Income Needed to Get a $1,000,000 Mortgage in Canada

The Bank of Canada’s interest rate adjustments have reshaped the Canadian housing market, directly affecting mortgage affordability and borrowing power. Whether you’re a first-time homebuyer looking to renew or refinance, understanding the latest income requirements for securing a mortgage loan is crucial in today’s shifting economic landscape.

Getting a $1,000,000 mortgage in Canada might seem straightforward, but understanding the financial and mortgage affordability requirements can make a big difference. Factors like income, down payment, and interest rates all affect eligibility.

This guide simplifies the process and offers practical tips to help you qualify for a $1,000,000 mortgage. It breaks down mortgage qualification criteria across Canada and explores how loan-to-value (LTV) ratios, debt service requirements, and amortization periods impact home affordability. Additionally, we’ll cover the latest changes in mortgage stress tests and other regulations and what they mean for Canadian borrowers navigating the real estate market.

Key Takeaways

- On a $1,000,000 mortgage at nesto, your monthly payment will range between $4,581 and $5,364.

- Depending on your down payment and debts, you will need a gross annual income between $210,048 and $262,392 to qualify for a $1,000,000 mortgage at nesto.

- You’ll need to earn between $101 and $126 hourly to qualify for $1,000,000 at today’s low rates at nesto.

How Much Income Do You Need for a $1,000,000 Mortgage?

For a $1,000,000 mortgage balance, your monthly mortgage payment ranges between $4,581 and $5,364, and the gross annual income required for this mortgage ranges between $210,048 and $262,392. At 39%, this would meet GDS guidelines for an insured or insurable mortgage or an uninsured mortgage at 35%.

Lenders calculate your mortgage affordability based on your debt service coverage ratios, known as Gross Debt Service (GDS) and Total Debt Service (TDS):

- GDS Ratio: You should not exceed 39% of your gross monthly income on insured and insurable mortgages or 35% for uninsured mortgages.

- TDS Ratio: You should stay below 44% of your gross monthly income or 42% on uninsured mortgages.

Details

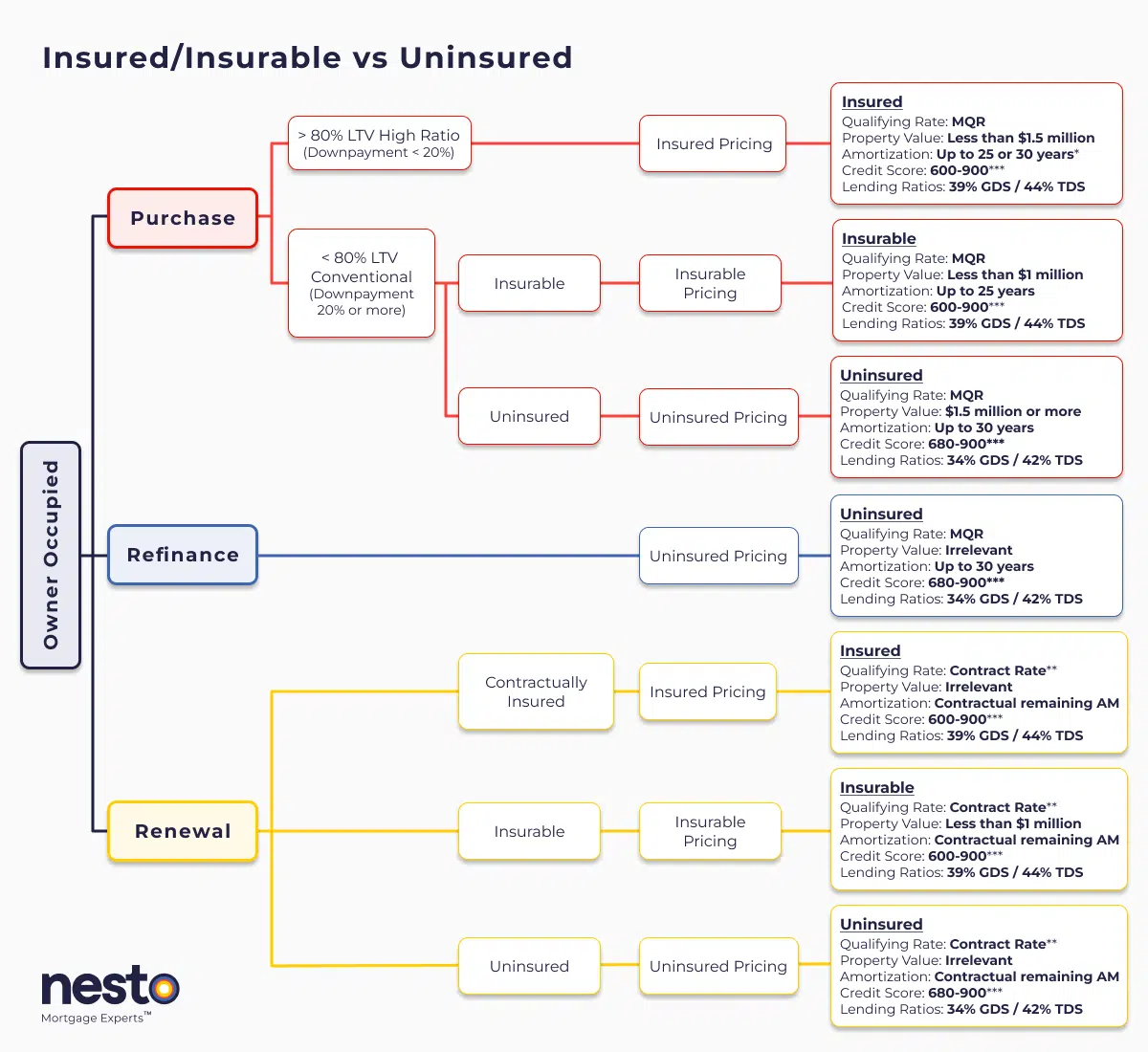

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

Most Popular $1,000,000 Mortgage Scenarios

The following two examples showcase calculations for the lowest and highest income needed to qualify for a $1,000,000 mortgage with an insured mortgage on a 25-year amortization and an uninsured mortgage on a 30-year amortization.

Example: A home valued at $1,111,111 with an insured mortgage on nesto’s low fixed rates:

- Down Payment: With a 10% down payment ($111,111), the mortgage amount would be $1,000,000.

- Additional Costs affecting debt ratios: Estimated monthly heating costs at $100 and property taxes at 1% annually.

- Income Needed: The income needed to qualify for a $1,000,000 insured mortgage is approximately $228,725, based on a 5-year fixed rate of

over a 25-year amortization.

The income needed to afford or renew that same $1,000,000 mortgage at nesto comes out lower at $193,149, and your actual mortgage payment in all instances for this insured fixed mortgage would be $6,408.

Example: A home valued at $1,250,000 with an uninsured mortgage on nesto’s low fixed rates:

- Down Payment: With a 20% down payment ($250,000), the mortgage amount would be $1,000,000.

- Additional Costs: Estimated monthly heating costs are $100, and property taxes are 1% annually.

- Income Needed: The income needed to qualify for a $1,000,000 uninsured mortgage is approximately $247,171, based on a 5-year fixed rate of

over a 30-year amortization.

The income needed to afford or renew that same $1,000,000 mortgage at nesto comes out lower at $205,885, and your actual mortgage payment in all instances for this uninsured fixed mortgage would be $4,863.

For all $1,000,000 mortgage scenarios at nesto’s lowest fixed or variable rates, the monthly mortgage payment ranges between $4,581 and $5,364, and the gross annual income required to qualify for the same mortgage ranges between $210,048 and $262,392.

All $1,000,000 Mortgage Scenarios

| Mortgage Type Amortization | Mortgage Rate Qualifying Rate | Mortgage Payment Qualifying Mortgage Payment | 5-Year Term Interest | Income Needed to Renew Mortgage | Qualifying Income Needed |

|---|---|---|---|---|---|

| Fixed Insured 25 years | $5,251 $6,408 | $176,702 | $193,149 | $228,725 | |

| Variable Insured 25 years | $5,106 $6,111 | $163,686 | $188,684 | $224,484 | |

| Fixed Insured 30 years | $4,723 $6,270 | $179,730 | $177,183 | $214,511 | |

| Variable Insured 30 years | $4,572 $6,511 | $166,517 | $172,526 | $210,048 | |

| Fixed Insurable 25 years | $5,120 $5,946 | $173,767 | $192,673 | $226,358 | |

| Variable Insurable 25 years | $4,979 $6,352 | $161,170 | $188,343 | $223,161 | |

| Fixed Uninsured 25 years | $5,364 $5,801 | $195,220 | $223,041 | $262,392 | |

| Variable Uninsured 25 years | $5,196 $6,067 | $180,480 | $217,288 | $256,913 | |

| Fixed Uninsured 30 years | $4,863 $6,215 | $198,502 | $205,885 | $247,171 | |

| Variable Uninsured 30 years | $4,688 $5,899 | $183,551 | $199,877 | $241,408 |

Affordability Factors for a $1,000,000 Mortgage

- Interest Rates: Lower rates mean smaller monthly payments, reducing the income needed. Shop around for competitive rates.

- Down Payment Size: A higher down payment lowers your mortgage amount and can eliminate the need for mortgage insurance.

- Debt Levels: High consumer debt can impact your TDS ratio, reducing the amount you qualify for.

How to Improve Your Mortgage Affordability

- Save for a Bigger Down Payment: Reducing your loan size lowers monthly payments.

- Pay Down Existing Debts: Reducing consumer debt improves your TDS ratio.

- Boost Your Credit Score: A higher credit score may help you qualify for better rates.

- Extend the Amortization Period: Stretching payments over 30 years reduces monthly costs (if offered by your lender).

How Much Could You Save On a $1,000,000 Mortgage With Nesto Compared to the Big Banks?

nesto’s lowest vs Big Bank insured mortgage rates

Results

For today, February 27, 2026, nesto’s {term}-year {type} mortgage rate is {bps} bps ({bps_percent}) lower than the similar average at Canada’s Big 6 Banks. On a {mortgage_ammount} mortgage over a {amortization_period}-year amortization, with nesto your monthly payment would be {nesto_monthly_payment}, saving you up to {monthly_savings} on your monthly payment. This equals {savings_interest} in interest saved while allowing you to pay down {extra_payment} extra on principal over your term, if you prefer.

Frequently Asked Questions (FAQ) About a $1,000,000 Mortgage in Canada

How much is the minimum down payment for a $1,000,000 home?

If your mortgage is insured, the minimum down payment on a $1,000,000 mortgage is 5% for the first $500,000 and 10% for the remainder up to $1.5 million, which equals $75,000.

Can I get a $1,000,000 mortgage with bad credit?

It may be challenging, but improving your credit score and reducing debt can increase your chances. Some alternative lenders may have more flexible requirements.

How does mortgage insurance affect my payment?

Mortgage insurance premiums typically range from 2.8% to 4% of your mortgage amount. Still, they can go up to 4.20% for first-time home buyers (FTHB) or those purchasing a newly built home with an insured mortgage and a 30-year amortization.

On a $1,000,000 mortgage, the default insurance premium from CMHC can range between $28,000 and $42,000.

These premiums increase your monthly payments. Mortgage insurance is mandatory for down payments of less than 20%. Still, borrowers can pay the premium upfront in cash instead of adding it to the mortgage balance, helping avoid additional interest costs over time.

What would my mortgage payment be on a $1,000,000 mortgage?

Your mortgage payment depends on your interest rate and amortization. Depending on your preferred mortgage solution and amortization chosen, your mortgage payment at nesto will range between $4,581 and $5,364 monthly.

At nesto’s current low insured 5-year fixed rate of

How much would I need to make per hour to afford a $1,000,000 mortgage?

Assuming 52 weeks of 40 hours, you’d need an hourly wage of between $101 and $126 to afford a $1,000,000 mortgage at nesto.

Final Thoughts

Securing a $1,000,000 mortgage in Canada requires a clear understanding of income requirements and affordability factors. However, managing debts, saving for a larger down payment, and choosing the right mortgage type can make homeownership more accessible.

Ready to take the next step? Contact nesto mortgage experts for personalized advice and the best rates to help you achieve your dream of homeownership.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and the quality of their advice. nesto aims to transform the mortgage industry by providing honest advice and competitive rates through a 100% digital, transparent, and seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!