Income Needed to Buy a Home in Montreal

Thinking of buying a home in Montreal? You might have more breathing room than in Toronto or Vancouver, but that doesn’t mean affordability isn’t a challenge. The gap between housing costs and household earnings has widened, even with recent interest rate relief. As property values continue to rise and stress test rules remain in place, homebuyers need to be better prepared than ever.

Let’s break down how much income you need to qualify for an average home in Montreal using today’s best mortgage rates, amortization options, and down payment scenarios. Whether you’re shopping for a condo, an owner-occupied multiplex, or a detached property, we’ll help you budget realistically.

Key Highlights

- The income required to buy a home in Montreal is now well above six figures, mainly due to stress test rules and price growth.

- The average monthly payment in Montréal ranges between $2,175 and $2,741.

- The income required to qualify for a mortgage in Montréal ranges between $103,691 and $121,910.

Average Home Price in Montreal

The average home price in Montreal is currently $579,900. That puts homeownership within reach of more people than in Vancouver or Toronto, but rising values are shrinking the gap. With a 20% down payment, buyers who need to qualify using an uninsured mortgage and pass the stress test at the higher of 5.25% or their rate plus 2%. To buy at this price point, the income required to qualify is $121,910.

Monthly Mortgage Payments in Montreal

While lenders test your finances against a higher qualifying rate, your actual monthly mortgage payment will be lower if approved. For a fixed insurable mortgage in Montreal, the actual monthly payment works out to $89,548 when amortized over 25 years. In contrast, you’ll have to qualify with a higher mortgage payment $105,175 if you choose to purchase with a 20% or more downpayment, or transfer/switch your mortgage to a federally regulated lender.

If you choose a 25-year variable mortgage on an insured rate, the monthly payment comes to $2,665, but the qualifying mortgage payment becomes $2,835 as the stress test rate is higher than your contract rate. However, these same monthly payments drop down to $92,458 and $111,940 if you extend your amortization to 30 years, respectively. Extending your amortization increases your borrowing costs, but accelerating your payment frequency can reduce these interest-carrying costs and reduce the time it takes to repay your mortgage.

Even with this flexibility, rate shifts can cause big swings in qualification thresholds from month to month, especially with amortization or rate type changes.

Want to save thousands of

dollars on your renewal?

Renew with nesto and you can.

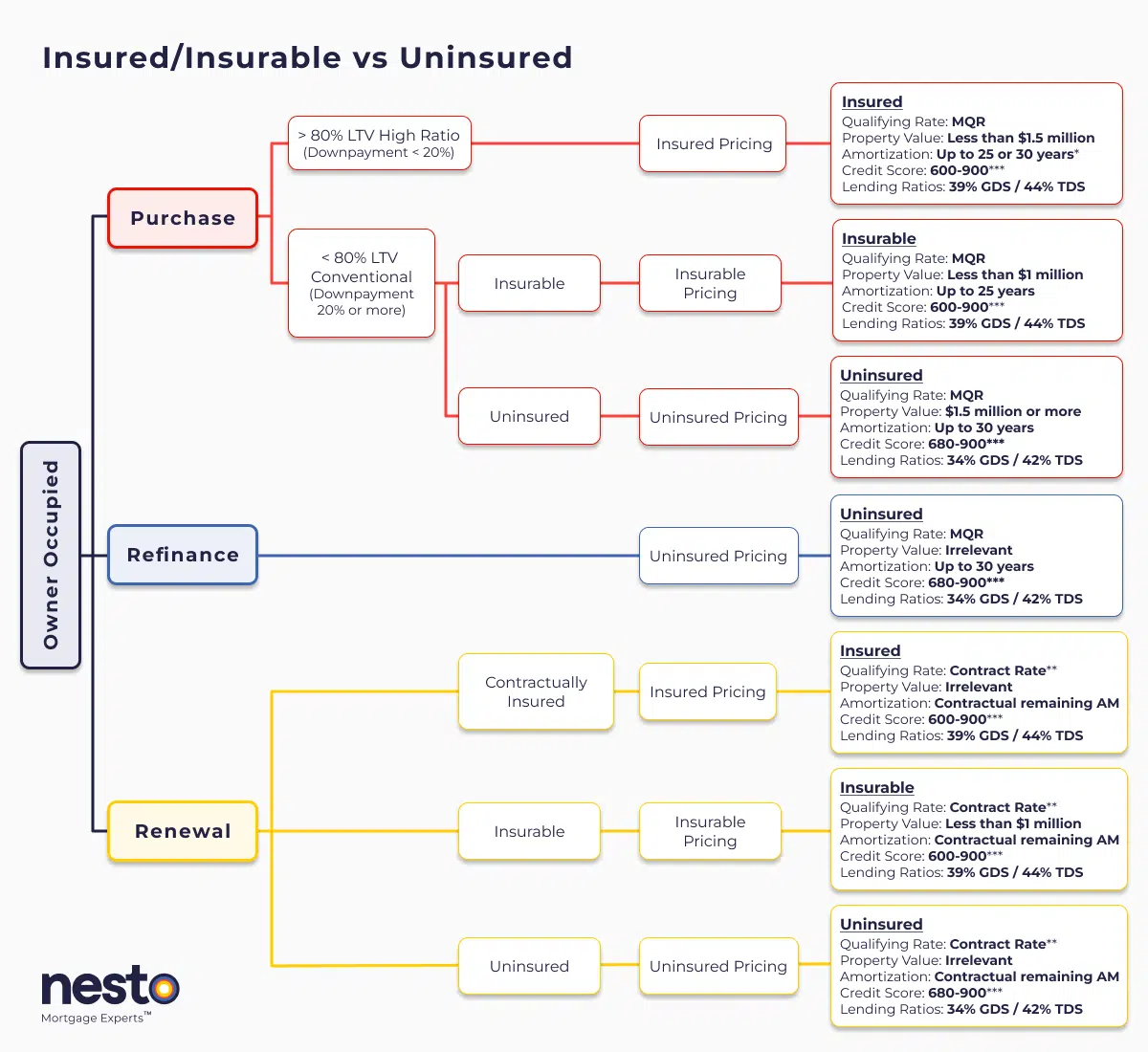

Mortgage Type and Down Payment Impact

Here’s how down payment and mortgage type affect your income requirements:

- Insured: Less than 20% down, only available on homes priced under $1.5M.

- Insurable: Requires a 20% or higher down payment on eligible properties valued up to $1M, with a 25-year amortization limit for borrowers.

- Uninsured: Any home over $1.5M, refinances, or longer amortizations come with higher rates and lender qualification rules.

In Montreal, most average-priced homes still fall within insured or insurable categories, but even those require careful income planning.

How Much Income Is Needed to Afford a Home in Montreal

To pass the stress test for a new mortgage, your gross debt service (GDS) ratio typically must stay below 35% of your household’s gross income for uninsured mortgage products. In January, the income required to qualify for a home in Montreal ranges between $103,691 and $121,910 when using nesto’s lowest available mortgage rates.

To qualify for the average home in Montreal with a 20% down payment, here’s what’s required based on current fixed mortgage rates:

- Required household income: $121,910

- With a 30-year amortization: $114,849

- Last year’s income needed: $118,890 (30-year amortization)

Using today’s variable mortgage rates, here’s how those figures shift:

- Required household income: $119,369

- With a 30-year amortization: $112,175

- Last year’s income needed: $121,505 (30-year amortization)

While there has been some year-over-year improvement, housing affordability in Montreal is still under pressure due to rising prices. Even with lower rates, many households continue to fall short of the income required to qualify under current lending rules.

How Much Income Do You Need to Afford vs Qualify

To simply afford your monthly payments on a typical Montreal home, you’d need an annual income of $89,548 with a 20% or more downpayment. But to qualify under Canada’s mortgage stress test, lenders want to see that borrowers can handle a higher payment, which increases the required income to $105,175.

This income gap continues to widen as home prices outpace incomes, even in cities like Montreal, which used to be considered relatively affordable.

How Montreal Compares to Other Canadian Cities

Montreal’s affordability gap is growing, even if it remains more manageable than in Toronto or Vancouver. According to the National Bank’s most recent housing affordability report, the median household income in Montreal is approximately $84,000. In contrast, the average income, as tracked by Teranet-National Bank HPI, is closer to $102,000.

Both figures fall short of the $121,910 required to qualify for an average home in the city today. Without a sizable down payment amount or a co-borrower, many prospective buyers would need well above the median income to qualify under current mortgage rules.

Here’s how Montreal home prices and income required to qualify compare to other major markets for January:

- Montreal – $579,900

Income needed: $121,910 - Toronto – $935,200

Income needed: $190,762 - Vancouver – $1,101,900

Income needed: $209,672 - Calgary – $555,500

Income needed: $113,116 - Ottawa – $606,700

Income needed: $133,106

Affordability Trends and Rate Pressures in Montreal

Despite being more affordable than Toronto and Vancouver, Montreal’s required income gap is expanding quickly due to a surge in prices. According to the National Bank’s most recent housing affordability report, “In the first quarter of 2025, affordability in Montreal as measured by the mortgage payment as a percentage of income deteriorated for the second straight quarter. The MPPI* rose 0.2 pp to 43.4%, which was above the average level since 2000 (31.8%). While the quarterly deterioration was worse than the improvement of the urban composite (-0.7 pp), the housing market still remained more affordable in Montreal than in the urban average, as the MPPI* of the latter stood at 55.4%. “

According to the Canada Mortgage and Housing Corporation (CMHC). “For example, the loss of affordability since 2019 in Montréal, Ottawa-Gatineau, the rest of Ontario and Nova Scotia leads to more housing being needed there.”

Details

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

We’re curious…

Are you a first-time buyer?

Mortgage Scenarios for Montreal

To better understand how borrowing needs impact affordability, the table below shows how monthly payments and income requirements scale by mortgage type, interest rate and amortization period in Montreal:

| Mortgage Type | Amortization | Mortgage Rate | Mortgage Payment | 5-Year Term Interest | Income Needed to Renew Mortgage | Qualifying Income Needed |

|---|---|---|---|---|---|---|

| Insured Fixed Rate | 25-year | $2,741 | $92,222 | $100,791 | $119,358 | |

| Insured Variable Rate | 25-year | $2,665 | $85,429 | $98,460 | $117,145 | |

| Insured Fixed Rate | 30-year | $2,465 | $93,803 | $92,458 | $111,940 | |

| Insured Variable Rate | 30-year | $2,386 | $86,907 | $90,027 | $109,610 | |

| Insurable Fixed Rate | 25-year | $2,375 | $80,614 | $89,548 | $105,175 | |

| Insurable Variable Rate | 25-year | $2,310 | $74,770 | $87,539 | $103,691 | |

| Uninsured Fixed Rate | 25-year | $2,488 | $90,566 | $103,655 | $121,910 | |

| Uninsured Variable Rate | 25-year | $2,410 | $83,728 | $100,986 | $119,369 | |

| Uninsured Fixed Rate | 30-year | $2,256 | $92,089 | $95,695 | $114,849 | |

| Uninsured Variable Rate | 30-year | $2,175 | $85,153 | $92,908 | $112,175 |

Condos often require less income, but 50% of the condo maintenance fees must be included in your debt service ratio when applying, which can drive up the income required to qualify.

Strategies to Improve Your Buying Power

If you’re struggling to qualify for your desired property, consider:

- Increasing your down payment to lower your loan-to-value ratio

- Extending your amortization period to 30 years

- Paying down high-interest debt to improve your debt service ratio

- Adding a co-borrower with stable income

- Exploring pre-construction options with longer possession timelines

Mortgage brokers or lenders can help run scenarios based on different rate types, terms, and property types to find your qualifying ceiling.

First-Time Buyer Programs in Montreal

First-time home buyers should look into programs that could help improve their overall purchasing capacity. These supports can help reduce upfront costs, such as:

- RRSP Home Buyers’ Plan (HBP): Withdraw up to $60,000 from your RRSP for a down payment, tax-free.

- First Home Savings Account (FHSA): FTHBs can withdraw up to $40,000 in tax-free savings for a down payment.

- Home Purchase Assistance Program (City of Montreal): FTHB can access up to $15,000 in financial aid and rebates depending on family size and property type.

Frequently Asked Questions (FAQ) About Income Requirements for Homeownership in Montreal

What income is needed to buy a home in Montreal?

To qualify for the average-priced home in Montreal with a 20% down payment, you will need a household income between $103,691 and $121,910 as of January.

Can I purchase a home in Montreal with an income under $100,000?

It may be possible to qualify for an insured mortgage on a lower-priced property, such as a condo, particularly if you apply with a co-borrower. However, qualifying on your own for a detached home is generally not feasible with an income below $100,000, unless you have a downpayment available that makes up the difference.

What is the average monthly mortgage payment in Montreal?

For January, the monthly mortgage payment for the average-priced home in Montreal with a 20% down payment falls between $2,175 and $2,741.

Is buying a condo in Montreal typically more affordable than buying a house?

Yes, condos usually cost less than single-family homes. However, buyers must consider monthly condo fees, which are factored into their debt servicing ratios and can reduce the amount of money they can borrow.

Why are home prices rising in Montreal?

Home prices in Montreal have been driven up by a combination of strong local demand, relatively limited resale inventory, sustained immigration to the region, and continued upward pressure on construction costs.

Make Your Mortgage Strategy Work in Montreal

With home prices rising in Montreal and the income gap widening, qualifying for a mortgage takes more than just strong credit. From down payment strategy to amortization planning, every detail counts. Whether you’re a first-time buyer or upgrading your space, our licensed and qualified mortgage experts will help you find the lowest rate and the best path to affordability.

Connect with a nesto mortgage expert today to secure a mortgage strategy that fits your income and helps you afford the home you want in Montreal.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and the quality of their advice. nesto aims to transform the mortgage industry by providing honest advice and competitive rates through a 100% digital, transparent, and seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!