How to Hack Your Mortgage Rate

Table of contents

Did you know that mortgage rates are sold at a premium? Simply put, all brokers and bank mortgage specialists have wiggle room when it comes to the mortgage products they decide to offer you.

Have you ever noticed that banks are willing to match that rate you got in writing from someone else once you present it to them’? Our question is: how come they wouldn’t offer the best solution to you in the first place? E.g., why did you make me take time off work and waste the time of others to do all this research when you knew all along that you could offer it?

In order to help you understand the rate dynamic here, we’re giving you an insider’s look at how banks and brokers work.

An insider’s look at mortgage rates

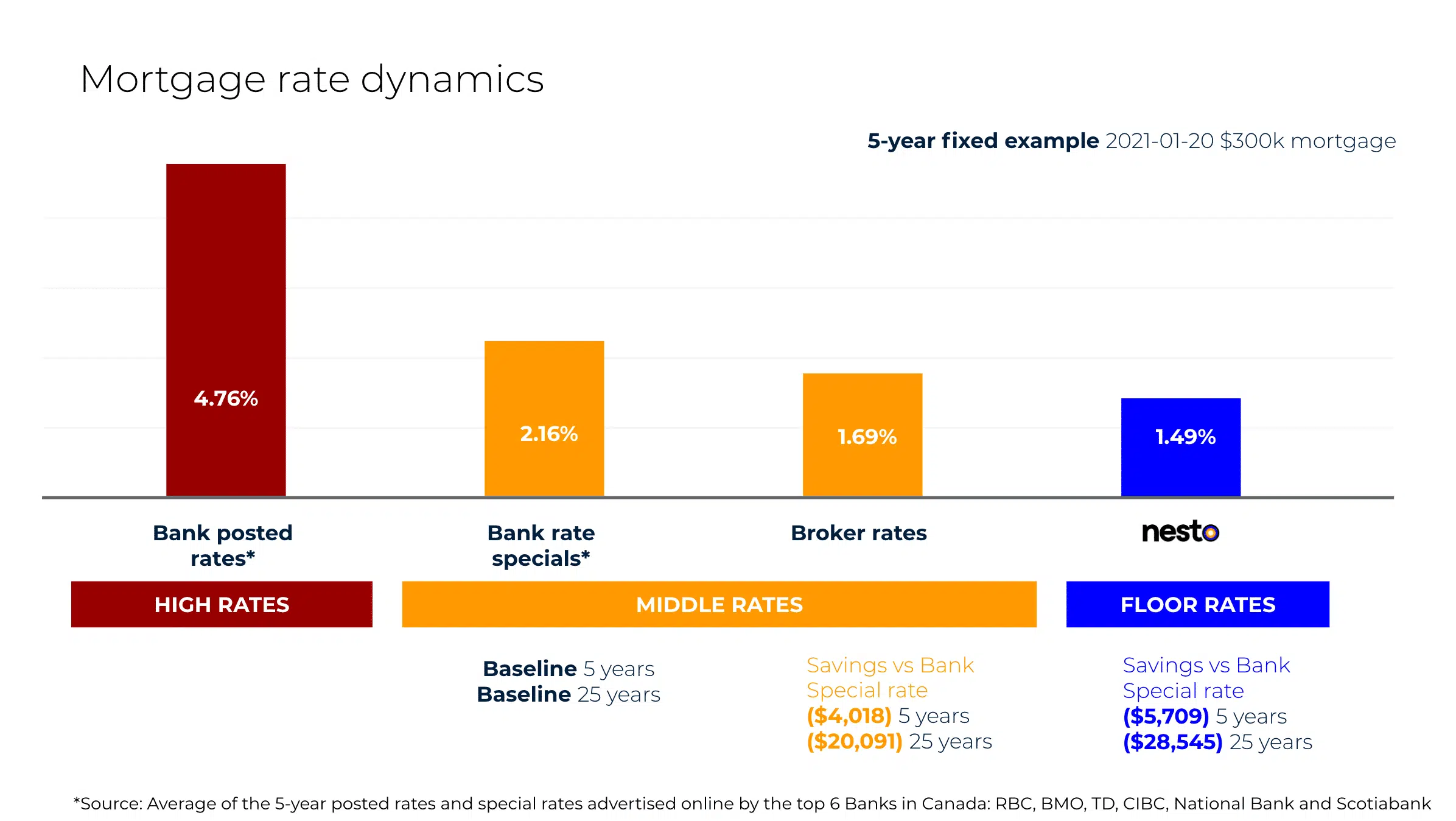

In simple terms, there are 3 types of rates for the same mortgage product:

⬆️ High rate: this is what’s posted on bank websites. They will never offer you this rate, but that’s the one they will use against you to calculate your penalty if you happen to break your mortgage. This rate is the handcuff used against you when breaking your mortgage.

⬅️ Middle rate: this is the rate you will likely be offered first – not great, but not too bad either. Brokers and bank mortgage specialists make the most commission when selling you this rate.

⬇️ Floor rate: the absolute minimum rate the lender is truly willing to lend at – which is only available if your mortgage broker or bank mortgage specialist is ready to let go of his/her commission.

Here is an illustration of what this means from a 5-year fixed mortgage as of January 2019:

In order to offer you the floor rate, a broker or mortgage specialist would have to give away a portion -or all of- their commission. Few are willing to go there… Hence why you have to go bank-to-bank, broker-to-broker, and negotiate amongst them to finally get such rate.

At nesto, we believe in offering you the floor rate from the start. Buying a home is one of the most expensive financial decisions of your life, why should you have to pay a premium for it?

Yes, we make less revenue than the average broker or mortgage specialist, but we get the peace of mind that we helped you save thousands of dollars on your mortgage. We feel pretty good about that! 🌈

#TransformingTheIndustry

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!