Find the

Best Mortgage

Rates in Canada

Mortgage

No rates at the moment

Compare current mortgage rates across Canada

No matter where you are in Canada, we can tell you the best mortgage rates. Instantly get low rates for everything from 3-year fixed-rate mortgages to 5-year variable-rate mortgages.

Rates shown here are for insured mortgages from $700k to less than $925k. Some conditions apply.

For visualization purposes only. Get a clearer view with our Mortgage Payment Calculator.

Mortgage rate options

You have lots of options when it comes to mortgage rates. Finding what best suits your needs before committing yourself to one. To help, we have a handy table that outlines the most popular rate terms and their risk levels.

Rates shown here are for mortgages between $700k and $925k. Uninsured rates apply to mortgages of $900k and over. Some conditions apply. Request a quote to get your personalized rate.

The loan-to-value (LTV) ratio compares your mortgage amount with the property’s appraised value. The higher your down payment, the lower your LTV ratio.

*Applicable only with an accepted offer to purchase or renewal (not applicable for pre-qualifications or refinances).

nesto’s lowest vs Big Bank insured mortgage rates

Results

For today, {date}, nesto’s {term}-year {type} mortgage rate is {bps} bps ({bps_percent}) lower than the similar average at Canada’s Big 6 Banks. On a {mortgage_ammount} mortgage over a {amortization_period}-year amortization, with nesto your monthly payment would be {nesto_monthly_payment}, saving you up to {monthly_savings} on your monthly payment. This equals {savings_interest} in interest saved while also paying down an extra {extra_payment} on principal over your term.

Top Big

Bank Rates

The top big bank rates are all in one easy-to-view table. See their rates, then beat their rates (or get $500) with nesto’s low rate guarantee.

Are you a first-time buyer?

Province

Find the right home

for your budget

Not sure where to start? Check out our tools to get started

Today’s Mortgage Interest Rate in Canada

For Tuesday, July 1, 2025, here are the trends for the average Big Bank interest rates in Canada:

Canada’s average 5-year insured fixed mortgage interest rates are

Canada’s average insured mortgage interest rates for 5-year variable and adjustable mortgages are

Canada’s average 3-year fixed-rate insured mortgage interest rates are

Canada’s average 3-year insured rates for variable and adjustable mortgages are

1 basis point is 1/100 of a percentage point, equaling 0.01%.

What are the best current mortgage rates in Canada today?

Canada’s average insured 5-year fixed mortgage interest rates at big banks is

Canada’s average insured 5-year variable and adjustable mortgage interest rates at big banks is

Canada’s average insured 3-year fixed mortgage rate at the big banks is

Canada’s average insured 3-year variable and adjustable mortgage interest rates at big banks is

Note: The average rate is calculated based on the posted rates of the six biggest lenders in Canada, which together make up over 70% of the retail mortgage market in the country. These six biggest lenders are the chartered banks Toronto-Dominion Canada Trust (TD), Royal Bank of Canada (RBC), Bank of Montréal (BMO), Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CIBC), and National Bank of Canada (NBC).

What is the lowest mortgage rate in Canada today?

Canada’s average posted 5-year conventional fixed mortgage rate is 6.09%. The lowest 5-year fixed rates are typically reserved for insured prime lending, with nesto at

Canada’s variable and adjustable rate discounts (or added premiums) on the 5-year term typically range from 0.50% to 1.50% from the Bank prime rate, currently at 4.95%. The most discounted variable and adjustable rates are generally reserved for insured prime lending, with nesto at

Canada’s average posted 3-year conventional fixed mortgage rate is 6.05%. The lowest 3-year fixed rates are typically reserved for insured prime lending, with nesto at

Canada’s variable and adjustable rate discounts (or added premiums) on the 3-year term range from 0.15% to 1.50% from the Bank prime rate, currently at 4.95%. The most discounted variable and adjustable rates are generally reserved for insured prime lending, with nesto at

Canada’s average 2-year fixed insurable mortgage rate is

Canada’s average 3-year fixed insurable mortgage rate is

Canada’s average 4-year fixed insurable mortgage rate is

Canada’s average 5-year fixed insurable mortgage rate is

Canada’s average 7-year fixed insurable mortgage rate is

Canada’s average 10-year fixed insurable mortgage interest rates is

Note: The average rate is calculated based on the posted rates of the six biggest lenders in Canada, which together make up over 70% of the retail mortgage market in the country. These six biggest lenders are the chartered banks Toronto-Dominion Canada Trust (TD), Royal Bank of Canada (RBC), Bank of Montréal (BMO), Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CIBC), and National Bank of Canada (NBC).

Should I choose a 5-year term or a 3-year term in Canada?

Typically, 3-year fixed mortgages carry 20 to 40bps (1 basis point equals 0.01%) lower interest rates than 5-year terms. In late 2022, this gap has shrunk further and even inverted to the point that today, lenders offer 3-year rates more than 30bps higher than 5-year rates. Usually, 3-year rates are lower, and the discount you get with a 3-year mortgage term can still provide significant savings in your monthly mortgage payments.

Choosing a shorter mortgage term is advisable if you anticipate decreasing interest rates in Canada. A shorter term would allow you to renew your mortgage again at even lower interest rates. However, if your expectations are unmet, you may be in for a stark surprise with a need to renew at higher interest rates. Generally, experts suggest shorter terms when rates are expected to decline, whereas longer terms are more appropriate when rates are predicted to rise.

As of the last week of December 2023, rates are expected to stay higher as the Bank of Canada’s fight against inflation is ongoing. The bond market expects rates to go down in the summer, meaning that we’re reaching the peak of the rate cycle, and fluctuating rates such as adjustable or variable mortgage rates may be the way to go. However, as the direction of the Canadian market diverges from the US, it could also bring economic uncertainty as US rates stay higher for longer due to their heated stock market. Canada may have some rate volatility until the US reverses course on its rate hikes. Typically, the Bank of Canada leads rate-setting direction as Canada’s smaller economy generally succumbs to changes much sooner than the bigger US economy.

This news should prompt you to make a decision based on your preferences. If you are looking for stability and predictability over a more extended period, then going for a 5-year fixed rate is the best option. If you want to reduce your risk while saving money, choosing a 3-year fixed rate may help you overcome this uncertainty until you can get a lower fluctuating rate. If you’re okay with risk and don’t mind if your mortgage payment rises before it falls, opting for a variable or adjustable rate might be better. If you’re risk-averse, we suggest locking into today’s lower fixed rates, providing the certainty you want over your 5-year term.

The most important consideration is your financial plan. If your long-term plan involves moving out of Canada or expecting an inheritance you’d like to use to pay off your mortgage sooner, you should choose a shorter term. Find a lender with suitable mortgage porting terms if you wish to switch homes before your term ends.

Mortgage Industry Insights

On September 4th, the Bank of Canada (BoC) cut Canada’s overnight policy rate to 2.75%. The mortgage rate forecast suggests it could reach 2.75% (based on BoC neutral rate projection) by the end of 2025, aligning with a similar downward revision to the neutral rate in the US Federal Reserve. Read the Bank of Canada’s press release and our post-rate announcement insights.

Future bond markets are now pricing another 57% probability of a 25 basis point (0.25%) and 47% probability of a 50 basis point (0.50%) rate cut at the Bank of Canada’s policy rate announcement on October 23rd. By the December 11th policy rate announcement, the likelihood of a rate cut will change to a 97% chance of a 25 basis point (0.25%) cut.

How do bonds affect mortgage rates?

Bonds, specifically Canada Mortgage Bonds (CMBs), are considered mortgage-backed securities (MBS). Bonds are debt securities issued by governments, such as the Government of Canada, to fund its growth and projects, including homebuilding and homebuying activity. Institution investors and pension funds purchase bonds from the government and receive interest payments until the bond’s maturity.

If interest rates go up in Canada, the prices of current bonds usually go down, even if the coupon rates remain the same, leading to higher bond yields. On the other hand, if interest rates in Canada go down, the prices of existing bonds typically go up, with the coupon rates staying constant, resulting in lower yields on those bonds.

The 5-year fixed mortgage rates in Canada follow 5-year Canadian bond yields plus a spread set by the banks. Bond yields can change direction based on market sentiment and economic factors like inflation and employment. While this won’t change your rate if you’re already locked into a 5-year fixed rate, it can change interest rates for new 5-year fixed mortgages. Simply put, mortgage rates follow the direction of bond yields, with an additional 1 to 2% spread to cover the lender’s risk premium and funding costs.

How many Canadian mortgages are at risk of payment shock?

Economists and policymakers predict that slightly more than $900 billion worth of mortgages may experience payment shock at renewal. This accounts for around 60% of all mortgages held at chartered banks set to be renewed from 2024 to 2026. Most Canadians are expected to renew their mortgages in 2026, with about $400 billion, or 26% of chartered bank mortgages, up for renewal.

According to CMHC, around 2.2 million Canadian mortgages, approximately 45% of all outstanding mortgages, will need to be renewed between 2024 and 2025. When these borrowers renew their mortgages, interest rates will be significantly higher, as many of these mortgages were secured at record-low interest rates between 2020 and 2021 during the pandemic.

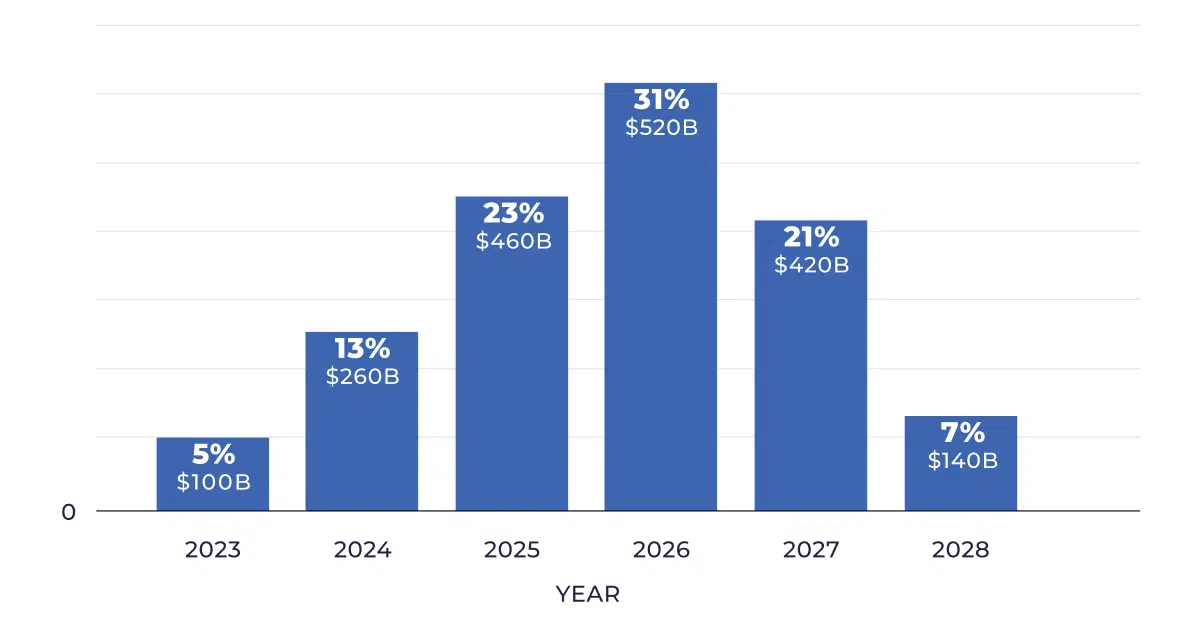

As reported by CMHC, around $2 trillion in mortgage debt needs to be paid off. In 2023, only 5% of this debt was up for renewal. This year, 13% of the debt is scheduled for renewal. However, the percentage will increase significantly in the coming years, with 23% in 2025, 31% in 2026, and 21% in 2027.

What is the Great Renewal?

The Great Renewal is a term nesto coined to refer to the massive number of Canadian mortgages expected to be renewed between 2025 and 2029.

At the onset of the pandemic, homeowners used low mortgage rates to renew or refinance their mortgages. Over 30% of homeowners chose to renew into a variable rate instead of the historically popular fixed rate. As mortgage rates were historically low for most of 2020 and 2021, many homebuyers could qualify for a higher mortgage amount to enter the surging real estate market, even more so on a variable rate, as these rates were lower than fixed rates at the time.

Policymakers and analysts expect approximately 50% of all mortgages to come up for renewal in 2025 and 2026. Mortgage interest rates are expected to stay elevated, creating payment shock at renewal time for those borrowers.

Find out what experts predict for mortgage rates in nesto’s mortgage forecast.

Average Bank Posted Mortgage & Prime Rate History

Let’s go back in time. Here’s a historical overview of changes to the posted and prime mortgage rates in Canada since 1980.

Source: bankofcanada.ca

*Most Recent Prime Rate Shown

Source: bankofcanada.ca

Learn About Rates & Mortgages

Welcome to our Frequently-Asked Questions (FAQ) section, where we answer the most popular questions our nesto mortgage advisors receive daily, designed to help you make informed mortgage decisions every time you need a new mortgage or to renew/refinance an existing one.

Understanding Today’s Best Mortgage Rates in Canada

Mortgage shopping can be confusing, especially if you’re a first-time home buyer. There are a lot of different terms and options out there, and it can be tough to know where to start. This section will cover some of the most common questions and terms when shopping for a mortgage in Canada. By the end, you should better understand the process and related terms to help you find the best mortgage rate in Canada.

What is a mortgage?

A mortgage is a loan that can be used to purchase property, which acts as security for the loan. A mortgage tends to be for a large sum and is usually paid off over 25 or 30 years. Even though the property is the collateral, the borrower retains ownership while paying off their mortgage.

What is a mortgage rate?

A mortgage rate, or the mortgage interest rate, is the percentage of interest you’ll pay on your borrowed mortgage amount throughout your mortgage. Canadian mortgage rates can be fixed, staying the same for the term, or variable, fluctuating based on a discount from the benchmark interest rate. The benchmark interest rate is always the lender’s prime rate for variable rates, usually based on a premium added to the Bank of Canada’s (BoC) key policy interest rate.

What are current mortgage rates?

The best 5-year fixed and 5-year variable mortgage rates in Canada are

How often are nesto’s mortgage rates updated?

Our best rates are updated regularly each time there is a change in the pricing of rates from capital markets. Capital markets is a broad term for the secondary money market where buyers and sellers exchange investments and debt instruments.

nesto can accomplish this thanks to our capital markets division, tasked with finding the best mortgage rates for our clients, and our advanced technology, which empowers us to ensure you always have the latest rate information at your fingertips. We also want to be transparent from the beginning, so the rate you see is the rate you get.

How often do Canadian mortgage rates change?

Fixed rates are based on the bond market and can fluctuate more regularly, although once you have locked in your fixed rate, you’ll pay the same interest throughout your term.

Variable rate discounts are based on short-term bonds, treasury bills and sovereign debt ratios. Variable mortgage rates in Canada will fluctuate regularly. These factors remain unimportant to the borrower once they lock in their discount from their lender’s prime rate. Their rate will fluctuate as often throughout the year that the Bank of Canada (BoC) updates its key policy overnight rate, which their lender will match by changing its prime lending rate.

Once most chartered banks follow suit on changes to their prime rate, nesto will follow suit to match. Typically, this will happen overnight when the BoC changes its key policy overnight rate.

Are you a first-time buyer?

How to Find the Best Mortgage Rates in Canada

As you begin looking for your dream home, you may wonder how to qualify for a mortgage in today’s competitive real estate market. It is important to note that qualifying for a mortgage in Canada will depend on several different factors, including your current financial situation and your credit score.

Should I complete a pre-approval or a pre-qualification?

Pre-approvals and pre-qualification are both an analysis of your borrowing capacity concerning your income, credit, conditions, down payment, savings, and net worth minus the down payment and closing costs. They do not consider the collateral (or property) as they are assessed before finding a subject property. Pre-qualifications do not have a rate or discount attached to your qualification, such as in the case of a variable rate.

A rate hold will give you peace of mind while shopping for a property in the case of a pre-approval. Pre-approvals with rate holds will cost the lender to hold the money for you at a specific rate/discount. Some lenders that offer the best rates do not offer pre-approvals with rate holds; conversely, they offer pre-qualifications without rate holds to keep the cost to buy money down for live mortgages where clients have an accepted offer on a property.

Most lenders that offer a pre-approval with a rate hold will attach a premium to this rate, meaning that if you return to that lender, you will be locked into that higher rate even if rates stay down. Therefore, lenders with the best rates offer only live rates, which can only be locked in once you have an accepted offer on a specific property. Please speak to our commission-free nesto expert to find the most suitable solution for your financial situation.

What is a mortgage rate hold?

Depending on the rate offered, lenders will hold your rate for a set time – say 60 to 180 days. Most lenders will add a premium to the rate for holding it longer.

Sometimes, lenders advertise or offer a quick close rate for the mortgage to be funded within 45 or 60 days. The quick close rate is a special offer with a limited supply of money at that rate.

A mortgage rate hold allows clients to lock in a rate at either the pre-approval or renewal / refinance stage. Once qualified, the lender will issue you a commitment to hold a rate for a fixed-rate mortgage or a discount from their prime rate for the variable-rate mortgage.

Mortgage Insights To Save You Money

Securing a mortgage in Canada can be overwhelming, and it is important to understand the various features and benefits you should look for when selecting a lender. This includes current market rates, an easy application process, and favourable terms and conditions that set your mortgage apart. Considering these common insights, you can better differentiate the most important ideas to land the best mortgage for your needs today.

What is the most common mortgage term length in Canada?

Canada’s most common mortgage term is 5 years, specifically the 5-year fixed-rate mortgage. While this isn’t always the most economical option for everyone, it has become the most popular.

A lot can happen in 5-years, so consider your future goals when selecting each mortgage term. If you plan to break your mortgage early, you could face some high early payout penalties, so consider short and long-term goals when discussing your mortgage with an advisor.

Is a variable rate better than a fixed rate?

A variable rate mortgage has proven to save borrowers more money than a fixed rate over time. Every borrower’s circumstances and goals differ; therefore, a mortgage expert should thoroughly discuss all current financial restraints and future considerations before deciding on the most suitable mortgage solution.

With a variable mortgage, the interest rate will fluctuate depending on benchmark rates, whereas a fixed rate remains the same throughout the mortgage term. A fixed-rate benefits budgeting and offers financial stability, given that mortgage payments always remain the same.

Deciding on a variable or fixed rate is a question of personal choice and risk appetite. We would recommend speaking with a mortgage professional to assess any material risks that may pose a concern for you over the term of your mortgage.

While variable mortgages have proven to be more cost-effective over time than fixed mortgages, some people prefer the certainty of having the same payment throughout the mortgage term.

For a first-time home buyer (FTHB) who is getting used to all their new bills related to owning a home, it is recommended that they choose a fixed rate to provide some stability during the first term of their mortgage. By making their biggest monthly obligations (mortgage, condo/maintenance/strata fees and property taxes) static amounts, they can take the time to put together a financial plan and start to put aside some money towards their emergency savings.

Which variable rate mortgage is more suitable for me? ARM or VRM?

There are two variable-rate mortgages: those with static payments and those with variable or fluctuating payments. Static payment variable rate mortgages are called variable rate mortgages (VRM). In contrast, variable-rate mortgages with a variable payment, where the payment adjusts with changes in the lender’s prime rate, are more accurately called adjustable-rate mortgages (ARM). Commonly, they are both known as variable-rate mortgages.

While it is a personal choice if you prefer an adjustable versus a variable mortgage, your choice will be influenced by the trajectory of rates in the current market, your risk appetite due to that trajectory and, of course, the need/use for that mortgage.

For instance, if you’re using this mortgage to purchase a rental/investment property, you may want a variable-rate mortgage as your interest will increase. You can have more interest to write off against your rental income.

The variable rate mortgage type that suits you depends on your risk and situation. Many clients holding a mortgage for an investment property may decide to keep the interest portion of their mortgages higher than the principal portion, as interest paid on mortgages for investment properties can be used to reduce the overall income taxes on the income generated.

For an investment property where the borrower’s goals, risk appetite, and cash flow allow, it may be prudent to choose a VRM. In most cases where the mortgage is used for a principal residence or their goal is to pay off the mortgage sooner, it may be wiser to choose an ARM.

How do I lock my mortgage rate?

The ability of a variable rate mortgage to be locked into a fixed rate for the duration of its term is a mortgage feature known as convertibility. Most mortgages will offer this feature, but there may be restrictions from lender to lender, so it is best to speak with your advisor to understand the solution you are getting.

It is important to understand the costs and benefits before converting your mortgage. You will want to ensure that any premium you pay on the higher fixed rate is worth it for the potential downside risk with the variable rate mortgage. Doing a cost of borrowing analysis between your options is imperative before moving ahead. The changeover should make economic sense within your mortgage term.

What are some mortgage features and benefits?

Taking advantage of your prepayment options, even minimally, can save you serious interest while helping pay down your mortgage faster.

The portability feature can let you transfer your mortgage to a new property should you have an unplanned need to move in the middle of your term without paying the penalty. This feature can come in handy if you have a large penalty to break your mortgage or a really low rate compared to the current market, so it may be worthwhile to port your rate to your new mortgage.

While not the most sought-after feature, assumability can allow a buyer to take on the seller’s mortgage upon approval by your lender when they purchase your home. In most cases, this means no penalty for you and possibly a low rate for them if you don’t need that mortgage on your new home or are moving outside the country.

Convertibility is another valuable feature that exists on mortgages. This feature allows you to early renew your variable rate mortgage (VRM) or an adjustable-rate mortgage (ARM) at any point in your term to a fixed-rate mortgage. Depending on the lender, you may be offered different options, such as renewing to a fixed rate at the remaining term only, renewing back to a 5-year term only, or renewing to any term as long as the term remaining is not decreased.

Not all lenders will offer all these features on all their financing solutions. Some lenders will offer you features a la carte based on how you want them to price your mortgage rate. nesto makes it easy as we offer all these features on all of our mortgages, even our limited-feature mortgages.

Are you a first-time buyer?

Going Beyond The Rate

When purchasing a home, many steps are involved in the mortgage process. This section will outline those steps and provide tips for successfully navigating them. The most important step is determining which mortgage is right for you. Taking the time to understand the various solutions and what each has to offer can ensure that you make sound decisions throughout the entire process and ultimately end up in the home of your dreams!

Should I choose the lender with the lowest rate?

The lowest rate is not always the best option for everyone. Depending on your short and long-term goals for owning your home, it may be wiser to choose the mortgage solution that works best for you. The best solution for you may not be the lowest rate option. As the mortgage rate is priced based on the risk the borrower represents for the lender, it may be best to review the restrictions attached.

There may be restrictions tied to a hefty penalty if the borrower pays out the loan before maturity. Restrictions can come in the form of features, benefits, and bigger penalties than the usual 3-month interest or interest rate differential.

You may have to give up features such as prepayments or porting privileges when opting for the lowest-rate product. Without the ability to port, penalties on these types of lowest-rate mortgages can be quite daunting, such as a percentage of the mortgage balance at the time of payout.

Please speak to one of our commission-free mortgage experts. They can show you how to save even more with a full-feature mortgage by making small changes to your mortgage repayment plan.

What are mortgage prepayment options?

Prepayment privileges enable you to make extra payments directly to pay off your principal. Prepayment options come in many forms and have different limitations based on your lender, but overall if you choose to exercise them, they will save you time and money so you can become mortgage-free faster.

There are several ways you can take advantage of prepayments, including:

- Lump-sum payments – This option will come either in the form of one single lump sum up to 10%, 15%, or 20% either once in a year or once a year on the anniversary date of the mortgage; or very liberally you can make multiple lump sum payments throughout the year without exceeding the allowable amount.

- Double Up Payments – This option lets you automate the lump sum payments to double up and match your regularly scheduled payments. The savings will be exponential if you’re already on an accelerated payment plan.

- Increase regular payments – If you have any prepayment privileges with your mortgage, you will have a corresponding option for lump sum payments to increase your regular payments by the same percentage on the anniversary date.

- Payment frequency – This option lets you accelerate your weekly or biweekly payment. This means that the semi-monthly payment amount is applied 24 times a year and 26 times a year for biweekly accelerated payments. In contrast, weekly accelerated payments are half the semi-monthly applied 52 times yearly. Although technically not considered a prepayment privilege, accelerated payments can shave off a couple of years over the life of the mortgage.

Depending on the lender and the mortgage restrictions, not all prepayment privileges will be standard. Most lenders will have a full-featured mortgage that gives you all privileges and a restricted or limited-feature mortgage that gives you none. Some lenders will price a mortgage interest rate based on the number of features it provides, while others will use an a la carte approach in pricing each file individually.

nesto has some of the most simplified features available. We give you all options on our full-feature mortgages, including making a minimum lump sum for as little as $100 with any of your regularly scheduled payments.

Albeit our limited-feature mortgages, we do not give any prepayment privileges. The pricing is the same for all clients who qualify and get either of these mortgages. We prefer to have clients discuss their short- and long-term goals with our mortgage experts to ensure that their solution suits their unique needs, as not all mortgage solutions are suitable for everyone.

How do I compare mortgage rates in Canada?

When comparing mortgage rates in Canada, it’s important to look at similarities and differences between the comparable types and terms. Comparisons must be made with complementary solutions, meaning a fixed rate with another fixed rate and vice versa. The mortgage term must be aligned well – compare a 5-year term with a 5-year one.

Then you have to look beyond the rate, the features, benefits and restrictions. Many low-rate mortgages have restrictions – such as pre-emptive qualifying criteria and prepayment penalties that are outside of the normal if paid off or refinanced before the end of its term. Some restrictions go as far as to inhibit the ability to payout or renew early by adding a bona fide sale clause – meaning you can’t break the mortgage except to sell the property to an unrelated party.

What are Bank of Canada mortgage rates?

The Bank of Canada (BoC) doesn’t set Canadian mortgage rates. But it does impact them directly and indirectly. The Bank sets the benchmark overnight target for the Policy Rate, which directly impacts all the Prime Rates in Canada, also known as the Bankrate. When the economy is strong, the BoC could raise the Policy Rate to keep inflation from rising above its 2% target. Likewise, when the economy is weak, the Bank could lower the Policy Rate to keep inflation from falling below its 2% target.

The Policy Rate directly impacts all the prime rates in Canada, which in turn directly impacts all the variable mortgage rates in Canada. However, fixed mortgage rates are determined by Bond yields which are priced and traded on the open market.

Bond yields can change direction based on market sentiment and economic factors like inflation and employment. While this won’t affect your mortgage interest rate if you’re already locked into a 5-year fixed mortgage rate, it can change bank’s interest rates on new 5-year fixed mortgages.

What Factors into My Personal Mortgage Rate in Canada?

Factors such as credit score, income, down payment and purpose of the loan play a role in determining how your mortgage rate is priced.

Mortgage rates in Canada vary depending on different factors such as the borrower’s credit, the property being used as collateral, the borrower’s income capacity to service the debt, the borrower’s capital in the form of savings/investments and down payment, and most importantly, conditions. Conditions such as the purpose of the loan and the loan-to-value (LTV) ratio – these two conditions will have the most impact on the rate. The mortgage rate is priced based on the risk associated with that mortgage, property and borrower.

The lowest rate is not the most important aspect of getting a mortgage that will save you the most interest. Sometimes the lowest rate is the “no frills” or “restricted” or “limited” mortgage that a lender offers, which beyond not having a high rate, doesn’t have any prepayment privileges or other features such as portability or assumability.

Mortgage Term

Your mortgage term is when your mortgage agreement and rate will be in effect. Mortgage terms range from 6 months to 10 years, with 5 years being the most common term. But, just because 5 years is the most common doesn’t mean it’s right for you. Like the mortgage, choosing the term depends on your needs and goals.

A mortgage term is one of the criteria lenders use to price mortgages, so comparing pricing based on rate alone doesn’t make sense without deliberating on the correct term that best suits your needs. We recommend you have a mortgage assessment discussion with your mortgage professional to understand the most suitable solution for your unique borrowing situation

Mortgage Type

The type of mortgage you select will significantly affect your mortgage rate. Mortgage types such as adjustable, variable, fixed, open, closed, standard charge or revolving home equity lines of credit (HELOCs) under a collateral charge are all personal choices based on your unique financial planning needs.

Open Mortgages vs. Closed Mortgages

When comparing open versus closed mortgages, for instance, it’s important to note that open mortgages are priced higher because they offer the flexibility to pay the mortgage off at any time without facing a penalty.

Variable Rate Mortgages (VRM) vs. Adjustable Rate Mortgages (ARM)

There are two types of variable rate mortgages, those that have static payments and those that have variable or fluctuating payments. Static payment variable rate mortgages are more specifically called variable rate mortgages (VRM); variable rate mortgages with a variable payment, in which the payment adjusts with changes in the lender’s prime rate, are more accurately called adjustable rate mortgages (ARM). Commonly, they are both known as variable-rate mortgages.

Mortgage Down Payment

The size of your down payment will determine your loan-to-value (LTV) ratio and whether you must also purchase mortgage default insurance. LTV is most important to mortgage rate pricing with insured or insurable lending criteria.

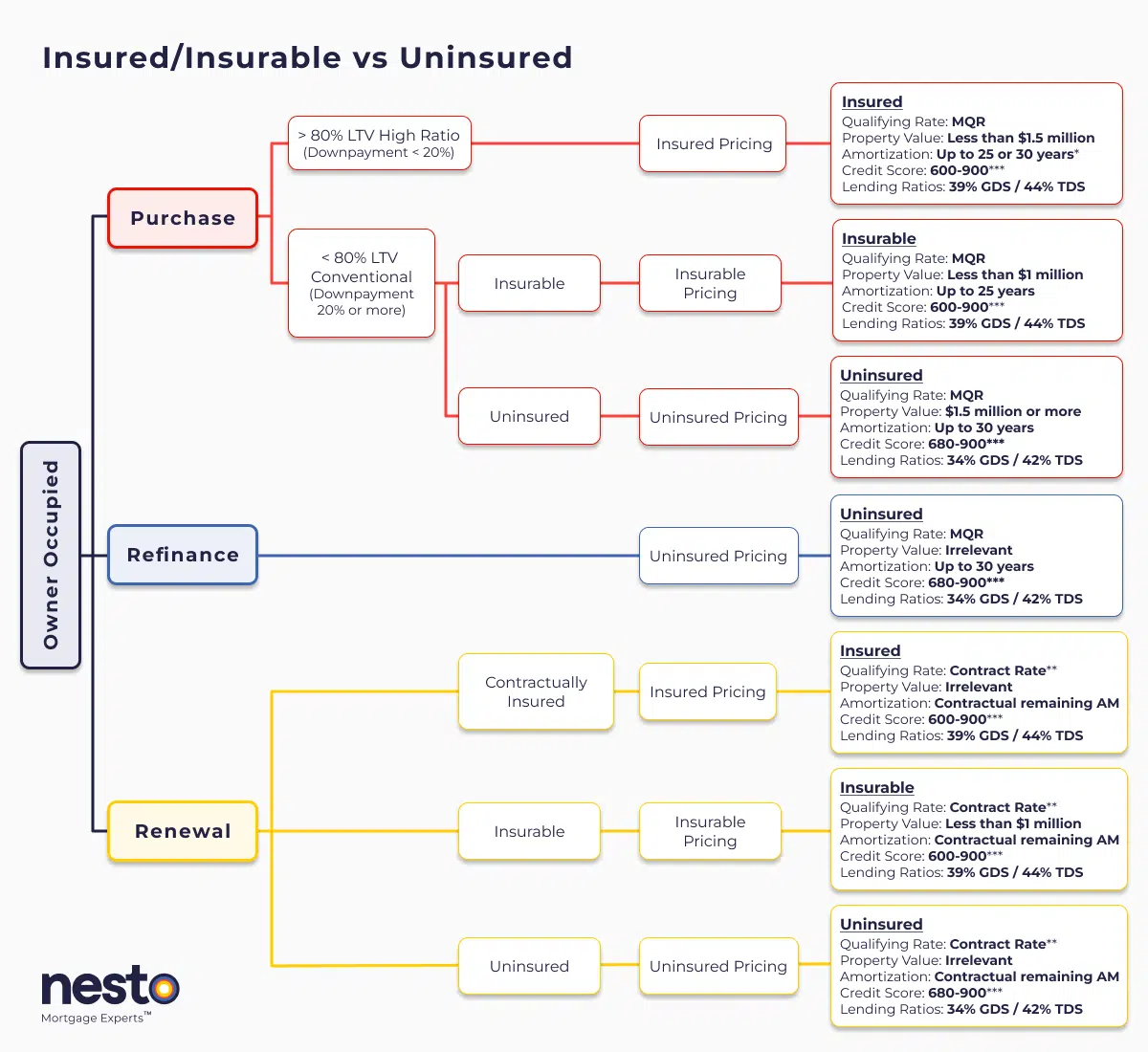

Insured Mortgages vs Insurable Mortgages

Insured and insurable mortgage rate pricing applies on properties valued at less than $1 million; the amortization is up to 25 years. In such cases, the lender will provide a better rate as there is a lower risk of loss.

The borrower would purchase the insurance on the front end in the case of an insured purchase with less than a 20% down payment. To give you a lower rate, lenders can also purchase the insurance on the back end to lower the default risk on the mortgage if your down payment is more than 20%.

An insured mortgage is qualified as such when your down payment is less than 20%. Therefore, you will need to purchase high-ratio default insurance. Although this insurance can be added to your mortgage, the taxes (PST) on purchasing this insurance are not.

Provincial Sales Tax on Mortgage Default Insurance

Upon your closing, your solicitor will collect and remit the PST on behalf of the high-ratio insurer (CMHC, Sagen, or Canada Guaranty). Once the high-ratio default insurance is purchased from one of the three default insurers, the lender’s risk is reduced, as the insurance will protect them in case of default.

All things being equal, the lowest rate, in this case, will be an insured purchase or insured transfer, where default insurance was purchased with the home by the borrower.

The Cost of Default Insurance to the Lender affects your Mortgage Rate

Second, there is an insurable criterion with mortgage finance companies that do not exist with large banks. If you put down 20% or more with a purchase price of less than $1 million having an amortization of up to 25 years, then your mortgage will be priced based on an insurable sliding scale – meaning the more down payment, the lower the mortgage interest rate.

The second-best rate applies to purchases and renewals with 35% or more equity or down payment – meaning 65% loan-to-value (LTV) will get you the second-best mortgage rate. This is because the lender will buy the default insurance on the back end, and the cost is insignificant, with 35% or more equity. The rate increases until the worst pricing occurs at exactly 80% LTV with 20% equity or down payment.

Uninsured Mortgages

Lastly, the mortgage price is highest for an uninsured mortgage, which means that either the amortization is higher than 25 years or the property purchase price is more than $1 million. In this case, the mortgage is uninsured, meaning you cannot purchase default insurance, meaning all the risk has defaulted back to the lender. The lender will price the mortgage rate higher than any other criteria for this higher-risk type.

Property Uses

If you’re buying a home you intend to live in, this is considered your primary residence and will be known as owner-occupied. If you’re buying an investment property you intend to rent to others, you’ll pay higher interest rates than your primary residence. Or suppose you purchase a primary residence with a second separate legally registered suite. In that case, it is considered an owner-occupied rental, and you’ll have access to the lowest rates similar to those offered on a primary residence.

The logic behind your higher rate for a mortgage on a property solely for investment purposes is if money is tight, people will pay the mortgage on their primary residence before other obligations. As such, lenders add risk premiums to their rates for rental properties.

Transaction Types

Mortgages are priced very much the same for purchases and renewals based on the loan-to-value (LTV) ratio and other factors that influence rates, such as whether the transaction is insured or insurable.

Mortgage Refinances and Uninsured Purchases & Renewals

Refinances are considered uninsured transactions and, therefore, carry higher risks. Lenders price the higher risk based on the number of exceptions to their policy they will make in exchange for the risk they are taking with a specific mortgage.

Refinances can occur for many reasons. Extending your mortgage balance or amortization would be considered a refinance. Changing a mortgage covenant, such as adding or removing someone from the property’s land title, would be considered a refinance. Adding a HELOC by changing the registered charge on the property would be considered a refinance. Combining a HELOC and mortgage separately mortgaged on the same property’s title but with different lenders will be considered a refinance. Combining two separately registered collateral charges on the same property may be considered a refinance. Transferring a mortgage to a prime (A) lender from an alternative (B or private) lender will be considered a refinance.

Converting or Transferring a Mortgage

Mortgage conversion and porting are other transactions priced without simple, straightforward rules. When you convert a variable mortgage, either VRM or ARM, into a fixed-rate mortgage, it is called conversion, also known as an early renewal.

The lender will not give any discounts on their posted rates if you convert your variable rate into a fixed mortgage rate, as they would for acquiring new business. Any term remaining less than 5 years may be converted to keep the remaining term the same or increase the term to 5 years. This same logic applies to the early renewal of a fixed-rate mortgage.

Mortgage Portability

With mortgage portability, a lender gives you 30 to 90 days from the time it is paid out at the sale of the current property to transfer your mortgage to a new property. The lender will refund the prepayment penalty once the new mortgage is closed and your current rate is transferred.

If the required mortgage you need is higher than the balance you paid out on the old mortgage, then the lender must provide you with a weighted average rate. In this case, the new rate is weighted concerning the balances based on the old rate, the mortgage paid out and ported, and the new rate based on current prevailing market rates.

Amortization Period

On the prime lending side, the amortization period cannot exceed 30 years. The maximum allowable amortization is 25 years on mortgages with less than a 20% down payment or equity in the property at the time of renewal. You can go up to 30yrs amortization on mortgages with down payments of 20% or more.

The longer the amortization, the lower your mortgage payment. The shorter your amortization period, the more money you save on interest over the term or life of the loan. The difference between two identical mortgages with different amortizations is the interest-carrying cost for the extended time the money is lent out.

Credit Score

There are multiple credit rating agencies and different types of scoring systems. The two main credit agencies prevalent in Canada are Equifax and TransUnion. They both provide different credit scores, one of which is the 3 years running score, also known as a soft credit check.

Both agencies will also provide a borrower with a hard credit score and a whole life score. The scoring is based on a total of 900. The hard credit score from Equifax, known explicitly as FICO (previously called Beacon), is the credit scoring method used by mortgage lenders and professionals. FICO stands for Fair Isaac & Co, aptly named after the company that developed that scoring system.

Hard Credit Checks

A hard credit check on your credit bureau does not immediately reduce your credit score. The credit rating agency will know who pulls your credit score and why. Multiple mortgage brokers or lenders completing hard credit checks within 45 days will be grouped as only one credit hit by the credit rating agency. Some credit rating points will be deducted from your credit score, but those will be reinstated with your timely bill payments over a few quarters.

Soft Credit Checks

Soft credit checks do not affect your credit score, and they are great for planning but don’t offer much assurance to a lender underwriting your mortgage application. At some point, the lender or broker must pull your FICO score to ensure you meet their requirements and check back on your entire repayment history.

Lenders have a specific minimum FICO score requirement of 680 or 720 out of 900 to provide you with the best mortgage rate. Lenders will not want missed payments, especially for mortgage payments, as it will show to the lender either you have poor budgeting or cash flow or your monthly obligations and carrying costs exceed your income. Lenders and brokers will want to know if you put any practices in place to avoid any negative habits in the future.

Minimum Credit Requirement

The best rates, such as nesto’s, are reserved for borrowers with a FICO score of 680+ and no missed mortgage payments. Exceptions can be made in some circumstances, such as missed payments due to separation. During a separation, neither party could take responsibility for all the household payments, and due to unforeseen circumstances, the mortgage may have been neglected.

There is always a story, and nesto mortgage experts are willing to listen and understand the whole story behind your credit report. If there is a reasonable explanation for missed payments, our mortgage expert will put a case together to ask for exceptions from the underwriting department on your behalf.

Canadian Income Proof

The stability of your income shows your capacity to carry the mortgage and any other debts, which show up as facilities on your credit bureau report. Your income must be established past the probationary period if your employment is new. Changing employers in the middle of your mortgage financing is not advisable. Lenders will use a two-year average on non-guaranteed income such as hourly, bonus, overtime, contract or self-employed income.

Types of Income in Canada

On the A or Prime lending side, lenders can use your taxed income, but any forms of income that are not taxed will not be considered. Upon exception, up to 70% of non-taxed income could be used for qualification. If you change industries and don’t have two years of average income, the lender may average your year-to-date received income over two years to get a conservative value.

Canadian Income Documentation

Lenders will ask for various documents to satisfy their risk assessment. The primary documents that borrowers may need to provide are paystubs, letters of employment, and T4s if they are employed. At a minimum, Business Registration or Articles of Incorporation, Notice of Assessments (NOAs), T1 Generals and 3 months of business/corporate/individual bank account histories are required for self-employed or incorporated individuals.

Canada Mortgage Stress Test

After the Great Recession in 2007, due to the mortgage market fallout in the US, the international community agreed to and mandated a set of mortgage underwriting guidelines to protect the world’s real estate. These rules are the B-20 Guidelines, mandated and legislated by the Office of the Superintendent of Financial Services (OSFI) in Canada.

As of October 2016, these guidelines slowly became different aspects of mandated rules governing prime mortgages in Canada. Canada already had rigorous mandates for its mortgage lenders, so our real estate was unaffected by the fallout south of the border.

One of the aspects of these guidelines is the mortgage stress test, with its first rule being implemented in October 2016. If you arranged your mortgage before October 2016 and have not refinanced it, you will not be impacted similarly by the stress test when you renew your mortgage with another lender.

Passing the Mortgage Stress Test

If you want the best rate, you’ll need to pass a stress test to qualify for a mortgage with a prime lender. You must prove you can afford payments at a qualifying interest rate typically higher than the actual rate in your mortgage contract.

You must pass this stress test to determine whether you require mortgage default insurance. Provincially regulated credit unions are not required to qualify all mortgages on the stress test; however, they will use a higher interest rate as they will not have access to prime lending rates on those mortgage solutions.

Federally regulated lenders such as mortgage finance companies and banks must use the higher interest rate of either:

- 5.25%

- the contracted interest rate plus 2%

On variable rate mortgages, both VRM and ARM, the rate you lock in during a pre-approval can change with the lender’s prime rate change. Indeed, the variable mortgage rate hold is a discount, which is being held from the lender’s prime rate, which fluctuates with the BoC’s Key Overnight Policy Rate.

If you already have a mortgage, you’ll need to pass this stress test if you:

- refinance (refi) your home for equity take out (ETO)

- renew by transferring or switching to a new lender, or

- take out a home equity line of credit

What is the current stress test in Canada?

Details

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

Canadian Mortgage Lending Ratios

Mortgage lending ratios are the Gross Debt Service (GDS) Ratio and Total Debt Service (TDS) Ratio. As the names suggest, GDSR calculates the household debt carrying capacity against an applicant’s qualified income, and TDSR calculates the total debt carrying capacity against a borrower’s income. On joint applications, ratios for qualifying are combined debt payments and incomes in the case of multiple borrowers.

Typically, insured or insurable transactions, where the purchase price or assessed value is under $1 million and the mortgage amortization is up to 25 years, will lend up to 39% on GDSR and 44% on TDSR. Some lenders will use different ratios due to their risk appetites.

Uninsured Transactions in Canada

Uninsured transactions are classified as purchases or renewals where a property is valued at more than $1 million, the amortization will be more than 25 years, or the transaction is a refinance – where equity is taken out or time is being extended.

In the case of uninsured transactions, lenders will have their risk assessment criteria to use whatever ratios they feel comfortable with based on the client’s unique situation. The lender can qualify the ratios and mortgage rate pricing on the file’s risk profile and lender’s risk appetite. The money they use to fund uninsured mortgages comes from their sources – instead of Canada’s mortgage bond market with its set of strict qualifying rules.

Calculating Your Debt Service Ratios

GDSR = (Mortgage Payment + Property Taxes + Condo Fees/2 + Hydro)/Income

TDSR = (All debts in GDSR calculation + all other debts) / Income

Initially, newer lenders will offer the best rates as they have to prove to the regulators and their investors their files are impeccable. As they fund more mortgages, their risk appetite will increase. They will provide more income and lending ratio exceptions, which may affect mortgage rate pricing on individually qualified files.

Pass Your Mortgage Stress Test

You must also pass a mortgage stress test to qualify for a certain mortgage amount. This stress test is essentially insurance that you’ll still be able to afford your mortgage payments if interest rates rise. This higher rate is known as the mortgage qualifying rate and is set by OFSI. All mortgage applications are subject to stress testing using the higher qualifying rate between the 5-year benchmark minimum qualifying rate (MQR) or the contractual mortgage rate (offered by your lender) plus 2%.

Are you a first-time buyer?

Choosing Between a Mortgage Broker vs. a Mortgage Lender

Mortgage finance companies, mortgage investment corporations (MIC), credit unions, banks, and other federally regulated financial institutions (FRFI) are all different lenders that offer mortgages and underwriting loans.

Lenders

Lenders will have different channels. Some will have branches and brokers that offer their services. In contrast, others will be direct to consumers to avoid the need to give commissions to external salespeople and pass the savings directly to their consumers.

You will need to be aware of which channel you’re working with, as pricing can vary in various channels due to the lender’s need to compensate the salesperson. You’ll also need to understand how the salesperson is being paid and how it affects your mortgage rate.

Mortgage Agents and Brokers

When arranging your mortgage, you should work with a qualified mortgage professional. Unlike a banking advisor who is a generalist, a qualified mortgage professional specializes in mortgages and can provide in-depth insight and knowledge as you go through the application and qualification process.

A qualified mortgage professional can come with various names depending on the province in which they are registered, such as agent, broker, sub-mortgage broker, salesperson or mortgage associate. However, they can provide the same services, must meet the exact educational requirements and be provincially regulated. Some provinces, such as Quebec, with its prime directive to protect consumer interests at each stage of the process, have more rigorous education and regulations than all other provinces.

At nesto, our mortgage experts concurrently hold professional designations from one or more provinces. We believe that our clients will receive the best advice and care when they speak with specialists that exceed the industry status quo. Is your mortgage professional licensed?

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Save up to $18,542 in your first term*

See current provinces rates

See current local rates

*Interest rates displayed, posted, or discussed verbally and in writing are subject to change at any time and without notice. The interest rate is not guaranteed until it is provided in the form of a mortgage commitment or loan agreement produced by the lending authority. Interest rates may change if the transaction type changes or evolves outside of the criteria of the originally secured interest rate. In order to secure your interest rate in a timely manner, all requested information and documents must be provided and deemed satisfactory by the lending authority.