What Is An Amortization Period?

Table of contents

If you’re looking to secure a mortgage, understanding the ins and outs of amortization is key. Amortization is a process by which debt (such as your mortgage) is slowly paid off over an extended period of time through regular payments.

In essence, amortization allows for lower monthly payments on debt. This practice makes what previously seemed overwhelming and unmanageable much more manageable.

Have you ever wondered how this extended period might affect your finances? Read on to see what it means when someone mentions an amortization period.

Key Takeaways

- An amortization period is the entire length of time it takes to pay off your mortgage in full.

- Each dollar applied as a prepayment on your mortgage will add up and save you interest and time on your mortgage.

- Prepayments made during your first mortgage term and earlier in your mortgage will have a greater impact on reducing the interest you pay over the life of your mortgage.

Short Versus Long Amortization Periods

When it comes to amortization periods, there are two types – short and long. What does that mean for your wallet, exactly?

Some borrowers will opt for a longer amortization as it offers lower monthly payments. However, a longer amortization will carry greater interest-carrying costs.

A shorter amortization will decrease the overall interest payments during the life of your mortgage but will come with a bigger mortgage payment to start.

How To Choose A Mortgage Amortization Period

When selecting your most suitable amortization, it is best to look at affordability and your financial plans.

An amortization period greater than 25 years will come with a higher interest rate, increasing your interest-carrying costs. If you select a restrictively low amortization, it will come with very large mortgage payments.

It’s best practice to select a suitable mortgage payment that will save you interest and provide a manageable payment that aligns with your budget and other goals.

Perhaps you have goals to set aside money for your investments while you pay your mortgage. These financial goals should be completed in tandem if your budget can be set up to allow for it. See: Mortgage Prepayment

Mortgage payment plans aren’t meant to be one-size-fits-all.

Chat with a nesto mortgage expert & get a mortgage payment fit to you.

What Goes Into Preparing Amortization Schedules?

- The period is the timing of each mortgage payment. This is the frequency of payments you would have chosen, either weekly, biweekly, monthly, or accelerated weekly/biweekly. The period helps break down the mortgage payments into intervals and can be expressed as a number (1, 2, 3, etc.) or a payment date.

- The beginning loan balance is the amount owed at the beginning of each period. This can be either the starting balance (when the mortgage is new and you have yet to make a payment) or the amount carried forward from the previous period (the amount now owing after your principal portion of the monthly payment has been applied).

- The payment is the amount owing for each payment period. This is generally a set amount you must pay during each period and, in most cases, will remain consistent over the term. The payment is made up of interest and principal components.

- The interest is the portion of the payment that will be applied as interest. As the mortgage amount decreases over time, the portion of the payment toward interest will also decrease.

- The principal is the amount remaining and is the total payment amount less interest. As the mortgage amount decreases over time, the portion of the payment going to the principal will increase.

- The ending balance is the difference between the beginning loan balance minus the principal applied. This is the new amount that is owed based on the payment(s) made.

Example: How To Calculate Your Amortization

For example, you are looking to obtain a $400,000 mortgage at 4.39% and want to amortize it over 25 years. You’ll need to determine your estimated monthly payment and the principal and interest you expect to pay on your first mortgage payment.

First, you’ll need to calculate the estimated monthly mortgage payment.

You can do that using the following steps:

Step 1 –

Determine the mortgage amount and the expected interest rate. Our example is $400,000 at 4.39%.

Step 2 –

Convert the interest rate into a decimal and divide by 12 to get the monthly interest (since you’re looking to calculate the monthly payment).

4.39 /100 = 0.0439

0.0439 /12 = 0.003658

Step 3 –

Multiply the amortized period by 12. In this example, we are using 25 years amortization.

25 x 12 = 300

Step 4 –

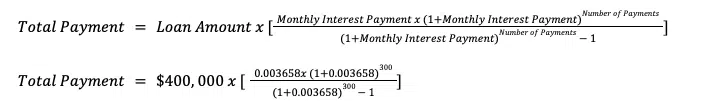

Plug these numbers into the following calculation:

Step 5 –

Calculate the top and bottom parts of the equation.

In this example, we raise 1.0036583 (1+0.0036583) to the power of 300, multiply the result by 0.00366 for the top part of the calculation, raise 1.0036583 (1+0.0036583) to the power of 300 and subtract 1 for the bottom part of the calculation.

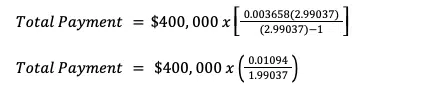

Step 6 –

Finish the calculation to reach the estimated monthly payment.

Total Payment = $400,000 x 0.00549

Total Payment = $2,196

Note: Rounding and compounding interest periods will affect the total payment amount if calculated manually. We recommend using nesto’s mortgage payment calculator to determine a more exact monthly payment amount for your situation.

In our example, we have calculated monthly compounding periods. Fixed terms will have semi-annual compounding, meaning they are compounded twice yearly, and variable terms will have monthly compounding, meaning they are compounded every month.

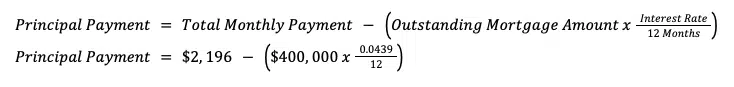

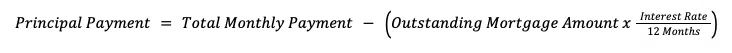

Now that we have an estimated monthly payment of $2,196, we can calculate the monthly principal and interest using the following calculation:

Principal Payment = $2,196 – $400,000 x 0.003658

Principal Payment = $2,196 – $1,463.20

Principal Payment = $732.80

For your first mortgage payment of $2,196, you should expect that $732.80 will go toward the principal and $1463.20 will go toward the interest.

How to Calculate Amortization of Loans

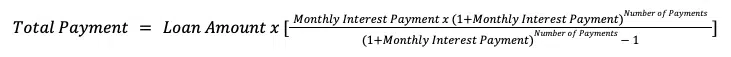

To calculate amortization on a monthly payment, you first need to know the total monthly payment. This is usually outlined in the mortgage contract. If you do not know your monthly payment or want to run scenarios, you can calculate an estimated total monthly payment as follows:

To get the monthly interest payment you will need to divide your annual interest rate by 12. You will also need to multiply the number of years in the mortgage amortization by 12 to get the number of payments.

To calculate the estimated monthly principal due on an amortized loan, you can use the following calculation:

An Amortization Loan Schedule

The chart below demonstrates the amortization schedule for the first year of mortgage payments on a $400,000 mortgage amount at 4.39% with monthly payments amortized over 25 years.

| Period | Beginning Balance | Payment | Principal | Interest | Ending Balance |

|---|---|---|---|---|---|

| 1 | $400,000.00 | $2,189.50 | $739.37 | $1,450.13 | $399,260.63 |

| 2 | $399,260.63 | $2,189.50 | $742.05 | $1447.45 | $398,518.58 |

| 3 | $398,518.58 | $2,189.50 | $744.74 | $1444.76 | $397,773.84 |

| 4 | $397,773.84 | $2,189.50 | $747.44 | $1442.06 | $397,026.40 |

| 5 | $397,026.40 | $2,189.50 | $750.15 | $1439.35 | $396,276.25 |

| 6 | $396,276.25 | $2,189.50 | $752.87 | $1436.63 | $395,523.38 |

| 7 | $395,523.38 | $2,189.50 | $755.60 | $1433.90 | $394,767.78 |

| 8 | $394,767.78 | $2,189.50 | $758.34 | $1431.16 | $394,009.44 |

| 9 | $394,009.44 | $2,189.50 | $761.09 | $1428.41 | $393,248.35 |

| 10 | $393,248.35 | $2,189.50 | $763.85 | $1425.65 | $392,484.50 |

| 11 | $392,484.50 | $2,189.50 | $766.62 | $1422.88 | $391,717.89 |

| 12 | $391,717.89 | $2,189.50 | $769.40 | $1420.10 | $390,948.49 |

| Year 1 Totals | $390,948.49 | $26,273.96 | $9,051.51 | $17,222.46 | $390,948.49 |

Amortization Versus Depreciation

Amortization and depreciation share some similarities. Both methods determine the decline in the cost of holding an asset over time.

The difference is that amortization captures the decreasing value of intangible assets – or liabilities when discussing mortgages. These depreciating liabilities can take the form of mortgage loans, student loans, auto loans, etc. A mortgage represents a liability for the mortgage holder (mortgagor) and an asset for the lender (mortgagee).

Meanwhile, depreciation captures the decreasing value of tangible assets (ex., Land, buildings, equipment, etc.) as they are used.

Ways To Shorten Your Mortgage Amortization

Want to speed things up? It’s possible!

While mortgage debt will cost you the lowest interest rate among the various forms of debt, there’s a certain sense of freedom to chip away at that principal balance and shorten the time it will take you to become mortgage-free.

As you pay down your principal balance, you also reduce the interest-carrying costs you’ll have to pay on your remaining mortgage amount.

Each dollar you put towards your mortgage will reduce your overall interest and the time it takes to pay off your mortgage.

You don’t have to make large prepayments to make a difference. That’s why it’s essential to ensure your mortgage includes pre-payment privileges if you expect some slack in your budget.

Not all mortgages are created equally, and not all include these features. While many people think of lump-sum amounts when they envision pre-payments, you can benefit even from small amounts over the course of your mortgage term.

Important: Be sure to know your pre-payment rules before making extra payments so you won’t be penalized by your lender for paying too much within a given year.

Even if you’re in your very first mortgage, there are steps you can take now to reduce the overall amount of money you’ll pay towards owning your property outright.

| 6 Ways to Shorten Your Amortization Period | |

| Increase your payment frequency. | By switching to an accelerated weekly or bi-weekly payment schedule, you’ll make an extra monthly payment each year that will go directly to paying down your principal. (See: Mortgage Payment Options) |

| Round up your mortgage payments. | If you round up your mortgage payments, say $766, to an even figure, such as $800, every extra bit goes directly toward your principal balance. |

| Keep payments the same at renewal. | This is when a lump-sum payment option can come in handy. Most lenders will allow you to make a lump-sum payment of between 10% and 25% of the value of your mortgage per year, based on the original amount you borrowed. Since mortgages decrease with each payment, it’s best to negotiate a lump-sum payment option based on the original amount you borrowed so you can pay more. |

| Take advantage of flexible payments. | Most lenders allow you to increase your regular payment to a set maximum, such as 10%, 15% or 20% (with nesto), while others (like nesto) let you double up your payments and increase your regular payment. |

| Put your bonus, inheritance, or any extra money toward your mortgage. | This is when a lump-sum payment option can come in handy. Most lenders will allow you to make a lump-sum payment of anywhere between 10% and 25% of the value of your mortgage per year. The lump-sum payment is based on either the original amount you borrowed. Since mortgages decrease with each payment, it’s best to negotiate a lump-sum payment option based on the original amount you borrowed so you can pay more. |

Frequently Asked Questions

Welcome to our Frequently-Asked Questions (FAQ) section, where we answer the most popular questions designed and crafted by our in-house mortgage experts to help you make informed mortgage financing decisions.

What is the average amortization period?

The average amortization period is 25 years, as most people qualify with less than a 20% downpayment. You’ll need a 20% downpayment or more to qualify for an amortization greater than 25 years.

What is negative amortization?

Negative amortization is when the remaining amortization increases over time instead of decreasing, as expected when payments are made on time.

Typically this can occur when you have a variable interest rate with fixed payments. If interest rates rise significantly, you may not pay enough to cover each payment’s interest and principal.

How does an amortization period affect monthly payments?

A longer amortization period will lower monthly payments, but you will pay more interest over time. A shorter amortization period will increase monthly payments but save you interest over time.

Can I change my amortization period?

Yes, you can shorten your amortization period when renewing your mortgage. However, if you need to extend it, this will be considered a refinance, which requires you to break your mortgage and re-qualify.

Final Thoughts

Understanding an amortization period is important if you plan on taking out a mortgage. Applying prepayments earlier in your mortgage will have an even greater impact on reducing your interest-carrying costs. Ultimately, by lessening the time it takes to pay down the mortgage, you have more opportunities to save on the interest-carrying costs of your payments. To ensure that you are making the most suitable decisions about your mortgage, it is recommended that you seek advice from an expert.

When time is money – every extra dollar counts when reducing your amortization. Reach out to one of nesto’s commission-free mortgage experts for advice, and let them help you find the most suitable amortization for your mortgage and financial goals.

Other articles in this guide: “Understanding Your Mortgage Rate”

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!