Mortgage Basics #Featured articles

Mortgage Basics #Featured articles

Capitalization Options for Variable Mortgages that have Reached their Trigger Point

Table of contents

Notice: Effective November 21, 2024, mortgage transfers between lenders will be exempt from requalification. Transactionally insured (those who originally purchased with less than 20% downpayment) and uninsured mortgages (without increasing mortgage balance or amortization) will no longer be required to stress test when changing lenders at maturity. Going forward, only new purchase and refinance mortgage applications must be qualified through the stress test.

Have a variable rate mortgage and feeling the heat? You’re not alone.

This year’s rapid rate increases by the Bank of Canada (BoC) have brought many variable-rate mortgages (VRM) to the brink of their budget. The BoC increased its Key Overnight Rate 7 times this year; although the rate has been higher many times in the past, it has not multiplied so rapidly within 9 months – going from 0.25% to 4.25% – that’s by a factor of 9. The rapid increase in the prime rate has been a double-edged sword for many homeowners who bought a home recently on a VRM with a fixed payment. On the one hand, their mortgage payment covers less and less of their principal as rates increase. Alongside, their property value declines while less of their mortgage principal is paid down – squeezing their retained equity further.

This article will cover how trigger rates turn into trigger points for anyone who bought into VRMs with a fixed payment strategy – including those variable mortgages offered by the big banks. We will discuss how to prepare for the inevitable: the options available to mitigate when you hit your trigger point, and how the default insurers are letting borrowers capitalize their ballooning mortgage balances.

Key Highlights

- A fifth of all mortgages in Canada have reached their trigger rates; hence, they are most likely to reach their trigger points if amendments are not made to their repayment schedule.

- Trigger points for each VRM are specific and dependent on the original loan-to-value ratio at the onset of the mortgage contract.

- Lenders and default insurers have provided a few options for VRM holders to mitigate through their trigger rates and avoid their trigger points.

What is a Trigger Point?

Trigger point occurs when a variable-rate mortgage (VRM) holder’s principal balance exceeds the original mortgage loan amount. All mortgage payments are made up of interest and principal payment components. As the lender’s prime rate rises with the Bank of Canada’s overnight rate, more of that mortgage holder’s fixed VRM payment will go towards interest until the whole payment is servicing only the interest component. This stage is known as the trigger rate.

Once the trigger rate is reached, all fixed VRM mortgage payments will go to the interest component. This process accelerates if there are further increases to the prime rate after reaching the trigger rate. The existing equity covers the increasing interest component on the mortgage payment. The existing equity is the share of ownership of the property — this is the difference between the mortgage balance (the portion of title ownership by the lender) and the property value (fair market value of the property).

At this stage, the homeowner and lender can come at odds. As the prime rate keeps increasing, not only is the property value decreasing due to market pressures, but also the owner’s equity position in the home is being eaten away by interest costs. By having interest tacked on to the mortgage balance – instead of decreasing as the principal is paid down – the mortgage will keep increasing until it reaches the trigger point.

Which Mortgages are Affected by Trigger Points?

All variable-rate mortgages (VRMs) with fixed (or static) payments that will exceed their original loan amounts are affected by trigger points. At this time, trigger rates affect almost a fifth of all mortgages as they depend on changes to the prime rate on which their interest is charged while carrying a fixed payment. However, reaching their trigger point is a matter of the specific loan-to-value (LTV) ratio on their mortgage contract.

According to Canada Mortgage and Housing Corporation (CMHC), the majority of mortgages originated in the prime lending space, which is predominantly made up of chartered banks – as well as a smaller double-digit percentage of originations attributed to credit unions and smaller regional lenders.

Prime lenders must stress-test borrowers to adhere to OFSI’s (Office of the Superintendent for Financial Institutions) lending guidelines. At this time in 2020, many borrowers and mortgage experts argued that stress-testing mortgages, at a minimum rate of greater than 5.25% or contractual rate plus 2%, were pointless as the contractual variable rates were a third of the stress test rate.

Looking back, we can see that the stress test provided safety in two ways to Canada’s overall mortgage and housing market. Firstly the stress test avoided a more rapid vertical bubble forming in the housing market. By limiting higher mortgage qualifying amounts, the stress test saved borrowers from further over-extending themselves.

Secondly, as rates rose due to the BoC’s (Bank of Canada) monetary tightening to curb inflation, the stress test provided stability to borrowers’ budgets as they had qualified at a higher rate for such a scenario. When the stress test originally came out, it had not anticipated the market situation we’re in now. In retrospect, the stress test has masterfully avoided a worse situation in the housing market than would have been the case otherwise.

Find a better rate, and we’ll match it, beat it, or give you $500*.

*Conditions Apply

With nesto, it’s stress-free

What Solutions is RBC / TD / Scotiabank / BMO / CIBC / National Bank / Desjardins offering their Clients who Reach their Trigger Points?

In the prime lending space, federal mortgage rules require that they are chronologically amortizing, meaning borrowers must pay down their principal. Some big banks are proactively reaching out to their clients at some stage after the trigger rate has been reached to increase the mortgage payment to compensate for the higher interest component. Borrowers can also pay down their principal if they wish to avoid affecting their payment.

In most cases, big banks are not required to to reach out to borrowers when the trigger rate has been reached (or some simply choose not to). However, they must reach out when their trigger point is reached due to federal requirements to bring the affected borrowers’ amortization back into line with the original loan-to-value.

Lenders have three options once a trigger-rate threshold has been reached:

- Raise monthly payments.

- Require a lump-sum prepayment on the mortgage.

- Allow borrowers to slip into negative or reverse amortization under rules set by banking authorities and mortgage insurers.

Lenders are required to bring the amortization back to the chronologically elapsed amortized period at the time of renewal. If the original mortgage was taken for 25 years, then after a 5-year term ends, the mortgage must be returned to 20 years. If the client renews early to a fixed rate in the middle of the term, their mortgage is amortized back to their remaining amortization.

In particular, we noticed that an insured mortgage of 25-year amortization started at the beginning of 2020 with a discounted variable rate of 1.40% would be reaching an amortization of 123 years at the end of October and then pass its trigger rate as of the last rate hike at the beginning of December 2022. This scenario affects the vast majority of insured mortgages as they are limited.

The original loan-to-value (LTV) ratio of a mortgage is measured at the start of the mortgage contract. That means that if the client took a mortgage with a 20% downpayment, their loan is 80% of the property value – so their LTV ratio would be 80%. If the client took out the mortgage valued at the start of the mortgage term at $1 million or more of the amortized mortgage at 30 years, it would not be insured.

Uninsured loans are not guaranteed by default insurance, and such are the sole responsibility of the lender. In cases where the mortgage was originally insured, with less than 20% downpayment, the respective insurer would set guidelines on how to deal with such borrowers reaching their trigger points effectively.

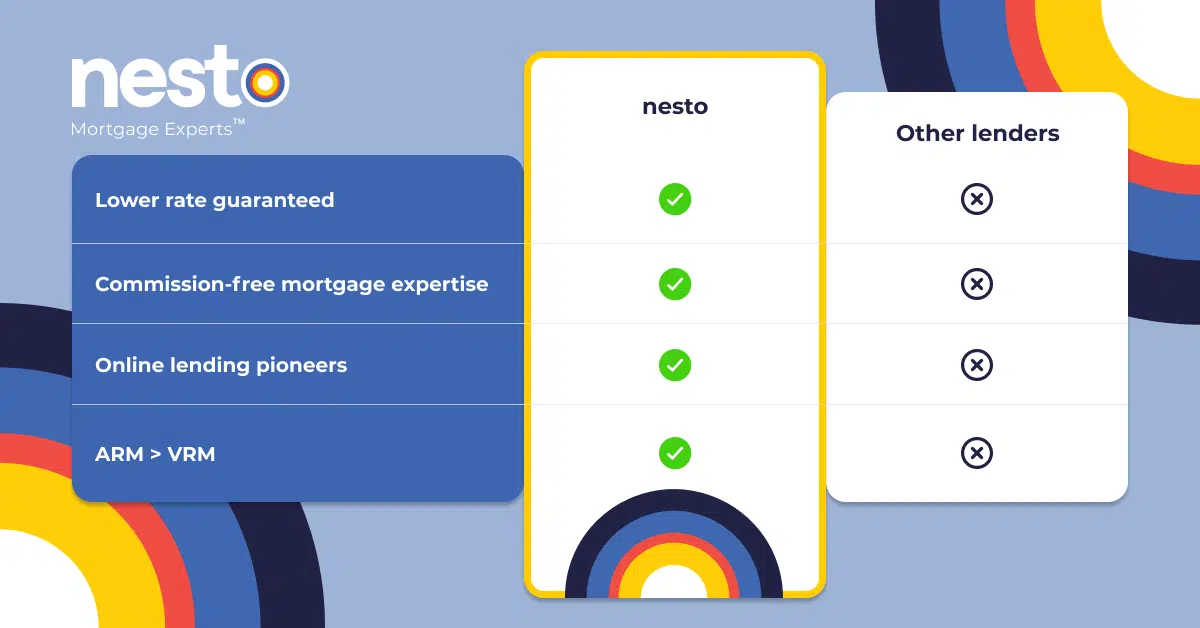

At this time, nesto clients are unaffected by trigger rates and trigger points as nesto only offers fixed-rate and adjustable-rate mortgages (ARMs). ARM payments fluctuate with the prime rate and, thus, are unaffected by trigger rates. ARMs also protect you from payment shock at renewal as the interest rate charged affects the payment in realtime. So ARMs cannot be negatively amortized like VRMs that are affected by trigger rates due to their static (or fixed) payment.

What Options are Default Insurers Making Available to Borrowers Reaching Their Trigger Points?

Default insurers, such as Canada Mortgage and Housing Corporation (CMHC), Sagen (formerly Genworth) and Canada Guaranty, are providing capitalization options for mortgages that they insured. Capitalization options allow for negative or reverse amortization rules set by insurers.

When a borrower cannot continue making principal and interest payments on a mortgage, it raises the prospect of default. Still, industry watchers say mortgage insurers CMHC and Sagen allow banks to do quick loan restructures with individual customers as needed without their approval.

CMHC, for example, allows negative amortization of up to 105% of the original loan amount. For uninsured mortgages, federally regulated lenders set their policies with approval from OSFI. Sagen allows up to 40 years of amortization for clients affected by trigger points. However, the affected borrower must be able to qualify for 39% debt service. A maximum of 39% of their income must be used to service their gross debts – comprised of their stress-tested mortgage payment, property taxes, heating costs and half of their applicable condo fees.

FAQ

What is a Trigger Rate?

The trigger rate is the point at which your mortgage payment is going fully towards your interest, and no principal is being repaid.

What is a Trigger Point?

The point at which the balance owing has increased to be more than the originally contracted mortgage amount – meaning that you owe more than your original loan-to-value ratio.

What is a Loan-to-Value Ratio?

The ratio of your loan to the property value (lower of the purchase price or appraised fair market value) at the start of the mortgage contract.

Final Thoughts

If everyone had taken out a fixed-rate mortgage over the last couple of years, Canada’s mortgage and housing market would have less volatility and systematic risk. The lack of housing and affordability due to qualifying on the stress test led more borrowers to disproportionately choose a variable rate over a fixed rate for a higher mortgage in the bubbled market conditions.

Every variable-rate mortgage holder’s trigger point is unique to their mortgage situation as outlined in their mortgage contract. We advise borrowers to proactively reach out to their lender before reaching their trigger point to find mitigating options exclusive to their mortgage contract.

You may need to refinance or renew your mortgage to make your payments easier to manage or bring your amortization in line to preserve your equity. You may be sitting on the sidelines for the opportune time to move into homeownership. nesto’s commission-free mortgage experts are ready to assist you in understanding your borrowing options and advise you on weathering the current market situation.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!