How Do Mortgage Brokers Get Paid?

Table of contents

The mortgage industry in Canada is a complex and dynamic sector that plays a crucial role in the country’s economy. Mortgage brokers are key players in this industry, acting as intermediaries between borrowers and lenders to help individuals secure the best mortgage deals. Mortgage brokers originate mortgages and nurture relationships to provide valuable expertise and guidance to homebuyers and homeowners, helping them navigate the often confusing world of mortgages.

Understanding how mortgage brokers get paid is essential for consumers seeking a mortgage. Brokers typically earn their income through commissions from lenders, which can vary depending on the type of mortgage and the lender involved. This payment structure can influence the recommendations brokers make to clients, as they may be incentivized to steer home buyers toward specific lenders or products that offer higher commissions. Consumers need to be aware of these potential conflicts of interest and ensure they are making informed decisions when choosing a mortgage broker.

Key Takeaways

- Mortgage broker’s commissions are typically from lenders, which can influence the mortgage products they recommend to clients.

- Broker compensation structures vary, while some can earn additional fees or bonuses based on submission volume, renewals, and preconstruction buydowns.

- Consumers should be aware of potential conflicts of interest and understand how broker compensation can impact the solution presented.

Mortgage Brokers, Specialists and Advisors

Understanding the differences between a mortgage broker, a mortgage specialist, and a mortgage advisor is essential for anyone purchasing a home or renewing a mortgage. A mortgage broker acts as an intermediary between borrowers and lenders, leveraging their extensive network to find the best mortgage options tailored to a client’s financial situation. They are skilled negotiators who can access various loan products from multiple lenders, ensuring that clients receive competitive rates and terms.

A mortgage specialist typically works for a specific lending institution and focuses on promoting that lender’s mortgage products. Their expertise lies in understanding the nuances of their employer’s offerings, allowing them to guide clients through the application process while ensuring compliance with the lender’s requirements. Mortgage specialists are paid a nominal commission (usually half or a third of what a broker might make) since they can access the lender’s client base.

A mortgage advisor is a generalist providing a broader range of financial advice, often assessing a client’s financial health and goals before recommending suitable mortgage solutions. They take a holistic approach, considering factors such as credit scores, income stability, and long-term financial plans, which help clients make informed decisions about their mortgage options. Mortgage advisors are compensated by their employer’s base salary plus a quarterly or annual sales target bonus.

Compensation and Commissions

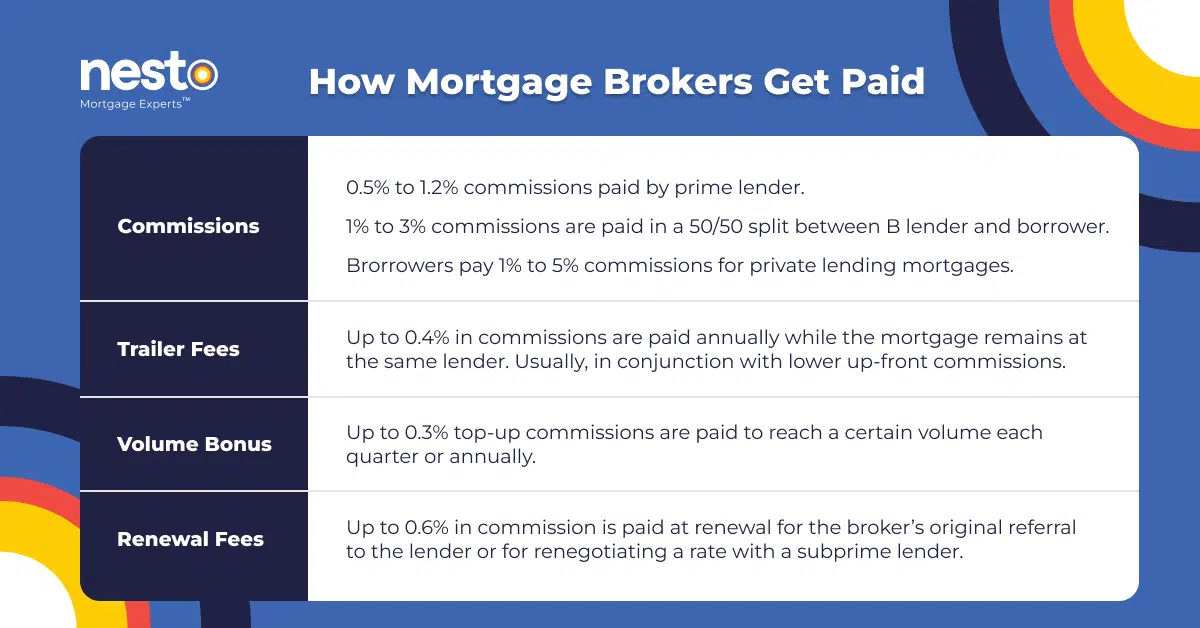

Mortgage brokers can be compensated in various ways, with payment structures that can include commissions, fees, and potential funding bonuses. Commissions are typically based on a percentage of the loan amount, while additional fees may be charged for services rendered throughout the mortgage process. Bonuses can also come into play, often as incentives for meeting set performance targets or closing a certain number of mortgage loans within a specified timeframe. These payment methods can vary depending on brokers’ agreements with their lenders, with some brokers receiving higher commissions but charging lower fees.

Trailer fees are payments made to brokers if the borrower continues with the same lender as the mortgage term is renewed each time at maturity. These fees are typically offered in return for a smaller upfront commission. This arrangement can discourage brokers from suggesting that borrowers switch lenders frequently, which may not always be in the best interest of the borrowers. However, this system provides the broker with a book of clients over the long term, increasing their interest in nurturing the relationship between the borrower’s mortgage renewals.

Renewal fees are given to the original broker when a borrower renews their mortgage with the same lender. This arrangement may make brokers more likely to suggest that you stick with your current lender. However, brokers also earn even more fees if you switch lenders at renewal. If you renew with a subprime lender, you should always use a trusted broker to negotiate a better rate. It is wise to compare rates when it’s time to renew, no matter how your broker is compensated.

Mortgage broker payment structures are designed to incentivize them to provide quality service to their clients while ensuring they are fairly compensated for their work. By offering a mix of commissions, fees, and bonuses, brokers can earn income differently, depending on their performance and the terms of their agreements with lenders. This can create a dynamic environment where brokers are motivated to excel in their roles, benefiting themselves and their clients.

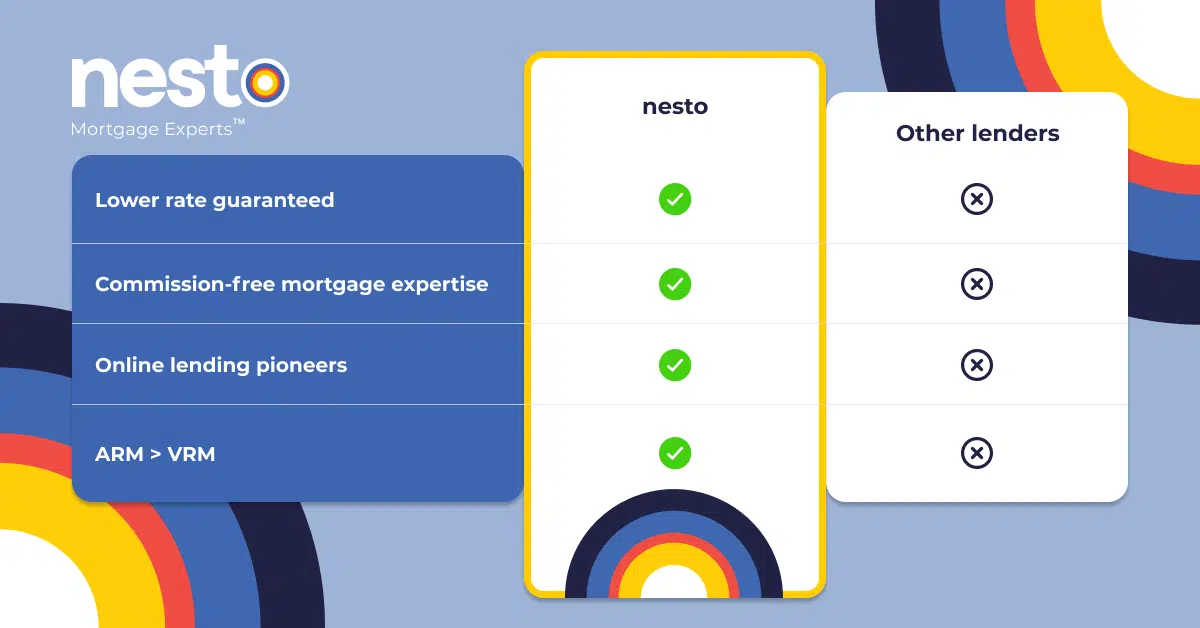

How Does nesto Compare Against Other Lenders?

Lender vs. Borrower Paid Commissions

Mortgage brokers play a crucial role in the home financing process, and one of their primary sources of income comes from commissions paid by lenders. When working with financial institutions and other prime lenders, brokers earn commissions solely from the lender by facilitating the connection between borrowers and lenders—think of it as a finder’s fee. In addition to receiving commissions from lenders, brokers may also earn commissions from borrowers in non-prime lending situations. These commissions serve as compensation for the services provided by the broker in securing a mortgage for the borrower. Some non-prime lenders will have a commission split, where half comes from the lender and the other half from the borrower.

These commissions are typically calculated as a percentage of the loan amount and can vary significantly depending on the lender and the specific mortgage product or solution. In Canada, mortgage broker commissions typically range from 0.5% to 1.2% of the mortgage value. This means that for a $300,000 mortgage, a broker could earn anywhere from $1,500 to $4,500; however, the amount that the broker receives might be far lower after fees are taken out by their brokerage network.

Mortgage brokers can receive up to an extra 0.3% in volume bonus or trailing commissions based on the total submission volume to each lender they collaborate with, provided these lenders have such incentives. This means brokers can increase their earnings by leveraging their submission volume and taking advantage of the bonus and commission structures offered by the lenders they work with.

Subprime lenders often implement a fee-sharing model in which 50% of the fee is derived from the higher interest rates imposed by B lenders. At the same time, the remaining portion is collected directly from the borrower. This fee structure generally results in a total fee between 2% and 3% added to the loan amount, reflecting the higher risk associated with subprime lending.

In the case of private mortgage lenders that do not offer commissions to mortgage brokers for securing business, borrowers may be responsible for covering the entire fee owed to the broker. The mortgage broker will establish the fee before the completion of the transaction, which can vary significantly, typically ranging from 3% to 5% of the total mortgage amount.

Commission rates for mortgage brokers can vary across different lenders in Canada. Some lenders may offer higher commission rates to brokers to incentivize them to bring in more business. For example, a traditional bank may offer a lower commission rate but add a volume bonus, while a private lender may offer higher commissions without any volume bonus. These differences in commission rates can impact the overall earnings of mortgage brokers and influence their choice of lenders to work with.

The variation in commission rates across different lenders can be attributed to several factors, including the lender’s business model, the type of mortgage offered, and the broker’s negotiation skills. For example, some lenders may offer higher commissions for specialized products, such as stated income, self-employed or incorporated, non-income qualified (NIQ) or total networth lending mortgages. Conversely, traditional and prime lenders might provide lower commissions due to their volume of business and established market presence.

Mortgage Brokers’ Operating Expenses

The fees associated with working as a mortgage broker can vary significantly depending on the level of experience and success of the broker. For example, a seasoned broker with a strong client base who can quickly generate a high volume of funding mortgages may only be charged around 20% in commissions by the brokerage. On the other hand, a new broker who requires extensive training and support to become proficient in the field may end up paying as much as 50% of their commission to the brokerage. In addition to these commission fees, other costs include charges for each client file, a monthly fee for Equifax registration, annual expenses for errors and omission insurance, and provincial registration fees to operate as a mortgage broker under regulatory guidelines.

When factoring in all these expenses, it becomes clear that the take-home pay for a mortgage broker can vary significantly based on their level of experience and the associated costs. For instance, a novice broker may only end up with $400 for every $1,000 earned in commission after deducting brokerage fees and operating expenses. In contrast, a well-established broker could take home $700 for every $1,000 in commissions. Additionally, income taxes should not be overlooked as they will further impact the net earnings of mortgage brokers at the end of the day.

Beginning your home journey?

Start with a low rate.

Chat with a nesto expert today, commission-free, and secure your rate.

Broker Buydowns

Buydowns are a financial strategy often utilized in mortgage lending, serving as a tool to lower the mortgage rate on a loan for a specified period or throughout its duration. A buydown lets the mortgage broker compensate the lender for a lower rate with the commissions they expect to earn from the deal. However, this buydown doesn’t work on 1:1 ratios – the most generous being 1:5, where for every 1 bps (1 basis point equals 0.01%) of rate, buydown equals 5 bps (5 basis points equals 0.05%). Typically, lenders price buydowns at 1:10 and 1:20 ratios, making it very costly for brokers to earn their full commission when buying down the rates from their lenders.

Another type of buydown involves preconstruction condos and homes, where the borrower or a third party, such as a seller or builder, pays an upfront fee to reduce the mortgage rate. This arrangement can significantly benefit borrowers by making their monthly payments more manageable while providing brokers with a unique opportunity to enhance their compensation. By facilitating a buydown, brokers may net additional fees or commissions, making it a mutually advantageous scenario for all parties involved.

The implications of buydowns extend beyond just immediate financial relief for borrowers; they also influence the overall dynamics of the mortgage market. For brokers, successfully negotiating a buydown can increase client satisfaction and loyalty, as borrowers appreciate the lower payments and the potential for long-term savings. However, brokers must carefully navigate the complexities of buydown structures, as they can affect the overall mortgage conditions and terms, affecting borrowers’ long-term financial outlook.

Commission Disclosure Regulations

Regulations are crucial in safeguarding consumers and ensuring ethical practices within the mortgage industry. Broker compensation can greatly influence brokers’ decisions and the guidance they offer to clients. In Canada, provincial regulators have established strict guidelines regarding broker commissions to protect consumers and enhance the quality of service they receive. These regulations emphasize the importance of transparency in disclosing broker compensation to borrowers, promoting trust and accountability in the mortgage process.

For instance, in provinces like Ontario and Quebec, mortgage brokers must disclose all fees upfront before any agreements are finalized. In Ontario, there are specific rules regarding fees for loans exceeding a certain amount, such as charging an initial fee or retainer for loans over $400,000. This fee structure ensures that clients know the costs involved and that payments are made to the brokerage rather than individual brokers, enhancing transparency and professionalism in the industry. By adhering to these regulations, brokers can build credibility and trust with clients while upholding fair practices in the mortgage sector.

Frequently Asked Questions

How do mortgage brokers get paid?

Banks and other prime lenders will pay a commission known as a finder’s fee to the broker directly based on a percentage ranging from 0.5 to 1.2% of the mortgage amount submitted. Borrowers must partially or fully pay their mortgage broker’s commissions when getting a subprime or private mortgage in Canada.

Do mortgage brokers charge fees?

Mortgage brokers charge a finder’s fee paid by the bank or another prime lender. The borrower will only be responsible for part or all of the broker’s finder fee if the mortgage is being arranged with a subprime or private lender.

Who pays the mortgage broker?

Prime lenders or banks pay mortgage brokers’ commissions. However, borrowers may also need to pay a mortgage broker depending on whether the mortgage solution provided is from a subprime or private lender.

How much do mortgage brokers make?

Mortgage brokers are paid between 0.5 and 1.2%, with the possibility of an additional 0.3% for volume bonuses. Under different arrangements, they can make up to 0.4% for trailing commissions or up to 0.6% on renewals.

How much do mortgage agents make?

Mortgage agents are paid between 0.5 and 1.2%, with additional volume bonuses. Typically, they are not salaried as they won’t be required to complete compliance, as in the case of mortgage brokers in Ontario.

How do mortgage agents get paid?

Mortgage agents are paid directly by banks and prime lenders, while the borrowers may entirely or partially pay the broker when arranging a subprime mortgage.

Are there hidden fees with mortgage brokers?

Depending on how a mortgage broker operates, there may be hidden fees. They could pass on ad-hoc costs, such as purview or credit history requests, or possibly charge an application fee. Before working with them, ask your mortgage broker to confirm hidden fees.

What costs do mortgage brokers have themselves?

Mortgage brokers can expect to pay around 30% to 60% of their commissions towards operating costs. A significant cost of being a broker is the franchise cost they may face if they work under a mortgage brokerage network. At the same time, many online brokerages in Canada, including nesto, pay their mortgage brokers wages as a salary. Advertising, technology, insurance premiums, provincial registration, and office rent are significant expenses that may reduce a typical mortgage loan broker’s salary.

Do mortgage brokers have a salary?

Mortgage brokers primarily earn commissions, so they only receive payment when they secure business. This creates a riskier environment for newcomers who lack a steady income. In Canada, some online brokerages like nesto offer their mortgage agents a salary instead.

When will a mortgage broker inform you of their fees?

In Ontario and Quebec, mortgage brokers must inform you upfront of any fees before an agreement can be signed.

In Ontario, mortgage brokerages can charge an initial fee or retainer for loans exceeding $400,000 to cover their services or any costs. This fee must not be paid in cash and must be directed to the mortgage brokerage rather than the individual mortgage agent or broker.

Final Thoughts

Understanding how mortgage brokers are paid is crucial for consumers. Mortgage brokers in Canada earn commissions from lenders, which can influence their recommendations. Knowing the difference between brokers, specialists, and advisors is essential, as their compensation structures vary. Additionally, factors like buydowns and regulatory oversight impact the mortgage process. With this knowledge, consumers can make informed decisions and find a mortgage broker who meets their needs. Use our insights to compare brokers, ask the right questions, and secure the best mortgage deal for your needs.

Want to find a mortgage broker with your best interests at heart? Reach out to nesto’s mortgage experts – professionally regulated and compensated by nesto as salaried employees. Ready to start your mortgage journey? Contact us today for expert advice and personalized mortgage strategy.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!