Income Needed To Buy A Home In Toronto

Table of contents

Notice: Effective December 15th, 2024, new mortgage reforms increase the default insured price cap from $1 million to $1.5 million. Additionally, eligibility criteria for 30-year insured amortizations have been expanded to include all first-time homebuyers and all buyers purchasing a new build.

Have you landed here because you’re wondering, “How much house can I afford in Toronto?” You’re not alone. The average household income in Toronto isn’t enough to qualify for an average-priced home in the city. It’s little wonder why the affordability question keeps popping up. In recent years, it’s become increasingly difficult for many first-time buyers to enter the real estate market as home prices and interest rates continue to climb.

For the second year in a row, Toronto has ranked as the most expensive city in Canada according to Mercer’s 2023 cost of living survey. The survey measures the comparative costs of items like housing, transportation, food, clothing, household goods, and entertainment. Mercer’s survey places Toronto ahead of Vancouver if we look at the complete picture of affordability in the city. If we look at just home prices alone, Toronto becomes Canada’s 2nd most expensive city, switching places with Vancouver, which takes the top spot.

Key Takeaways

- Toronto was ranked the most expensive city in Canada, beating out Vancouver when looking at the total cost of living.

- Most homes in Toronto remain above $1 million, requiring a 20% downpayment.

- A gross household income between $253,000 and $263,000 is needed to qualify for the average-priced home in Toronto.

Why Is Toronto Real Estate So Expensive For Homebuyers?

Like many other major cities, Toronto has a much higher cost of living.

According to Numbeo, the average monthly estimated cost for a single person living in the city, excluding housing, is $1,513.90. This means less disposable income for prospective homeowners to save up for a down payment.

Coupled with the high cost of rent (the average rental is currently $2,849) and the high cost of purchasing a home (the average purchase price is currently $1,161,200), this only further extends the savings period required for homeownership.

If we look at Mercer’s latest survey, out of 227 global cities, 5 Canadian cities made the list.

- Toronto (90th globally) was ranked the most expensive city in Canada

- Vancouver (116th globally),

- Montreal (135th globally),

- Ottawa (137th globally),

- and Calgary (145th globally)

Below are the comparisons between each Canadian city from the survey and their respective affordability when looking at the average household income in that city.

We used the average home prices from the latest CREA data, calculated the income required using nesto’s best rate +2% to get the qualifying income, and compared that to the average household income from StatsCan census data.

The numbers above mean you need to make more than 3x of the average household income to become a homeowner in Toronto.

So, what is fuelling the affordability crisis? Well, it’s a cumulation of a few things.

Supply and demand are significant contributors to affordability; with rental vacancies in the city under 1%, there is an apparent housing shortage. There’s also the ever-increasing cost to build homes, with the average cost of building supplies doubling in recent years.

This has caused many builders to pause or delay building plans, intensifying the housing shortage.

The second part of having a lack of supply and an increased demand is population growth. Toronto is one of the largest cities in the country and is a significant economic hub that contributes 20% of the country’s GDP. The city is the centre for many major industries like finance, manufacturing and technology.

Being an economic hub, this naturally attracts a larger population of people who need to call the city home, especially if you need to be a commutable distance from work. This means a growing population with increased immigration and competition for the already limited housing supply in the city.

How Much Income Do You Need to Afford a Home In Toronto?

In Toronto, you would need approximately $263,300 in gross income to be approved for the average home price of $1,103,600.

The table below shows how much total income you would need to afford a home based on the average home cost, mortgage rate, and property tax rate in 2023.

Learn more about this calculation and how gross debt service and debt-to-income ratios affect your mortgage qualifying amount. Use our affordability calculator to see what you qualify for and determine the maximum property price you can afford in Toronto.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

Income Needed To Qualify For A Toronto Mortgage

Let’s review the income you would need to live in Toronto.

To simplify the qualifying criteria, we have used a 30-year amortization with a 20% down payment, giving us the carrying costs of the mortgage without any added mortgage default insurance premiums.

For Toronto, we’ve used the annual property tax amount of 0.632% and an estimated $150 for monthly heating costs.

It is important to highlight that lenders will use lower debt service ratios when mortgages are not default-insured, typically using 35% of a borrower’s gross income to qualify them. The lower your debt-to-income ratio, the more attractive you are to lenders.

Debt service ratios are an indication of how much debt you carry in relation to your gross income. Having a lower ratio will help you qualify for a mortgage and leave room in your budget for other financial goals, such as saving for retirement or covering any unexpected expenses that might arise.

It is also important to mention that if your FICO credit score is below 680, lenders may qualify you on only 32% of your household’s gross income to reduce risk further.

How Much To Make To Buy A House In Toronto

How Much To Make To Buy A Condo In Toronto

In addition to the qualifying amounts from the above chart, if you want to purchase a condo in Toronto, you must add 50% of the estimated condo fees to your monthly carrying costs to determine the required income.

Below, we used 50% of a $500 condo fee to determine the income required to purchase a condo.

How To Calculate What You Can Afford In Toronto

To begin your search for a home, you must first assess how much you can spend on housing. This will be important as affordability is based on your current income, expenses, debts, and savings.

The general rule is that housing costs should not exceed a third of your gross monthly income. You can determine your housing budget by starting with your monthly income (salary, bonuses and other resources that produce income) and subtracting monthly expenses.

These expenses should include car payments, credit card payments, student loans and any other debts you may have, as well as expenses such as property tax, utilities and home maintenance.

Once you’ve calculated your monthly budget, you can estimate how much house you can afford by considering your downpayment, mortgage rate and amortization period.

Use nesto’s mortgage affordability calculator to see what you can afford.

What Is The Average Mortgage Rate In Toronto?

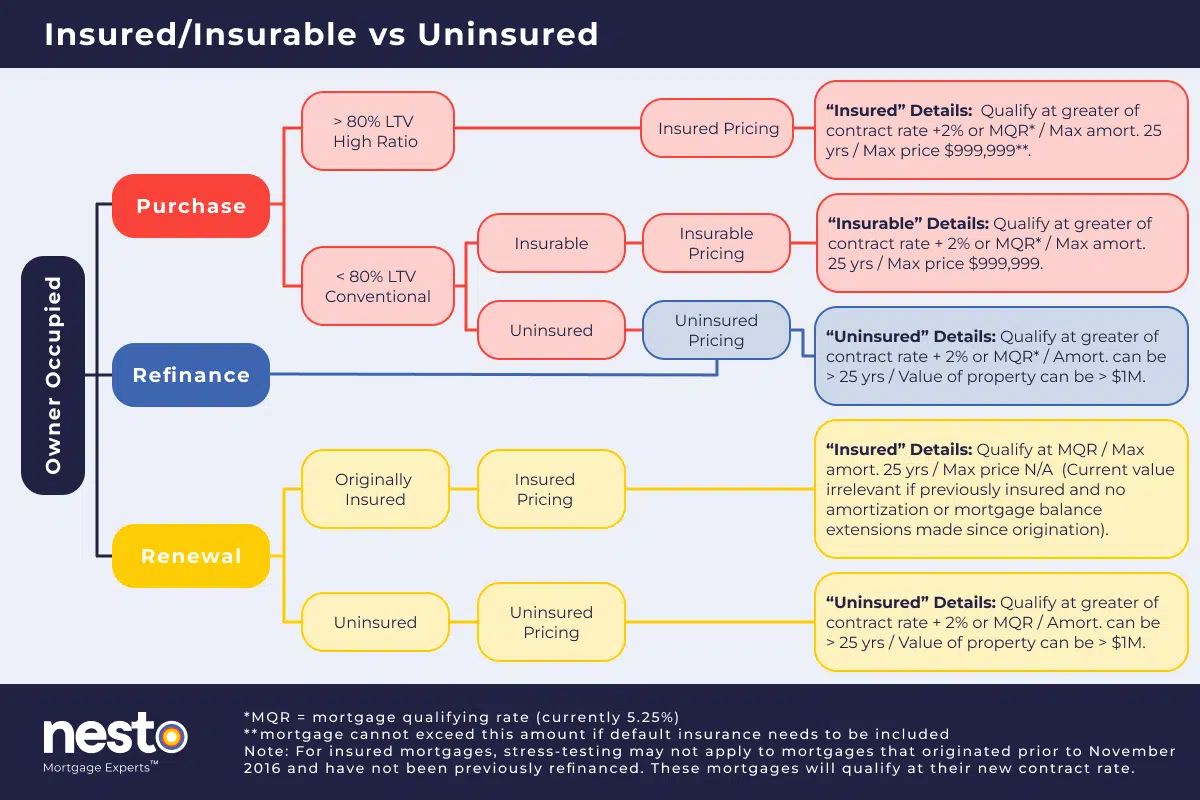

When mortgages are default insured, you’ll get the best rates the lender offers. However, as mentioned earlier, houses in Toronto are typically above the $1 million mark, meaning you’ll have access to only uninsured rates.

This is not always bad, as uninsured mortgage rates come with uninsured lending guidelines, meaning you can amortize your mortgage over 30 years versus being limited to 25 years.

Default-insurance on mortgages is required when you have put down less than 20% as a down payment. You will pay mortgage default insurance, which reduces some of the risks to the lender should you default on your mortgage payments. Uninsured mortgages require 20% or more as the down payment or when the property is priced at $1 million or above.

The chart below shows how default insurance affects the total mortgage required. If we look at a home with an asking price of $500,000 and a 25-year amortization, the 5%, 10%, and 15% down payment options will all require a default-insured mortgage with mortgage default insurance added to the total cost of the mortgage.

| Down Payment (%) | Down Payment ($) | Mortgage Needed (After Downpayment) | Mortgage Default Insurance (CMHC) | Total Mortgage Needed (With Default Insurance) |

|---|---|---|---|---|

| 5% | $25,000 | $475,000 | $19,000 | $494,000 |

| 10% | $50,000 | $450,000 | $13,950 | $464,000 |

| 15% | $75,000 | $425,000 | $11,900 | $437,000 |

| 20% | $100,000 | $400,000 | $0 | $400,000 |

A 20% down payment will require an uninsured mortgage, and no default insurance will need to be added to the mortgage. Depending on the province, you may also need to pay sales taxes on the amount you pay for mortgage default insurance.

The good news about buying in more populated areas, specifically Toronto, is that almost all lenders that work nationally are willing to lend to you on a property for the following reasons:

- A greater proportion of potential buyers exist in Toronto, making it less risky to sell your property in a market downturn.

- Properties are more desirable due to their location with more potential buyers.

- More opportunities for business and work.

- Physical office locations for employees.

- More than 70% of the value is in the land when it comes to houses in the city.

- Close proximity for car-free conveniences.

Passing The Mortgage Stress Test To Get A Mortgage In Toronto

The mortgage stress test requires federally regulated lenders to use the stress test criteria of 5.25% or your interest rate +2%, whichever is higher.

OFSI sets this requirement to test borrowers and protect lenders from taking on excess risk. The stress test confirms that you can still afford mortgage payments should interest rates increase, or your income is reduced.

When qualifying for a mortgage, you must qualify based on the qualifying payment, which is your stress-tested amount. This ensures you can still comfortably manage mortgage payments if your financial situation changes.

If we look at a $500,000 mortgage with a 25-year amortization, if the current interest rate offered to you is

You’ll notice that needing to qualify on the stress-tested amount reduces your buying power by a significant amount.

If we look at a $500,000 mortgage with a 30-year amortization, if the current interest rate offered to you is

You’ll notice that needing to qualify on the stress-tested amount reduces your buying power by a higher amount on a 30-year amortization.

First-Time Homebuyer Tips For Buying A House In Toronto

You may ask yourself, how can I afford a house in Toronto? Although knowing how much salary you’ll need and how much to save for a down payment is important, so is finding the right home.

Here are some tips to help you prepare for house hunting in Canada.

- Browse MLS listings of your preferred neighbourhoods and attend open houses while paying attention to comparable home prices and their duration on the market. Our Toronto Housing Market Outlook offers a simple way of tracking home prices in the region.

- Our Mortgage Payment Calculator can help you budget by estimating closing costs and monthly mortgage payments.

- Mortgage pre-approval is crucial to avoid any financial surprises. The lender will need access to your income, credit score, and debts. Once approved, you will receive a letter with an interest rate guarantee valid for 90 or 120 days.

- If rates are expected to decrease, get your pre-qualification in place. A pre-qualification won’t lock you into a rate but will also not require as much documentation to understand your financial situation so you can shop confidently. Speak to one of nesto’s commission-free mortgage experts and have them guide you through this tedious but important process.

- Before starting your search, consider hiring a real estate lawyer. You can find the most suitable lawyer and realtor by asking friends and family for referrals. Once you think you’ve found one, ask them all the questions you have to see how helpful they are and if they are the right choice.

- Once you’ve found a property, a home inspection is always recommended.

Property Types Available In Toronto

Toronto has a diverse range of homes suitable for every lifestyle.

- There are condos perfect for first-time buyers or downsizers that generally offer great amenities and proximity to groceries, dining, and public transit.

- Detached and semi-detached homes typically provide a larger footprint, perfect for growing families or multi-generation households, outdoor space, and more privacy.

- Then there are townhouses that offer the combined benefits of condo and semi-detached living.

- Another emerging trend in Toronto is laneway suites, which are self-contained homes located on the same property as a detached or semi-detached house. These properties are typically smaller in size and are located in the backyard or next to a public laneway.

Land Transfer Taxes in Toronto

Land transfer taxes (LTT) were first introduced in the 70s and 80s as a tax that must be paid to the provincial government when the property title (including the land it sits on) is transferred into your name. The amount owed will depend on the value of the property.

Toronto has an additional municipal land transfer tax (MLTT), meaning that when you purchase a home in the city, you are faced with a double land transfer tax fee. One fee goes to the city, and the other to the province. Toronto has the highest land transfer tax rates in Canada.

Land transfer taxes are paid as part of your closing costs, which will be handled by your real estate lawyer. This tax is added to the total closing costs due when your property’s title is registered.

Provincial Land Transfer Taxes

| Purchase Amount | LTT Rate |

|---|---|

| Amounts up to and including $55,000 | 0.5% |

| Amounts exceeding $55,000, up to and including $250,000 | 1.0% |

| Amounts exceeding $250,000, up to and including $400,000 | 1.5% |

| Amounts exceeding $400,000 | 2.0% |

| Amounts exceeding $2,000,000, where the land contains one or two single-family residences | 2.5% |

Municipal Land Transfer Taxes

| Purchase Amount | MLTT Rate |

|---|---|

| Amounts up to and including $55,000 | 0.5% |

| $55,000.01 to $250,000 | 1.0% |

| $250,000.01 to $400,000 | 1.5% |

| $400,000.01 to $2,000,000 | 2.0% |

| Over $2,000,000 | 2.5% |

If you’re purchasing a $500,000 home, you’d owe $12,950 in property taxes broken down as follows.

Provincial LTT portion

$55,000 x 0.5% = $275

$195,000 x 1.0% = $1,950

$150,000 x 1.5% = $2,250

$100,000 x 2.0% = $2,000

$275 + $1,950 + $2,250 + $2,000 = $6,475

Municipal LTT portion

$55,000 x 0.5% = $275

$195,000 x 1.0% = $1,950

$150,000 x 1.5% = $2,250

$100,000 x 2.0% = $2,000

$275 + $1,950 + $2,250 + $2,000 = $6,475

Total amount owed

$6,475 + $6,475 = $12,950

If you’re a first-time homebuyer, you are eligible to receive a rebate of up to $4,475 toward the municipal land transfer tax and $4,000 toward the provincial land transfer tax. This would reduce the amount you owe from $12,950 to $4,475 as a first-time buyer.

First-Time Home Buyer (FTHB) Incentives In Toronto

Canada Home Buyers’ Plan (HBP)

First-time homebuyers can borrow up to $60,000 from their RRSP on a tax-free basis, provided they are buying the property to live in no later than a year after purchase. The funds must be paid back to their RRSP in installments each tax year within a 15-year time frame. Learn more

Toronto & Ontario Land Transfer Tax Rebates (LTTR)

As a first-time homeowner, you may qualify for a City of Toronto land transfer tax rebate of up to $4,475 if you occupy your new residence within nine months of purchase. Learn more

As long as you live in your new home within nine months of purchasing it, first-time home buyers in Ontario can receive up to $4,000 in land transfer tax rebate from the province. Learn more.

Home Buyers Tax Credit (HBTC)

When eligible, homebuyers can receive a maximum of $1,500 in tax credits by claiming 15% of expenses up to $10,000 for home purchases. The condition is that the homebuyer has owned no residence in the last 4 years. Learn more

First Home Savings Account (FHSA)

Individuals purchasing a home for the first time may generate tax-deductible contributions of up to $8,000 yearly into a new savings account to a maximum of $40,000. Withdrawals from this account made to purchase a home will also be exempt from tax, similar to the TFSA account.

Contributions are tax-deductible. Funds not utilized after 15 years can be transferred tax-free to an RRSP or RRIF account. Learn more.

Multi-Generational Home Renovation Tax Credit (MGHRTC)

Anyone who spent up to $50,000 constructing a secondary suite for multi-generational living can claim 15% of your eligible renovation and construction expenses as tax credits. This can go up to a maximum of $7,500. Learn more.

Future Housing Outlook For First-Time Buyers in Ontario

With the recent interest rate hikes, home prices have remained relatively stable, with only some slight dips in the province. With inflation predicted to remain above its 2% target for much longer than expected, more interest rate increases may be necessary to achieve the target inflation rate.

As affordability remains the most significant barrier to homeownership for first-time homebuyers in Toronto, supply constraints, population growth, and a tight rental market all add to the unaffordable nature of housing.

With inventory in short supply due to the low level of new listings coming to the market, slowing construction, and robust population growth, there are concerns about a housing crisis in Ontario that could unfold in the coming years.

Frequently Asked Questions

How much do you need to buy a home in Toronto?

Toronto house prices range by neighbourhood but generally average above $1 million. You’ll need to save 20% of the purchase price for your downpayment and budget another 5% for your closing costs. Based on today’s interest rates, most applicants will qualify for a mortgage about 4 times their income.

Conversely, you could qualify for a condo with a downpayment below 20% as the prices range below $1 million. The minimum income or minimum salary needed to qualify in Toronto will be a quarter of the mortgage amount.

How much would a typical home cost?

Typical home costs vary by region and city. Today the average home costs around $680,000 across Canada, but that number can fall below $200,000 in parts of Quebec or be well above $800,000 in parts of Ontario and BC.

What’s next for the average Canadian mortgage?

Rates should likely reduce over the next few years, making it easier for Canadians to qualify for their mortgages. As the supply is not being increased, qualifying will likely get more difficult for the average person – especially if the federal mortgage regulator decides to increase mortgage qualifying restrictions further.

Around 30% of mortgage holders currently hitting their trigger rates in their fixed payment variable mortgage are likely to experience payment shock as their mortgages come up for renewal.

Final Thoughts

Qualifying to purchase a home in Toronto can be challenging, particularly for first-time homebuyers. The city’s average home prices are far beyond what the average household income can afford, so it requires careful planning and budgeting to make it work. If inflation can be brought back under control in the next couple of years, a reduction in mortgage rates should provide some relief for homebuyers looking to purchase. If you are ready for homeownership, seek advice from nesto’s commission-free mortgage experts, who will help guide you through the process of qualifying to become a homeowner in Toronto.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

EXPLANATIONS

Interest Rates

Property Values

Home Price Index

Property Types

Property Ownership Classes

Strata Insurance

Rental Values

Qualifying Criteria

Professional Titles

Mortgage Experts

Interest Rates

Qualified using nesto’s fixed 5-year insured and uninsured rates as advertised on our website. For today, Thursday, July 3, 2025, our example calculations are qualified on our lowest rates, which may or may not apply to your unique financing situation or long-term goals. Insured fixed-rate mortgages will be qualified at

The average rates are calculated based on the advertised rates of the six biggest lenders in Canada. The six biggest lenders are the chartered banks Toronto-Dominion Bank (TD), Royal Bank of Canada (RBC), Bank of Montréal (BMO), Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CIBC), and National Bank of Canada (NBC). We may also display a similar average with the inclusion of Desjardins, Tangerine, First National Financial (FN) and nesto to round out Canada’s 10 biggest mortgage lenders. The averages shown may be further broken down between insured and conventional rates.

We appreciate your patience and understanding and encourage you to email us at website@nesto.ca with information that needs correction, along with your sources.

Property Values

Home values collected from CREA or QPAREB are those presented as the composite benchmark or average prices for each city/province/region unless specified. They may be interchangeably called average home prices, though an average price may not be available for many regions outside Quebec.

MLS® Home Price Index (HPI)

The MLS® Home Price Index (HPI) is a real estate price index compiled by the Canadian Real Estate Association (CREA) that tracks the price of homes in your neighbourhood. It’s a quick way for Canadians to compare home prices in different parts of Canada and between different periods without having to factor in the unique characteristics of a particular property.

While market prices can vary from one month to the next based on seasonal factors, the Home Price Index (HPI) provides a more consistent view and tracks price trends over an extended period. The Home Price Index (HPI) is updated annually in May to reflect changes in real estate markets.

MLS® HPI is the most comprehensive and precise way to track a neighbourhood’s home price level and trends. MLS HPI uses over 15 years of data from the MLS® System and advanced statistical models to create a “typical” home based on the characteristics of homes purchased and sold. This benchmark home is tracked across all Canadian neighbourhoods and various types of homes.

Property Types

Detached homes, also known as single-family homes, are residential properties that stand alone and are not connected to other buildings. They are legal single residential units on their own parcel of land and have a separate title.

Semi-detached homes are characterized by their unique architectural design. Two houses are built side by side and share a common wall. Although sharing a building, semi-detached homes have their own parcel of land and separate legal titles.

Townhouses are residential dwellings typically characterized by narrow, tall structures, often sharing walls with neighbouring units. Although they may share yards or common elements with their neighbours, townhouses will have separate legal titles from any adjoining building. Townhouses can be purchased as freehold or leasehold within a condo or strata and may come with their own land parcel. Townhouses can be part of a low-rise or high-rise building.

Condo apartments, also known as condominiums, are residential properties that combine elements of apartments and individual homes. It is a unit within a larger building or complex owned by an individual who also shares ownership of common areas and amenities with other residents. Condo apartment owners have legal ownership of their units and can modify them within the guidelines set by the condominium association. Unlike a townhouse, condos do not offer exclusive use of outdoor space unless they come with a balcony or terrace. Condos can be part of a low-rise or high-rise building.

Plexes or multiplexes are unique residential buildings constructed into 2 to 6 units within a single structure. Traditionally, they have been designed as low-rise residential buildings where any unit is accessible via an external entrance with higher floors connected by staircases. Each unit will have a separate registration and title but may share common elements and co-ownership fees with the other multiplex owners. Plexes are common in Québec and older parts of Toronto.

Property Ownership Classes

A freehold is a type of property ownership where an individual or entity has complete and indefinite ownership rights over a property and its parcel of land. Common freehold property types include detached houses, semi-detached houses, farms, and townhouses, which are not part of condominium corporations.

A condominium or condo is a distinct type of property class that combines apartment living and individual homeownership elements. In a condominium, individual units are owned by the residents, while the common areas and amenities are shared among all the unit owners. This type of ownership gives you rights to your specific unit and some rights and responsibilities to the common areas, such as the hallways, elevators, garage, pool and rooftop patios.

A leasehold is a legal arrangement where a person or entity holds the right to use and occupy a property for a specific period, typically through a lease agreement. In some cases, the leaseholder may own the building or unit and rent the land from the landowner (landlord).

Strata insurance

Strata insurance is insurance that a strata or condominium uses to cover damages to common areas, assets and liabilities to the strata. It can also include fixtures built or installed as part of the original construction of each unit, even though these may not be common structures. Strata insurance can cover the following:

- Buildings and structures on the strata’s property, including common areas such as the garage, roof, lobby, pool, etc.,

- Liabilities for any property damage or bodily harm due to an injury suffered on a strata property,

- Which also includes fixtures in the standard unit or part of the original make of each unit.

Strata insurance generally does not cover personal belongings and appliances in a condo unit. Damage caused by individual unit owners (e.g., water damage due to a unit owner’s negligence) is typically covered under personal condo insurance.

Rental Values

Our monthly or year-over-year rental averages are sourced from Urbanation’s monthly Rentals.ca National Rental Report.

Mortgage Qualifying Criteria

Insured qualifying criteria are limited to a 39% gross debt service (GDS) ratio and up to 25 years of amortization. For insured mortgage transaction calculations, we have used a 20% downpayment, unless otherwise indicated, in our examples and excluded any mortgage default insurance (CMHC) premium. Uninsured qualifying criteria are limited to a 35% gross debt service (GDS) ratio and up to 30 years of amortization. Our examples use a 20% downpayment for uninsured mortgage transaction calculations. Unless otherwise indicated, a $100 monthly heating cost is attributed to the total monthly stress-tested payment. Municipal tax rates are the most recently shown on the applicable municipality’s website (1% used as default when unavailable or for a region with an unspecified mill rate). Mortgage default insurance is not permitted on purchases that have valuations of $1 million or more, amortizations exceeding 25 years, or on refinance transactions.

Regulatory Titles

In Ontario (FSRA), mortgage brokers and agents serve as the middle person between borrowers and lenders, helping clients find the most suitable mortgage options for their financing situation. A Mortgage Agent works under the supervision of a Mortgage Broker and assists in the mortgage application process. A Mortgage Broker may also be responsible for compliance requirements for their brokerage or a team.

The provinces of Quebec (AMF) and Newfoundland (Digital & Government Service NL) both exclusively utilize the designation of Mortgage Broker as a licensing designation.

British Columbia (BCFSA) has two distinct roles within the mortgage industry: the Submortgage Broker and the Mortgage Broker. These positions have specific responsibilities and functions that contribute to the overall process of securing mortgages for clients. The Submortgage Broker works under the supervision of a licensed Mortgage Broker and assists in various tasks, such as gathering client information, completing paperwork, and liaising with lenders. The Mortgage Broker oversees the entire mortgage application process, including assessing client needs, finding suitable mortgage options, negotiating terms, and ensuring compliance with regulations.

In Alberta (RECA) and New Brunswick (FCNB), the distinction between a Mortgage Associate and a Mortgage Broker lies in their roles and responsibilities within the mortgage industry. A Mortgage Associate typically works under the supervision of a Mortgage Broker and assists in the mortgage application process gathering necessary documentation, and providing support to clients. A Mortgage Broker is licensed to independently negotiate and arrange mortgage loans on behalf of clients, offering a more comprehensive range of mortgage options and expertise in the field.

In Saskatchewan (FCAA) and Nova Scotia (Government of Nova Scotia, Business Licensing), there are distinct roles for both Associate Mortgage Brokers and Mortgage Brokers. The critical difference lies in their level of experience and licensing requirements. Associate Mortgage Brokers work under the supervision of a licensed Mortgage Broker and are in the early stages of their career. They may assist with gathering client information and preparing mortgage applications. Mortgage Brokers have obtained the necessary qualifications and licences to operate independently and provide mortgage services directly to clients. They have the authority to negotiate mortgage terms, advise clients, and facilitate the mortgage process from start to finish.

In Manitoba (MSC), a Salesperson is primarily responsible for promoting and selling products or services, while an Authorised Official holds the authority to make legally binding decisions on behalf of the organization. These roles have different levels of authority and expertise, with the Salesperson focusing on sales and the Authorised Official having broader decision-making powers and acting as the liaison between the brokerage and the regulator.

For a complete list of licensing terms in Canada, please see the Mortgage Broker Regulators’ Council of Canada (MBRCC) published list.

nesto Mortgage Experts

Titles such as mortgage broker, mortgage agent, submortgage broker, mortgage salesperson, or principal broker are provincially regulated licensing terms with educational requirements specific to each province. Although they may all commonly be referred to as mortgage brokers, in Ontario, where mortgage agents are used as a designation, mortgage brokers or principal brokers have additional responsibility for compliance and training mortgage agents.

Licensed mortgage professionals often use the industry norm of “mortgage broker,” “broker,” or “advisor” to refer to themselves. However, disclosure requirements for licensed mortgage professionals’ titles vary across each province in Canada. These disclosures require mortgage brokers to adhere to specific rules when using titles to represent their qualifications and expertise. The provinces have regulations and guidelines that govern the use of titles by mortgage brokers. These regulations aim to ensure transparency and protect consumers in the mortgage industry.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!