Featured articles #Real Estate

Featured articles #Real Estate

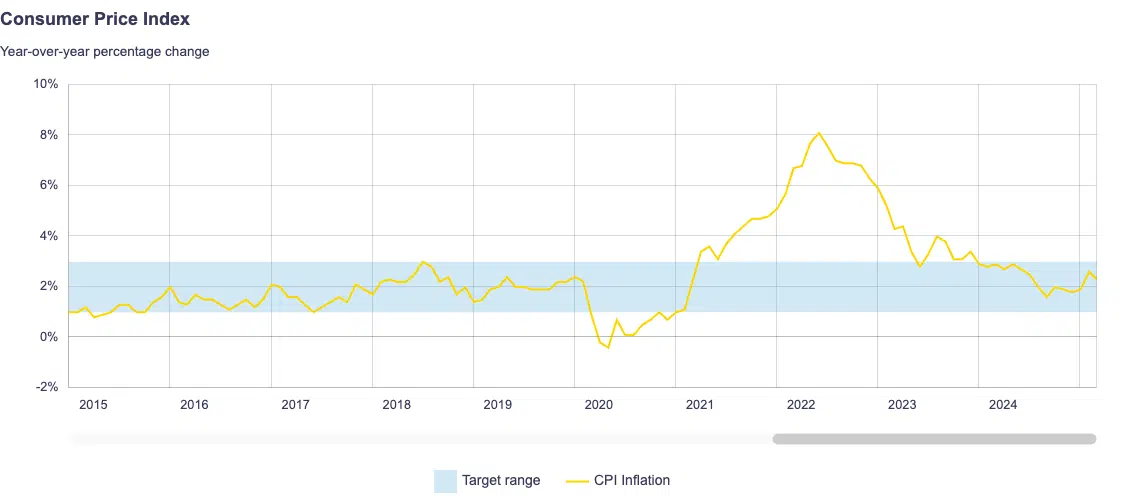

Inflation Rate and CPI in Canada Today

Table of contents

The inflation rate is the rate of increase in the price of goods and services in the Canadian economy over time. Inflation is measured using the Consumer Price Index (CPI), which measures the price movements of a basket of goods and services over time.

The Bank of Canada uses CPI readings to monitor the impact of monetary policy measures on the economy, adjusting the policy interest rate to bring inflation within the target range. As the fight against inflation continues, Canada’s inflation rate in May rose year-over-year to 1.7%, matching the 1.7% increase in April.

Key Takeaways

- Inflation measures the rate at which the cost of goods and services increases year-over-year.

- When the Bank of Canada makes monetary policy decisions, it monitors CPI-trim, CPI-median, and CPI-common rather than core inflation measures.

- Inflation is typically driven by supply and demand in the economy.

Current Inflation Rate in Canada: 1.7%

Inflation rose 1.7% year over year, matching the increase in April. This was due to smaller price increases for rent and a decline in travel tours, which put downward pressure on the CPI this month. Smaller declines for gas and cellular services put upward pressure on CPI.

Shelter prices grew at a slower pace in May, rising 3.0% after increasing 3.4% in April. Mortgage interest costs decelerated for the 21st consecutive month in May (+6.2%) after rising 6.8% in April.

Prices for travel tours fell 0.2% after rising 6.7% in April. Gasoline fell 15.5% year-over-year after declining 18.1% in April. Prices for cellular services declined by 5.5%, compared to a 10.8% decrease in April. Prices for new passenger vehicles rose 4.9% year-over-year in May following an increase of 4.6% in April.

The measures of core inflation that the Bank of Canada monitors and uses as the basis for monetary policy decisions decreased to 3.0% for CPI-trim and CPI-median decreased to 3.0%. Shelter has consistently been the most significant driver of inflation; however, in May, food (+3.4%) outpaced shelter (+3.0%).

Inflation by CPI Category May 2025

| CPI Category | CPI |

|---|---|

| Food | 3.4% |

| Shelter | 3.0% |

| Household Operations, Furnishings and Equipment | 1.6% |

| Clothing and Footwear | 0.5% |

| Transport | -1.3% |

| Health and Personal Care | 2.1% |

| Recreation, Education and Reading | 0.8% |

| Alcoholic Beverages, Tobacco Products, and Recreational Cannabis | 2.0% |

Inflation Rates by Province May 2025

| Province | Inflation Rate |

|---|---|

| Newfoundland and Labrador | 0.5% |

| Prince Edward Island | 0.7% |

| Nova Scotia | 1.3% |

| New Brunswick | 0.9% |

| Quebec | 1.7% |

| Ontario | 1.7% |

| Manitoba | 1.9% |

| Saskatchewan | 1.6% |

| Alberta | 1.7% |

| British Columbia | 2.3% |

Shelter Continues to Climb

Canadians continue to feel the impact of rising prices, as shelter prices increased 3.0% year-over-year. Year-over-year rent prices in Canada declined 3.3% in May, following a 2.8% decrease in April. Atlantic Canada (+4.0%) and Saskatchewan (+4.0%) experienced the most significant year-over-year increase in rental prices this month. Higher interest rates and population growth have continued to put upward pressure on the Canadian rent index.

Higher interest rates continue to make homebuying more expensive, forcing many to stay in the rental market and creating further competition that impacts rental prices. Shelter costs, which include rental prices, remain one of the most significant drivers of inflation among the 8 CPI components.

What Is Inflation and How Is It Measured

Inflation measures the increase in the cost of goods and services over time. Inflation reduces purchasing power over time, and as inflation increases, your dollar no longer goes as far as it used to.

Inflation is measured using the Consumer Price Index (CPI), which measures price movements by comparing retail prices of a basket of goods and services over time. CPI is divided into 8 major categories, each weighted and assigned a share according to the importance of the good or service based on consumer spending habits. Basket weights are typically updated annually.

CPI Basket Weights (2024)

| Category | CPI Basket Weight |

|---|---|

| Food | 16.72% |

| Shelter | 29.12% |

| Household Operations, Furnishings and Equipment | 13.28% |

| Clothing and Footwear | 4.40% |

| Transportation | 17.29% |

| Health and Personal Care | 5.06% |

| Recreation, Education, and Reading | 10.16% |

| Alcoholic Beverages, Tobacco Products and Recreational Cannabis | 3.98% |

CPI is calculated based on the percentage change over a 12-month period and is a key indicator of inflationary pressures in the Canadian economy. CPI data is measured in each province and territory and weighted according to the importance of that province to consumer spending in Canada.

CPI Basket Weights by Province (2024)

| Geography | Weight |

|---|---|

| Canada | 100% |

| Newfoundland and Labrador | 1.27% |

| Prince Edward Island | 0.36% |

| Nova Scotia | 2.45% |

| New Brunswick | 1.88% |

| Quebec | 20.66% |

| Ontario | 40.20% |

| Manitoba | 3.17% |

| Saskatchewan | 2.75% |

| Alberta | 12.30% |

| British Columbia | 14.78% |

| Whitehorse, Yukon | 0.08% |

| Yellowknife, Northwest Territories | 0.07% |

| Iqaluit, Nunavut | 0.03% |

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

The Bank of Canada’s Preferred Measures of Core Inflation

The Bank of Canada monitors 3 measures of core inflation and uses these readings as the basis for monetary policy decisions.

CPI-trim

This measurement excludes CPI components with extreme price movements in a given month. This measure reduces the impact of volatile changes due to conditions that only impact a specific component. For example, extreme drought affecting crop prices could artificially inflate the food component in a given month. CPI-trim removes 40% of the total CPI basket, calculated by removing the highest and lowest 20% of weighted monthly price variations.

CPI-median

This measurement also filters out volatile price movements for components similar to CPI-trim. However, this measurement uses the middle point or median price change out of the range for a component.

CPI-common

This measurement follows price changes that are common across basket categories. A statistical model called the factor model detects common variations, filtering out price movements specific to a component.

Is a July Rate Cut a Possibility?

On June 4, the Bank of Canada (BoC) held Canada’s overnight policy rate at 2.75%, leaving mortgage lender’s prime rates unchanged at 4.95%. Our mortgage rate forecast predicts global economic uncertainty could prompt the Bank of Canada to lower rates to 2.25% this year. Read the current Bank of Canada press release, and our post-rate announcement insights.

Bond futures markets are now pricing another 72% probability of no change and a 28% probability of a 25 basis point (0.25%) rate cut at the Bank of Canada’s policy rate announcement on July 30. By the September 17 policy interest rate announcement, the likelihood of a rate cut will change to a 30% chance of a 25 basis point (0.25%) cut.

How Does Canada Compare?

When examining global inflation rates, Canada’s 1.7% rate for May aligns with the rates being experienced by other developed countries. Most other countries experienced a slight decrease in inflation or saw it remain unchanged in May. US inflation rose year-over-year to 2.4% in May, up slightly from 2.3% in April.

Historical Inflation Rates in Canada

The table below provides a 10-year historical overview of Canadian inflation rates from January 2015 to the present day.

Source: Bank of Canada

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 1.0% | 1.0% | 1.2% | 0.8% | 0.9% | 1.0% | 1.3% | 1.3% | 1.0% | 1.0% | 1.4% | 1.6% |

| 2016 | 2.0% | 1.4% | 1.3% | 1.7% | 1.5% | 1.5% | 1.3% | 1.1% | 1.3% | 1.5% | 1.2% | 1.5% |

| 2017 | 2.1% | 2.0% | 1.6% | 1.6% | 1.3% | 1.0% | 1.2% | 1.4% | 1.6% | 1.4% | 2.1% | 1.9% |

| 2018 | 1.7% | 2.2% | 2.3% | 2.2% | 2.2% | 2.5% | 3.0% | 2.8% | 2.2% | 2.4% | 1.7% | 2.0% |

| 2019 | 1.4% | 1.5% | 1.9% | 2.0% | 2.4% | 2.0% | 2.0% | 1.9% | 1.9% | 1.9% | 2.2% | 2.2% |

| 2020 | 2.4% | 2.2% | 0.9% | -0.2% | -0.4% | 0.7% | 0.1% | 0.1% | 0.5% | 0.7% | 1.0% | 0.7% |

| 2021 | 1.0% | 1.1% | 2.2% | 3.4% | 3.6% | 3.1% | 3.7% | 4.1% | 4.4% | 4.7% | 4.7% | 4.8% |

| 2022 | 5.1% | 5.7% | 6.7% | 6.8% | 7.7% | 8.1% | 7.6% | 7.0% | 6.9% | 6.9% | 6.8% | 6.3% |

| 2023 | 5.9% | 5.2% | 4.3% | 4.4% | 3.4% | 2.8% | 3.3% | 4.0% | 3.8% | 3.1% | 3.1% | 3.4% |

| 2024 | 2.9% | 2.8% | 2.9% | 2.7% | 2.9% | 2.7% | 2.5% | 2.0% | 1.6% | 2.0% | 1.9% | 1.8% |

| 2025 | 1.9% | 2.6% | 2.3% | 1.7% | 1.7% |

What Drives Inflation?

Supply and demand in the economy are typically the key drivers of inflation. Demand for products or services can sometimes be greater than the supply available. When this happens, prices are increased to close the gap. This is known as demand-pull inflation, which occurred in the economy recently when businesses laid off employees during the pandemic and then struggled with labour shortages, unable to meet increased demand.

Higher prices due to higher production costs can cause prices to increase. This is known as cost-push inflation, which occurred most recently with lumber prices. Businesses that rely on lumber to produce products were impacted by shortages and higher costs, increasing their business costs. These additional costs are passed on to consumers through price increases so that companies can maintain or increase profit margins.

When inflation remains high, and expectations are that it will remain high, workers may ask for wage increases to afford the higher cost of living. This is known as built-in inflation, which occurs when companies increase the prices of their products or services to compensate for wage increases to maintain profit margins. This creates a loop or a wage-price spiral. As prices rise, workers demand higher wages to keep up with inflation and the high cost of living, contributing further to inflation.

How to Calculate Inflation Rate

To calculate the inflation rate, you need to know the current price of the good or service and the cost of that good or service in the year you wish to calculate the rate.

Inflation Rate = (Current CPI – Previous CPI) / Previous CPI x 100

This can be applied to the real world for any price of goods or services as long as you know the previous price. For example, if you want to calculate the inflation rate for a pound of cherries compared to last year, you can use the formula above to determine the inflation rate. If cherries were $6.99 a pound in May 2024 and $8.99 a pound in May 2025, you can calculate the inflation rate as follows:

Inflation Rate = ($8.99 – $6.99) / $6.99 x 100

Inflation Rate = 28.61%

Who Benefits From Inflation?

Corporations that can raise prices and profit from these inflated prices tend to benefit the most from inflation. Specifically, industries like real estate and supermarkets benefit most when inflation is high. Once prices are raised due to inflation, they don’t fall to previous prices as the increases are broad, not just a one-time spike, like if droughts affect lettuce crops. Instead, they stagnate and remain the same or rise much slower once inflation has been tamed.

Who Does Inflation Hurt?

Inflation harms consumers, specifically those with low or fixed incomes, as inflation erodes purchasing power. When earnings remain the same while the cost of everything increases, your money no longer goes as far as it used to. Those with lower incomes or fixed budgets typically spend a significant percentage of their income on things like rent and food, which are hard to go without when prices increase. To adjust, they must sacrifice other spending, affecting their living standards.

Frequently Asked Questions

What is the inflation rate?

The inflation rate measures the rate at which the general level of prices for goods and services is rising and, subsequently, purchasing power is falling. Central banks attempt to limit inflation to keep the economy running smoothly.

Why is the inflation rate important?

The inflation rate is an important economic indicator because it affects the value of money and indicates the health of an economy. A moderate rate of inflation is generally considered normal in a growing economy. However, high inflation can erode purchasing power and create economic uncertainty.

How does inflation impact consumers?

Inflation erodes purchasing power, meaning consumers must spend more to afford the same amount of a good or service they used to spend less on. This impacts those with lower incomes or fixed budgets as more of their income will need to be spent as prices increase, lowering their standard of living.

What is disinflation?

Disinflation occurs when the pace of price increases slows. This means prices are still rising, but much slower than before. Canada is currently in a disinflationary period as inflation comes back down and price growth for goods and services moderates.

What is deflation?

Deflation is the opposite of inflation and occurs when prices fall rapidly. While this may sound good to those struggling to afford inflated prices, rapidly falling prices can mean businesses see lower profits as consumers become reluctant to spend money as they wait for prices to fall further. If falling prices are prolonged, this can lead to job losses and wage cuts, affecting the entire economy.

Deflation can be a warning signal that a recession is coming or occurring. An example of prolonged deflation occurred in Canada during the Great Depression, when prices fell significantly, leading to a skyrocketing unemployment rate.

What are negative real interest rates?

Real interest rates have been adjusted to remove inflation. This can be calculated as the interest rate minus the headline inflation rate. This calculation more accurately reflects the actual cost of funds for borrowers and the real yield for lenders or investors.

For example, if you have a Canadian bond with a return of 4% and inflation is currently 2.9%, your real rate of return is 1.1%. A negative real interest rate results from inflation outpacing the interest rate. For example, your Canadian bond with a 4% return when inflation is currently 5% would mean a negative real rate of return of 1%.

A negative real interest rate occurs in the Canadian economy when the policy rate is lower than inflation. In March 2022, the policy rate was 0.5%, and inflation was 6.7%, resulting in a negative real interest rate of 6.2%.

Final Thoughts

The inflation rate in Canada, as measured by the Consumer Price Index (CPI), is an important economic indicator currently standing at 1.7%. The Bank of Canada monitors different CPI metrics to guide its monetary policy decisions and strives to maintain inflation within a target range, which has implications for the overall economy and interest rates.

Whether you’re a homeowner with a mortgage, a renter, a business owner, or a consumer, monitoring the inflation rate and understanding its implications for your financial strategy, homebuying, and mortgage plans is essential.

Ready to purchase your new home or renew/refinance your mortgage? Contact nesto’s mortgage experts to guide you in making the best decision for your mortgage strategy that suits your financial circumstances.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!