Income Needed to Buy a Home in the Atlantic Provinces

Buying a home in Atlantic Canada may appear more affordable than in larger provinces, but mortgage approval is subject to the same federal rules nationwide. Lenders approve mortgages based on stress tested qualifying income, mortgage balance, downpayment structure, property taxes, and debt service ratios. Lower home prices do not improve mortgage affordability, as they depend on the borrower’s qualifying income, while total carrying costs depend on after-tax income and the actual monthly payment.

We’ll explain how mortgage affordability and qualification work across New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador, and compare income requirements across provinces and key Atlantic cities using the latest CREA data.

Key Takeaways

- Mortgage approvals in Atlantic Canada are stress tested at the minimum qualifying rate, not the contract rate.

- Income requirements vary across NB, NS, PEI, and NL due to differences in home prices and property tax rates.

- The downpayment structure and mortgage default insurability materially affect the maximum approval.

Qualifying for a Mortgage in Atlantic Canada

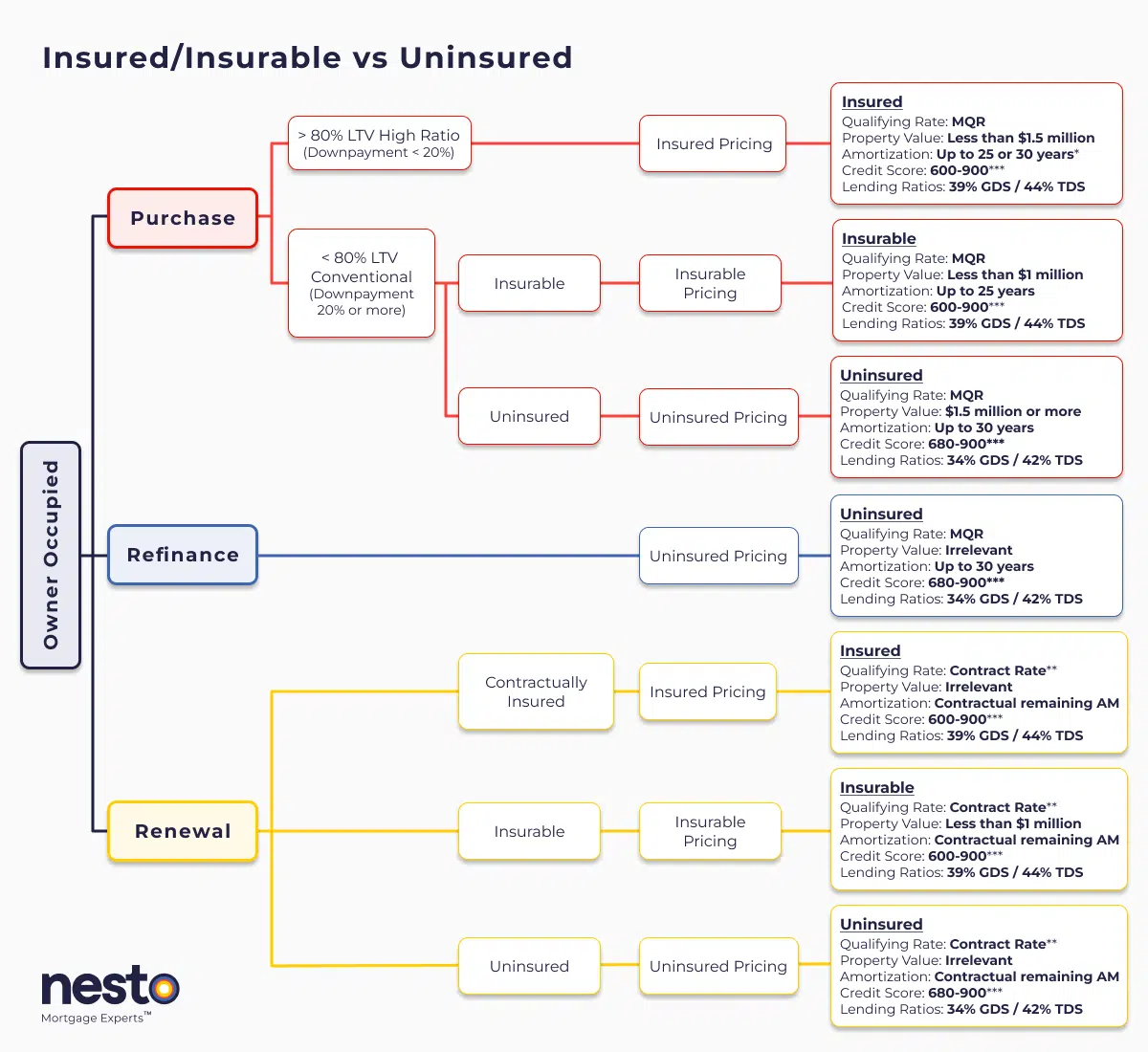

Details

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

How Mortgage Qualification Works in Atlantic Canada

All new mortgage purchases and refinances in Atlantic Canada must pass the federal stress test. Borrowers qualify at the higher of 5.25% or their contract rate plus 2%. This minimum qualifying rate (MQR) is used strictly for approval purposes and does not determine the borrower’s actual monthly payment.

Lenders apply gross debt service (GDS) and total debt service (TDS) ratios to ensure housing costs and existing debts remain within federally approved thresholds. Debt service ratio flexibility depends on the mortgage structure you choose, which affects your qualifying income requirement.

| Transaction Type & Limitation | Minimum GDS | Minimum TDS |

|---|---|---|

| Credit score (FICO) for the lowest-score borrower (between 650 and 680) | 32 | 40 |

| Uninsured refinance or uninsured purchase of a property valued at $1.5 million or more | 35 | 42 |

| Insured purchase with a down payment of less than 20% (also applies to insurable mortgages for new purchases and renewals) | 39 | 44 |

Insured, Insurable, and Uninsured Mortgages in the Atlantic Provinces

Mortgage structure, particularly the loan-to-value (LTV) ratio based on the borrower’s downpayment, plays a major role in affordability.

Insured mortgages apply when the downpayment is under 20% and generally allow higher qualifying ratios. Insurable mortgages meet insurer standards with a 20% downpayment and are typically limited to properties under $1M. Uninsured mortgages avoid insurance premiums but are subject to tighter debt service limits, allowing purchases of homes valued at over $1.5 million.

Choosing the right mortgage structure in the Atlantic Provinces can affect both the income required to qualify and the affordability of the carrying costs.

Mortgage Default Insurance Requirements

Mortgage default insurance is mandatory for downpayments under 20%, impacting your mortgage qualifying amount and monthly costs. Default insurance often applies to higher-LTV loans, making high-ratio mortgages more affordable. Due to limitations on amortization periods, these mortgages require a smaller downpayment despite having a higher monthly payment.

| Loan-to-Value | Premium (25-year Amortization) | Premium (30-year amortization) |

|---|---|---|

| 80.01% to 85% | 2.80% | 3.00% |

| 85.01% to 90% | 3.10% | 3.30% |

| 90.01% to 95% | 4.00% | 4.20% |

Atlantic Canada Housing Affordability Snapshot

While the Atlantic provinces generally have lower benchmark rates than Ontario and BC, approval is still based on income under the federal stress test rules.

New Brunswick’s average home price is $329,400, with qualifying income ranging from $65,972 to $77,129.

Nova Scotia’s average home price is $417,700, with qualifying income between $83,046 and $97,125.

Prince Edward Island’s average home price is $371,700, with qualifying income between $74,144 and $86,700.

Newfoundland and Labrador’s average home price is $334,000, with qualifying income between $62,483 and $73,292.

Income Needed Across Atlantic Cities

City-level affordability reflects local home pricing differences within each province. Mortgage qualifying rules are consistent. Home prices and property tax rates differences create qualifying income differences

Income Needed to Buy an Average-Priced Home in Atlantic Canada

| Cities | Average Home Price | Lowest Income Needed | Highest Income Needed |

|---|---|---|---|

| Fredericton | $351,800 | $72,865 | $85,056 |

| Moncton | $379,800 | $73,453 | $86,019 |

| Saint John | $326,100 | $69,858 | $81,422 |

| Halifax | $545,200 | $93,617 | $110,303 |

| St.John’s | $395,500 | $71,799 | $84,348 |

Income Needed by Mortgage Amount in Atlantic Canada

Some borrowers think in terms of mortgage balance rather than purchase price. You’ll need slightly more income to qualify for each $100K mortgage in Atlantic Canada, as the above figures are based on Canada’s 1% average property tax rate. In comparison, the Atlantic provinces have average property tax rates above 1%.

| Province | Property Tax rate |

|---|---|

| New Brunswick | 1.58% |

| Nova Scotia | 1.6% |

| Prince Edward Island | 1.59% |

| Newfoundland and Labrador | 1.07% |

The income required to qualify for a mortgage is based on stress tested monthly payments, not actual contract rate payments.

For every $100,000 of mortgage balance, qualifying income typically ranges from $23,774 to $29,325, depending on mortgage structure and amortization.

For a $200,000 mortgage, qualifying income ranges from $44,471 to $55,221.

For a $300,000 mortgage, qualifying income ranges from $65,168 to $81,118.

How Downpayment Scenarios Affect Mortgage Amounts in Atlantic Canada

Your downpayment size directly affects the mortgage amount you need and the default insurance status of your loan. A 20% downpayment avoids mortgage default insurance premiums but is qualified under stricter uninsured lending guidelines. Minimum downpayments increase your mortgage amount but fall under insured or insurable lending guidelines, allowing more flexibility with debt service ratios.

Home Financing Scenarios Affecting Downpayment and Mortgage Amounts

| Province | Scenario | Downpayment Needed | Mortgage Needed |

|---|---|---|---|

| New Brunswick | Minimum Downpayment | $16,470 | $312,930 |

| 10% Downpayment | $32,940 | $296,460 | |

| 20% Downpayment | $65,880 | $263,520 | |

| Nova Scotia | Minimum Downpayment | $20,885 | $396,815 |

| 10% Downpayment | $41,770 | $375,930 | |

| 20% Downpayment | $83,540 | $334,160 | |

| Prince Edward Island | Minimum Downpayment | $18,585 | $353,115 |

| 10% Downpayment | $37,170 | $334,530 | |

| 20% Downpayment | $74,340 | $297,360 | |

| Newfoundland and Labrador | Minimum Downpayment | $16,700 | $317,300 |

| 10% Downpayment | $33,400 | $300,600 | |

| 20% Downpayment | $66,800 | $267,200 |

We’re curious…

Are you a first-time buyer?

Frequently Asked Questions (FAQ) About Mortgage Affordability in Atlantic Canada

How much income do I need to buy a home in Atlantic Canada?

Across Canada’s Atlantic region and within each province, home prices and mortgage qualification requirements vary widely. Income requirements depend not only on the province alone but also on the city or municipality, mortgage balance, and downpayment structure.

How does the mortgage stress test apply in Atlantic Canada?

The mortgage stress test is a federal requirement for prime lending and applies the same across all provinces and territories. All borrowers must meet the minimum qualifying rate (MQR), which is the higher of 5.25% (the benchmark rate) or their contract rate plus 2%. This qualifying rate is used only for approval and does not determine the borrower’s actual payment.

How much income do I need for a $400,000 mortgage in Atlantic Canada?

Under current stress-test rules, qualifying income for a $400,000 mortgage ranges from $85,865 to $107,014, depending on amortization and insurance classification. Typically, you’ll need slightly more income to qualify for a $400K mortgage in Atlantic Canada, as the above figures are based on the nationally averaged 1% property tax rate; however, each of the 4 Atlantic provinces has a higher average property tax rate.

How much mortgage can I afford with 20% down in Atlantic Canada?

A 20% downpayment reduces the mortgage balance and avoids insurance premiums. Final approval depends on the stress tested qualifying rate, the applicant’s household income, the debt service ratios used by the applicant’s mortgage lender, and the property taxes in the province/municipality where the subject property is located.

Typically, you’ll qualify for a mortgage amount of 3.5 to 4.5 times your household income. We’ll use Nova Scotia as an example since it has the highest property prices and property tax rates among the Atlantic provinces. The average home price in Nova Scotia is $417,700.

Currently, a 20% downpayment would set you back $83,540. You’ll need to qualify for a mortgage balance of $334,160 if you’d like to buy the average-priced home in Nova Scotia.

How much house can I afford on a $100,000 salary in Atlantic Canada?

Your mortgage approval depends on your debts, downpayment compared to the home purchase price. Under federal stress test rules, many borrowers qualify for mortgage balances between 4 and 5 times gross household income, provided their debt service ratios remain within lender limits.

As a reference point, each $100,000 of mortgage balance typically requires qualifying income between $23,774 and $29,325 under current stress test rules.

However, these numbers assume a 1% property tax rate; the qualifying income required will vary by province. With Nova Scotia’s 1.6% property tax rate, the income needed to qualify for each $100K mortgage balance should be slightly higher, whereas New Brunswick, PEI and Newfoundland will require more income to qualify with their property tax at 1.58%,1.59% and1.07%, respectively.

Final Thoughts

Mortgage affordability in Atlantic Canada is determined by provincial average home prices, down payments, qualifying interest rates, and federal debt service rules. Although benchmark home prices in NB, NS, PEI, and NL are often lower than in larger provinces, lenders apply the same qualifying criteria nationwide.

Comparing provincial averages, city-level affordability, and mortgage balance scenarios provides a clearer view of realistic approval outcomes. Adjusting your downpayment approach, amortization length, and insurance type can materially influence both qualifying income and long-term affordability.

If you are planning to buy in Atlantic Canada, speak with a nesto mortgage expert to review your income, compare insured and uninsured options, and structure a mortgage strategy that aligns with your goals and regional market realities.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and the quality of their advice. nesto aims to transform the mortgage industry by providing honest advice and competitive rates through a 100% digital, transparent, and seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!