Find the Best Mortgage

Rates in Canada

No rates at the moment

*Insured mortgage rates. Other conditions apply. Rate in effect as of July 14, 2025.

Compare current mortgage rates across Canada

No matter where you are in Canada, we can show you the best mortgage rates. Instantly compare low rates on everything from 3-year fixed mortgages to 5-year variable mortgages.

Mortgage rate options

Many mortgage rate options are available in Canada, so it’s important to find the one that best fits your needs before deciding. To make things easier, we’ve compiled a simple table highlighting the most common rate terms and their associated risk levels.

Rates shown here are for mortgages between $700,000 and $1,375,000. Uninsured rates apply to mortgages of $900,000 and over. Some conditions apply. Request a quote to get your personalized rate.

The loan-to-value (LTV) ratio compares your mortgage amount with the property’s appraised value. The higher your down payment, the lower your LTV ratio.

*Applicable only with an accepted offer to purchase or renewal (not applicable for pre-qualifications or refinances).

Top Big

Bank Rates

The top big bank rates are all in one easy-to-view table. See their rates, then beat their rates (or get $500) with nesto’s low rate guarantee.

Are you a first-time buyer?

Province

Find the right home

for your budget

Not sure where to start? Check out our tools to get started

Today’s Mortgage Interest Rate in Canada

For Monday, July 14, 2025:

Canada’s average 3-year fixed conventional mortgage rates are

Canada’s average 3-year conventional mortgage rates for variable and adjustable mortgages are

Canada’s average 5-year conventional fixed mortgage rates are

Canada’s average 5-year conventional mortgage rates for variable and adjustable mortgages are

1 basis point is 1/100 of a percentage point, equaling 0.01%.

What are the average mortgage rates in Canada today?

As of Monday, July 14, 2025, Canada’s most popular mortgage options are the 5-year fixed and 5-year variable conventional rates. The average 5-year fixed rate is

Below are the current average conventional mortgage rates available across Canada, including in Ontario, Québec, British Columbia, and Alberta:

- 2-year fixed conventional mortgage rate:

5.09% - 3-year fixed conventional mortgage rate:

4.69% - 3-year variable conventional mortgage rate:

5.50% - 4-year fixed conventional mortgage rate:

5.22% - 5-year fixed conventional mortgage rate:

4.58% - 5-year variable conventional mortgage rate:

4.67% - 7-year fixed conventional mortgage rate:

5.82% - 10-year fixed conventional mortgage rate:

6.78%

What are the lowest mortgage rates in Canada today?

Canada’s average posted 5-year conventional fixed mortgage rate is 6.09%. The lowest 5-year fixed rates are typically reserved for insured prime lending, with nesto at

Canada’s variable and adjustable rate discounts (or added premiums) on the 5-year term typically range from 0.50% to 1.50% from the Bank prime rate, currently at 4.95%. The most discounted variable and adjustable rates are generally reserved for insured prime lending, with nesto at

Canada’s average posted 3-year conventional fixed mortgage rate is 6.05%. The lowest 3-year fixed rates are typically reserved for insured prime lending, with nesto at

Canada’s variable and adjustable rate discounts (or added premiums) on the 3-year term range from 0.15% to 1.50% from the Bank prime rate, currently at 4.95%. The most discounted variable and adjustable rates are generally reserved for insured prime lending, with nesto at

Below are insured mortgage rates available across Canada:

- 2-year fixed insured mortgage rate:

- 3-year fixed insured mortgage rate:

- 3-year variable insured mortgage rate:

- 4-year fixed insured mortgage rate:

- 5-year variable insured mortgage rate:

- 5-year variable insured mortgage rate:

- 7-year fixed insured mortgage rate:

- 10-year fixed insured mortgage rate:

Should I choose a 5-year term or a 3-year term in Canada?

Choosing a shorter mortgage term is advisable if you anticipate decreasing interest rates in Canada. A shorter term would allow you to renew your mortgage again at even lower interest rates. However, if your expectations are unmet, you may be in for a stark surprise with a need to renew at higher interest rates. Generally, experts suggest shorter terms when rates are expected to decline, whereas longer terms are more appropriate when rates are predicted to rise.

The bond market expects rates to go down in the fall, meaning that we’re reaching the peak of the rate cycle, and fluctuating rates, such as adjustable or variable mortgage rates, may be the way to go. The Bank of Canada might face pressure to lower interest rates in light of the recent cuts by the Federal Reserve. A slowdown in the US economy could adversely affect Canada, given its dependence on US trade. The Bank may contemplate reducing rates to avoid a widening interest rate gap that could weaken the Canadian dollar and raise import costs. A downturn in the US economy could decrease Canadian exports and GDP, which might prompt similar cuts to encourage growth. However, if domestic inflation continues to be a concern, the Bank may decide to keep its rates steady despite the reductions in the US.

This news should prompt you to make a decision based on your preferences. If you are looking for stability and predictability over a more extended period, then going for a 5-year fixed rate is the best option. If you want to reduce your risk while saving money, choosing a 3-year fixed rate may help you overcome this uncertainty until you can get a lower, fluctuating rate. If you’re okay with risk and don’t mind if your mortgage payment rises before it falls, opting for a variable or adjustable rate might be better. If you’re risk-averse, we suggest locking into today’s lower fixed rates, providing the certainty you want over your 5-year term.

The most important consideration is your financial plan and mortgage strategy. If your long-term plan involves moving out of Canada or expecting an inheritance you’d like to use to pay off your mortgage sooner, you should choose a shorter term. Find a lender with suitable mortgage porting terms if you wish to switch homes before your term ends.

Mortgage Industry Insights

On June 4, the Bank of Canada (BoC) held Canada’s overnight policy rate at 2.75%, leaving mortgage lender’s prime rates unchanged at 4.95%. Our mortgage rate forecast predicts global economic uncertainty could prompt the Bank of Canada to lower rates to 2.25% this year. Read the current Bank of Canada press release, and our post-rate announcement insights.

Bond futures markets are now pricing another 72% probability of no change and a 28% probability of a 25 basis point (0.25%) rate cut at the Bank of Canada’s policy rate announcement on July 30. By the September 17 policy interest rate announcement, the likelihood of a rate cut will change to a 30% chance of a 25 basis point (0.25%) cut.

How do bonds affect mortgage rates?

Bonds, specifically Canada Mortgage Bonds (CMBs), are considered mortgage-backed securities (MBS). Bonds are debt securities issued by governments, such as the Government of Canada, to fund its growth and projects, including homebuilding and homebuying activity. Institution investors and pension funds purchase bonds from the government and receive interest payments until the bond’s maturity.

If interest rates go up in Canada, the prices of current bonds usually go down, even if the coupon rates remain the same, leading to higher bond yields. On the other hand, if interest rates in Canada go down, the prices of existing bonds typically go up, with the coupon rates staying constant, resulting in lower yields on those bonds.

The 5-year fixed mortgage rates in Canada follow 5-year Canadian bond yields plus a spread set by the banks. Bond yields can change direction based on market sentiment and economic factors like inflation and employment. While this won’t change your rate if you’re already locked into a 5-year fixed rate, it can change interest rates for new 5-year fixed mortgages. Simply put, mortgage rates follow the direction of bond yields, with an additional 1 to 2% spread to cover the lender’s risk premium and funding costs.

How many Canadian mortgages are at risk of payment shock?

Economists and policymakers predict that slightly more than $900 billion worth of mortgages may experience payment shock at renewal. This accounts for around 60% of all mortgages held at chartered banks set to be renewed from 2024 to 2026. Most Canadians are expected to renew their mortgages in 2026, with about $400 billion, or 26% of chartered bank mortgages, up for renewal.

According to CMHC, around 2.2 million Canadian mortgages, approximately 45% of all outstanding mortgages, will need to be renewed between 2024 and 2025. When these borrowers renew their mortgages, interest rates will be significantly higher, as many of these mortgages were secured at record-low interest rates between 2020 and 2021 during the pandemic.

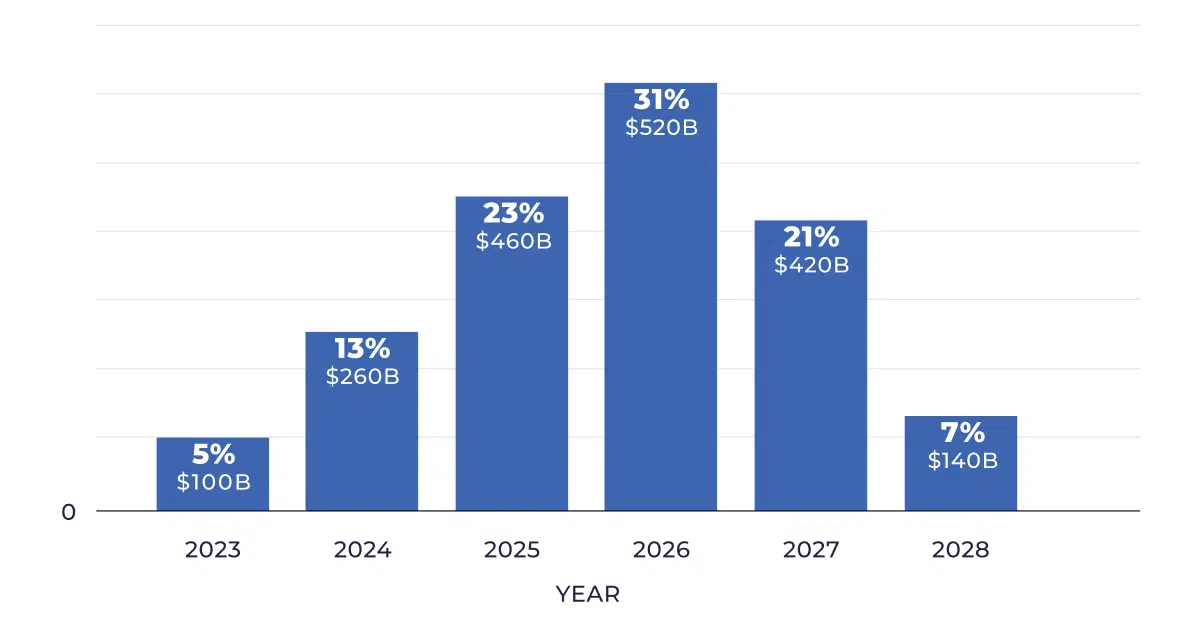

As reported by CMHC, around $2 trillion in mortgage debt needs to be paid off. In 2023, only 5% of this debt was up for renewal. This year, 13% of the debt is scheduled for renewal. However, the percentage will increase significantly in the coming years, with 23% in 2025, 31% in 2026, and 21% in 2027.

What is the Great Renewal?

The Great Renewal is a term nesto coined to refer to the massive number of Canadian mortgages expected to be renewed between 2025 and 2029.

At the onset of the pandemic, homeowners used low mortgage rates to renew or refinance their mortgages. Over 30% of homeowners chose to renew into a variable rate instead of the historically popular fixed rate. As mortgage rates were historically low for most of 2020 and 2021, many homebuyers could qualify for a higher mortgage amount to enter the surging real estate market, even more so on a variable rate, as these rates were lower than fixed rates at the time.

Policymakers and analysts expect approximately 100,000 mortgages to come up for renewal in 2025 and 2026. Mortgage interest rates are expected to stay elevated, creating payment shock at renewal time for those borrowers.

Find out what experts predict for mortgage rates in nesto’s mortgage forecast.

Average Bank Posted Mortgage & Prime Rate History

Let’s go back in time. Here’s a historical overview of changes to the posted and prime mortgage rates in Canada since 1980.

Source: bankofcanada.ca

*Most Recent Prime Rate Shown

Source: bankofcanada.ca

Learn About Rates & Mortgages

Welcome to our Frequently-Asked Questions (FAQ) section, where we answer the most popular questions our nesto mortgage advisors receive daily, designed to help you make informed mortgage decisions whenever you need a new mortgage or renew/refinance an existing one.

Understanding Today’s Best Mortgage Rates in Canada

Mortgage shopping can be confusing, especially if you’re a first-time home buyer. There are a lot of different terms and options out there, and it can be tough to know where to start. This section will cover some of the most common questions and terms when shopping for a mortgage in Canada. By the end, you should better understand the process and related terms to help you find the best mortgage rate in Canada.

What is a mortgage?

A mortgage is a loan used to purchase property, which acts as security for the loan. A mortgage tends to be for a large sum and is usually paid off over 25 or 30 years. Even though the property is the collateral, the borrower retains ownership while paying off their mortgage.

What is a mortgage rate?

A mortgage rate, or the mortgage interest rate, is the percentage of interest you’ll pay on your borrowed mortgage amount throughout your mortgage. Canadian mortgage rates can be fixed, staying the same for the term, or variable, fluctuating based on a discount from the benchmark interest rate. The benchmark interest rate is always the lender’s prime rate for variable rates, usually based on a premium added to the Bank of Canada’s (BoC) key policy interest rate.

What are current mortgage rates?

Canada’s best 5-year fixed and 5-year variable mortgage rates are

How often are nesto’s mortgage rates updated?

nesto’s dynamic pricing ensures you always see the most current mortgage rates as they change in real time. Every time there is movement in the pricing of rates within the capital markets, which is the part of the financial system where lenders, investors, and institutions trade investments and debt, nesto’s technology automatically updates your available rates.

This approach is supported by nesto’s dedicated capital markets division, which continuously sources the most competitive funding options for mortgages across Canada. Combined with our advanced technology platform, it means you do not have to negotiate or wait to get the best rate. The rate you see on nesto’s platform is transparent, up to date, and reflective of actual market conditions, so you can make decisions confidently knowing you are getting the most accurate pricing available.

How often do Canadian mortgage rates change?

Fixed rates are based on the bond market and can fluctuate more regularly, although once you have locked in your fixed rate, you’ll pay the same interest throughout your term.

Variable rate discounts are based on short-term bonds, treasury bills and sovereign debt ratios. Variable mortgage rates in Canada will fluctuate regularly. These factors remain unimportant to the borrower once they lock in their discount from their lender’s prime rate. Their rate will fluctuate as often throughout the year that the Bank of Canada (BoC) updates its key policy overnight rate, which each lender will match by changing its prime lending rate.

Nesto and most chartered banks follow suit on changes to their prime rate, typically overnight, when the BoC changes its key policy overnight rate.

Are you a first-time buyer?

How to Find the Best Mortgage Rates in Canada

As you begin looking for your dream home, you may wonder how to qualify for a mortgage in today’s competitive real estate market. It is important to note that qualifying for a mortgage in Canada will depend on several different factors, including your current financial situation and your credit score.

Should I complete a pre-approval or a pre-qualification?

Pre-approvals and pre-qualifications are analyses of your borrowing capacity concerning your income, credit, conditions, down payment, savings, and net worth minus the down payment and closing costs. They do not consider the collateral (or property) as they are assessed before finding a subject property. Pre-qualifications do not have a rate or discount attached to your qualification, such as in the case of a variable rate.

A rate hold will give you peace of mind while shopping for a property in the case of a pre-approval. Pre-approvals with rate holds will cost the lender to hold the money for you at a specific rate/discount. Some lenders that offer the best rates do not provide pre-approvals with rate holds; conversely, they offer pre-qualifications without rate holds to keep the cost to buy money down for live mortgages where clients have an accepted offer on a property.

Most lenders that offer a pre-approval with a rate hold will attach a premium to this rate, meaning that if you return to that lender, you will be locked into that higher rate even if rates stay down. Therefore, lenders with the best rates offer only live rates, which can only be locked in once you have an accepted offer on a specific property.

What is a mortgage rate hold?

Depending on the rate offered, lenders will hold your rate for a set time—say 60 to 180 days. Most lenders will add a premium to lock it longer. Sometimes, lenders advertise or offer a quick close rate for the mortgage to be funded within 45 or 60 days. The quick close rate is a special offer with a limited supply of money at that rate.

A mortgage rate hold allows clients to lock in a rate at either the pre-approval or renewal / refinance stage. Once you’re qualified and your mortgage is approved, the lender will issue you a mortgage commitment to hold a fixed mortgage rate or hold a discount from their prime rate on a variable or adjustable mortgage.

With up to 150 days, nesto currently offers Canada’s most extended rate hold period for new mortgages, including those being switched and transferred from other lenders.

Mortgage Insights To Save You Money

Securing a mortgage in Canada can be overwhelming, and it is essential to understand the various features and benefits you should look for when selecting a lender. This includes current market rates, an easy application process, and favourable terms and conditions that set your mortgage apart. Considering these insights, you can better differentiate mortgage options to land the best mortgage for your needs today.

What is the most common mortgage term length in Canada?

Canada’s most common mortgage term is 5 years, specifically the 5-year fixed-rate mortgage. While this isn’t always the most economical option for everyone, it has become the most popular.

A lot can happen in 5 years, so consider your future goals when selecting each mortgage term. If you plan to break your mortgage early, you could face some high early payout penalties, so consider short—and long-term goals when discussing your mortgage with an advisor.

Is a variable rate better than a fixed rate?

Variable and adjustable mortgage rates have proven to save borrowers more money over time than a fixed-rate mortgage. Every borrower’s circumstances and goals differ; therefore, a mortgage expert should thoroughly discuss all current financial restraints and future considerations before deciding on the most suitable mortgage solution.

With a variable mortgage, the interest rate fluctuates depending on benchmark rates, whereas a fixed rate remains the same throughout the mortgage term. Given that mortgage payments always remain the same, a fixed rate benefits budgeting and offers financial stability.

Deciding on a variable or fixed rate is a question of personal choice and risk appetite. We would recommend speaking with a mortgage professional to assess any material risks that may pose a concern for you over the term of your mortgage. While variable mortgages have proven more cost-effective over time than fixed mortgages, some people prefer the certainty of having the same payment throughout the mortgage term.

For a first-time home buyer (FTHB) who is getting used to all their new bills related to owning a home, it is recommended that they choose a fixed rate to provide some stability during the first term of their mortgage. By making their most significant monthly obligations (mortgage, condo/maintenance/strata fees and property taxes) static amounts, they can take the time to put together a financial plan and start to put aside some money towards their emergency savings.

Which variable rate mortgage is more suitable for me? ARM or VRM?

There are two types of variable-rate mortgages: those with static payments and those with variable or fluctuating payments. Static-payment variable-rate mortgages are called variable-rate mortgages (VRM). In contrast, variable-rate mortgages with a variable payment, where the payment adjusts with changes in the lender’s prime rate, are more accurately called adjustable-rate mortgages (ARM). Commonly, they are both known as variable-rate mortgages.

While it is a personal choice if you prefer an adjustable versus a variable mortgage, your choice will be influenced by mortgage rates forecast in the current market, your risk appetite due to that trajectory and, of course, the need for that mortgage solution.

For instance, if you’re using this mortgage to purchase a rental or investment property, you may want a variable mortgage (VRM), as your interest will increase. This allows you to write off more interest against your rental income. The variable rate mo

rtgage type that suits you depends on your risk and situation. Many clients holding a mortgage for an inv

estment property may decide to keep the interest portion of their mortgages higher than the principal portion, as interest paid on mortgages for investment properties can be used to reduce the overall income taxes on the income generated. For an investment property where the borrower’s goals, risk appetite, and cash flow allow, it may be prudent to choose a VRM. In most cases, however, where the mortgage is used for a principal residence or the borrower’s goal is to pay off the mortgage sooner, it may be wiser to choose an ARM.

How do I lock my mortgage rate?

A mortgage feature known as convertibility allows a variable-rate mortgage to be locked into a fixed rate for the duration of its term. Most mortgages offer this feature, but there may be restrictions from lender to lender, so it is best to speak with your advisor to understand the solution you are getting.

It is essential to understand the costs and benefits before converting your mortgage. You will want to ensure that any premium you pay on the higher fixed rate is worth it for the potential downside risk with the variable rate mortgage. Before moving ahead, you must do a cost-savings analysis between your options. The changeover should make financial sense within your mortgage term.

What are some mortgage features and benefits?

Taking advantage of your prepayment options, even minimally, can save you serious interest while helping pay down your mortgage faster.

The portability feature can let you transfer your mortgage to a new property should you need to move in the middle of your term without paying the penalty. This feature can come in handy if you have a large penalty to break your mortgage or a really low rate compared to the current market, so it may be worthwhile to port your rate to your new mortgage.

While not the most sought-after feature, assumability can allow a buyer to take on the seller’s mortgage upon approval by your lender when they purchase your home. In most cases, this means no penalty for you and possibly a low rate for them if you don’t need that mortgage on your new home or are moving outside the country.

Convertibility is another valuable feature that exists on mortgages. This feature allows you to renew your variable rate mortgage (VRM) or an adjustable-rate mortgage (ARM) at any point in your term to a fixed-rate mortgage early. Depending on the lender, you may be offered different options, such as renewing to a fixed rate at the remaining term only, renewing back to a 5-year term only, or renewing to any term as long as the term remaining is not decreased.

Not all lenders will offer all these features on all their financing solutions. Some lenders will offer you features a la carte based on how you want them to price your mortgage rate. nesto makes it easy as we offer all these features on all of our mortgages, even our limited-feature mortgages.

Are you a first-time buyer?

Going Beyond Your Mortgage Rate

The mortgage process involves many steps when purchasing a home. This section will outline those steps and provide tips for successfully navigating them. The most important step is determining which mortgage is right for you. Taking the time to understand the various solutions and what each has to offer can ensure that you make sound decisions throughout the entire process and ultimately end up in the home of your dreams!

Should I choose the lender with the lowest rate?

The lowest rate is not always the best option for everyone. Depending on your short and long-term goals for owning your home, it may be wiser to choose the mortgage solution that works best for you. The best solution for you may not be the lowest rate option. As the mortgage rate is priced based on the risk the borrower represents for the lender, it may be best to review the restrictions attached.

There may be restrictions tied to a hefty penalty if the borrower pays out the loan before maturity. Restrictions can come in the form of features, benefits, and bigger penalties than the usual 3-month interest or interest rate differential.

When opting for the lowest-rate product, you may have to give up features such as prepayments or mortgage porting privileges. Without the ability to port, penalties on these types of lowest-rate mortgages can be very hefty, such as a percentage of the mortgage balance at the time of payout.

Please speak to one of our commission-free mortgage experts. They can show you how to save even more with a full-feature mortgage by making minor changes to your mortgage repayment plan.

What are mortgage prepayment options?

Prepayment privileges enable you to make extra payments directly to pay off your principal. Prepayment options come in many forms and have different limitations based on your lender, but overall if you choose to exercise them, they will save you time and money so you can become mortgage-free faster.

There are several ways you can take advantage of prepayments, including:

- Lump-sum payments – This option will come either in the form of one single lump sum up to 10%, 15%, or 20% either once in a year or once a year on the anniversary date of the mortgage; or very liberally you can make multiple lump sum payments throughout the year without exceeding the allowable amount.

- Double-up payments—This option lets you automate lump sum payments to double up and match your regularly scheduled payments. The savings will be exponential if you’re already on an accelerated payment plan.

- Increase regular payments – If you have any prepayment privileges with your mortgage, you will have a corresponding option for lump sum payments to increase your regular payments by the same percentage on the anniversary date.

- Payment frequency—This option lets you accelerate your weekly or biweekly payment. This means that the semi-monthly payment amount is applied 24 times a year and 26 times a year for biweekly accelerated payments. In contrast, weekly accelerated payments are half the semi-monthly amount applied 52 times yearly. Although technically not considered a prepayment privilege, accelerated payments can shave off a couple of years over the life of the mortgage.

Depending on the lender and the mortgage restrictions, not all prepayment privileges will be standard. Most lenders will have a full-featured mortgage that gives you all privileges and a restricted or limited-feature mortgage that gives you none. Some lenders will price a mortgage interest rate based on the number of features it provides, while others will use an a la carte approach in pricing each file individually.

nesto has some of the most simplified features available. We give you all options on our full-feature mortgages, including making a minimum lump sum for as little as $100 with any of your regularly scheduled payments.

Unlike our limited-feature mortgages, we may not offer prepayment privileges; however, the pricing is the same for all clients who qualify and get either of these mortgages. We prefer to have clients discuss their short- and long-term goals with our mortgage experts to ensure that their solution suits their unique needs, as not all mortgage solutions are suitable for everyone.

How do I compare mortgage rates in Canada?

When comparing mortgage rates in Canada, it’s essential to look at similarities and differences between the comparable types and terms. Comparisons must be made with complementary solutions, meaning a fixed rate with another fixed rate and vice versa. The mortgage term must be aligned well – compare a 5-year term with a 5-year one.

Then you have to look beyond the rate, the features, benefits and restrictions. Many low-rate mortgages have restrictions – such as pre-emptive qualifying criteria and prepayment penalties that are outside of the normal if paid off or refinanced before the end of its term. Some restrictions go as far as to inhibit the ability to payout or renew early by adding a bona fide sale clause – meaning you can’t break the mortgage except to sell the property to an unrelated party.

What are Bank of Canada mortgage rates?

The Bank of Canada (BoC) doesn’t set Canadian mortgage rates. But it does impact them directly and indirectly. The Bank sets the benchmark overnight target for the policy rate, which directly affects all the prime rates in Canada, also known as the Bank rate. When the economy is strong, the BoC could raise the policy rate to keep inflation from rising above its 2% target. Likewise, when the economy weakens, the Bank could lower the policy rate to keep inflation from falling below its 2% target.

The policy rate directly impacts all the prime rates in Canada, which in turn directly affects all the variable mortgage rates in Canada. However, fixed mortgage rates are determined by bond yields, which are priced and traded on the open market.

Bond yields can change direction based on market sentiment and economic factors like inflation and employment. While this won’t affect your mortgage interest rate if you’re already locked into a 5-year fixed mortgage rate, it can change bank’s interest rates on new 5-year fixed mortgages.

What Factors Affect My Mortgage Rate in Canada?

Factors such as credit score, income, down payment, and the purpose of the loan determine how your mortgage rate is priced.

Mortgage rates in Canada vary depending on different factors such as the borrower’s credit, the property being used as collateral, the borrower’s income capacity to service the debt, the borrower’s capital in the form of savings/investments and down payment, and most importantly, conditions. Conditions such as the purpose of the loan and the loan-to-value (LTV) ratio – these two conditions will have the most impact on the rate. The mortgage rate is priced based on the risk associated with that mortgage, property and borrower.

The lowest rate is not essential to getting a mortgage that will save you the most interest. Sometimes, the lowest rate is the “no frills” or “restricted” or “limited” mortgage that a lender offers. Beyond not having a high rate, these mortgages don’t have any prepayment privileges or other features such as portability or assumability.

Mortgage Term

Your mortgage term is when your mortgage agreement and rate will be in effect. Mortgage terms range from 6 months to 10 years, with 5 years being the most common term. But, just because 5 years is the most common doesn’t mean it’s right for you. Like the mortgage, choosing the term depends on your needs and goals.

A mortgage term is one of the criteria lenders use to price mortgages, so comparing pricing based on rate alone doesn’t make sense without deliberating on the correct term that best suits your needs. We recommend you discuss a mortgage assessment with your mortgage professional to understand the most suitable solution for your unique borrowing situation.

Mortgage Type

The mortgage type you select will be the most prominent factor in your mortgage rate. Mortgage types such as adjustable, variable, fixed, open, closed, standard charge or revolving home equity lines of credit (HELOCs) under a collateral charge are all personal choices based on your unique financial planning needs.

Open Mortgages vs. Closed Mortgages

When comparing open versus closed mortgages, for instance, it’s important to note that open mortgages are priced higher because they offer the flexibility to pay the mortgage off at any time without facing a penalty.

Variable Rate Mortgages (VRM) vs. Adjustable Rate Mortgages (ARM)

There are two types of variable-rate mortgages: those with static payments and those with variable or fluctuating payments. Static-payment variable-rate mortgages are more specifically called variable-rate mortgages (VRM); variable-rate mortgages with a variable payment, in which the payment adjusts with changes in the lender’s prime rate, are more accurately called adjustable-rate mortgages (ARM). Commonly, they are both known as variable-rate mortgages.

Mortgage Down Payment

The down payment size will determine your loan-to-value (LTV) ratio and whether you must also purchase mortgage default insurance. LTV is most important to mortgage rate pricing with insured or insurable lending criteria.

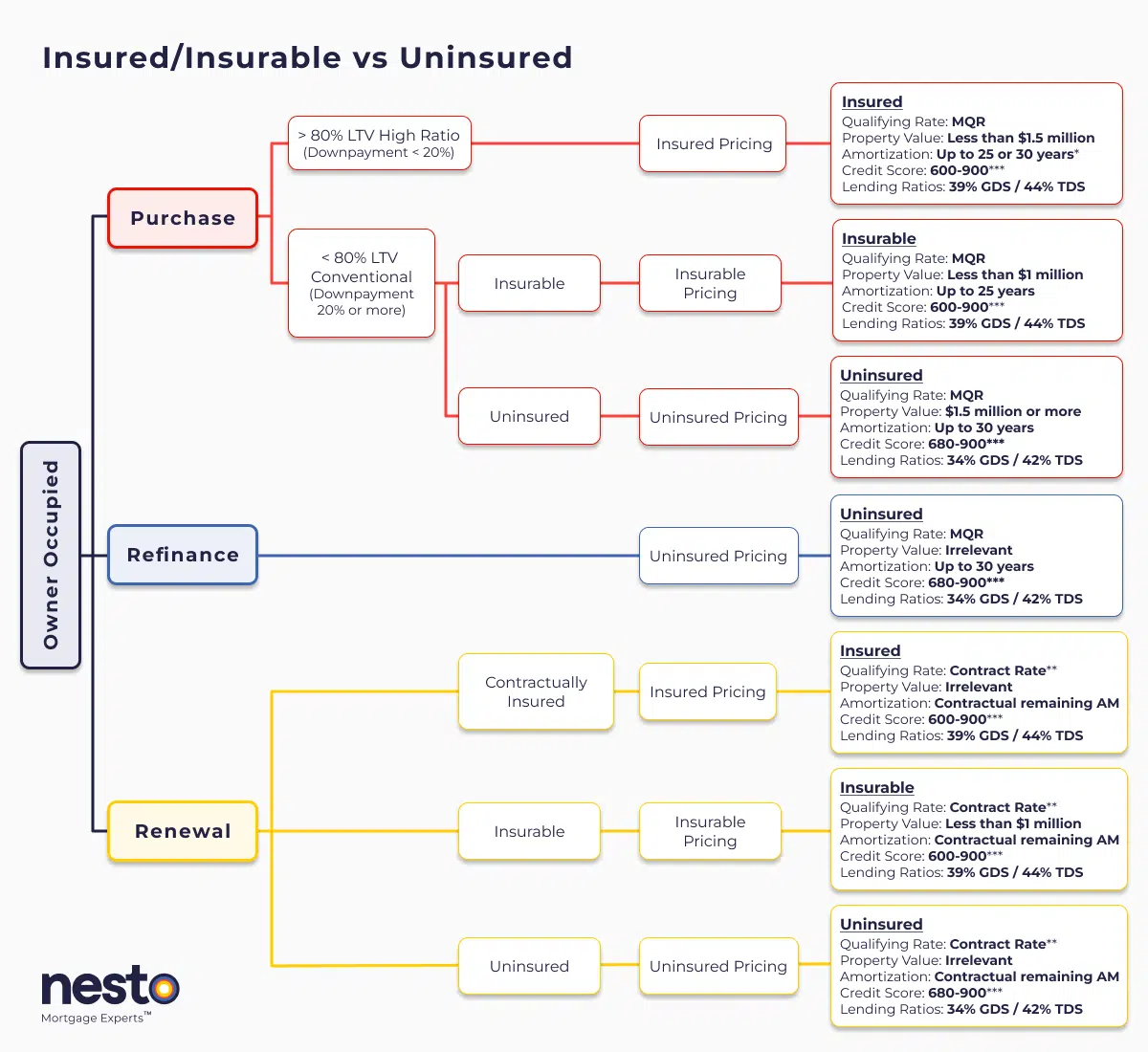

Insured Mortgages vs Insurable Mortgages

Insured and insurable mortgage rate pricing applies on properties valued at less than $1 million; the amortization is up to 25 years. In such cases, the lender will provide a better rate as there is a lower risk of loss.

The borrower would purchase the insurance on the front end in the case of an insured purchase with less than a 20% down payment. To give you a lower rate, lenders can also purchase the insurance on the back end to lower the default risk on the mortgage if your down payment is more than 20%.

An insured mortgage is qualified as such when your down payment is less than 20%. Therefore, you will need to purchase high-ratio default insurance. Although this insurance can be added to your mortgage, the taxes (PST) on purchasing this insurance are not.

Provincial Sales Tax on Mortgage Default Insurance

Upon your closing, your solicitor will collect and remit the PST on behalf of the high-ratio insurer (CMHC, Sagen, or Canada Guaranty). Once the high-ratio default insurance is purchased from one of the three default insurers, the lender’s risk is reduced, as the insurance will protect them if you default.

All things being equal, the lowest rate, in this case, will be an insured purchase or insured transfer, where default insurance was purchased with the home by the borrower.

The Cost of Default Insurance to the Lender affects your Mortgage Rate

Second, there is an insurable criterion with mortgage finance companies that do not exist with large banks. If you put down 20% or more with a purchase price of less than $1 million having an amortization of up to 25 years, then your mortgage will be priced based on an insurable sliding scale – meaning the more down payment, the lower the mortgage interest rate.

The second-best rate applies to purchases and renewals with 35% or more equity or down payment – meaning 65% loan-to-value (LTV) ratio will get you the second-best mortgage rate. This is because the lender will buy the default insurance on the back end, and the cost is insignificant, with 35% or more equity. The rate increases until the worst pricing occurs at exactly 80% LTV with 20% equity or down payment.

Uninsured Mortgages

Lastly, the mortgage price is highest for an uninsured mortgage, which means that either the amortization is higher than 25 years or the property purchase price is more than $1 million. In this case, the mortgage is uninsured, meaning you cannot purchase default insurance, meaning all the risk has defaulted back to the lender. The lender will price the mortgage rate higher than any other criteria for this higher-risk type.

Property Use

If you’re buying a home you intend to live in, this is considered your primary residence and will be known as owner-occupied. If you’re purchasing an investment property you plan to rent to others, you’ll pay higher interest rates than your primary residence. Or suppose you are buying a primary residence with a second separate legally registered suite. In that case, it is considered an owner-occupied rental, and you’ll have access to the lowest rates similar to those offered on a primary residence.

The logic behind your higher rate for a mortgage on a property solely for investment purposes is that if money is tight, people will pay the mortgage on their primary residence before other obligations. As such, lenders add a risk premium to mortgage rates for rental properties.

Transaction Type

Mortgages are priced very much the same for purchases and renewals based on the loan-to-value (LTV) ratio and other factors that influence rates, such as whether the transaction is insured or insurable.

Mortgage Refinances and Uninsured Purchases & Renewals

Refinances are considered uninsured transactions and, therefore, carry higher risks. Lenders price the higher risk based on the number of exceptions to their policy they will make in exchange for the risk they are taking with a specific mortgage.

Refinances can occur for many reasons. Extending your mortgage balance or amortization would be considered a refinance. Changing a mortgage covenant, such as adding or removing someone from the property’s land title, would be a refinance. Adding a HELOC by changing the registered charge on the property would be considered a refinance. Combining a HELOC and mortgage separately mortgaged on the same property’s title but with different lenders will be regarded as a refinance. Combining two separately registered collateral charges on the same property may be considered a refinance. Transferring a mortgage to a prime (A) lender from an alternative (B or private) lender will be regarded as a refinance.

Converting or Transferring a Mortgage

Mortgage conversion and porting are other transactions priced without simple, straightforward rules. When you convert a variable mortgage, either VRM or ARM, into a fixed-rate mortgage, it is called conversion, also known as an early renewal.

The lender will not give any discounts on their posted rates if you convert your variable rate into a fixed mortgage rate, as they would for acquiring new business. Any term remaining less than 5 years may be converted to keep the remaining term the same or increase the term to 5 years. This same logic applies to the early renewal of a fixed-rate mortgage.

Mortgage Portability

With mortgage portability, mortgage lenders typically give you 30 to 90 days from when your mortgage is paid out at the sale of the current property to transfer to a new one. The lender will refund the prepayment penalty once the new mortgage is closed and your current rate is transferred to the new home.

If the required mortgage you need is higher than the balance you paid out on the old mortgage, then the lender must provide you with a weighted average rate. In this case, the new rate is weighted concerning the balances based on the old rate, the mortgage paid out and ported, and the new rate based on current prevailing market rates.

Amortization

The amortization period cannot exceed 30 years on the prime lending side. The maximum allowable amortization is 25 years on mortgages with less than a 20% down payment or equity in the property at the time of renewal. You can go up to 30yrs amortization on mortgages with down payments of 20% or more.

The longer the amortization, the lower your mortgage payment. The shorter your amortization period, the more money you save on interest over the term or life of the loan. The difference between two identical mortgages with different amortizations is the interest-carrying cost for the extended time the money is lent out.

Credit Score

There are multiple credit rating agencies and different types of scoring systems. The two leading credit agencies prevalent in Canada are Equifax and TransUnion. They both provide different credit scores, one of which is the 3 years running score, also known as a soft credit check.

Both agencies will also provide borrowers with a hard credit score for their complete credit history. The scoring is based on a total of 900. The hard credit score from Equifax, known explicitly as FICO (previously called Beacon 9.0), is the credit scoring method used by mortgage lenders and professionals.

Hard Credit Checks

A hard credit check on your credit bureau does not immediately reduce your credit score. The credit rating agency will know who pulls your credit score and why. Multiple mortgage brokers or lenders completing hard credit checks within 45 days will be grouped as only one credit hit by the credit rating agency. Some credit rating points will be deducted from your credit score, but those will be reinstated with your timely bill payments over a few quarters.

Soft Credit Checks

Soft credit checks do not affect your credit score and are great for planning. However, they don’t offer much assurance to a lender underwriting your mortgage application. At some point, the lender or broker must pull your FICO score to ensure you meet their requirements and check back on your entire repayment history.

Lenders have a specific minimum FICO score requirement of 680 or 720 out of 900 to provide you with the best mortgage rate. Lenders will not want missed payments, especially for mortgage payments, as it will show to the lender either you have poor budgeting or cash flow or your monthly obligations and carrying costs exceed your income. Lenders and brokers will want to know if you put any practices in place to avoid any negative habits in the future.

Minimum Credit Requirement

The best rates, such as nesto’s, are reserved for borrowers with a FICO score of 680+ and no missed mortgage payments. Exceptions can be made in some circumstances, such as missed payments due to separation. During a separation, neither party could take responsibility for all the household payments, and due to unforeseen circumstances, the mortgage may have been neglected.

There is always a story, and nesto mortgage experts are willing to listen to and understand the whole story behind your credit report. If there is a reasonable explanation for missed payments, our mortgage expert will put a case together to ask for exceptions from the underwriting department on your behalf.

Canadian Income Proof

The stability of your income shows your capacity to carry the mortgage and any other debts, which show up as facilities on your credit bureau report. If your employment is new, your income must be established past probation. Changing employers in the middle of your mortgage financing is not advisable. Lenders will use a 2-year average on non-guaranteed income such as hourly, bonus, overtime, contract, or self-employed income.

Types of Income in Canada

On the A or Prime lending side, lenders can use your taxed income, but any forms of income that are not taxed will not be considered. Upon exception, up to 70% of non-taxed income could be used for qualification. If you change industries and don’t have two years of average income, the lender may average your year-to-date received income over two years to get a conservative value.

Canadian Income Documentation

Lenders will ask for various documents to satisfy their risk assessment. The primary documents that borrowers may need to provide are paystubs, letters of employment, and T4s if they are employed. At a minimum, Business Registration or Articles of Incorporation, Notice of Assessments (NOAs), T1 Generals and 3 months of business/corporate/individual bank account histories are required for self-employed or incorporated individuals.

Canada Mortgage Stress Test

Due to the mortgage market fallout in the US after the Great Recession in 2007, the international community agreed to and mandated a set of mortgage underwriting guidelines to protect the world’s real estate. These rules are the B-20 Guidelines, mandated and legislated by the Office of the Superintendent of Financial Services (OSFI) in Canada.

As of October 2016, these guidelines slowly became different aspects of mandated rules governing prime mortgages in Canada. Canada already had rigorous mandates for its mortgage lenders, so our real estate was unaffected by the fallout south of the border.

One of the aspects of these guidelines is the mortgage stress test, with its first rule being implemented in October 2016. If you arranged your mortgage before October 2016 and have not refinanced it, you will not be impacted similarly by the stress test when you renew your mortgage with another lender.

Passing the Mortgage Stress Test

If you want the best rate, you’ll need to pass a stress test to qualify for a mortgage with a prime lender. You must prove you can afford payments at a qualifying interest rate typically higher than the actual rate in your mortgage contract.

You must pass this stress test to determine whether you require mortgage default insurance. Provincially regulated credit unions are not required to qualify all mortgages on the stress test; however, they will use a higher interest rate as they will not have access to prime lending rates on those mortgage solutions.

Federally regulated lenders such as mortgage finance companies and banks must use the higher interest rate of either:

- 5.25%

- the contracted interest rate plus 2%

On variable rate mortgages, both VRM and ARM, the rate you lock in during a pre-approval can change with the lender’s prime rate change. Indeed, the variable mortgage rate hold is a discount, which is being held from the lender’s prime rate, which fluctuates with the BoC’s Key Overnight Policy Rate.

If you already have a mortgage, you’ll need to pass this stress test if you:

- Refinance (refi) your home for equity take out (ETO)

- Take out a home equity line of credit

What is the current stress test in Canada?

Details

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

Canadian Mortgage Lending Ratios

Mortgage lending ratios are the Gross Debt Service (GDS) Ratio and Total Debt Service (TDS) Ratio. As the names suggest, GDSR calculates the household debt carrying capacity against an applicant’s qualified income, and TDSR calculates the total debt carrying capacity against a borrower’s income. On joint applications, ratios for qualifying are combined debt payments and incomes in the case of multiple borrowers.

Typically, insured or insurable transactions, where the purchase price or assessed value is under $1 million and the mortgage amortization is up to 25 years, will lend up to 39% on GDS and 44% on TDS. Some lenders will use different ratios due to their risk appetites.

Uninsured Transactions in Canada

Uninsured transactions are classified as purchases or renewals where a property is valued at more than $1 million, the amortization will be more than 25 years, or the transaction is a refinance – where equity is taken out or time is being extended.

In the case of uninsured transactions, lenders will have their risk assessment criteria to use whatever ratios they feel comfortable with based on the client’s unique situation. The lender can qualify the ratios and mortgage rate pricing on the file’s risk profile and lender’s risk appetite. The money they use to fund uninsured mortgages comes from their sources – instead of Canada’s mortgage bond market with its set of strict qualifying rules.

Calculating Your Debt Service Ratios

GDS = (Mortgage Payment + Property Taxes + Condo Fees/2 + Hydro)/Income

TDS = (All debts in GDS calculation + all other debts) / Income

Initially, newer lenders will offer the best rates as they have to prove to the regulators and their investors their files are impeccable. As they fund more mortgages, their risk appetite will increase. They will provide more income and lending ratio exceptions, which may affect mortgage rate pricing on individually qualified files.

Pass Your Mortgage Stress Test

You must also pass a mortgage stress test to qualify for a specific mortgage amount. This stress test is essentially insurance that you’ll still be able to afford your mortgage payments if interest rates rise. This higher rate is known as the mortgage qualifying rate and is set by OFSI. All mortgage applications are subject to stress testing using the higher qualifying rate between the 5-year benchmark minimum qualifying rate (MQR) or the contractual mortgage rate (offered by your lender) plus 2%.

Are you a first-time buyer?

Choosing Between a Mortgage Broker vs. a Mortgage Lender

Mortgage finance companies, mortgage investment corporations (MIC), credit unions, banks, and other federally regulated financial institutions (FRFI) are all different lenders that offer mortgages and underwrite loans.

Lenders

Lenders will have different channels. Some will have branches and brokers that offer their services. In contrast, others will be direct to consumers to avoid the need to give commissions to external salespeople and pass the savings directly to their consumers.

You will need to be aware of which channel you’re working with, as pricing can vary in various channels due to the lender’s need to compensate the salesperson. You’ll also need to understand how the salesperson is being paid and how it affects your mortgage rate.

Mortgage Agents and Brokers

When arranging your mortgage, you should work with a qualified mortgage professional. Unlike a banking advisor who is a generalist, a qualified mortgage professional specializes in mortgages and can provide in-depth insight and knowledge as you go through the application and qualification process.

A qualified mortgage professional can come with various names depending on the province they are registered in, such as agent, broker, sub-mortgage broker, salesperson, or mortgage associate. However, they can provide the same services, must meet the same educational requirements, and be provincially regulated. Some provinces, such as Quebec, with its prime directive to protect consumer interests at each stage of the process, have more rigorous education and regulations than all other provinces.

At nesto, our mortgage experts concurrently hold professional designations from one or more provinces. We believe that our clients will receive the best advice and care when they speak with specialists that exceed the industry status quo. Is your mortgage professional licensed?

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are non-commissioned, salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and advice quality. nesto aims to transform the mortgage industry by providing honest advice and competitive rates using a 100% fully digital, transparent, seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Save up to $18,542 in your first term*

See current provinces rates

See current local rates

*Interest rates displayed, posted, or discussed verbally and in writing are subject to change at any time and without notice. The interest rate is not guaranteed until it is provided as a mortgage commitment or loan agreement produced by the lending authority. Interest rates may change if the transaction type changes or evolves outside of the criteria of the originally secured interest rate. To secure your interest rate in a timely manner, all requested information and documents must be provided and deemed satisfactory by the lending authority.

The average rates are calculated based on the advertised rates of the six biggest lenders in Canada. The six biggest lenders are the chartered banks Toronto-Dominion Bank (TD), Royal Bank of Canada (RBC), Bank of Montréal (BMO), Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CIBC), and National Bank of Canada (NBC). We may also display a similar average with the inclusion of Desjardins, Tangerine, First National Financial (FN) and nesto to round out Canada’s 10 biggest mortgage lenders. The averages shown may be further broken down between insured and conventional rates.