June 2024 Mortgage Report: Anticipation Brewing in the Housing Market Following BoC Rate Cut

Table of contents

In their June announcement, the Bank of Canada cut the overnight policy rate to 4.75%. With experts predicting more rate cuts, the market is already building up with some anticipatory energy. Buyers are exiting the sidelines to enter the market in full force. At the same time, many renewers– to avoid payment shock– continue to wait out the BoC for more rate cuts.

And while we have yet to see them surge, home prices have already begun to increase, with average purchase price experiencing an increase across the board for nesto clients. This may be an ideal window of opportunity for hesitant buyers, as fixed rates have come down and home prices have not reached their highest point.

Key Highlights

- Mortgage Rates: Fixed rates at nesto maintained their downtrend at 4.69% in May, while variable rate discounts from prime remained unchanged.

- Purchase vs. Renewal vs. Refinance: Purchases comprised 52% and renewals 48% of nesto’s mortgage applications.

- Purchase Timing Intent: For the first time in over 2 years, 50% of clients reported being ‘ready to buy’ compared to those ‘just looking.’

- Purchase Price & Down Payments: Our data for May shows average purchase prices increasing (by $53K) for the first time since November 2023. This effect has been even sharper since March 2024, partly due to the start of the 2024 spring lending season and nesto’s first fixed rate decrease.

Mortgage Rate Trends To Know

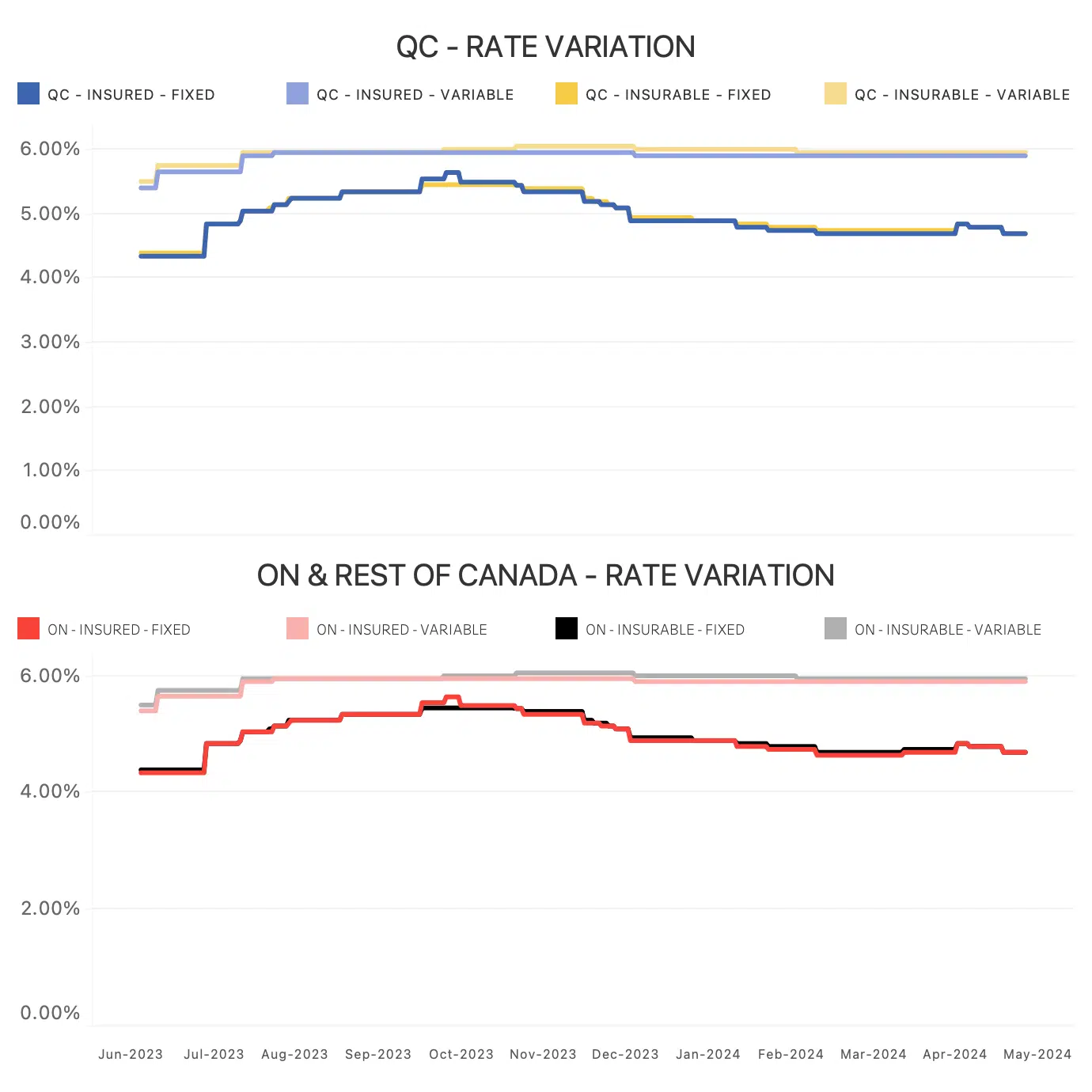

It’s no surprise that this summer’s hot topic is mortgage rate variance, with the graph above illustrating that nesto’s fixed rates have slowly declined over the last 5 months.

There are two key factors to note here. First, the Bank of Canada’s continuous rate holds have moderated inflationary pressure, which explains the direction of lowered fixed rates. Second, in recent predictions, experts have grown more optimistic about a potential BoC rate cut in July.

Rate Variation

Fig. 1: These graphs show the rate variances between transaction types in Quebec compared to Ontario and the rest of Canada.

Purchases vs Renewals vs Refinances

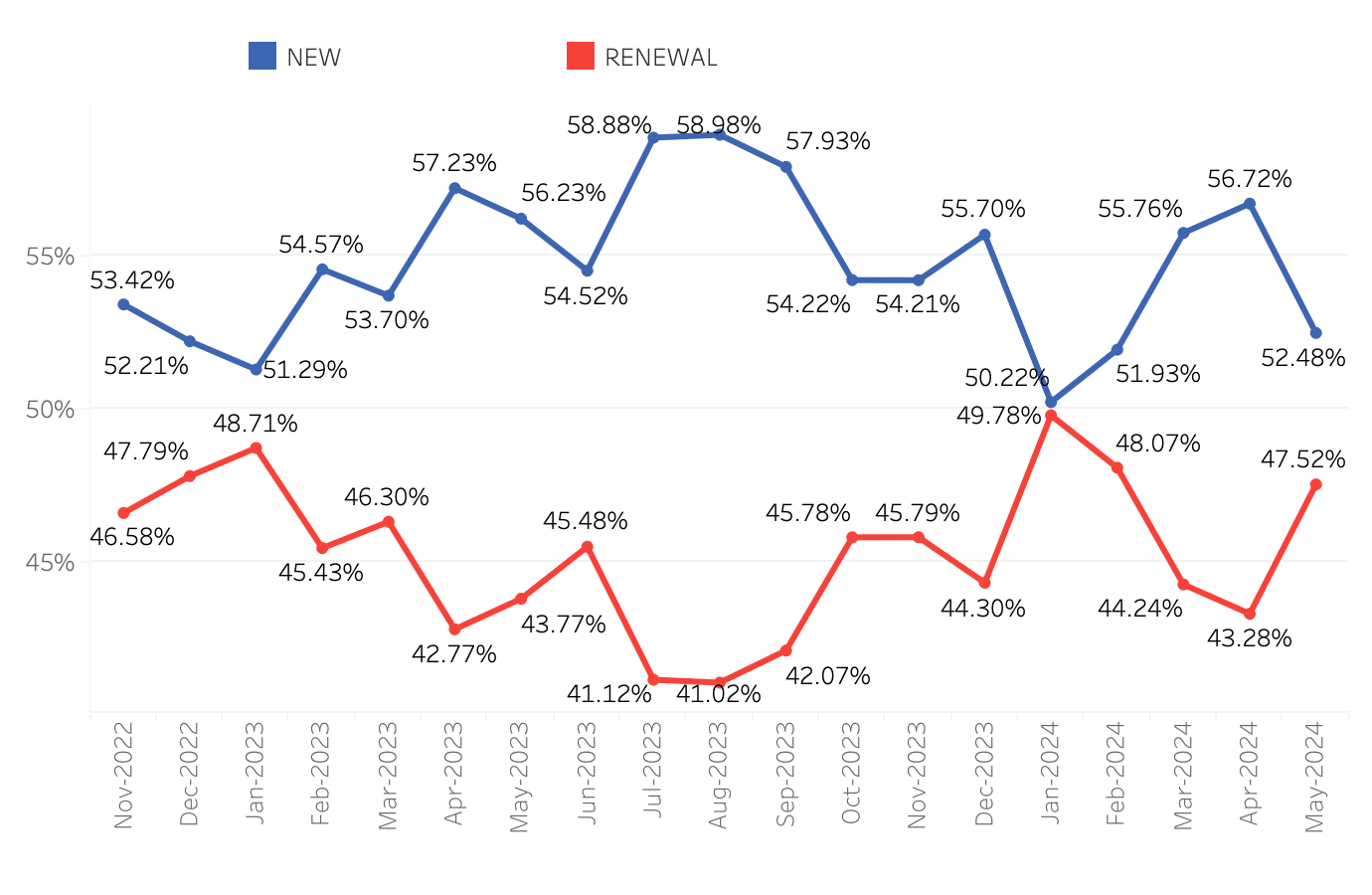

In 2024, spring and summer have seen a resurgence in homebuyers, as the portion of purchases among nesto mortgage applications steadily increased from 50% to 57% between January and April. Despite the staggering number of Canadian mortgages coming up for renewal in 2024 and 2025, renewals took a back seat, decreasing from 50% to 43%.

Trends for the Proportion of New Mortgages and Renewals

Fig. 2: Trends for the proportion of purchases (new mortgages) vs. renewals vs. refinances over the last 18 months, from November 2022 to May 2024.

In May 2024, the gap between purchase and renewal applications tightened, with purchases making up 52% of applications and renewals 48%. It’s clear that the homebuying season is going strong, and with June’s rate cut, we are likely to see purchases increase further.

Similarly, mortgage holders are likely putting off renewing in hopes of lower rates. A recent Mortgage Professionals Canada survey indicates that 76% of renewers are anxious about starting the process due to much higher interest rates.

When Is The Best Time To Buy?

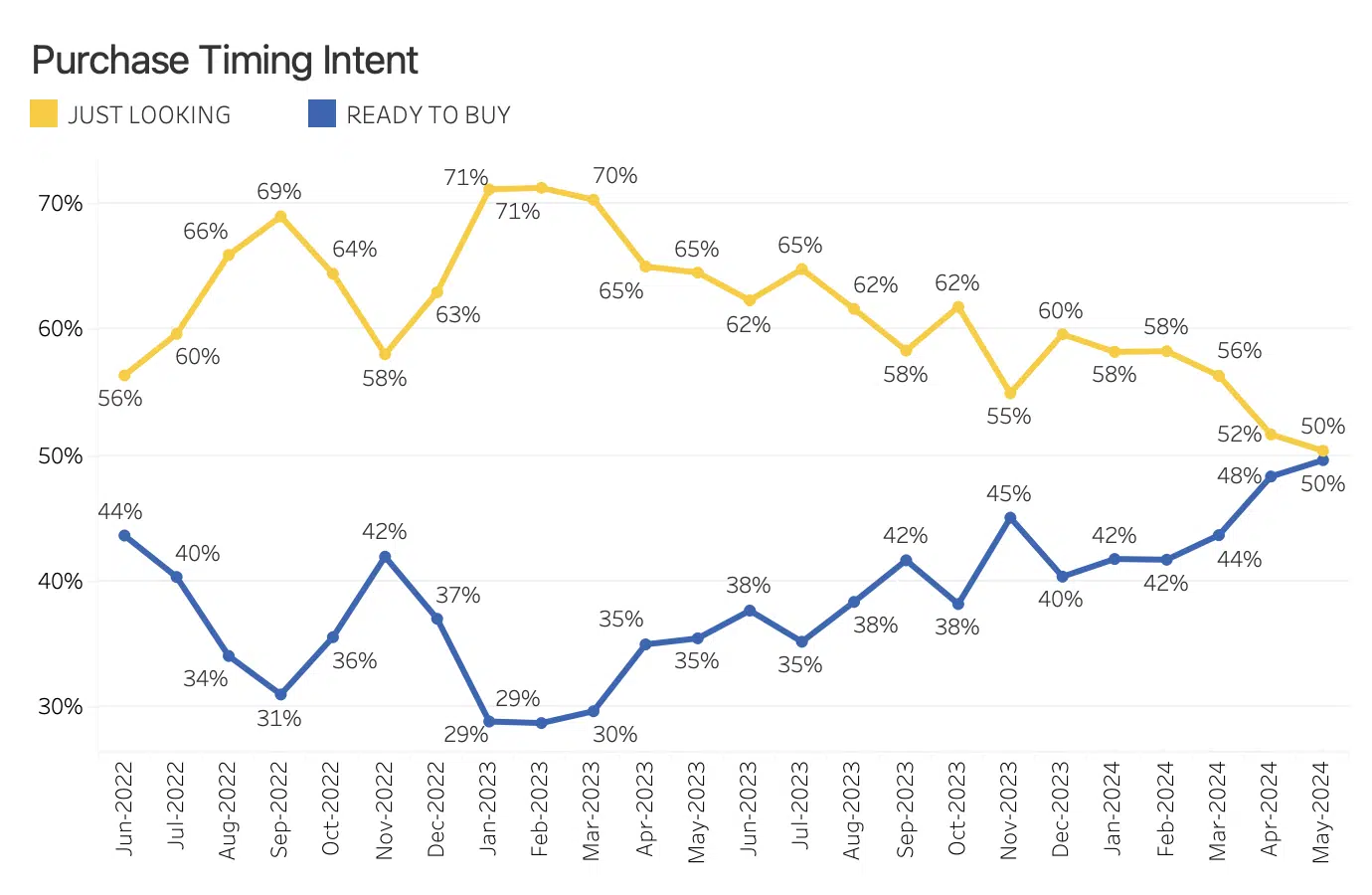

The percentage of clients who indicated they are ‘ready to buy’ has increased by 10 points since the beginning of the year, likely in anticipation of summer rate cuts. In May 2024, clients who were ‘ready to buy’ and those who were ‘just looking’ were split 50/50. With the upcoming expectation of a rate cut on July 24th, we could see those who are ‘ready to buy’ overtake those ‘just looking’ as borrowing becomes more affordable.

Purchase Intent: proportion of users “ready to buy” vs. “just looking”

Fig. 3: Purchase intent: proportion of clients “ready to buy” vs. “just looking” in their mortgage journey with nesto, illustrated over the last 2 years from June 2022 to May 2024.

Home Prices And Down Payments

In May 2024, the average purchase price for properties financed through nesto increased again. Despite rising by only $3K, we can note an overall increase in purchase price since November 2023. There was an even sharper rise in March 2024, partly due to the start of the spring lending season and the first decrease in nesto’s fixed rate.

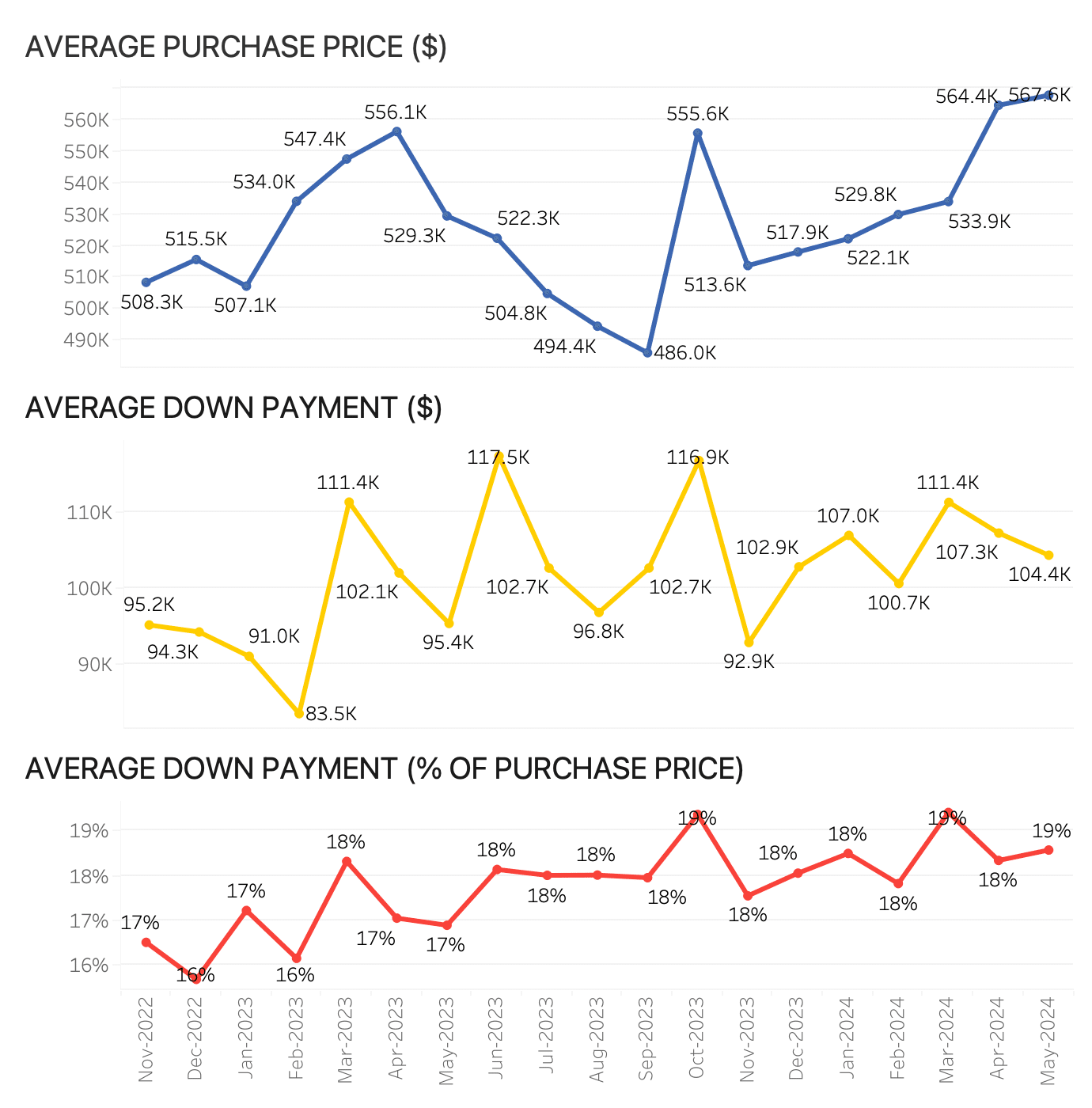

Average Purchase Price and Average Down Payment in Canada

Fig. 4: Average purchase price and average down payment values over the last 2 years in Canada between November 2022 and May 2024.

Homebuyers are taking advantage of this brief window, during which fixed rates have lowered slightly, and home prices have stabilized before their next surge. With the possibility of more rate cuts over the coming months, the average purchase price could likely continue to increase.

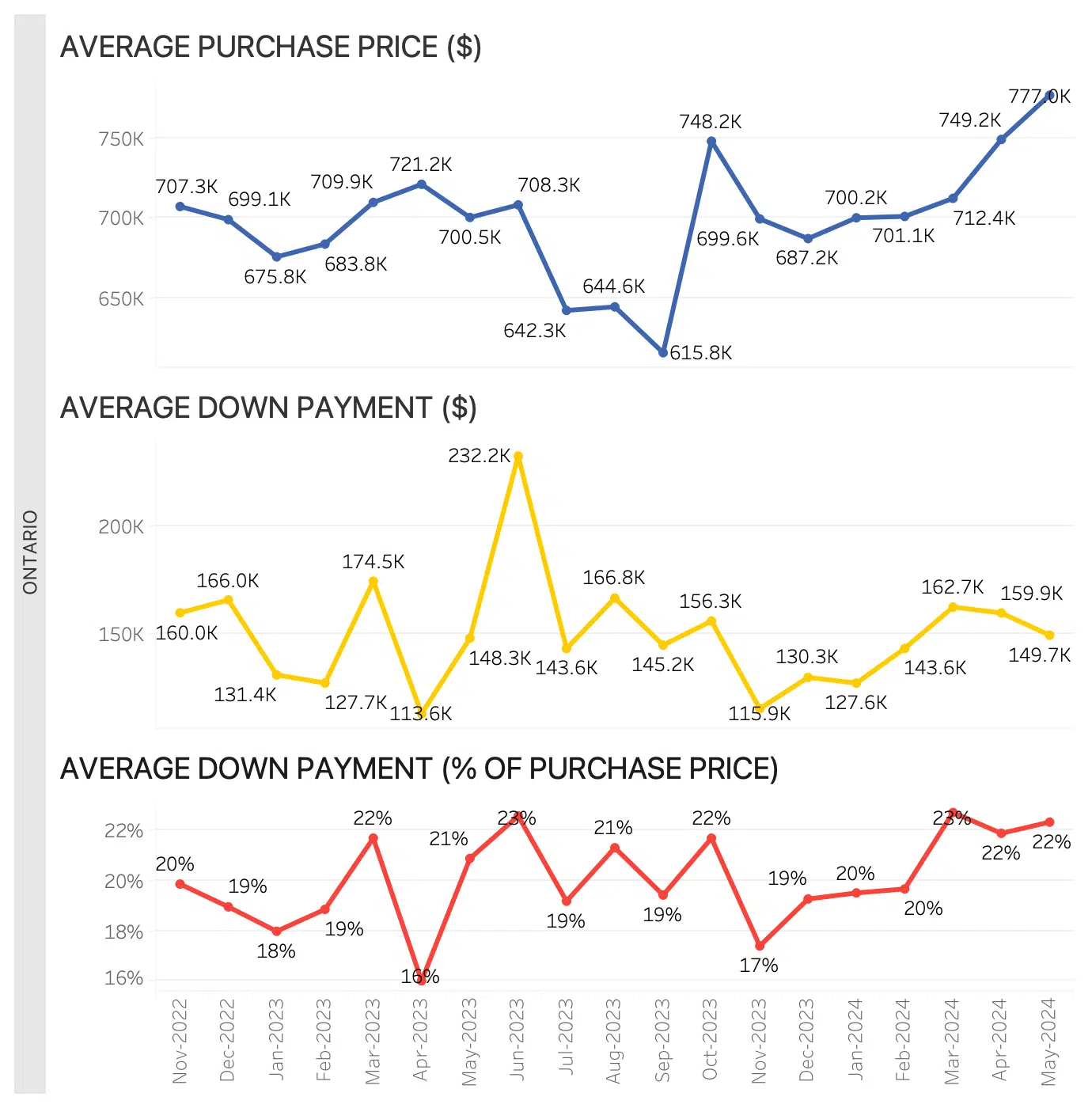

Ontario

Fig. 5: Average purchase price and average down payment values in Ontario over the last 2 years, between November 2022 and May 2024.

In May 2024, Ontario’s home purchase data primarily continued to reflect national trends similar to those in the previous graph. The average purchase price increased by $27K, and while down payments remained somewhat stable in dollar value, the median down payment contribution was as high as 22%. This is likely a result of Ontario homebuyers making higher down payments to avoid the additional cost of adding default insurance to their mortgage balance or making up for higher home prices than the rest of the country.

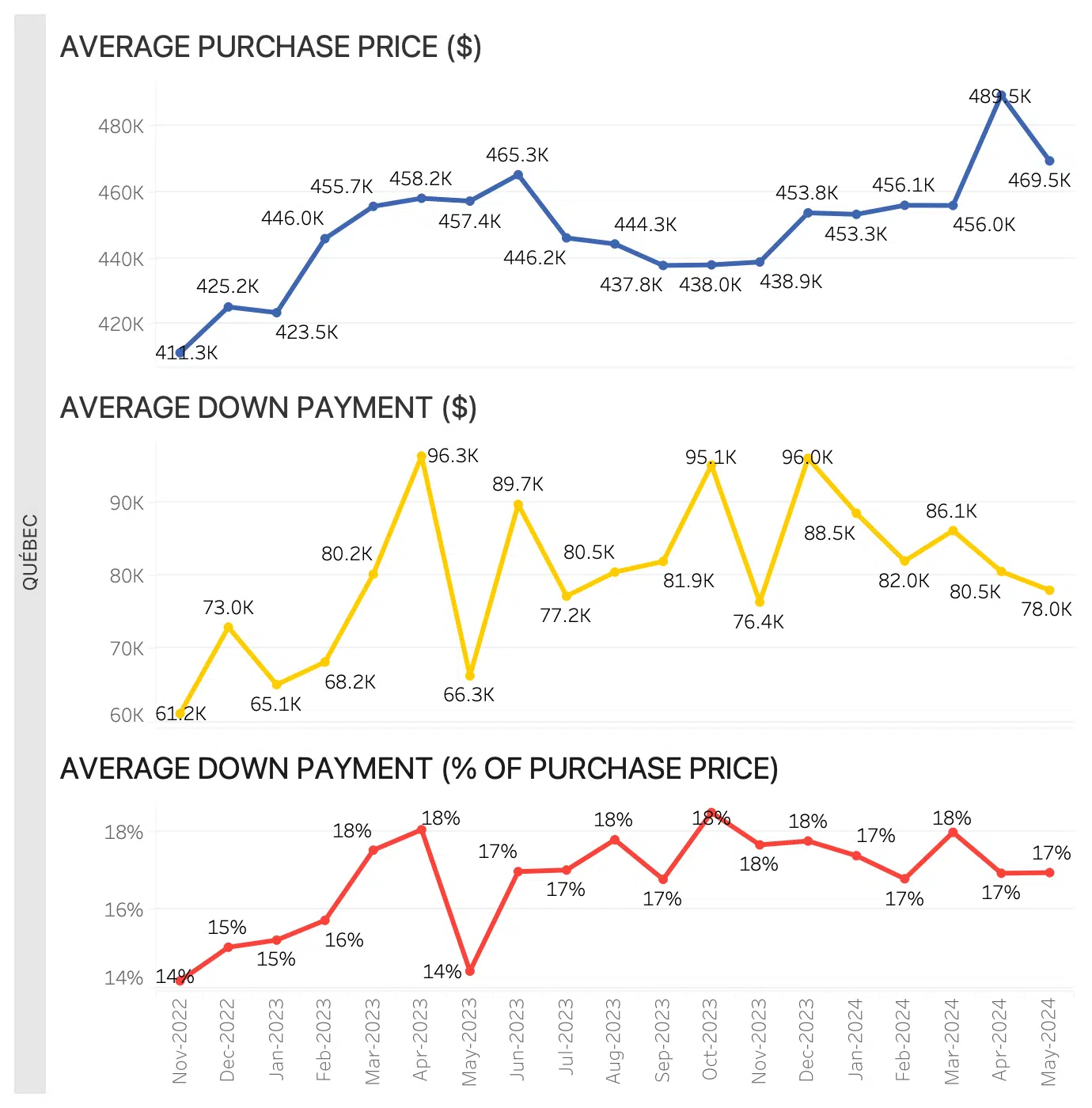

Quebec

Fig. 6: Median purchase price and median down payment values in Quebec over the last 2 years, between November 2022 and May 2024.

Meanwhile, in Quebec, the average purchase price at nesto experienced a sharp increase after remaining relatively stable since January 2023. In May 2024, the average purchase price decreased from $490K to $470K, which is still higher than in previous months since the BoC rate hikes began. In contrast, down payments have continued to decline over the same period.

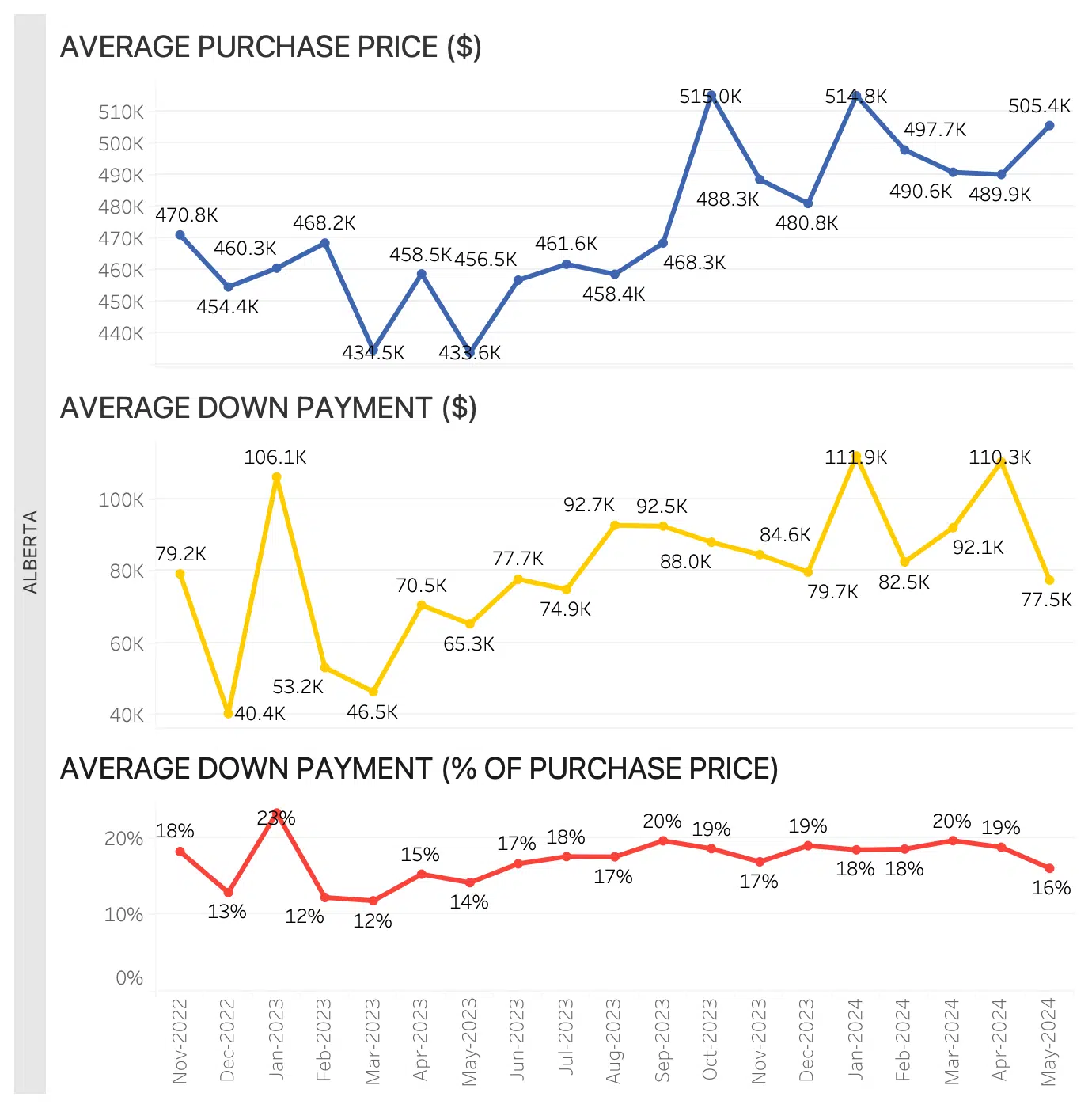

Alberta

Fig. 7: Average purchase price and average down payment values in Alberta over the last 2 years, between November 2022 and May 2024.

In May 2024, average home purchase prices financed by nesto in Alberta continued their upward trend, increasing to $504K from $490K. Conversely, average down payments decreased from $110K to $77K in dollars and from 19% to 16% as a percentage of the new mortgages closed at nesto. As the interprovincial population surge continues to tighten Alberta’s housing market, home prices are catching up to the rest of Canada.

Final Thoughts

Potential homebuyers were already entering the market with anticipation before the June rate cut. With the rate cut now in effect, nesto’s June data is expected to offer a clearer picture of the initial effects of the rate cuts on the market. This data will also show what homebuyers and mortgage renewers can expect for the remainder of the summer. Experts and markets are forecasting additional rate cuts so that the June data may offer a glimpse into a potentially hotter housing market later in the year.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!