August 2022 nesto-meter Report

August 17th 2022 – Chase Belair, Co-Founder and Principal Broker at nesto

Welcome to nesto’s monthly mortgage trends and insights report, aka the nesto meter! Each month we’ll report on the state of the housing and mortgage industry. August 2022 mortgage report highlights a cooling market and a decreasing median purchase price. Read on, and learn more!

Key takeaways

- The housing market continues to show signs of cooling down through decreasing median purchase prices dropping $20,000 – from $495,000 to $475,000.

- Refinances were at their lowest levels in an almost two year period. Showing that more people are less willing to refinance with the interest rates sitting where they are today.

- There’s another upward swing from ‘ready to buy’ to ‘just looking’; with the latter clocking in at 60% and the former at just 40%. There’s little surprise we see this difference increase each month there’s a Bank of Canada rate announcement.

- With the rate hike announcement on 7/13, we saw the cost of a variable rate mortgage increase by an average of $187 per month.

- In Alberta, median purchase prices increased by $52,000. Being an outlier to Ontario and Quebec, where median purchase prices have either stabilized monthly (ON) or decreased (QC).

Median Purchase Price Dropped $20,000 in July 2022

For many, July sent shock waves through the mortgage and home industry, when the Bank of Canada announced a 1.0% increase to its overnight rate. This move was one of the highest increases in recent history, and left many wondering about the impact on monthly payments as well as the affordability of owning a home in 2022.

While aggressive, this rate hike seems to have done what it set out to do – cool the hot housing market. While we saw incremental shifts occurring in both our June and July monthly reports, this last month, things are wrapped up with a homeowner’s gift: Median purchase prices dipped another $20,000 and down payments leveled out in the 13% range, showing competition is dwindling.

Read on and learn more!

1. RATES

a. Volatility

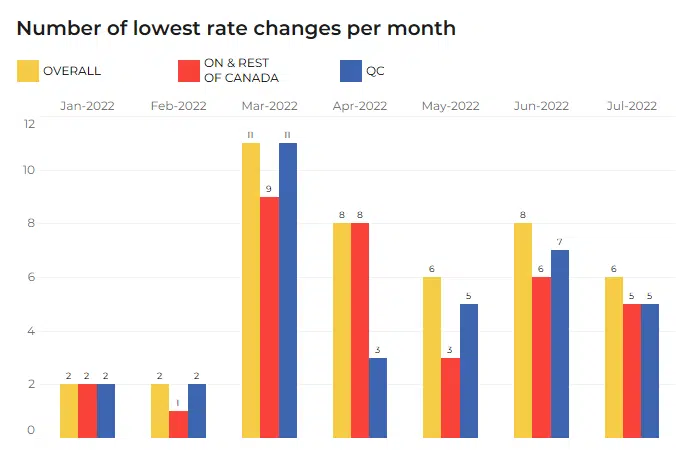

Fig. 1: Number of times the lowest rates offered by nesto to its users changed per month across provinces between January 2022 and July 2022.

Looking at rate changes from January 2022 through July 2022, the impact of a rising prime rate has a clear impact to the rates offered to users in the nesto database. As seen, prior to the Bank of Canada announcements that began in March 2022, the average rate changes per month were 2; however, now they average 5-7 per month. In July 2022, we had 6 rate changes overall, slightly down from 8 total seen in June 2022.

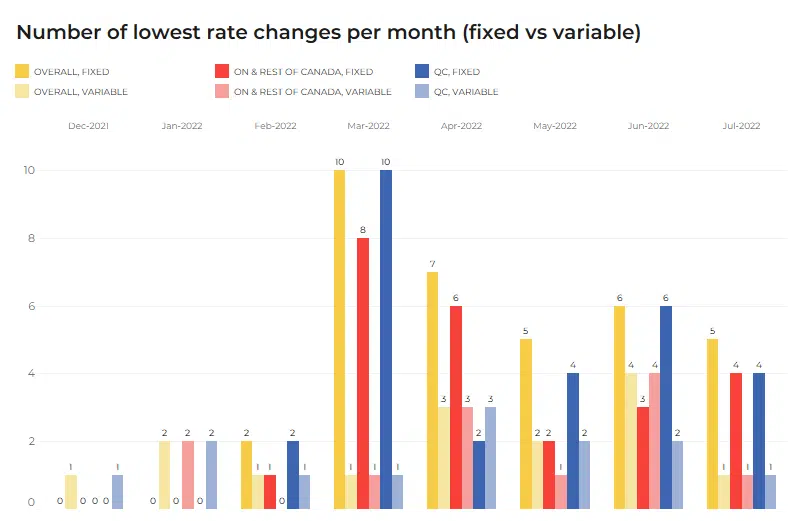

Fig. 2: Number of times the lowest rates offered by nesto to its users changed per month across provinces between December 2021 and July 2022 comparing fixed to variable rates. July 2022 showed fewer rate changes across variable

rates, and slightly lower rate changes across fixed rates.

Overall, the graph displays what many in the industry already know: Fixed rates are due for continual increases, while variable rates will take a considerably longer time to get to such high levels. Yes, both are going up, but they are not moving at the same speed. For this reason, no matter the province you reside, variable rates are still a great option to keep mortgage payments as low as possible in the short term.

b. Variance

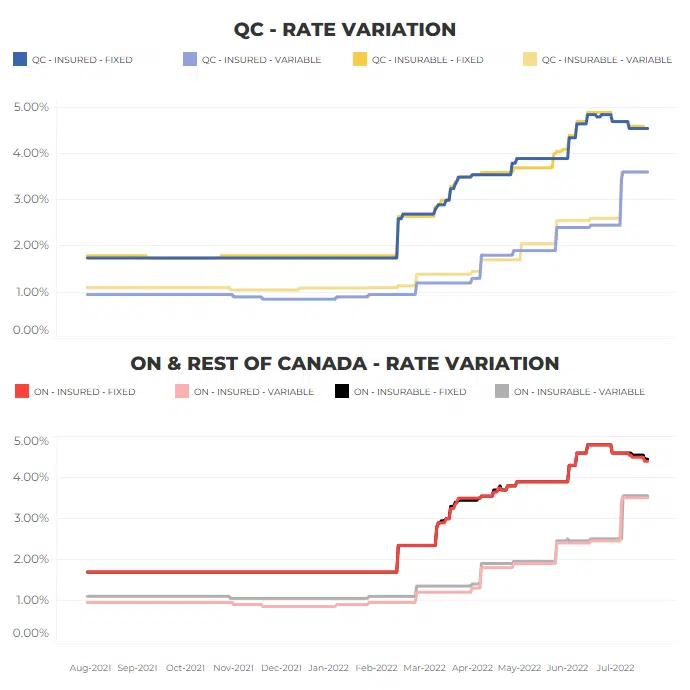

Fig. 3: These graphs show the rate variance in Quebec compared to Ontario and the rest of Canada.

Now let’s talk about variance! Fixed rates continue to rise at a faster pace than variables. This gap widened from March 2022 onwards ( >4.0% for fixed, and < 4.0% for variable) which is attributed to the interest rate hikes from the Bank of Canada.

Rates are spiking, secure your low rate today to save tomorrow.

With nesto, you can get a low rate with a 150 day hold.

2. MORTGAGE TYPE TRENDS

a. Purchase vs Renewal vs Refinance

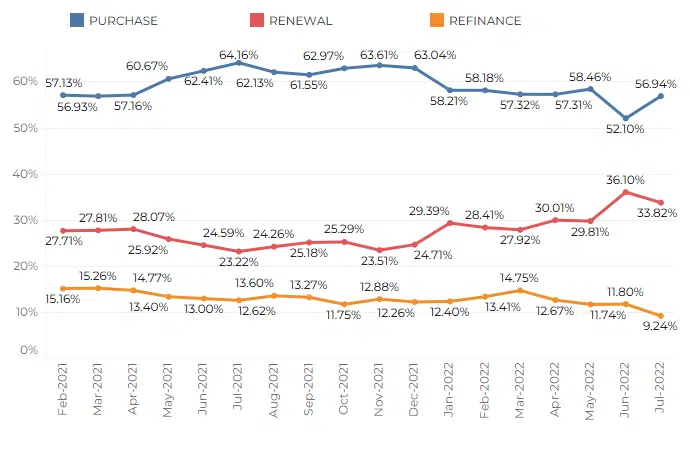

Fig. 4: Trends for proportion of purchases (new mortgages) vs renewals vs refinances from February 2021 to July 2022.

In our last report, we highlighted that renewals again took the lead among mortgage types, and had one of the most major jumps since the start of 2021. Then, renewals sat at 36.11%, up 6% from their previous documented high in April (30.03%) of this year. While renewals are still at high levels, the number in July 2022 did see a slight drop, coming in at 33.82%, or a 2.28% decrease.

On the new purchases front, looking at July 2022, we noticed a 4.84% increase from June 2022. While this increase is a welcomed change, the overall numbers remain the lowest they’ve been in 2022. Thus showing many first time homebuyers are likely being forced out of the market until interest rates level out, or prices continue trending downwards..

Lastly, when it comes to refinances, we see the lowest number recorded in the lastyear and a half: They reached 9.24%, down 5.6% from this year’s high in March 2022. What this simply means is that people are less willing to refinance their mortgages given the current interest rates.

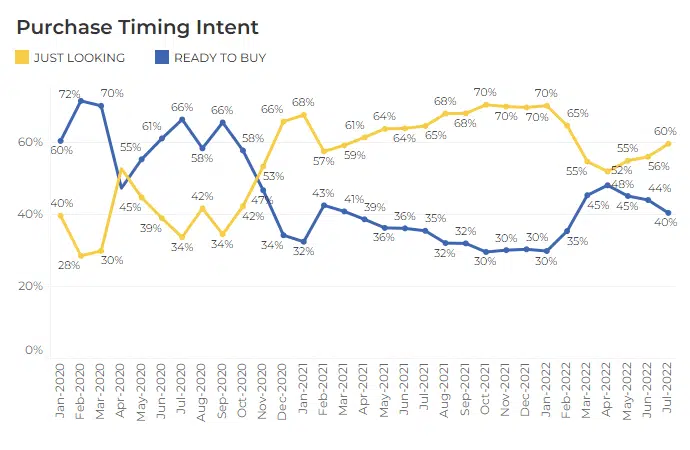

3. PURCHASE TIMING INTENT

a. Purchase vs Renewal

Fig. 5: Purchase intent: proportion of users “ready to buy” vs “just looking” in nesto’s mortgage process, showing month by month from January 2020 through July 2022.

Reported last month, there was an increase of users “just looking”, sitting at 55%, and a decrease of users “ready to buy”, sitting at 45%.

When we look at July 2022, the story around buyer caution is seemingly the same. Since home prices are still relatively high, though dropping quickly, and mortgage interest rates are at the highest point since pre-pandemic, it makes sense to see that ‘just looking’ continued to have a majority stake at 60% of nesto users, compared to 40% who were ‘ready to buy’.

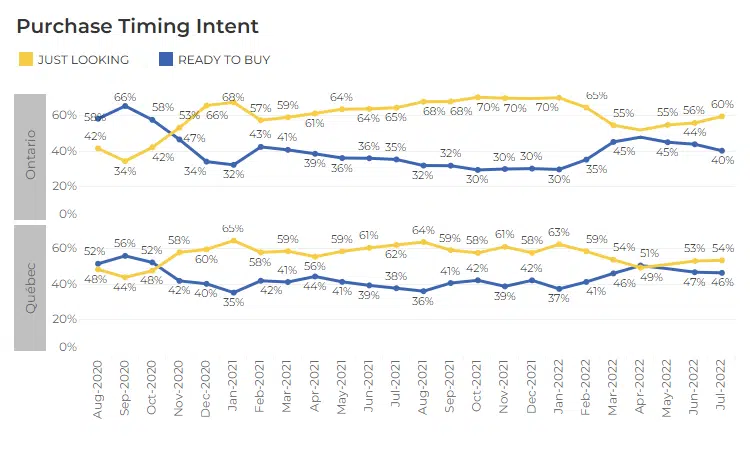

b. By province

Fig. 6: Purchase timing intent proportion of users “ready to buy” vs “just looking” in nesto’s mortgage process, from January 2020 through June 2022 in Quebec and Ontario.

As can be seen above, in Ontario, potential buyers are more hesitant than their Quebec counterparts – with 60% reportedly ‘just looking’ (ON) compared to 53% (QC). Additionally, whereas only 44% are presumably ‘ready to buy’ in ON, in QC, we see 47% are. This difference could stem from the higher median purchase prices in ON and cost of living. ON median home price clocks in at about $300,000 more than QC’s.

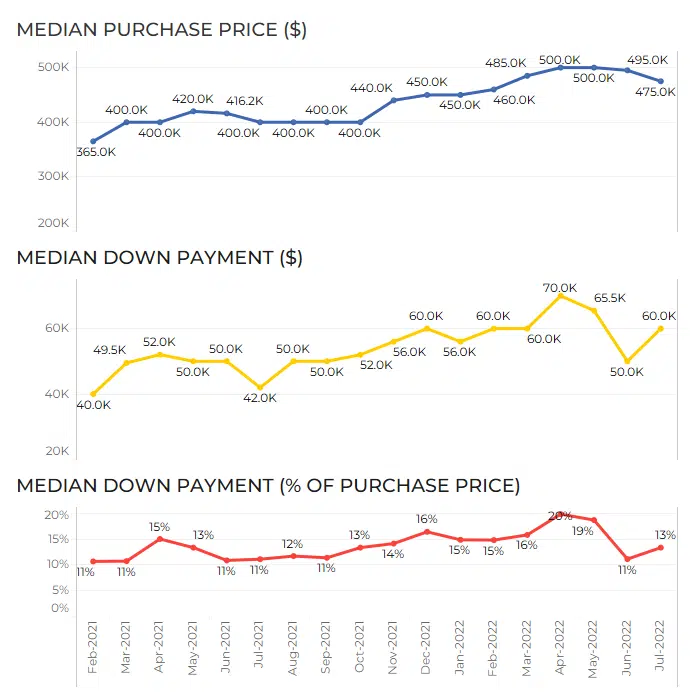

4. PROPERTY VALUE AND DOWN PAYMENT

Fig. 7: This chart shows a continuation of the cooling market, with median purchase prices dropping $20,000 over the course of one month.

As reported last month, in June, the market cooling trend continued, as predicted. We saw the median down payment total drop $15,000 in one month, and the median purchase price drop to $496,000 from $500,000.

In July 2022, while median down payments (dollars and percentages) were slightly up across the board – $60,000 from $50,000, and 13% from 11% respectively – the median purchase price continued to fall, dropping from $495,000 to $475,000.

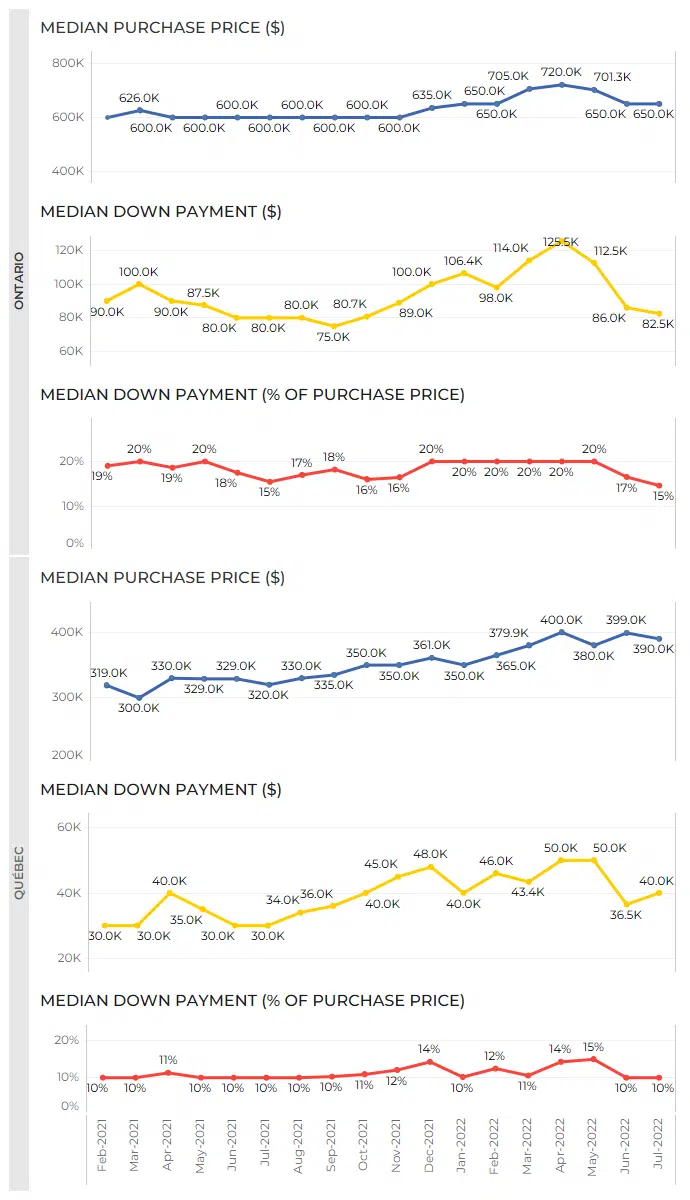

By province

Fig. 8A: Graph of intended purchase prices vs down payment (in dollars and percentage) from February 2021 through July 2022 in Ontario and Quebec.

As seen in the charts above, there is a decline happening in both Ontario and Quebec in regards to the average home down payment. In Ontario, the median down payment fell once more from the previous low of 17% to 15% in July 2022. Additionally, the median purchase price, that took a fall in Ontario last month, and entered the $600K territory for the first time in 4 months, remains the same: $650,000. In Quebec, the median purchase price decreased, coming in at $390,000. While down payments slightly increased, the percentage remained the same from June 2022 into July 2022, sitting at 10%.

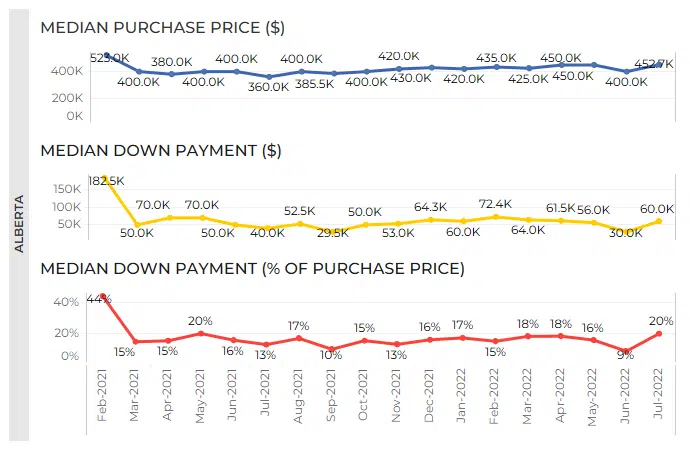

Fig. 8B: Graph of intended purchase prices vs down payment (in dollars and percentage) from February 2021 through July 2022 in Alberta.

However, when it comes to Alberta, the median purchase price increased by $52,000.

While the price remains in the $400,000 range as it has for 2022, it’s still a notable increase

after the market experienced a $50,000 fall the month prior in June.

Mortgages giving you a headache?

Take a breather and work with nesto experts to make it easy for you.

METHODOLOGY

The data used for this study comes from nesto’s online application and is solely based on the experience of nesto.ca customers/users, not the national market as a whole.

Data is collected from thousands of monthly users declaring their intent or completing online applications across Canada. The data is anonymized and aggregated for analysis.

Data presented within our Rate volatility and variances report refer to nesto’s “best rate” at any given moment. nesto’s best rate comes from any one of our many lending partners at any given moment.

Author: Chase Belair,

Co-Founder and Principal Broker at nesto

For press and research-related requests,

email us at media@nesto.ca.

Want the full report?

Download below and get it sent directly to your inbox