Renewal and Refinancing #Featured articles

Renewal and Refinancing #Featured articles

Risks of Negative Amortization On Your Variable Mortgage

Table of contents

Several Canadians are extending their mortgage repayment periods beyond 30 years in response to rising interest rates. But what does this mean? Most are aware of the two types of mortgages: fixed and variable. Fixed rates are often assumed to have a fixed payment, while variable rates have a floating payment, which is only sometimes true.

There are actually 3 types of mortgages: a fixed rate mortgage and 2 types of variable mortgages. One is called variable (VRM), and the other is called adjustable (ARM). The difference is that variable-rate mortgages have fixed payments on a floating rate discounted from the lender’s prime rate. In contrast, the adjustable-rate mortgage has a floating payment based on the discounted rate from the lender’s prime rate.

When you hear of over-amortization or negative amortization in the news, you’re hearing the impact of rising interest rates, affecting the time it takes to pay off variable mortgages with fixed payments. This post will examine negative amortization and the reality of the 90-year mortgage in Canada that you may have heard about in the news.

Key Takeaways

- Variable mortgages can increase the amortization if your payment is static.

- Many increases to the prime rate may cause you to hit your trigger rate.

- Trigger rates are hit when all your mortgage payments go toward interest, and trigger points occur when your mortgage balance exceeds your original mortgage amount.

What Does It Mean to be Negatively Amortized?

Amortization refers to the total time it takes to pay off your mortgage through regular payments. The maximum amortization period is typically 25 years for insured mortgages (more recently, 30 years for first-time buyers or anyone purchasing a newly built home) and up to 30 years for uninsured mortgages.

Negative amortization occurs when homeowners with variable-rate mortgages (VRM) have a mortgage repayment that grows beyond what they started with. This extension is usually a response to rising interest rates where the mortgage payment no longer sufficiently covers the interest and principal portions. The unpaid amount continues to increase the mortgage balance rather than decrease as it should.

When your mortgage ends up negatively amortized, the interest component of your mortgage payment exceeds the fixed payment amount, causing your interest to be deferred and added back to your principal balance. Eventually, the balance will grow, and you will owe more than the original loan amount.

This means the homeowner is in debt for a longer period, and the total interest paid over the life of the mortgage increases significantly.

How Many Canadians Go Beyond a 30-Year Payment Period?

The latest analysis from the Bank of Canada, using data from the Office of the Superintendent of Financial Institutions (OFSI), found that federally regulated lenders account for around 80% of the total dollar value in outstanding mortgages, comprising about 6 million mortgages for a total value of $1.7 trillion. Of these mortgages, approximately 7% (420,000 mortgages accounting for $119 billion) have an amortization greater than 30 years.

Additionally, as of September 2024, around 12% of variable-rate mortgages (VRM) were negatively amortized. This accounts for approximately 2% (120,000 mortgages or $34 billion) of all federally regulated mortgages. The increasing trend of negative amortization has raised concerns among financial experts and regulators regarding the potential risks associated with such extended repayment periods.

Surging Rates: Too Many in Quick Succession

Recently, we have seen news headlines about borrowers with 70, 80, or 90-year amortizations. These amortizations aren’t offered in Canada, not even on the commercial side, which typically extends up to 40 years. These numbers only exist on paper temporarily, meaning once borrowers with these amortizations come up for renewal, they must bring the amortization back in line with their original amortization schedule.

For example, if you started with a 25-year amortization and a 5-year term at renewal, you’ll have to adjust your payments to bring the mortgage back to a 20-year amortization. Although lenders may offer a reprieve by allowing time to adjust back to your original amortization schedule, it’s still in the borrower’s best interest to adjust back as soon as possible to save on interest-carrying costs.

So, how did these borrowers end up with a 90-year mortgage on paper?

Adjustable-rate mortgages (ARM) update the interest rate and payment on the mortgage each time the lender’s prime rate changes. This fluctuating payment reduces the mortgage balance over time, and your mortgage payments will adjust, going up or down accordingly. These types of mortgages will never over-amortize.

Conversely, payments on a variable-rate mortgage (VRM) stay fixed while the interest rate fluctuates with the lender’s prime rate. This increases the amortization instead of seeing monthly payments increase to account for adjustments in the interest rate. These types of mortgages are at risk of over-amortizing.

When interest rates move downward or remain static, this is a non-issue since there are timely full payments to the principal component of a variable rate mortgage payment. However, in times like today, unlike any other in recent memory, surging interest rates have played into a little-known concern called trigger rates.

Trigger rates occur when a mortgage payment no longer covers the principal repayment, allotting the full payment to the interest portion. This attribute solely applies to variable-rate mortgages (VRM) and does not impact adjustable-rate mortgages (ARM).

If you started a variable rate mortgage between April 2020 and March 2022, you may be impacted by trigger rates due to the Bank of Canada rate tightening to curb inflationary pressures. Trigger rates can leave you on the hook with a much larger balance to pay out than what you originally were loaned.

High interest rates got you stressed?

Find your low rate refinance with nesto today

VRM and ARM: Same Starting Point, Different Outcomes

Borrowers who put less than 20% down on their mortgage must purchase high-ratio default insurance from the Canada Mortgage and Housing Corporation (CMHC). This insurance protects the lender if the borrower defaults on the mortgage, known as an insured mortgage.

As this insurance reduces the risk for the lender, the lender can offer the borrower a bigger discount on the interest rate. For the two years between March 2020 and March 2022, when the prime rate had dropped to 2.45%, clients were booking insured mortgages at discounts of 1% to 1.20% from the prime rate, effectively carrying rates around 1.40% on average at nesto.

Let’s look at how a $100K balance is impacted by variable-rate (VRM) and adjustable-rate (ARM) mortgages since interest rates began rising in 2022.

| Date Rate Changed | Bank Rate – Lender’s Discount = Client Rate | Monthly Payment VRM | Monthly Payment ARM | Interest Differential (Added to VRM outstanding balance) |

|---|---|---|---|---|

| Apr 1, 2020 | 2.45% – 1.05% = 1.40% | $395.25 | $395.25 | $0 |

| Mar 2, 2022 | 2.70% – 1.05% = 1.65% | $395.25 | $407.92 | $12.67 |

| April 13, 2022 | 3.20%- 1.05% = 2.15% | $395.25 | $431.12 | $35.87 |

| June 1, 2022 | 3.70% – 1.05% = 2.65% | $395.25 | $455.98 | $60.73 |

| July 13, 2022 | 4.70% – 1.05% = 3.65% | $395.25 | $507.97 | $112.72 |

| Sep 7, 2022 | 5.45% – 1.05% = 4.40% | $395.25 | $548.92 | $153.67 |

| Oct 26, 2022 | 5.95% – 1.05% = 4.90% | $395.25 | $577.08 | $181.83 |

| Dec 7, 2022 | 6.45% – 1.05% = 5.40% | $395.25 | $605.89 | $210.64 |

| Jan 25, 2023 | 6.70% – 1.05% = 5.65% | $395.25 | $620.53 | $225.28 |

| June 7, 2023 | 6.95% – 1.05% = 5.90% | $395.25 | $635.30 | $240.05 |

| July 12, 2023 | 7.20% – 1.05% = 6.15% | $395.25 | $650.20 | $254.95 |

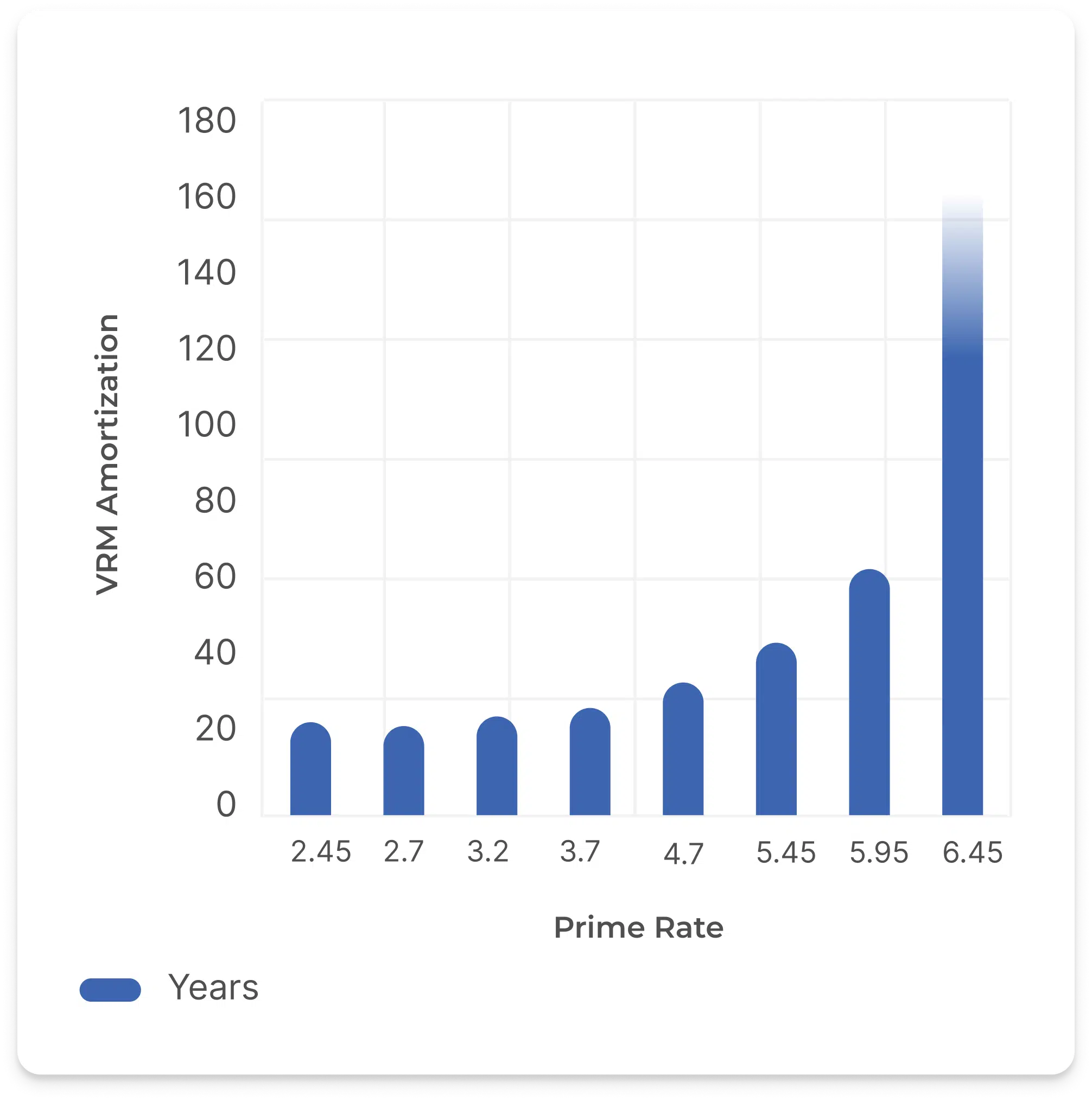

The chart above shows that increasing interest rates did not impact the ARM amortization as the adjusted payments compensated for any changes. Meanwhile, the VRM amortization began to reverse course and climb as soon as interest rates changed. The difference required to cover the change in interest rates will be added to the remaining mortgage balance each month, causing the amortization to increase instead of decrease.

How Bank of Canada Rate Hikes Affect Your Variable-Rate Mortgage (VRM)

The scenario below examines how Bank of Canada (BoC) increases affect the amortization, total interest paid, and balance remaining on a $500,000 mortgage over a 5-year term. Changes occur in the first year only. More importantly, it examines the expected change to monthly mortgage payments at renewal.

With the scenario below, the trigger rate is reached in September when the policy rate increases. By the end of the mortgage term, your amortization will have ballooned to over 160 years. At renewal, you must return your amortization to the contract (20 years) through a principal prepayment or increased mortgage payments.

It’s important to note that the Office of the Superintendent for Financial Services (OFSI), which regulates all mortgage lenders in Canada, re-iterated that default insurers who insure prime mortgages must maintain capital to allow a maximum amortization of 40 years on these insured mortgages.

This change will limit capitalization in the form of amortization to 40 years when principal payments are not being made on insured mortgages. Currently, Canada has three default insurers: Canada Mortgage and Housing Corporation (CMHC), Sagen (GE, also known as Genworth), and Canada Guaranty (CG). These insurers insure all default-insured mortgages in Canada.

| Month | BoC Policy Rate | Prime Rate (Policy Rate +2.2%) | Monthly Mortgage Payment ARM | Monthly Mortgage Payment VRM |

|---|---|---|---|---|

| January | 0.25% | 2.45% | $2,230.51 | $2,230.51 |

| February | 0.25% | 2.45% | $2,230.51 | $2,230.51 |

| March | 0.50% | 2.70% | $2,293.40 | $2,230.51 |

| April | 1.00% | 3.20% | $2,421.85 | $2,230.51 |

| May | 1.00% | 3.20% | $2,421.85 | $2,230.51 |

| June | 1.50% | 3.70% | $2,553.52 | $2,230.51 |

| July | 2.50% | 4.70% | $2,827.60 | $2,230.51 |

| August | 2.50% | 4.70% | $2,827.60 | $2,230.51 |

| September | 3.25% | 5.45% | $3,041.65 | $2,230.51 |

| October | 3.75% | 5.95% | $3,188.34 | $2,230.51 |

| November | 3.75% | 5.95% | $3,188.34 | $2,230.51 |

| December | 4.25% | 6.45% | $3,337.63 | $2,230.51 |

| Interest Paid | $142,201 | $151,303 | ||

| Remaining Mortgage Balance | $449,432 | $517,472 | ||

| Remaining Amortization | 20 yrs, 0 m | 160 yrs + | ||

| Mortgage Payment at Renewal | $3,337.63 | $3,842.92 |

How Bank of Canada Rate Decreases Affect Your Variable-Rate Mortgage (VRM)

The scenario below examines how decreases in the Bank of Canada (BoC) policy rate impact the amortization, total interest paid, and balance remaining on a $500,000 mortgage over a 5-year term. Changes occur in the first year only. More importantly, it examines the expected change to monthly mortgage payments at renewal.

With the scenario below, having a VRM when rates decrease helps you pay the mortgage principal faster, reducing the amortization. At renewal, your payments will decrease, and since you have less time remaining to pay off the mortgage, you will save on interest-carrying costs.

| Month | BoC Policy Rate | Prime Rate (Policy Rate +2.2%) | Monthly Mortgage Payment ARM | Monthly Mortgage Payment VRM |

|---|---|---|---|---|

| January | 5.00% | 7.20% | $3,597.94 | $3,597.94 |

| February | 5.00% | 7.20% | $3,597.94 | $3,597.94 |

| March | 5.00% | 7.20% | $3,597.94 | $3,597.94 |

| April | 5.00% | 7.20% | $3,597.94 | $3,597.94 |

| May | 5.00% | 7.20% | $3,597.94 | $3,597.94 |

| June | 4.75% | 6.95% | $3,518.82 | $3,597.94 |

| July | 4.50% | 6.70% | $3,440.67 | $3,597.94 |

| August | 4.50% | 6.70% | $3,440.67 | $3,597.94 |

| September | 4.25% | 6.45% | $3,287.49 | $3,597.94 |

| October | 3.75% | 5.95% | $3,138.00 | $3,597.94 |

| November | 3.75% | 5.95% | $3,138.00 | $3,597.94 |

| December | 3.25% | 5.45% | $3,064.90 | $3,597.94 |

| Interest Paid | $135,521 | $132,041 | ||

| Remaining Mortgage Balance | $447,387 | $416,164 | ||

| Remaining Amortization | 20 yrs, 0 m | 13 yrs, 9 m | ||

| Mortgage Payment at Renewal | $3,064.90 | $2,851.00 |

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

What Can You Do If You Find Your Mortgage Negatively Amortized?

Interest rate increases typically don’t surge as quickly as they have over the last few years. Any over-amortization of a mortgage will generally even out over the term as rates come down.

At renewal, your mortgage will be re-adjusted for any discrepancies, and you may have payment shock. How does that happen? The remaining amortization and larger balance from carrying a static payment will have to be paid down. Your new payment will be based on the remaining mortgage balance on an amortization reduced by your term (ex. 5 years).

If rates are rising, expect to make a prepayment at renewal or higher payments once you renew. Ideally, you may have made prepayments on your mortgage or had an accelerated payment frequency, which will help ease the overall shock upon renewal.

If you are in the middle of your term, you could early renew your mortgage to a fixed rate with your current lender. You would be locked into a higher rate with a much higher payment, but this could help prevent payment shock down the road. Or you could shop around to see if a lender might offer a lower interest rate to renew with them, considering that you’ll have costs to switch or transfer the mortgage and your 3-month interest penalty.

Once you hit your trigger rate before renewal, your lender will re-adjust your mortgage payment, similar to renewal, to balance your mortgage back to where it should be. The trigger rate occurs when no principal is paid down on your mortgage. To get to that point, only the interest was paid down for a while as rates increased.

If you reach a point where your balance owing on your mortgage is more than the original mortgage amount, then you’ve reached your trigger point. Your options are limited once you’ve reached this point. The trigger point occurs when no principal is paid down on your mortgage. To get to that point, you’d have hit your trigger rate, and only the interest was paid down for a while as rates increased.

You do not need to take any action when you reach your trigger rate. However, if you want to avoid hitting your trigger point, you can either increase your payment to compensate or prepay your mortgage balance to bring the amortization back to manageable levels based on your cash flow (usually less than 40 years).

Your options to put your mortgage back on track can be in various ways, such as:

- Making a principal prepayment to cover the ballooned principal balance. This is only a feasible option for some borrowers if they have significant savings set aside.

- Increasing your payment to compensate for the additional payment to the principal (we’re likely talking about only a few hundred dollars a month at this point).

- Refinance your mortgage to increase your amortization.

Frequently Asked Questions (FAQs)

Are there 60, 80 or 90-year mortgage amortization periods in Canada?

Conventional mortgages in Canada typically have a maximum amortization period of up to 30 years. However, some homeowners have extended their repayment periods even further due to rising interest rates. While such extended amortization periods may offer temporary relief in terms of lower monthly payments, they also entail higher overall interest-carrying costs.

What is the maximum amortization period in Canada?

The maximum amortization period for insured mortgages is 25 years (more recently, 30 years for first-time buyers and those purchasing a new build). For mortgages where the borrower has a downpayment of at least 20%, the amortization period may extend up to 30 years. Subprime mortgages may allow up to 35 to 40-year amortizations with increased closing costs and mortgage rates. Private mortgages may not consider amortization as a component of their overall lending as they are meant to provide short-term (3 to 6 months) relief to stressed borrowers.

When is a VRM most suitable?

Why is a VRM more suitable for investment properties?

If the subject property is a rental, the client would benefit from keeping the total interest charged as high as possible and writing it off against rental income, leaving a reduced rental income to be taxed. At the same time, this would allow them the flexibility to sell their investment property if their goals or financial situation change while only incurring a 3-month interest penalty.

Final Thoughts

Like many other Canadians, you may be impacted by inflation and the inability to manage finances easily, much less make a large and unplanned prepayment on your mortgage. That’s when the third option, a refinance, is the most viable option for your situation.

Since 2016, refinances have usually been financed at a higher rate as they cannot be default-insured. The risk of default is on the lender, and to compensate for this risk, mortgage refinances typically come with higher rates.

How can nesto help? We have some of the lowest mortgage rates available, so we can help you save more of your money from interest-carrying costs. And our adjustable-rate mortgage (ARM) won’t leave you at risk of negative amortization at nesto.

Reach out and speak to one of our commission-free mortgage experts to see if refinancing is the best option for you.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!