Income Needed to Buy a Home in Toronto

Thinking of buying a home in Toronto? You’re not alone, but mortgage affordability remains one of the biggest hurdles. Most households earn far less than what’s required to qualify for the average-priced property in the city. With home prices hovering near the million-dollar mark, a 20% down payment is no longer just a strategy; it’s often a necessity.

Let’s break down the gross income needed to qualify for a typical mortgage loan in Toronto based on current mortgage rules, today’s best mortgage rates in Canada, and amortization options. Whether you’re buying a condo, townhouse, or detached home, understanding the monthly payments and stress test implications is key to planning your purchase and protecting your budget.

Key Takeaways

- Toronto homebuyers face a steep affordability gap with the income required to qualify for an average home often reaching nearly three times the city’s median household income.

- Monthly mortgage payments are easing slightly compared to last month and last year, offering modest relief.

- Despite these small gains, affordability remains stretched, making strategic planning essential for your mortgage.

Average Home Price in Toronto

The average home price in Toronto is currently $935,200. Prices have increased 8.1% year over year, keeping Toronto among the most expensive markets in Canada.

That means many buyers must rely on substantial down payments, currently averaging for a 20% down payment, just to meet uninsured lending criteria and qualify under Canada’s stress test rules. Affordability challenges persist, especially for first-time buyers without access to significant savings or co-purchasing arrangements.

Monthly Mortgage Payments in Toronto

For January, the monthly mortgage payment for the average home in Toronto ranges between $3,507 and $4,420.

For a buyer taking an uninsured 5-year fixed mortgage with a 25-year amortization, monthly payments have eased slightly compared to last year and even last month, offering a bit of relief for those entering the market now. The current monthly payment to qualify for this type of mortgage sits at $4,882, reflecting how recent interest rate movements are beginning to shift affordability.

Here’s how it compares to actual monthly payment changes month over month and year over year:

- Current payment: $4,013

- Last month: $4,064

- Last year: $4,547

While this doesn’t erase the broader affordability challenge, it does signal a more favourable environment than homebuyers faced 12 months ago. Even a slight drop in monthly costs can make a meaningful difference when qualifying under today’s stress test rules.

This drop in monthly cost reflects some modest rate relief. Still, payments remain high due to large loan sizes and stricter uninsured qualification rules.

How Much Income Is Needed to Afford a Home in Toronto

To pass the stress test for a new mortgage, your gross debt service (GDS) ratio generally must not exceed 35% of your gross household income for uninsured products. For the average home in Toronto, the income required to qualify ranges between $161,980 and $190,762 in January when using nesto’s lowest mortgage rates.

To qualify for the average home with a 20% down payment, on today’s fixed mortgage rates:

- Required household income: $190,762

- With a 30-year amortization: $179,374

- Last year’s income needed: $185,891 (30-year amortization)

Here’s how income needed to qualify changes against today’s variable mortgage rates:

- Required household income: $186,663

- With a 30-year amortization: $175,063

- Last year’s income needed: $190,109 (30-year amortization)

Although there has been a slight improvement in income required year-over-year, housing affordability still puts the average Toronto home out of reach for many.

How Toronto Compares to Other Canadian Cities

Toronto’s affordability gap remains among the widest in Canada. According to the National Bank’s most recent housing affordability report, the median household income in Toronto is around $98,000, while average household income, as cited by Teranet HP, is closer to $129,000.

Both figures fall well below the $190,762 required to qualify for an average home in the city today. Unless a buyer comes with a substantial down payment or applies with a co-borrower, they’d need nearly triple the median income to qualify.

Here’s how Toronto home prices and income required to qualify compare to other major markets for January:

- Toronto – $935,200

Income needed: $190,762 - Vancouver – $1,101,900

Income needed: $209,672 - Montreal – $579,900

Income needed: $121,910 - Calgary – $555,500

Income needed: $113,116 - Ottawa – $606,700

Income needed: $133,106

Affordability Trends and Rate Pressures in Toronto

According to NBC Economics, housing affordability in Toronto has seen a modest improvement compared to earlier this year. In Q2, the mortgage payment as a percentage of income (MPPI) fell to 75.3%, down from 77.8% in Q1 and 85.0% in Q4 of last year.

Despite these improvements, affordability remains severely stretched compared to the long-term average of 53.7%. Without a meaningful rise in incomes or further rate cuts, most buyers will still face steep barriers when qualifying for a mortgage.

According to the Canada Mortgage and Housing Corporation (CMHC), “Second, restoring affordability to levels last seen 2 decades ago isn’t realistic, especially after the post-pandemic price surge. COVID-19 significantly changed the affordability landscape across the country. In particular, Toronto and Vancouver face more structural affordability challenges that require more time to address.”

Details

*30-year amortizations on insured purchases are limited to first-time homebuyers (FTHBs) or anyone purchasing newly built homes.

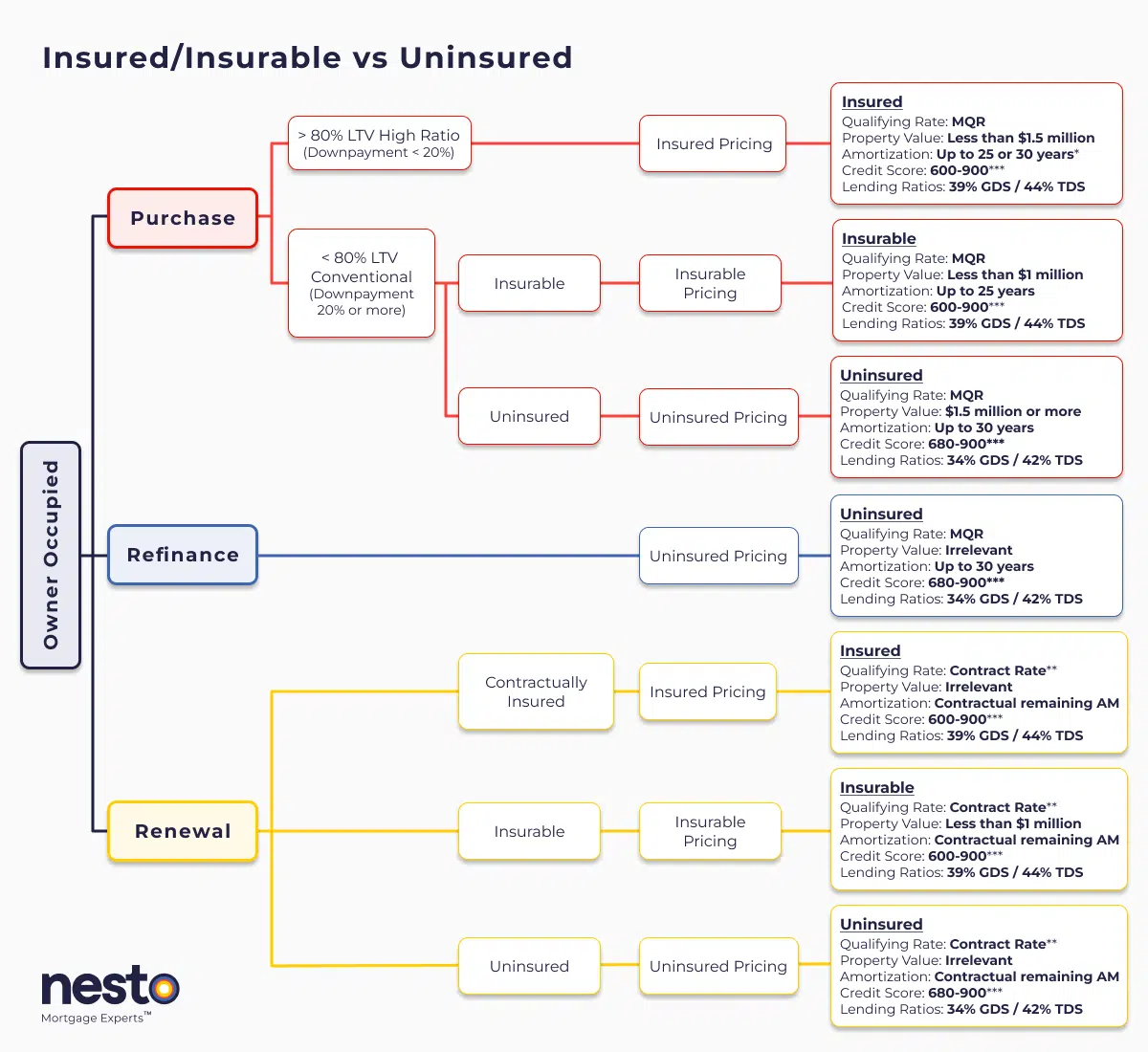

**Qualified at contract rate at renewal only if there are no increases to contractually remaining amortization or remaining balance, and the mortgage is being transferred from a federally regulated lender as outlined by the Department of Finance (DOF) as a straight switch. The Minimum Qualifying Rate (MQR) requirements have been amended by the Office of the Superintendent for Financial Institutions (OSFI). It will be used to qualify all mortgages used for purchases and refinances. The MQR does not apply to renewals if the mortgage is renewed with the current lender or switched from a federally regulated lender.

***A credit score of 600 or 650 is allowable based on the mortgage insurer, and if there is a secondary applicant with a credit score of 680 or above. Lenders may scale debt service ratios (GDS/TDS) based on applicant(s) credit score(s) or reason for purchase/renewal (primary residence vs rental property). If one applicant on a joint mortgage has a credit score below 680, the lender may apply lending ratios as low as 32% GDS and 40% TDS. All criteria in the chart above apply to an owner-occupied primary residence mortgage with nesto.

Contractually insured mortgages are initially mortgage default insured by the borrower at the time of purchase and have not been refinanced or changed in any way that increases their remaining contractual amortization or mortgage balance. These insured mortgages are also known as high-ratio mortgages. In contrast, insurable and uninsured terms apply to conventional mortgages that are back-end bulk portfolio insured (typically lender-paid) or not.

New Purchase Qualifying Rates

Insured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insured home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Insurable home purchases may be qualified using our lowest variable rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest fixed rate, which will be the greater of 5.25% or

Uninsured home purchases may be qualified using our lowest variable rate, which will the greater of 5.25% or

Renewal (Switch or Transfer) Qualifying Rates

An insured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insured rates, currently at

An insurable mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable insurable rates, currently at

An uninsured mortgage may be qualified for renewal using the contract rate, which could be on our lowest fixed or variable uninsured rates, currently at

We’re curious…

Are you a first-time buyer?

Mortgage Scenarios for Toronto

To better understand how borrowing needs impact affordability, the table below shows how monthly payments and income requirements scale by mortgage type, interest rate and amortization period in Toronto:

| Mortgage Type | Amortization | Mortgage Rate | Mortgage Payment | 5-Year Term Interest | Income Needed to Renew Mortgage | Qualifying Income Needed |

|---|---|---|---|---|---|---|

| Insured Fixed Rate | 25-year | $4,420 | $148,726 | $157,302 | $187,245 | |

| Insured Variable Rate | 25-year | $4,298 | $137,771 | $153,544 | $183,676 | |

| Insured Fixed Rate | 30-year | $3,976 | $151,275 | $143,863 | $175,282 | |

| Insured Variable Rate | 30-year | $3,848 | $140,154 | $139,944 | $171,525 | |

| Insurable Fixed Rate | 25-year | $3,831 | $130,005 | $139,170 | $164,372 | |

| Insurable Variable Rate | 25-year | $3,725 | $120,581 | $135,930 | $161,980 | |

| Uninsured Fixed Rate | 25-year | $4,013 | $146,056 | $161,322 | $190,762 | |

| Uninsured Variable Rate | 25-year | $3,887 | $135,028 | $157,017 | $186,663 | |

| Uninsured Fixed Rate | 30-year | $3,639 | $148,511 | $148,485 | $179,374 | |

| Uninsured Variable Rate | 30-year | $3,507 | $137,325 | $143,991 | $175,063 |

Condos often require less income, but 50% of the condo maintenance fees must be included in your debt service ratio when applying, which can drive up the income required to qualify.

Can First-Time Buyers Still Buy in Toronto?

It’s no secret that buying a your first home in Toronto has become more difficult, especially for first-time buyers. For years, many were shut out of insured mortgage products, which previously only applied to homes priced under $1 million. But recent policy changes are opening up new opportunities to help first-time buyers get into the market:

- CMHC now insures homes up to $1.5 million, expanding the number of properties eligible for insured mortgages.

- 30-year amortizations are now available on insured mortgages for newly built homes and first-time buyers, helping reduce monthly payments.

- The RRSP Home Buyers’ Plan (HBP) allows borrowers to withdraw up to $60,000 from their RRSP for a down payment, tax-free.

- The First Home Savings Account (FHSA) allows up to $40,000 in tax-free savings for a down payment.

- Land transfer tax rebates of up to $8,475 (Toronto and Ontario combined) are available for qualifying FTHBs in Toronto.

These incentives and programs won’t solve Toronto’s affordability issues overnight. Still, they do offer real advantages to buyers who can combine them to offset their closing costs or increase their downpayment, especially those purchasing pre-construction, receiving gifted downpayments from family, or entering the market with a partner.

Mortgage Strategies to Boost Qualification Odds

If your income falls short of the mortgage you need, here are a few proven ways to strengthen your mortgage application:

- Increase your down payment to reduce your loan-to-value (LTV) ratio and unlock insurable options (requires 20% downpayment)

- Opt for a 30-year amortization to lower monthly debt service

- Buy a more affordable location or choose a different property type (e.g., condo instead of house)

- Add a co-applicant or guarantor with qualifying income and minimal debts

- Pay down other debts to improve your total debt service (TDS) ratio

Mortgage brokers and lenders can help tailor a qualification strategy around your financial goals and guide you through the options that best fit your situation.

Frequently Asked Questions (FAQ) About Toronto Income Requirements for Homeownership

What income is needed to buy a home in Toronto?

You’ll need an income between $161,980 and $190,762 in January to qualify for the average-priced home in Toronto with a 20% down payment.

Can I buy in Toronto with less than $100K income?

It’s possible to qualify for an insured mortgage on a lower-priced condo or with a co-borrower at that income level. However, you’re unlikely to qualify as a sole applicant for a detached home with an income of less than $100,000, unless you make up the difference with your downpayment.

What is the average monthly mortgage payment in Toronto?

The monthly payment for the average-priced home in Toronto is between $3,507 and $4,420 in January with a 20% downpayment.

Is buying a condo in Toronto more affordable?

Typically, yes, buying a condo in Toronto is more affordable than buying a house; however, you must account for monthly condo maintenance fees, which reduce the amount you can qualify to borrow.

Why are Toronto home prices so high?

Strong demand, limited supply, increased immigration, development delays, and high land transfer taxes all contribute to elevated housing costs in Toronto.

Make Your Mortgage Strategy Work in Toronto

Buying a home in Toronto is no small feat, but it’s not out of reach with the right strategy. If your income doesn’t quite meet today’s qualification thresholds, there are still ways to make the numbers work in your favour. Adjusting your amortization, exploring different property types, or making a larger down payment can help. New opportunities from changes to insured mortgage rules and pre-construction financing options also offer valuable pathways.

The key is finding a mortgage strategy that fits your situation, not someone else’s. Connect with a nesto mortgage expert to compare fixed and variable rates, insured and uninsured options, and to model your affordability across different amortization periods. With expert guidance and thoughtful planning, you can build a strategy that helps you enter the Toronto market with confidence.

Why Choose nesto

At nesto, our commission-free mortgage experts, certified in multiple provinces, provide exceptional advice and service that exceeds industry standards. Our mortgage experts are salaried employees who provide impartial guidance on mortgage options tailored to your needs and are evaluated based on client satisfaction and the quality of their advice. nesto aims to transform the mortgage industry by providing honest advice and competitive rates through a 100% digital, transparent, and seamless process.

nesto is on a mission to offer a positive, empowering and transparent property financing experience – simplified from start to finish.

Contact our licensed and knowledgeable mortgage experts to find your best mortgage rate in Canada.

Ready to get started?

In just a few clicks, you can see our current rates. Then apply for your mortgage online in minutes!