Helping Your Clients Make Smart Mortgage Decisions in 2025’s Volatile Environment

Table of contents

The Market Cycles We Know—and the Surprises We Don’t

In the world of investments, understanding market cycles is essential for mitigating risks and maximizing returns; the same holds true for mortgages. Just as an investor studies market highs and lows, financial advisors can help clients navigate mortgages by examining historical rate behaviours. Rate cycles, like economic cycles, tend to recur every five years, but, as we’ve seen with surprise rate hikes—such as those in the early 2000s—even the best predictions can have twists.

- Leverage Rate Cycle Patterns: Think of fixed and variable rates as comparable to bonds and equities. Educate clients about the historical frequency of rate peaks and troughs, empowering them to allocate their “mortgage portfolio” accordingly.

- Promote Diversified Mortgage Solutions: Imagine balancing a stock-heavy portfolio with a touch of bonds. Similarly, hybrid mortgage products—like a five-year blend of fixed and variable rates paired with a serving of HELOC—offer stability and growth potential. It’s about hedging for both certainty and opportunity.

- Advocate for Risk Management: Just as prudent investors maintain a liquidity reserve, homeowners should build a savings buffer. A strong financial plan includes keeping six months of their budget in cash; similarly, setting aside funds equivalent to a 30% payment increase for up to 30 months on their mortgage can help them cushion against market volatility.

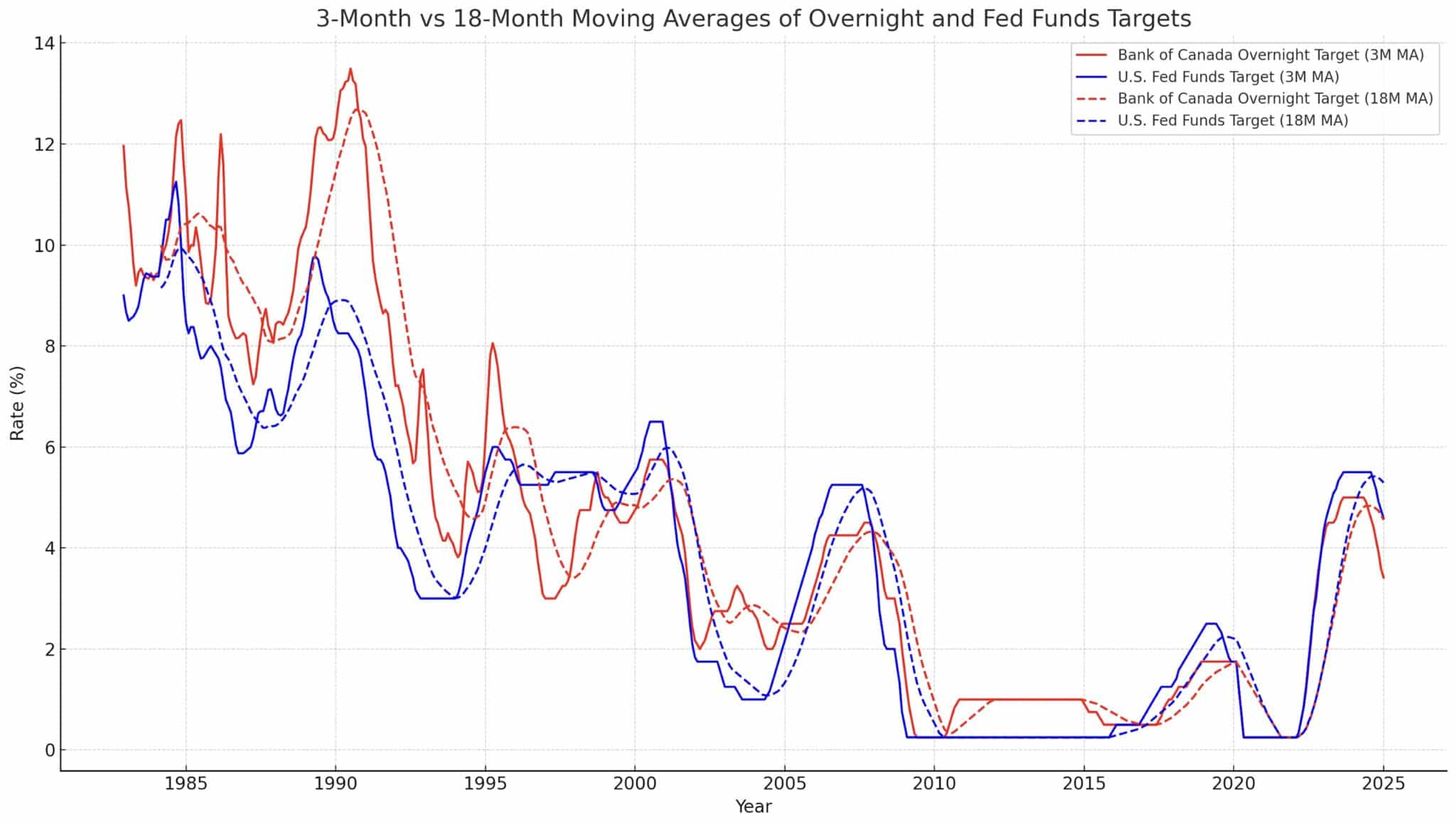

Understanding and leveraging interest rate trends is crucial to helping clients navigate financial markets effectively. Policy rate changes often take 12 to 24 months to fully impact inflation and economic output, so using longer-term trends, like 18-month averages, can provide more accurate forecasts. Explain this to clients in simple terms, using historical data to demonstrate how aligning their financial strategies with these cycles—peaking roughly every five years in Canada—can optimize their investments and mortgage decisions.

Highlight the significant influence of the US on Canadian interest rates. By emphasizing the economic interdependence between the two countries, you can position yourself as a knowledgeable advisor who anticipates potential shifts and tailors financial solutions accordingly. This is particularly valuable during periods of temporary rate divergence such as the one we’re currently in, which historically last two to three years before stabilizing.

Connect past economic events to current trends to build trust and drive action. For example, compare the current AI-driven economic surge to the late-1990s tech boom, demonstrating how similar scenarios have influenced interest rates and created opportunities. Use these parallels to offer solutions that align with your client’s long-term financial goals, such as variable-rate products or diversified investment options.

Combining clear education with actionable advice simplifies complex topics and empowers clients to make better decisions. Showcasing how strategic timing and adaptability can help them weather market volatility and achieve financial stability reinforces their confidence in proactive financial planning.

Key Drivers Set to Boost Mortgage Volumes in 2025

Imagine you’re monitoring economic indicators to predict investment flows. In the mortgage space, key market drivers can serve as “leading indicators” for growth. Here’s what’s on the horizon:

- Renewal Surge: Much like a bond approaching maturity, 100,000 mortgages are set to “renew” at higher rates (payment shock risk) each month in 2025. With many originating before the recent rate hikes, clients will look for the best deals—a perfect opportunity to capture new business.

- Stress Test Relief for Switchers: This is similar to removing red tape, such as a minimum investment in a highly sought-after mutual fund or ETF. Borrowers switching lenders are now exempt from the stress test, making mortgage renewals more straightforward and competitive.

- Expanded Borrower Capacity: Rising incomes and property appreciation over the last 5 years since most mortgage holders’ last renewal are akin to a growing GDP—they increase client “eligibility” and pave the way for higher-value mortgage transactions.

2025 Predictions & Mortgage Strategy Insights

The 2025 mortgage market mirrors an investment landscape in flux. Strategy will be your client’s best asset with rate cuts on the horizon, housing prices rebounding, and geopolitical uncertainties. Here’s how to guide them:

- Rate Cuts on the Horizon: Variable rates are the “growth stocks” of the mortgage world. As the Bank of Canada’s policy rate falls closer to neutral, it may yield strong returns for clients seeking flexibility. As rate cuts take effect, highlight the growth potential of variable rates for clients with a higher risk tolerance. They can use the money saved on interest-carrying costs towards their investment goals or supercharge prepaying their mortgage balance to become mortgage-free faster.

- Fixed Rate Stability: Fixed rates resemble “blue-chip stocks”—steady and dependable, but initially, you might have to pay a higher unit cost to add them to your portfolio. Despite expectations for declines, upward bond yield pressures may provide these borrowers with stable mortgage payments, offering peace of mind. Recommend fixed rates to clients seeking a safe haven, emphasizing their stability even if the initial cost is slightly higher.

- Continued Price Rebound: Like a recovering sector in the stock market, Canadian home prices are set to rise, buoyed by household savings and resilient demand. Encourage clients to balance fixed and variable products in their mortgage portfolios to hedge against market shifts while seizing opportunities from rebounding home values.

Navigating Policy Volatility in 2025

In investments, regulatory changes can shift the playing field overnight. The same holds true for mortgages. Advisors must be prepared to adapt quickly to changes in housing policies, rates, and client expectations.

- Affordability Dilemmas: Rising home prices relative to wages create affordability issues, much like inflated valuations in certain asset classes. Flexible mortgage plans, akin to adaptable investment portfolios, can address this challenge by providing clients with solutions that accommodate evolving financial circumstances.

- Policy Changes: Federal elections could usher in “new rules of the game.” Pre-approvals should be flexible enough to accommodate potential shifts in qualification criteria. Proactive communication through detailed client notes can inform clients about these rate changes, ensuring they’re prepared to act decisively and in line with their long-term plan.

- Gradual Rate Cuts: The Bank of Canada’s cautious approach to rate reductions may mirror slow monetary easing, keeping fixed rates elevated and creating rate volatility. By designing hybrid mortgage strategies that include fixed (term loans) and variable (term loans and HELOCs) elements while aligning these with broader financial goals, advisors can help clients mitigate uncertainty and maintain long-term focus—similar to structuring a well-balanced retirement plan.

Conclusion

Canada’s mortgage market in 2025 is shaping up to be a jungle ruled by big banks flexing their muscle with aggressive pricing and expanded sales teams. While they chase volumes over margins, advisors have a prime opportunity to stand out. Highlight your transparency, personalized strategies, and client-first approach—no hidden fees or relentless cross-selling here. With 65% of mortgages set to renew by 2026 and new rules in play, early outreach and clear guidance are key. In a market of competing rates and shifting regulations, your expertise and tailored solutions can be the value clients can’t resist.

Exception-based pricing can be a mortgage broker’s headache, with unpredictable rates and inefficiencies creating more games than gains. While banks may justify better mortgage rates in their branch as a reward for control and cross-sales, clients often see it as unfair—and brokers bear the brunt of the fallout. The solution? Adapt with scale, automation, and standout advice. By affiliating with strong networks (like nesto), streamlining processes (100% digital application process with expert nesto advice), and delivering compelling insights (nesto mortgage advice), you can stay ahead of the curve. After all, it’s about rates and relationships—and making every client feel like the real winner.

Just as skilled investors rely on insights and strategic planning to build wealth, financial advisors can help clients make smarter mortgage decisions by treating mortgages like bond holdings inside investment portfolios. By balancing risks, leveraging opportunities, and being knowledgeable, you can guide clients toward financial resilience and long-term success.

Staying ahead of market trends, understanding key drivers like renewal surges and stress test relief, and predicting how rate cuts or housing prices will shift create trust and add value to your advisory practice. Integrating diversified mortgage solutions and emphasizing flexible, client-focused plans enables you to meet evolving needs effectively.

Ready to elevate your client conversations and drive long-term results? Connect with your homebuyers, homeowners and clients looking for a mortgage refinance to accelerate their financial goals to our team of experts today to explore tailored mortgage strategies and insights that empower your clients and strengthen your practice.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!