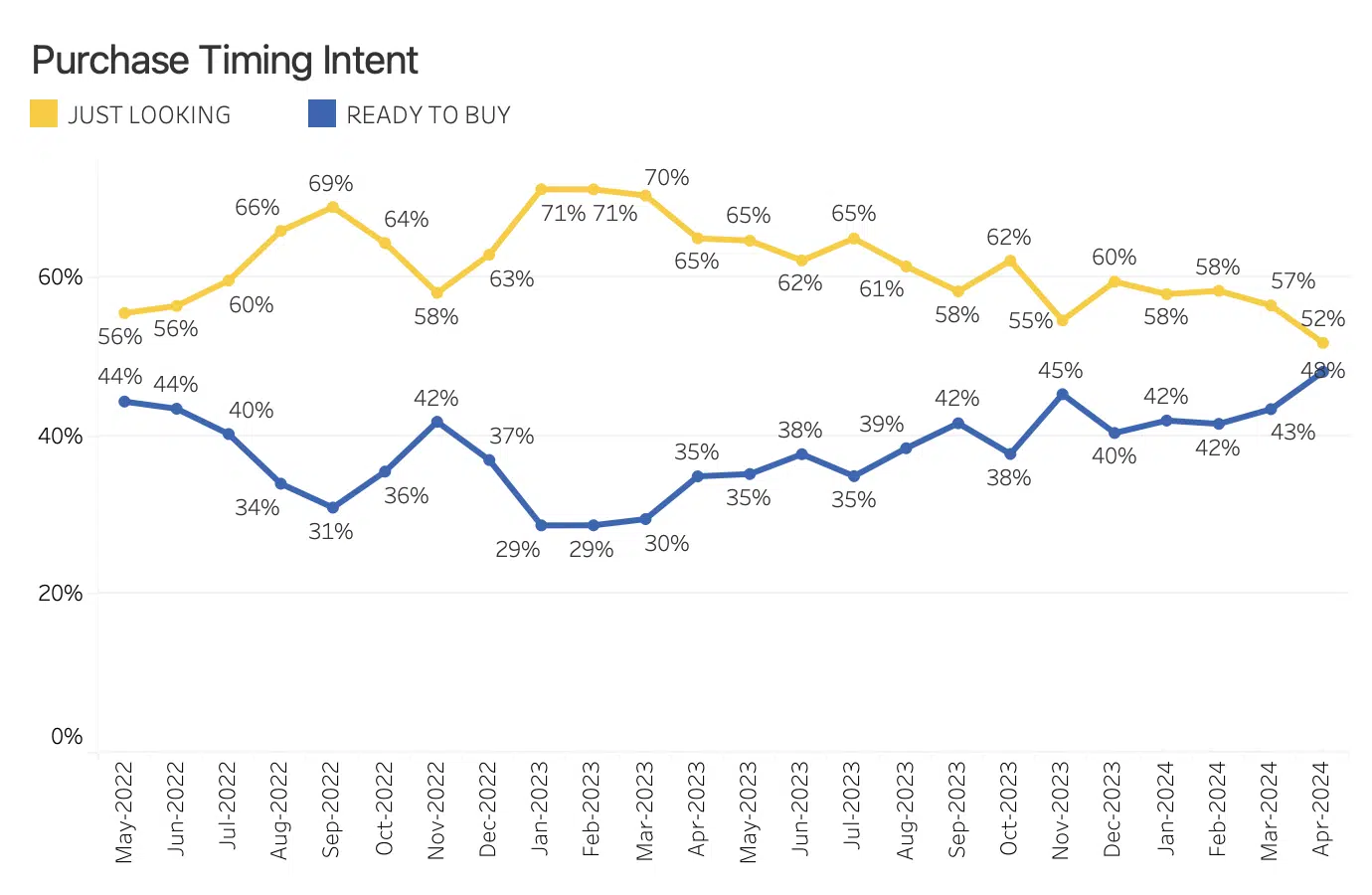

When Is The Best Time To Buy?

The most exciting point in this graph is how homebuyer intent shifts alongside rate variance and minor improvements in homeowner affordability. Over the same period, the number of clients who are ‘ready to buy’ has increased from 40% to 48%, and the fixed rate has decreased, as illustrated in the previous graph. This narrowing divide aligns with the ongoing trend of more clients exiting the sidelines and looking to purchase homes.

Purchase Intent: proportion of users “ready to buy” vs. “just looking”

Fig. 3: Purchase intent: proportion of clients “ready to buy” vs. “just looking” in their mortgage journey with nesto, illustrated over the last 2 years from May 2022 to April 2024.

With the current shift in the interest rate environment towards rate cuts, there is a potential for an upward movement in home prices during the summer. This change in the housing market dynamics could create a more competitive buyer landscape. As interest rates decrease, it becomes more affordable to borrow money, leading to an increase in demand. Consequently, this surge in demand can drive up home prices as buyers compete for limited inventory.

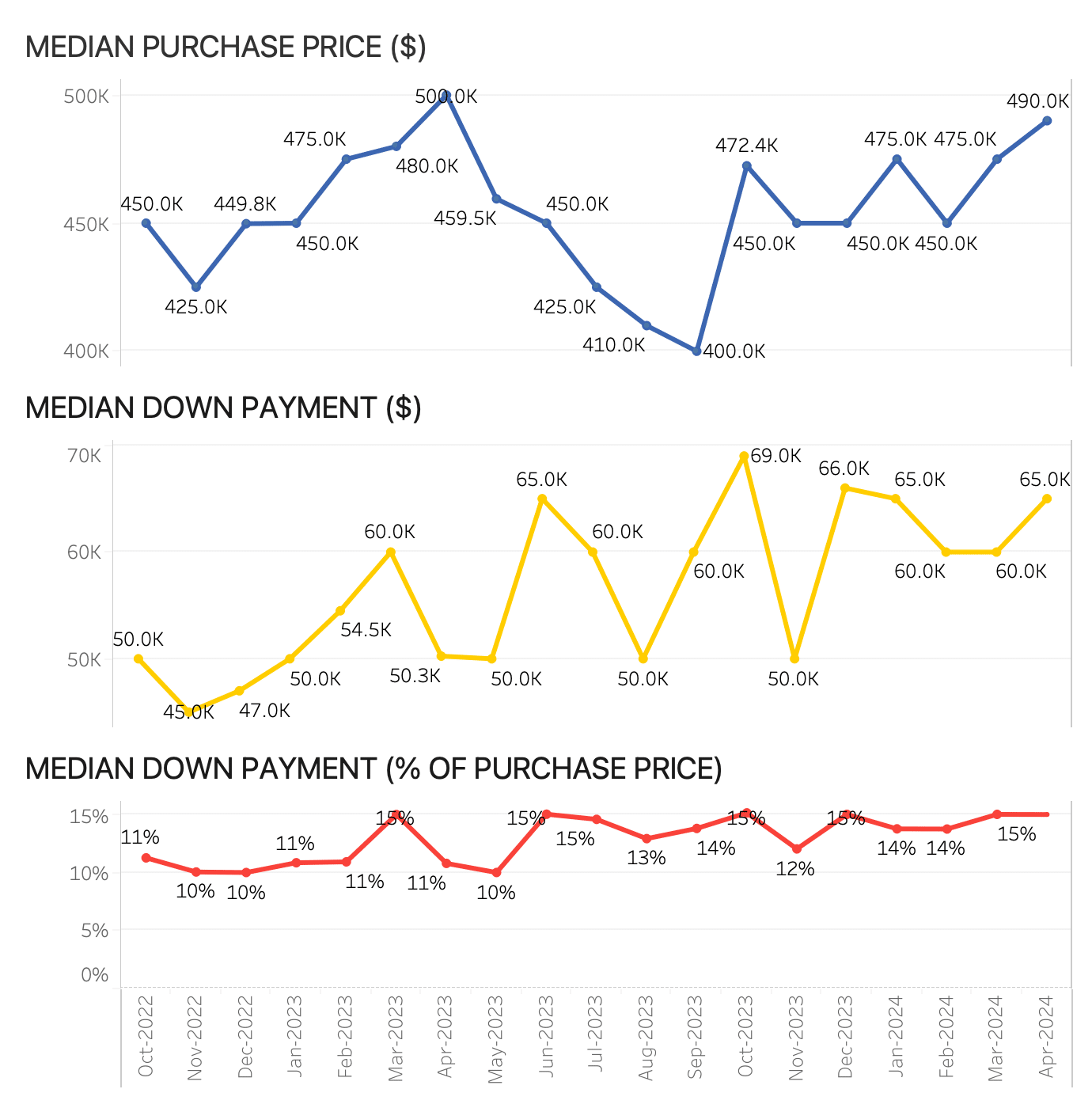

Home Prices And Down Payments

In April 2024, the median purchase price for properties financed through nesto increased by $15K, with median down payment contributions in dollar value also increasing from $60K to $65K. The ability to shop at higher price points or contribute larger down payments compared to previous months is likely due to fixed rates coming down, even by a small margin.

Potential buyers should take advantage of this brief window. Fixed rates have lowered slightly, and home prices have stabilized before their next surge.

Median Purchase Price and Median Down Payment in Canada

Fig. 4: Median purchase price and median down payment values over the last 2 years in Canada between October 2022 and April 2024.

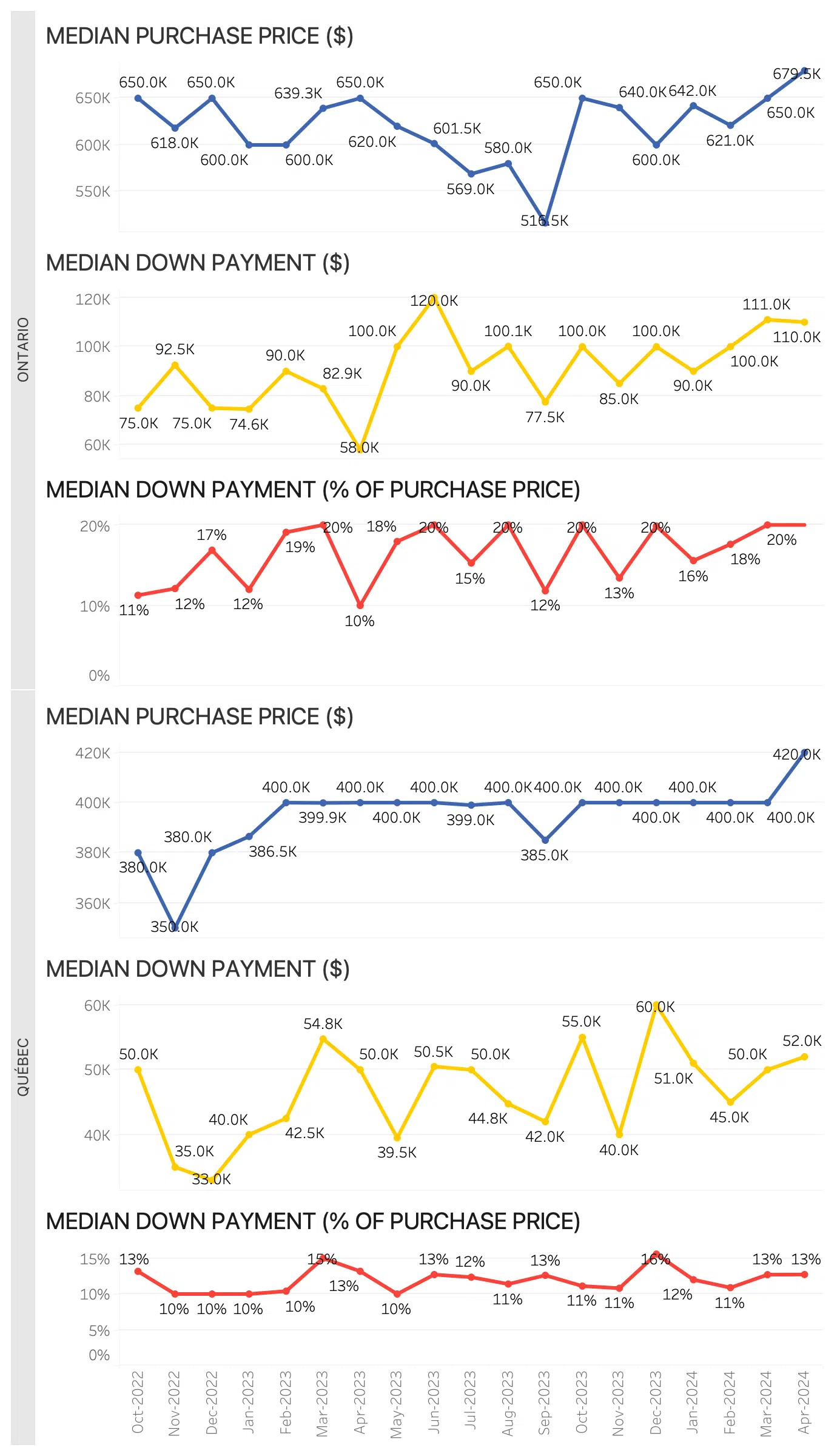

In April 2024, Ontario’s home purchase data primarily reflected national trends similar to those in the previous graph. The median purchase price increased by $30K, and while down payments remained stable in dollar value, the median down payment contribution was as high as 20%. It is likely to avoid the additional cost of adding default insurance to the mortgage balance or home prices being higher on average compared to most other parts of the country.

Quebec and Ontario

Fig. 5: Median purchase price and median down payment values in Ontario and Quebec over the last 2 years, between October 2022 and April 2024.

Meanwhile, in Quebec, the median purchase price at nesto increased for the first time since January 2023, finally exiting its 6-month plateau at $400K to hit $420K. Applications for purchases through nesto in Quebec also saw down payment contributions increase slightly by $2K in the past month.

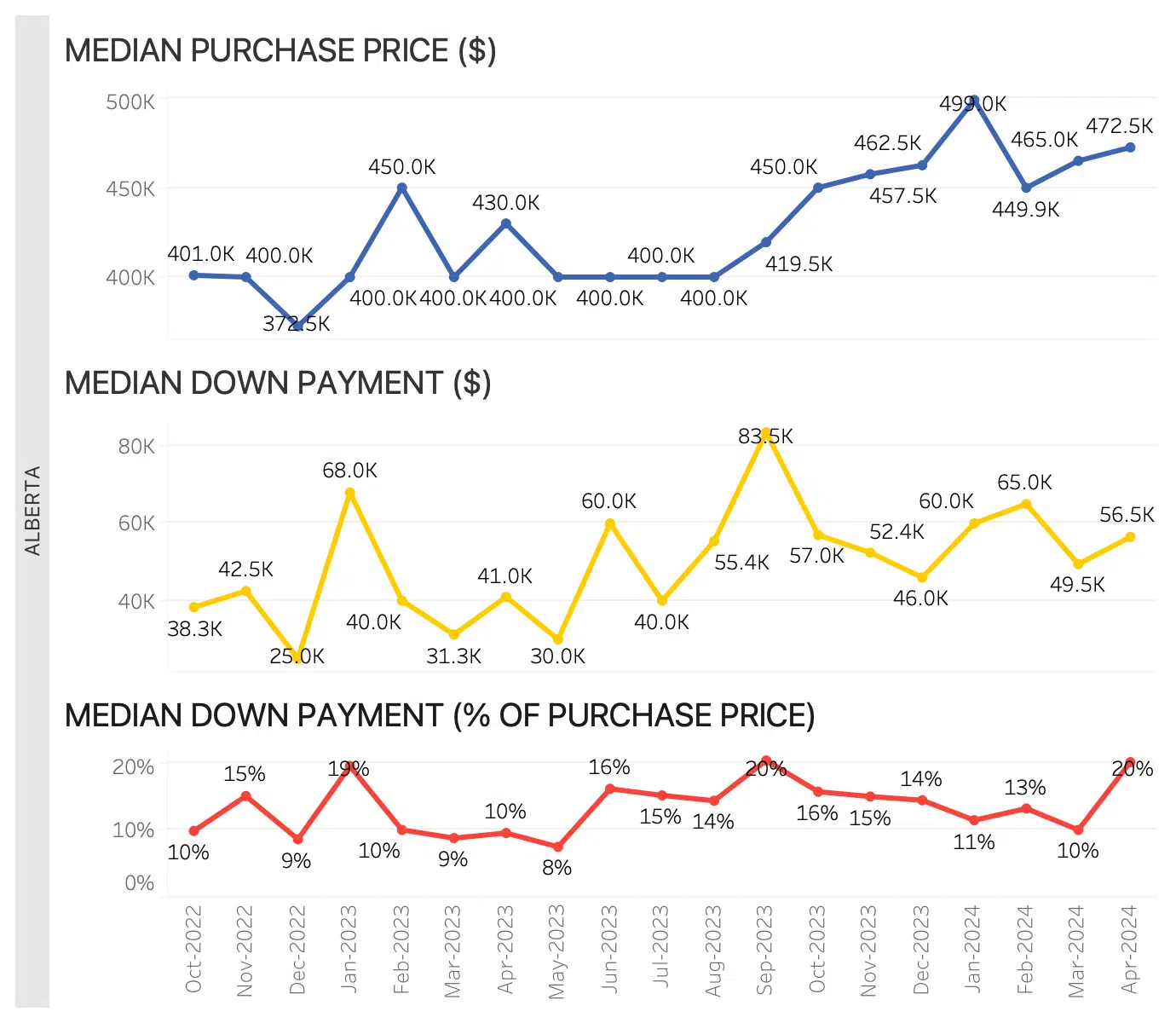

Alberta

Fig. 6: Median purchase price and median down payment values in Alberta over the last 2 years, between October 2022 and April 2024.

In April 2024, home prices in Alberta continued their upward trend, increasing to $473K from $465K. Down payment contributions also increased overall, going from $50K to $57K in dollars and from 10% to a high of 20% as a percentage of the mortgage.

Final Thoughts

Market participants face uncertainty around the possibility of rate cuts by the Bank of Canada, with much speculation regarding when and to what extent these cuts will occur. As a result, financial markets have adopted a cautious approach, with investors and analysts closely observing economic indicators and central bank communications for any indications of future rate cuts. This issue’s lack of clarity has created a sense of anticipation and vigilance within the mortgage and housing market.

The Canadian housing market is expected to heat up in the coming months. As fixed rates slowly come down and homebuying becomes competitive again, potential homebuyers should start considering their mortgage strategy.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!