Industry News #Featured articles

Industry News #Featured articles

Shifting Forecasts Increase Chances of Aggressive Rate Cuts

Table of contents

Shifting Forecasts Increase Chances of Aggressive Rate Cuts

Major Canadian banks, including TD, CIBC, and BMO, have recently adjusted their forecasts for interest rates, indicating that the Bank of Canada (BoC) may implement quicker and more substantial cuts over the next 16 months. This prediction shift reflects a growing consensus among financial institutions about needing a more aggressive monetary policy response to current economic conditions. As these banks revise their outlooks, it signals a significant change in the financial landscape that could affect various sectors, particularly borrowing and lending.

Key Takeaways

- Major Canadian banks predict aggressive hikes from the Bank of Canada.

- The US job market shows mixed signals, decreasing inflation but underwhelming job growth.

- Canada’s job market faces challenges, with job losses, a low labour participation rate, and rising youth unemployment.

Global Markets

The global financial markets are facing significant turbulence, primarily influenced by developments in Japan and the United States. In Japan, there are rising concerns regarding potential changes in the central bank’s monetary policy, creating uncertainty. Meanwhile, fears of a recession fueled by persistently high interest rates add to the instability in the US. This combination of factors contributes to a volatile market environment that impacts investor confidence and economic forecasts.

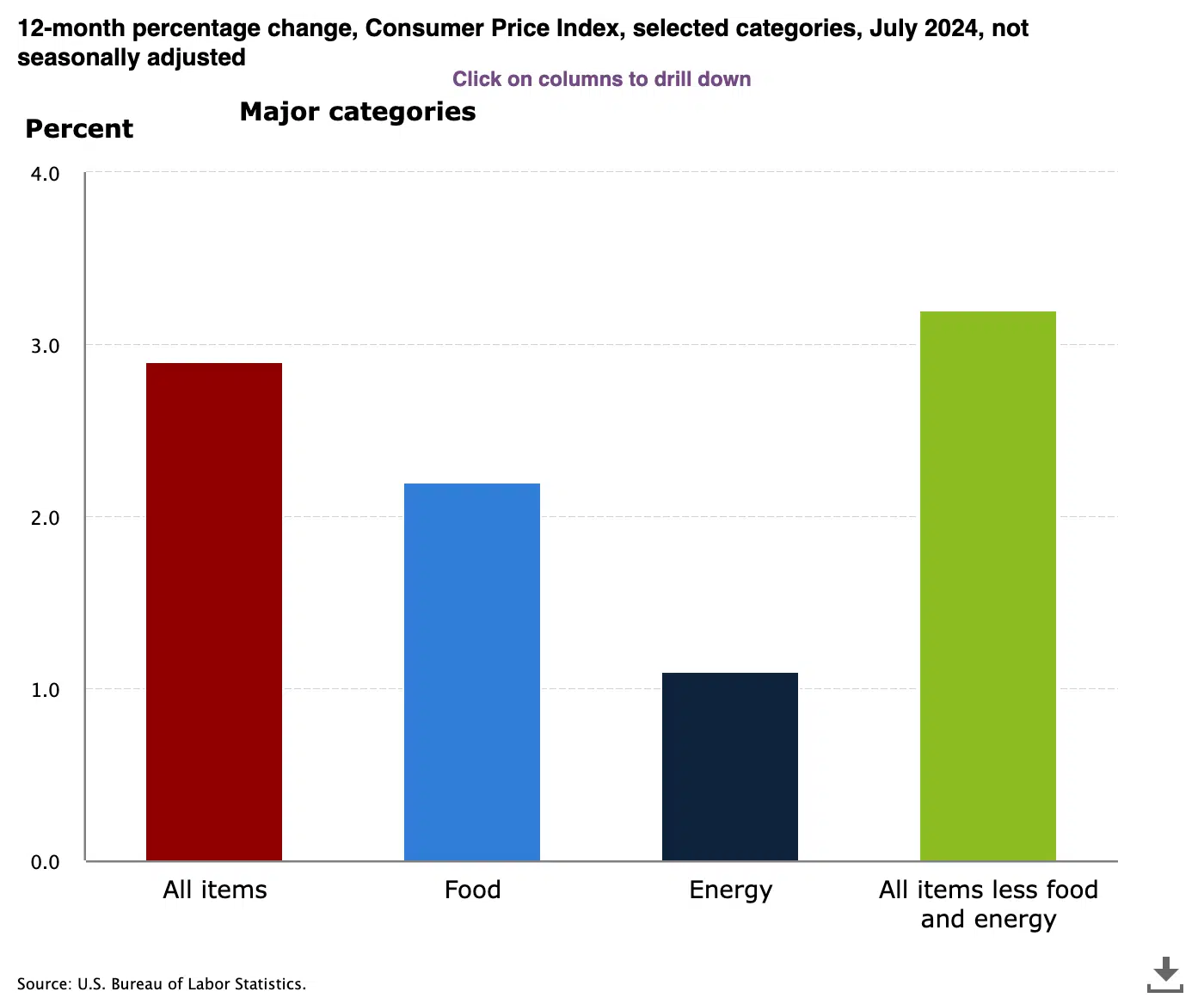

US July Inflation

Recent statistics show that US headline inflation has dropped below expectations, marking its lowest point in 40 months. This decline is a hopeful sign in the fight against rising prices. In July, the US Consumer Price Index (CPI) increased by 2.9% compared to the same month last year, a slight reduction from June’s 3% rise. The core CPI, which excludes the volatile food and energy prices, also saw a year-over-year increase of 3.2%, aligning with forecasts and showing a minor decrease from the previous month. Despite the positive inflation figures, market caution remains due to rising shelter costs, indicating that the Fed’s strategy of raising interest rates to combat inflation is working. The decrease in core inflation suggests that the slowdown is not solely due to the unpredictable nature of food and energy prices.

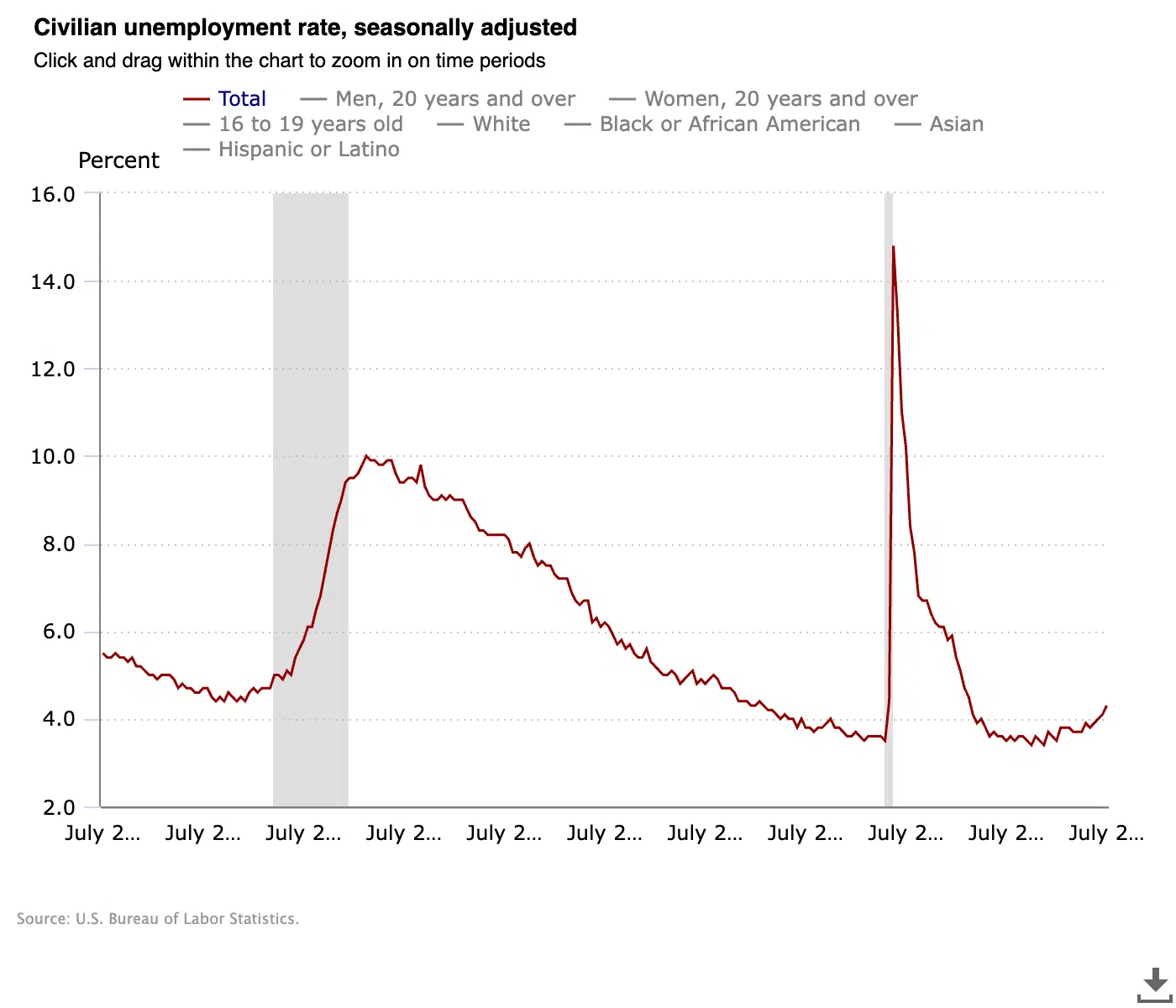

US July Employment

The recent underwhelming July jobs report in the US has heightened expectations for multiple rate cuts by the Fed this year. Markets predict more than a 50% chance of a 25 basis points (0.25%) rate cut in September. The subdued market response indicates that traders largely expected this outcome. Furthermore, the slight rise in Canadian yields is tied to the effects of the slowing US economy on Canada. The likelihood of a rate cut by the Bank of Canada in September suggests it may follow a similar path as the Fed in easing monetary policy. The latest cooling inflation data from the US is seen as a positive sign for the global economy, prompting central banks worldwide to consider relaxing their monetary policies.

Canada July Employment

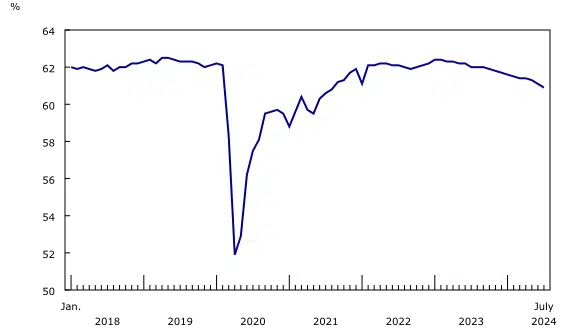

Canada’s job market suffered a setback in July, recording a net loss of 2,800 jobs, following a decline of 1,400 jobs in June. This raises alarms about the labour market’s overall health. Such losses suggest that the economy may struggle to create new employment opportunities, which could have broader economic stability and growth implications.

The labour force participation rate has dropped to its lowest point in over 25 years, which is particularly alarming. This decline indicates that fewer individuals actively seek work, which could lead to challenges in filling job vacancies and hinder potential economic expansion. A shrinking workforce can limit productivity and innovation, ultimately affecting the country’s economic prospects.

Source: StatsCanada – Canada Labour Participation Rate

Public Sector Jobs Growing Faster Than Private Sector

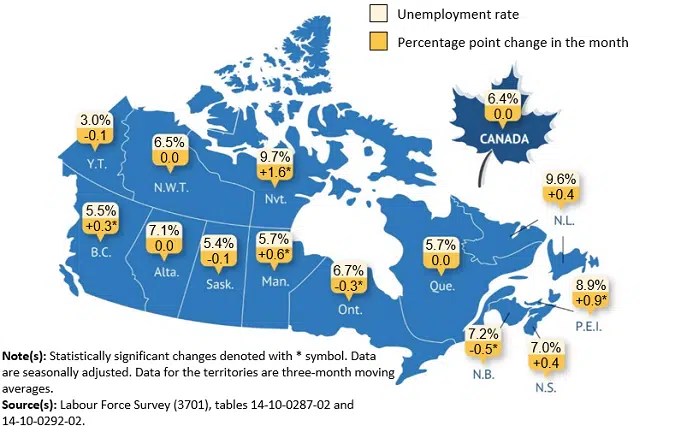

The public sector saw an increase of 41,000 jobs, contrasting sharply with a loss of 42,000 jobs in the private sector. This imbalance between public and private sector employment raises concerns about sustainability and productivity. Additionally, average wage growth has decreased from 5.4% in June to 5.2% in July, with expectations of a further decline. As a result of base effects, wage growth is expected to decrease to 1.95% by the year’s end.

Source: StatsCanada – Canada Unemployment Rate By Jurisdiction

Youth Unemployment Rising Fastest

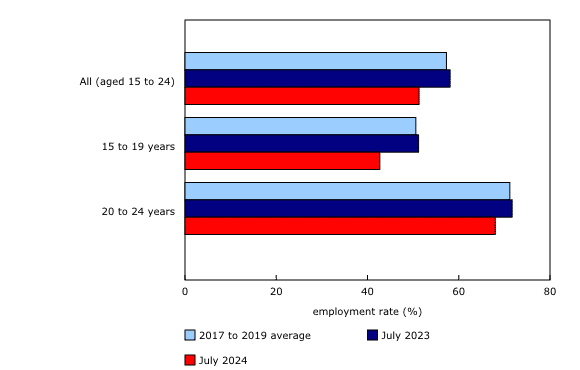

Youth unemployment in Canada is rising, hitting 14.2% in July, which marks the highest rate outside the pandemic in over ten years. This statistic indicates that approximately one in seven young adults looking for work cannot secure a job. Those young adults returning to school face even more significant challenges, with unemployment reaching 17.2% in July, the highest level since 2009 when considering non-pandemic figures. In contrast, the unemployment rate for prime-aged workers between 25 and 54 has increased much slower, staying below 6.0% as of June.

Source: StatsCanada – Youth Employment Rate

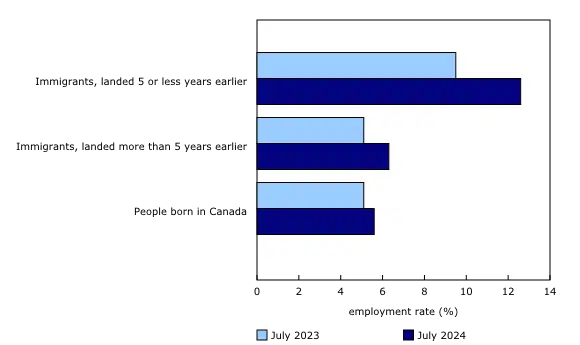

Several factors contribute to the rising youth unemployment rate. One significant reason is the ongoing impact of the pandemic on service-oriented businesses, which have struggled to fully recover. Additionally, the job market is experiencing saturation due to a record number of immigrants, particularly lower-skilled temporary foreign workers and international students. There has also been a noticeable decline in youth hiring and labour force participation among young adults. Over the past two years, Canada’s young adult population has expanded by nearly 12%, creating difficulties for the job market to accommodate such a swift increase in job seekers.

Source: StatsCanada – Immigrant Employment Rate

Bond Markets

The bond futures market anticipates that the Bank of Canada will reduce interest rates by 0.75% by the end of this year. If average wage growth decreases significantly and quickly, the Bank will have more room to make even more significant cuts. Additionally, the situation for variable-rate mortgages is improving, indicating a more favourable environment for borrowers. This trend may allow the Bank of Canada to lower interest rates more than the market anticipates, potentially leading to lower bond yields and fixed mortgage rates.

For Canadian mortgage borrowers, the anticipated interest rate cuts could present an opportunity to secure lower fixed mortgage rates. As bond yields in Canada have fallen to their lowest levels in two years, this trend may lead to more favourable borrowing conditions. However, the economic landscape remains unpredictable, and borrowers should assess their financial situations and risk appetites before making any commitments. The ongoing debate about the pace of rate cuts further complicates the decision-making process, as some experts urge caution to prevent a resurgence of inflation.

Inflation and jobs data in the US suggest that borrowers in Canada can anticipate a continued decrease in fixed, variable and adjustable mortgage rates, alleviating concerns about renewal payments.

Beginning your home journey?

Start with a low rate.

Chat with a nesto expert today, commission-free, and secure your rate.

Don’t Let Uncertainty Hold Back Your Decision

Given the current economic climate of shifting forecasts and the possibility of aggressive rate cuts, staying informed and making well-calculated decisions about your mortgage is more important than ever. At nesto, our team of mortgage experts is dedicated to helping you navigate these complex challenges and secure the best possible mortgage rates for your unique situation. Whether you’re a first-time homebuyer, looking to keep a low mortgage payment on your next renewal, or considering refinancing, we offer a range of special mortgage products and personalized advice to suit your needs.

Are you still unsure what to do? Check out our Prime Time Special Offer, and you will benefit from lower rates over the next 6 months without locking in your mortgage. Don’t let uncertainty hold you back – take control of your financial future and explore your mortgage options with nesto today. Reach out to our team and let us help you find the perfect mortgage solution for your mortgage strategy.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!