Income Needed to Buy a Home in British Columbia

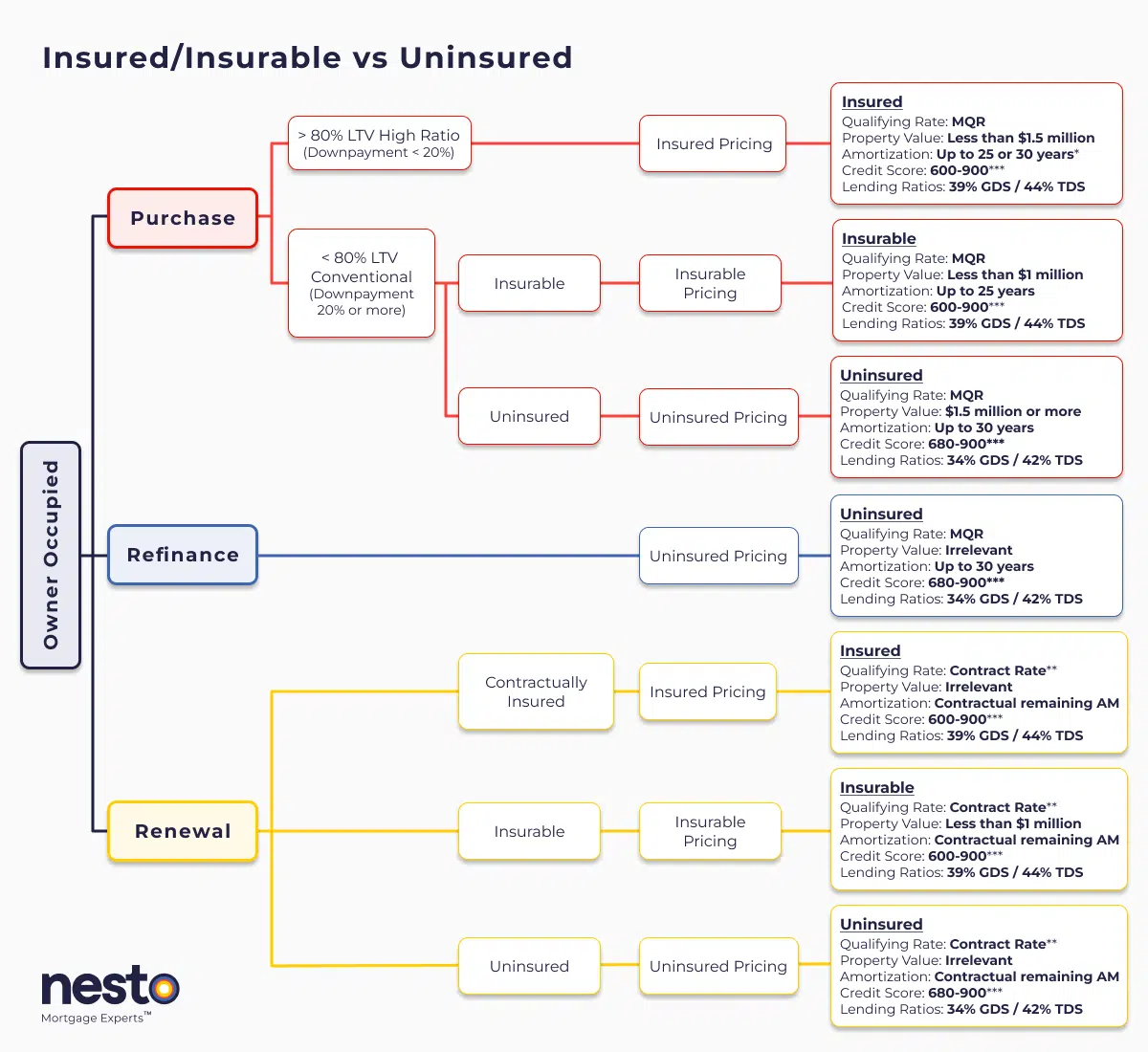

Buying a home in British Columbia is not just about musing over the higher purchase prices compared to the rest of the country. However, BC municipalities, especially Vancouver and Victoria, continue to offer some of the lowest property tax rates in Canada, making carrying costs more affordable than in municipalities where higher property tax rates are used to compensate for lower home prices. Mortgage approval depends on how lenders calculate qualifying income under federal stress-test rules, how much capital you can put into your downpayment, and whether your mortgage is insured, insurable, or uninsured.

Two households with the same income can receive different approval amounts depending on how their mortgages are structured. Below, we’ll break down how qualification works in BC and compare income requirements across the province using stress tested data updated monthly from CREA and BCREA.

Key Takeaways

- Mortgage approval in BC is based on stress-tested qualifying income, not your contract rate.

- Income requirements vary significantly between Vancouver, Victoria, and the provincial average, reflecting price differences.

- Downpayment size and insurability directly affect both qualifying income and the maximum approval amount.

Qualifying for a Mortgage in British Columbia

Details

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

How Mortgage Qualification Works In British Columbia

All new mortgage purchases and refinances in BC must pass the federal mortgage stress test. Borrowers must qualify at the minimum qualifying rate (MQR), which is the higher of 5.25% (benchmark rate) or their contract rate plus 2%. This qualifying rate is used strictly for approval purposes. It does not determine the actual interest rate you will pay.

Lenders then apply gross debt service (GDS) and total debt service (TDS) ratios. These debt service ratios measure how much of your income goes toward housing costs and total debts. As a result, qualifying income can vary materially even when the home price remains the same.

Debt service ratio flexibility depends on the mortgage type:

- Insured mortgages generally allow higher GDS and TDS limits.

- Insurable mortgages, typically with 20% downpayment but within insurance guidelines, fall in between.

- Uninsured mortgages often face tighter ratio limits, even though no insurance premium applies.

| Transaction Type & Limitation | Minimum GDS | Minimum TDS |

|---|---|---|

| Credit score (FICO) for the lowest-score borrower (between 650 and 680) | 32 | 40 |

| Uninsured refinance or uninsured purchase of a property valued at $1.5 million or more | 35 | 42 |

| Insured purchase with a down payment of less than 20% (also applies to insurable mortgages for new purchases and renewals) | 39 | 44 |

Insured, Insurable, and Uninsured Mortgages in BC

Mortgage structure, particularly the loan-to-value (LTV) ratio based on the borrower’s downpayment, plays a major role in affordability.

Insured mortgages apply when the downpayment is under 20% and generally allow higher qualifying ratios. Insurable mortgages meet insurer standards with a 20% downpayment and are typically limited to properties under $1M.

Uninsured mortgages avoid insurance premiums but are subject to tighter debt service limits, allowing purchases of homes valued at over $1.5 million. A 20% downpayment avoids mortgage insurance premiums.

Choosing the right mortgage structure in BC can affect both the income required to qualify and the affordability of the carrying costs.

Mortgage Default Insurance Requirements

Mortgage default insurance is mandatory for downpayments under 20%, impacting your mortgage qualifying amount and monthly costs. Default insurance often applies to higher-LTV loans, making high-ratio mortgages more affordable. Due to limitations on amortization periods, these mortgages require a smaller downpayment despite having a higher monthly payment.

| Loan-to-Value | Premium (25-year Amortization) | Premium (30-year amortization) |

|---|---|---|

| 80.01% to 85% | 2.80% | 3.00% |

| 85.01% to 90% | 3.10% | 3.30% |

| 90.01% to 95% | 4.00% | 4.20% |

British Columbia Housing Affordability Snapshot

The average home price in British Columbia is currently $886,200.

Under current qualifying rules, the income needed to buy an average-priced home in BC ranges from $142,974 to $169,046, depending on amortization, mortgage type, and insurance structure.

Actual monthly mortgage payments on an average-priced BC home range between $3,324 and $4,188, reflecting insured, insurable, and uninsured scenarios.

Income Needed Across Major BC Cities

Mortgage rules are applied consistently across British Columbia, but home prices differ widely between cities. That price difference directly impacts the qualifying income required.

Income Needed to Buy an Average-Priced Home in BC

Vancouver’s higher benchmark price naturally increases both the required mortgage balance and the qualifying income. Victoria also sits above the provincial average, while smaller markets typically fall closer to BC-wide affordability levels.

| Region | Average Home Price | Lowest Income Needed | Highest Income Needed |

|---|---|---|---|

| BC | $886,200 | $142,974 | $169,046 |

| Vancouver | $1,101,900 | $177,308 | $209,672 |

| Victoria | $861,600 | $142,405 | $168,142 |

Income Needed By Mortgage Amount In British Columbia

Some borrowers think in terms of mortgage size rather than home price. Looking at affordability by loan balance makes qualification easier to understand.

For every $800,000 of mortgage balance, qualifying income typically ranges from $168,654 to $210,599, depending on mortgage type, between fixed and variable, and the amortization.

For example:

- A $900,000 mortgage requires qualifying income between $189,351 and $236,496.

- A $1,000,000 mortgage produces stress-tested qualifying monthly payments between $6,408 and $5,899. These qualifying payments are calculated at the stress-test rate, not at the contract rate.

How Downpayment Scenarios Affect Mortgage Amounts In BC

The downpayment size changes both your loan-to-value (LTV) ratio and your insurance classification. It can reduce your mortgage balance, but it can also shift you into uninsured guidelines with stricter debt ratios.

Home Financing Scenarios Affecting Downpayment and Mortgage Amounts

| Scenario | Downpayment Needed | Mortgage Needed |

| Minimum Downpayment | $63,620 | $822,580 |

| 10% Downpayment | $88,620 | $797,580 |

| 20% Downpayment | $177,240 | $708,960 |

We’re curious…

Are you a first-time buyer?

Frequently Asked Questions (FAQ) About Mortgage Affordability In British Columbia

How much income do I need to buy a home in BC?

Income requirements depend on location, mortgage amount, downpayment, and existing debts. Province-wide, qualifying income in BC ranges from $142,974 to $169,046. Vancouver and Victoria often require higher qualifying incomes because benchmark prices are above the provincial average.

How does the mortgage stress test work in BC?

In BC, all new mortgage purchases and refinances must qualify at the higher of 5.25% (benchmark rate) or the contract rate plus 2%. This stress test rate is used for approval purposes only and does not affect your actual monthly payment.

How much income do I need for a $400,000 mortgage in BC?

Under current stress-test rules, qualifying income for a $400,000 mortgage ranges from $85,865 to $107,014, depending on whether the mortgage is insured, insurable, or uninsured and whether it uses a 25- or 30-year amortization. Typically, you’ll need slightly less income to qualify for a $400K mortgage in BC, as the above figures are based on Canada’s 1% average property tax rates, while BC has an average property tax rate as low as 0.29%.

How much mortgage can I afford with a 20% down payment in BC?

With a 20% downpayment, you avoid mortgage insurance premiums, and your mortgage balance is reduced. Based on BC’s average home price of $886,200, a 20% downpayment equals $177,240, resulting in a mortgage balance of $708,960 for an average-priced home. Final approval depends on your stress-tested income and your meeting of debt service ratios.

How much house can I afford on a $100,000 salary in BC?

Affordability depends on debt obligations, downpayment size, and location. Higher-priced markets, such as Vancouver, require higher qualifying income than the BC average. Under stress-test rules, lenders typically approve mortgage balances between 4 and 5 times gross household income, provided debt service ratios remain within limits.

For example, the income requirement to qualify for a $100,000 mortgage balance typically ranges from $23,774 to $29,325. You can use this as a factor to assess how much you’ll qualify for a $100,000 income.

Final Thoughts

Mortgage affordability in British Columbia depends on how income, mortgage balance, downpayment, and regional home prices interact under federal stress-test rules. Vancouver and Victoria require higher qualifying income than the provincial average. Still, the mortgage type and loan-to-value (LTV) ratio can materially affect approval outcomes across markets.

Comparing insured, insurable, and uninsured scenarios provides a clearer picture of realistic approval ranges before submitting an application. Structuring the right amortization and downpayment strategy can improve flexibility and align your mortgage with your long-term financial goals.If you are planning to buy in British Columbia, speak with a nesto mortgage expert to review your income, compare insured and uninsured options, and build a mortgage strategy tailored to your budget.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and the quality of their advice. nesto aims to transform the mortgage industry by providing honest advice and competitive rates through a 100% digital, transparent, and seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!